Bank Muamalat Malaysia Bhd chief economist Afzanizam Abdul Rashid said the greenback continued its retreat in tandem with the decline in the US Dollar Index (DXY) to 97.330 points.

He said last Friday’s weak US labour market report has strengthened the conviction of an interest rate cut in the upcoming US federal open market committee meeting next week.

“There is also an impression that the US Federal Reserve (Fed) could be behind the curve in delivering timely monetary easing as the previous series of labour market data, such as the US nonfarm payrolls (NFP), saw sizeable downward revision.

“As such, the ringgit has breached the psychological level of RM4.20,” he told Bernama.

SPI Asset Management managing director Stephen Innes said expectations of Fed interest rate cuts have narrowed yield gaps, giving the local currency more room to rise.

He said the potential rate cuts signal a broader reassessment of how much policy support the Fed may be compelled to provide this year.

“The real inflection point may come (later today), when the annual revision to the NFP lands.

“Fed governor Christopher Waller has already cautioned that last year’s job tally may have been overstated by as many as 720,000 positions, a gap that would recast the entire narrative around US labour resilience.

“For markets, such a revision is weighing heavily on the US dollar, which continues to drift lower as investors prepare for the possibility of a larger policy shift,” he added.

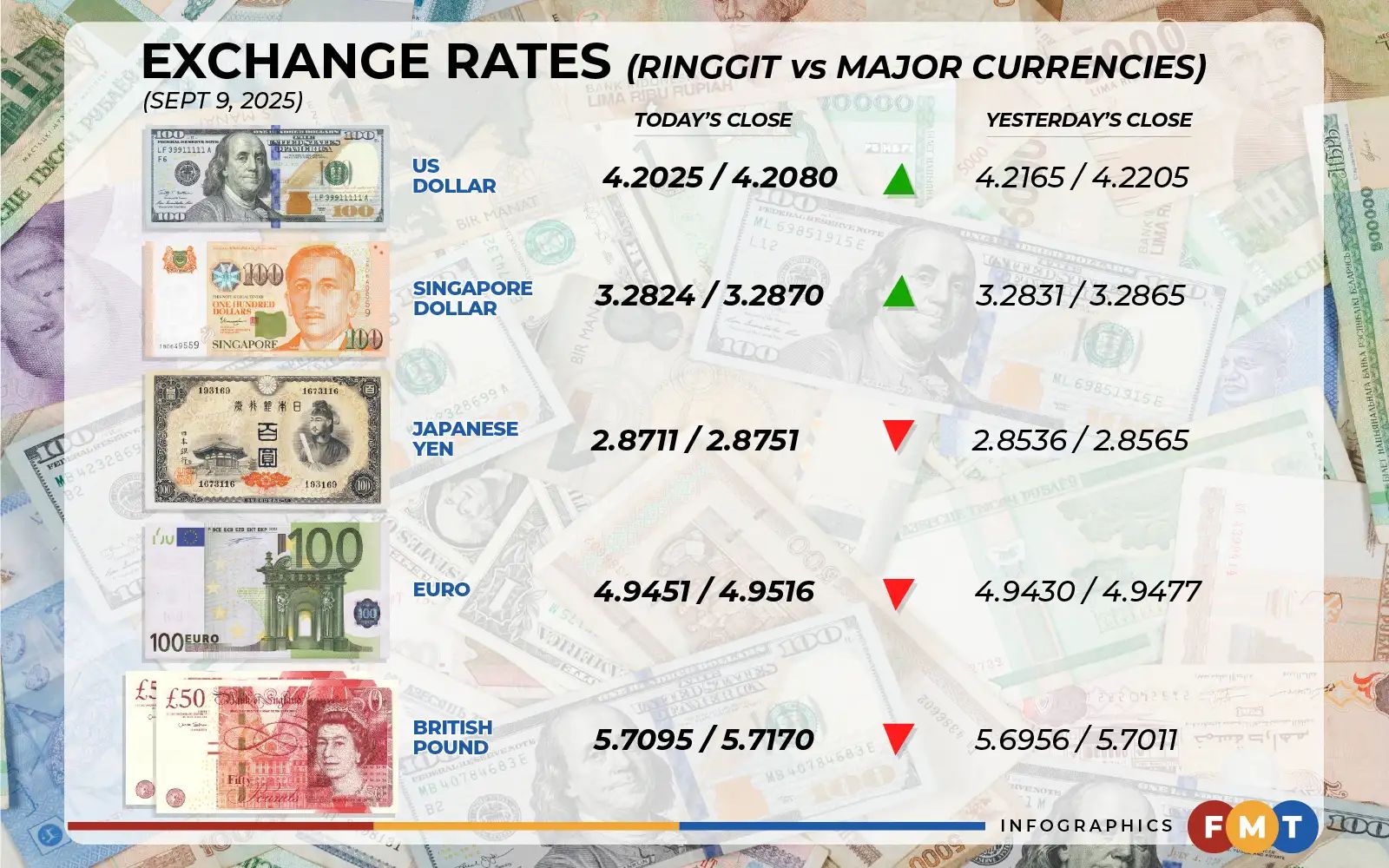

At 6pm, the local note bounced to 4.2025/4.2080 from yesterday’s close of 4.2165/4.2205.

At the close, the ringgit was lower against a basket of major currencies.

It eased against the euro to 4.9451/4.9516 from 4.9430/4.9477, slipped versus the yen to 2.8711/2.8751 from 2.8536/2.8565, and was down vis-a-vis the pound to 5.7095/5.7170 from 5.6956/5.7011 yesterday.

However, the local note was mostly higher against Asean currencies.

It inched up versus the Singapore dollar to 3.2824/3.2870 from 3.2831/3.2865, fell against the baht to 13.2688/13.2925 from 13.2299/13.2491, gained vis-a-vis the rupiah to 254.9/255.4 from 258.5/258.8 and increased against the Philippine peso to 7.37/7.39 from 7.43/7.44 previously.