Photo by Chandler Cruttenden on Unsplash

Global warming is increasing the frequency and severity of extreme weather events such as heatwaves, floods and wildfires. Extreme weather events in turn raise homeowners insurance costs, especially for those living in the most affected areas. For example, as global warming intensifies wildfires in California, millions of people are struggling to afford higher insurance premiums and some insurance companies are cancelling coverage in fire-prone areas. While many Americans believe that weather-related disasters are increasing in their frequency and severity, some do not yet understand the links between global warming, extreme weather events, and insurance rates.

In the latest Climate Change in the American Mind survey, conducted in May 2025, we asked Americans about their views on how global warming is affecting homeowners insurance costs.

Key takeaways:

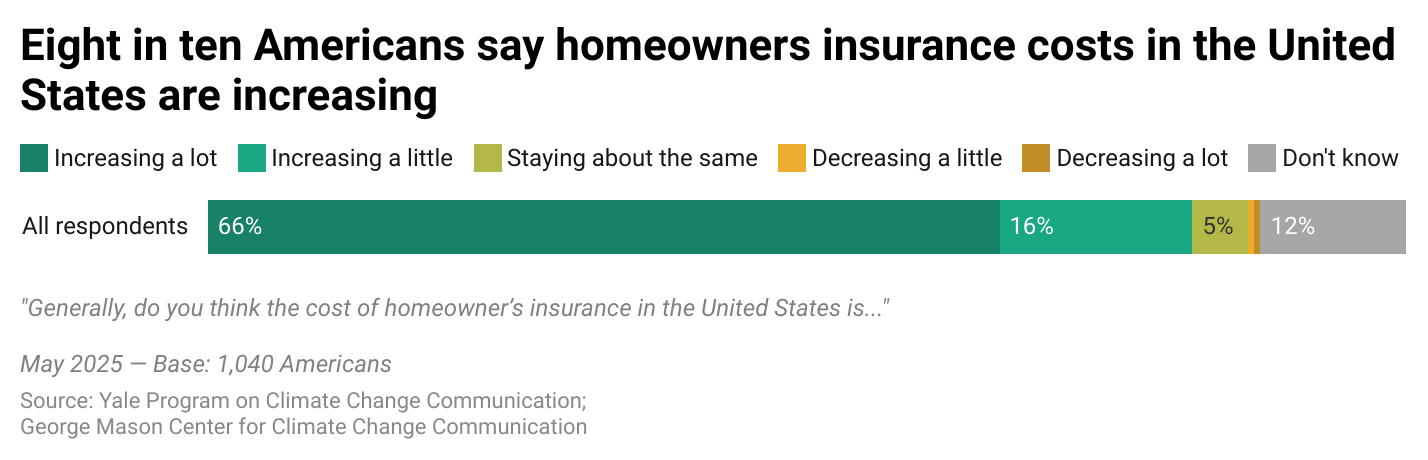

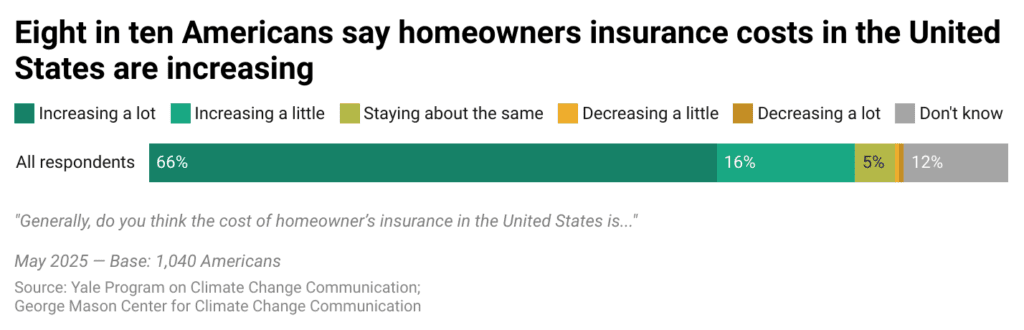

A large majority of Americans (82%) say the cost of homeowners insurance is increasing, including about two-thirds (66%) who say it is increasing “a lot.”

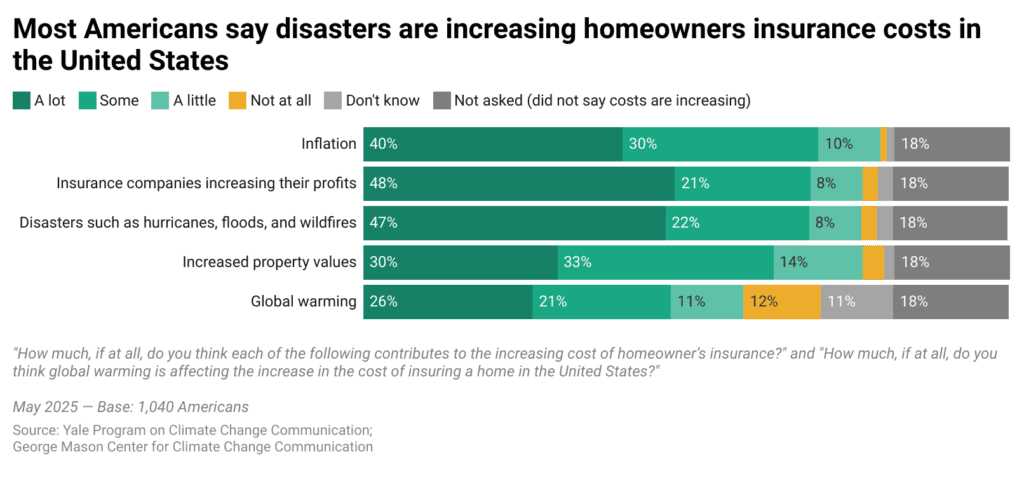

A majority of Americans (69%) think disasters such as hurricanes, floods, and wildfires contribute to increasing homeowners insurance costs, including nearly half (47%) who say such disasters contribute “a lot.”

About half of Americans (48%) think global warming contributes to increasing homeowners insurance costs.

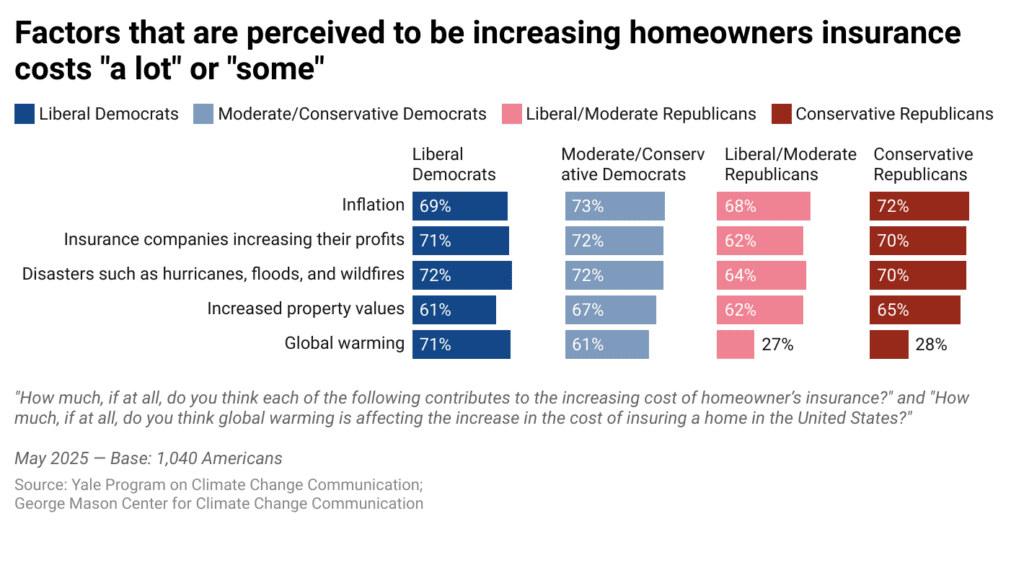

More Democrats than Republicans say that global warming contributes to the increasing cost of homeowners insurance.

Although many Americans understand that global warming contributes to rising homeowners insurance costs, more attribute the cost increases to corporate profits, disasters (such as hurricanes, floods, and wildfires), inflation, and rising property values. Democrats and Republicans hold similar views about these other factors’ roles in increasing insurance costs.

A large majority of Americans (82%) say the cost of homeowners insurance is increasing, including about two-thirds (66%) who say it is increasing “a lot.”

Most Americans say that multiple factors contribute “a lot” or “some” to rising homeowners insurance costs. These include inflation (70%; including 40% who say it contributes “a lot”), insurance companies increasing their profits (69%; 48% “a lot”), disasters such as hurricanes, floods, and wildfires (69%; 47% “a lot”), and increased property values (63%; 30% “a lot”). About half of Americans (48%) say global warming is affecting the increase in cost of homeowners insurance in the United States (including 26% who say it contributes “a lot”).

More Democrats than Republicans think global warming contributes to increasing homeowners insurance costs “a lot” or “some” (liberal Democrats: 71%, moderate/conservative Democrats: 61%, liberal/moderate Republicans: 27%, conservative Republicans: 28%).

For the other factors we asked about (inflation, insurance companies increasing their profits, disasters, and increased property values), there were no significant differences between respondents of different political ideologies.

Conclusion

These findings indicate that about half of Americans understand that global warming is contributing to rising homeowners insurance costs. While inflation, corporate profits, and property values remain top of mind, political divides persist when it comes to climate-related explanations. Many more people say disasters themselves are increasing the cost of insurance (69%), than say global warming is doing so (48%). This perception gap is primarily present among Republicans, with more than twice as many attributing increased costs to “disasters” (68%) as “global warming” (27%). This suggests there is an important communication opportunity to help Americans (especially Republicans) connect the dots between increasingly costly weather-related disasters and global warming. As climate impacts grow more severe and costly, communicating the link between global warming and everyday financial burdens like insurance may help deepen public understanding of climate risks.

Methods

The results of this report are based on Spring 2025 data from the Climate Change in the American Mind survey (n = 1,040) — a nationally representative survey of U.S. public opinion on climate change conducted twice yearly by the Yale Program on Climate Change Communication and the George Mason University Center for Climate Change Communication. The survey was conducted May 1–12, 2025. All questionnaires were self-administered by respondents in a web-based environment. The sample was drawn from the Ipsos KnowledgePanel®, an online panel of members drawn using probability sampling methods. Percentages are weighted to match national population parameters.

Participants were asked the following question:

“Generally, do you think the cost of homeowner’s insurance in the United States is… [Increasing a lot/Increasing a little/Staying about the same/Decreasing a little/Decreasing a lot/Don’t know]”

Participants who responded “increasing a lot” or “increasing a little” to the previous question were also asked the following questions later in the survey:

“How much, if at all, do you think global warming is affecting the increase in the cost of insuring a home in the United States? [A lot/Some/A little/Not at all/Don’t know/Refused]”

“How much, if at all, do you think each of the following contributes to the increasing cost of homeowner’s insurance? [Increased claims for damages caused by disasters such as hurricanes, floods, and wildfires/Insurance companies increasing their profits/Increased property values/Inflation] [A lot/Some/A little/Not at all/Don’t know/Refused]”

Group differences were tested for statistical significance using the weighted proportions and unweighted sample sizes of each group. Average margins of error at the 95% confidence interval for the subgroups of respondents are:

Liberal Democrat +/- 6 percentage points (n = 245)

Moderate/Conservative Democrat +/- 7 percentage points (n = 222)

Liberal/Moderate Republican +/- 9 percentage points (n = 123)

Conservative Republican +/- 6 percentage points (n = 283)