As we enter a new era of innovation and technological capabilities, the space sector is seeing unprecedented growth. A new report from Boston Consulting Group and Novaspace analyzes the changes, drivers, and opportunities of space’s next frontier.

Space has long been the final frontier for science and technology. But in recent years, several disruptive trends have been reshaping the sector. For example, the cost of launching satellites has fallen by 95% over the last three decades and is expected to decrease even further. Lower barriers to entry in the sector are creating opportunities for new entrants.

In what was once primarily the domain of government-funded space agencies, private players are now on the rise. SpaceX, for example, has changed the game with their reusable rockets, which have helped make commercial space activities viable. That includes activities far beyond just science and discovery – there is huge potential for mining, manufacturing, and even tourism. This fourth stage of evolution is being called Space 4.0.

The new space economy

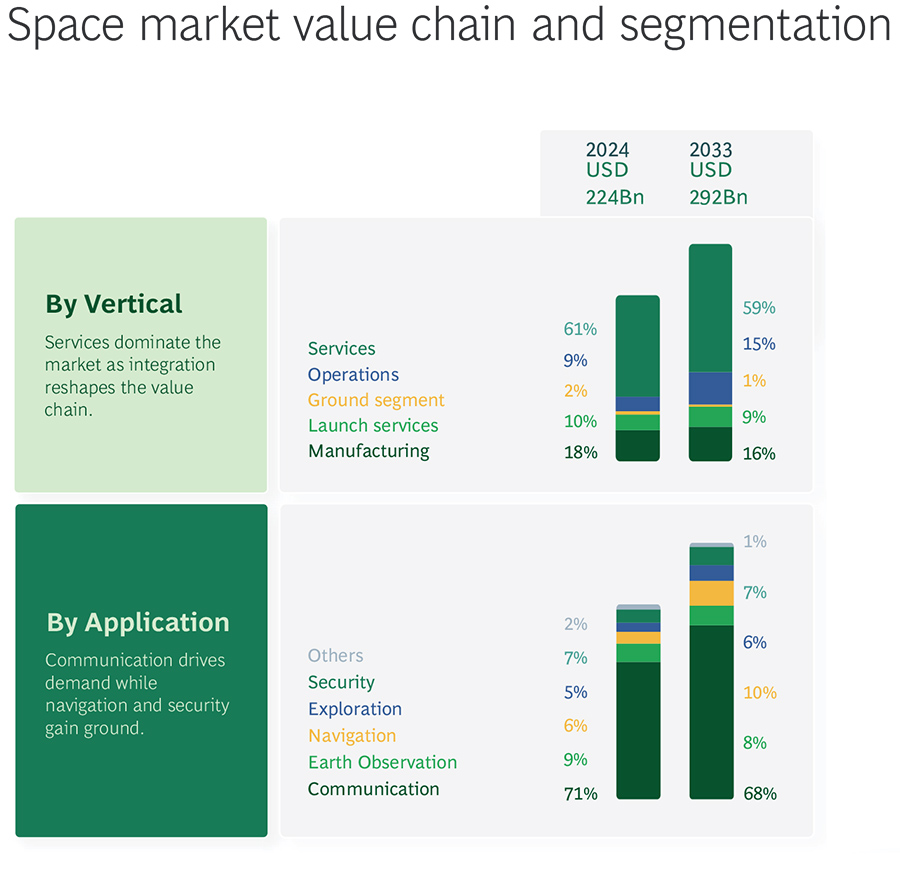

To understand where firms in the space economy are operating and generating revenue, it is useful to examine the key verticals and applications driving the industry.

Source: BCG, Novaspace

The services sector is currently the greatest revenue driver by vertical today in the space economy, while the communications sector is at the top when it comes to applications, with 71% of total market revenues. Specifically, satellite communications (satcom) has outpaced all other applications, mainly thanks to its dominance in the shrinking but still significant satellite television market.

The space market is divided into upstream and downstream segments. Upstream are areas like launch facilities, ground operations, and spacecraft design and manufacturing. Further downstream of those are areas related to operations and services.

Those downstream markets have been mingling with digital industries, as technologies like AI and cloud computing are leveraged for mass data collection and processing. This area shows significant potential compared to upstream activities, which face ongoing challenges like growing costs and a shortage of materials and components.

Applications in the green transformation

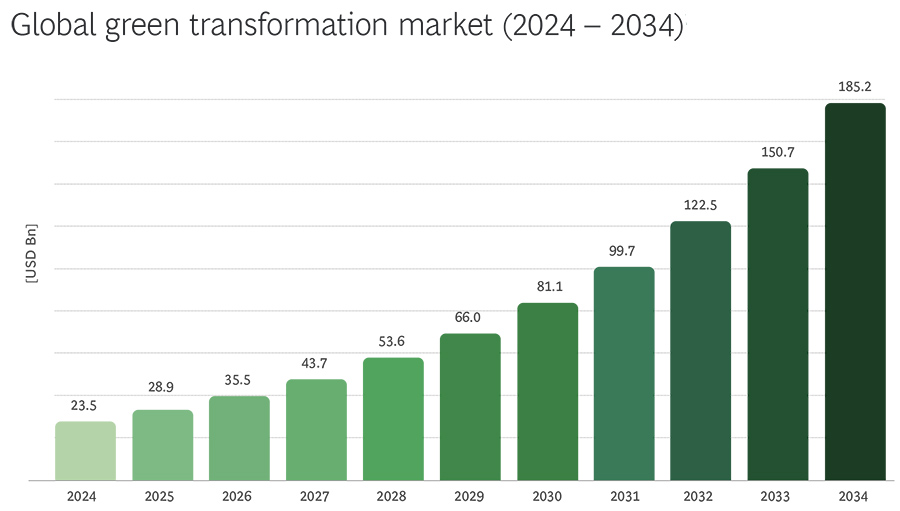

Space-based technologies are increasingly seen as one more tool in the toolkit when it comes to the global shift to more sustainable practices. Satellites, for example, enable us to monitor environmental changes, optimize resource use, and lessen our impact on the planet.

Source: BCG, Novaspace

The green transformation market, spurred on by national sustainability goals and international frameworks like the Paris Agreement, is experiencing rapid growth and is forecast to expand even more in the next decade. Now valued at around $29 billion, it is projected to soar to $185.2 billion by 2034.

By integrating space technology into sustainability efforts, many industries stand to benefit in terms of efficiency and reductions in carbon emissions. As more and more players get involved in the space sector, decarbonization efforts may get a boost from products and services like satellite-based monitoring and real-time emissions tracking.

The role of governments

As the space industry sees unprecedented momentum, now is the time for governments to participate in the sector. The report urges favorable government policy aimed at supporting the Space 4.0 industry.

There has been a dramatic increase in the number of national space agencies over the past two decades. Today, nearly 80 nations have government space agencies, up from only 40 in the early 2000s. A total of 16 of these agencies now have launch capabilities, including some newcomers such as the UAE (2014), Bahrain (2014), and Australia (2018).

Source: BCG, Novaspace

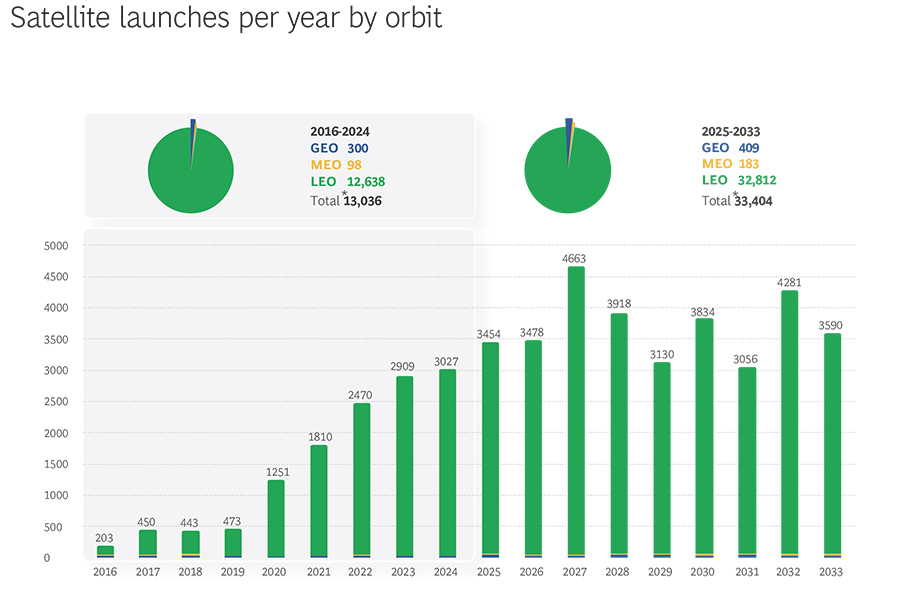

The number of satellites in orbit has increased dramatically in recent years. By 2033, over 30,000 satellites are expected to be launched, almost tripling the count from 2016 to 2024. This increased congestion calls for more effective space traffic management, which will need to be a collaborative effort between governments around the world and private companies that have deployed satellite constellations, like SpaceX, OneWeb, and Amazon.

Rising geopolitical tensions around the world have begun to raise alarms on the issue of the space arms race. The Trump administration’s launch of Space Force, the newest branch of the US military, has been a controversial move.

“As space increasingly becomes a frontline for geopolitical influence, governments that act now can secure strategic advantages,” said Thibault Werle managing director and partner at Boston Consulting Group, and co-author of the report.

“Sovereign access to space assets is critical for military, communication, and climate monitoring purposes. The rapid pace of investments and advancements by major spacefaring nations means governments must act swiftly to maintain competitiveness.”

The main takeaway is that less expensive space travel is quickly unlocking new possibilities across multiple industries. The low Earth orbit economy alone could contribute about €1 trillion to the global economy by 2040. But in order to ensure the space sector’s compelling socioeconomic, environmental, technological, and political benefits, governments and the private sector need to work together.