Slovakia’s economy has endured a disappointing first half of the year, with growth sharply undershooting expectations and leaving policymakers with dwindling fiscal space.

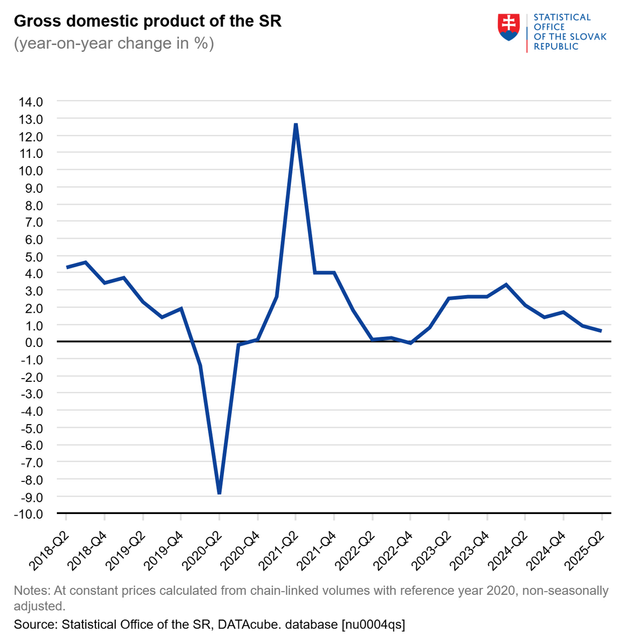

Gross domestic product expanded by just 0.6 percent year on year in the second quarter, according to data released on 5 September by the national Statistics Office — the slowest pace in two and a half years. Eurostat figures put Slovakia’s growth fractionally higher at 0.7 percent, but still less than half the eurozone average of 1.5 percent.

The slowdown is a mounting challenge for Finance Minister Ladislav Kamenický of the ruling Smer party, who has unveiled another fiscal consolidation package. Economists warn that the measures are already weighing on activity, while weaker growth makes the task of shoring up public finances even harder.

Consumption, traditionally the economy’s backbone, has been subdued for much of the year. A pre-emptive shopping spree at the end of 2024, ahead of new fiscal measures, left households cautious in early 2025. Spending picked up modestly in the second quarter, supported by one-off bonuses in the public and private sectors, but household consumption still recorded its slowest growth in 18 months.

Czechia: 2.6 percent

Poland: 3 percent

Hungary: 0.2 percent

Austria: 0.3 percent

Euro area: 1.5 percent

EU: 1.6 percent

Source: Eurostat

Fixed investment offered a stronger boost, rising 4.2 percent year on year, fuelled by higher drawdowns from the EU’s Recovery and Resilience Facility. Public investment was expected, but private capital spending — led by the car industry and construction of Volvo’s new plant in eastern Slovakia — exceeded forecasts. A recovering property market also lifted household investment.

Even so, analysts stress that the drivers of growth remain temporary. “The fiscal consolidation, which significantly raised the tax burden on the private sector, is dampening activity,” said Ľubomír Koršňák, economist at UniCredit Bank. He told Sme that Slovakia’s industrial base, heavily reliant on car exports, remains exposed to US tariffs. A new trade agreement cutting duties on cars from 27.5 to 15 percent will provide some relief, though its impact will only be felt from 2026.

Future momentum will hinge on a revival in Germany and wider Europe, as well as looser monetary policy from the European Central Bank. But most analysts have already trimmed forecasts, with growth in 2025 now expected at just 0.7–0.8 percent — far short of earlier hopes for a stronger recovery.