While Europe’s policymakers and opinion leaders obsess over semiconductors and clean tech, another economic engine is humming along with far less fanfare – and far greater local impact. In its forecast for the five-year period from 2024 to 2029, Oxford Economics named travel and tourism the world’s fastest-growing established industry – outpacing financial services, manufacturing, and even information and communication. It’s time Europe treated it as a serious pillar of economic strength – not a sideshow.

And yet, the travel industry remains strikingly underappreciated by Europe’s top decision-makers.

© World Travel & Tourism Council

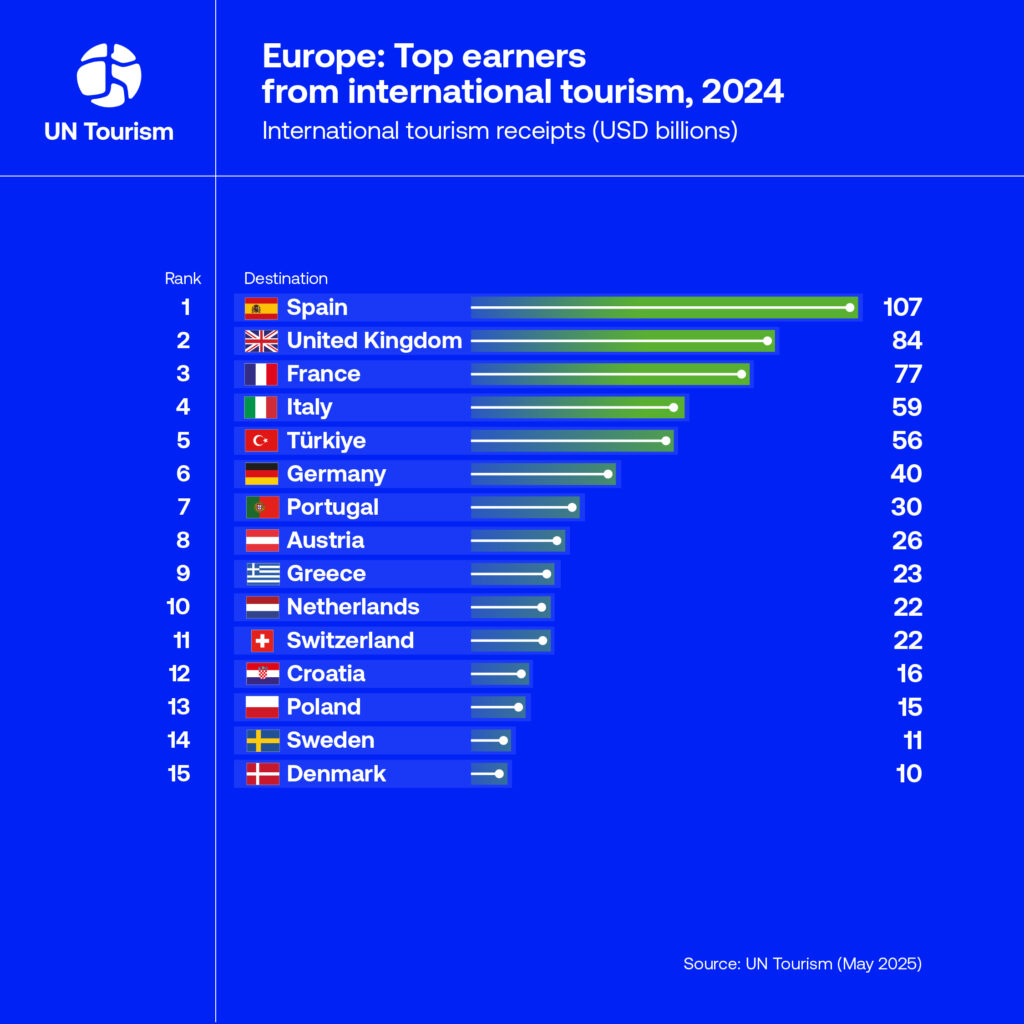

© World Travel & Tourism CouncilIf we add up international tourism receipts for the EU’s top ten markets in 2024, the figure comes to roughly €400 billion – comparable to the size of a mid-sized EU member state. Unlike other revenue streams, tourism receipts count as service exports – real money flowing in from outside into the local economies of Member States, supporting jobs that cannot be offshored.

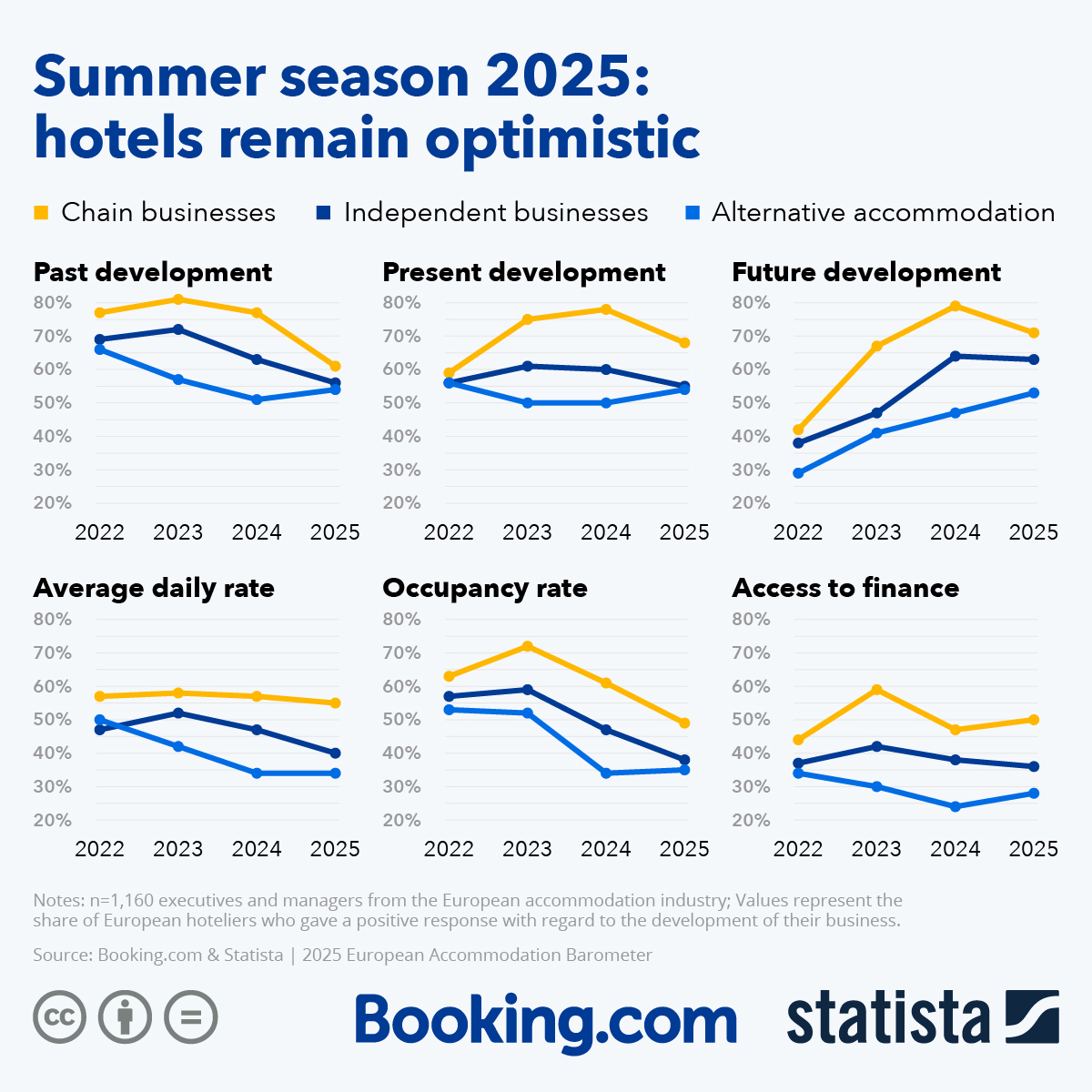

The latest European Accommodation Barometer 2025 paints a clear picture: the sector is “grounded, growing, and optimistic about the future.” Even as the revenge-travel wave (post-COVID) recedes, the industry is stabilising at a high level, with 63% of accommodations anticipating positive business development over the next six months.

This optimism reflects real momentum in the market, and Southern Europe – particularly Greece, Italy, Spain, and Portugal – continues to show sustained strength. The sector’s trajectory stands in stark contrast with the caution prevalent in the Europe-wide market outlook.

© UN Tourism

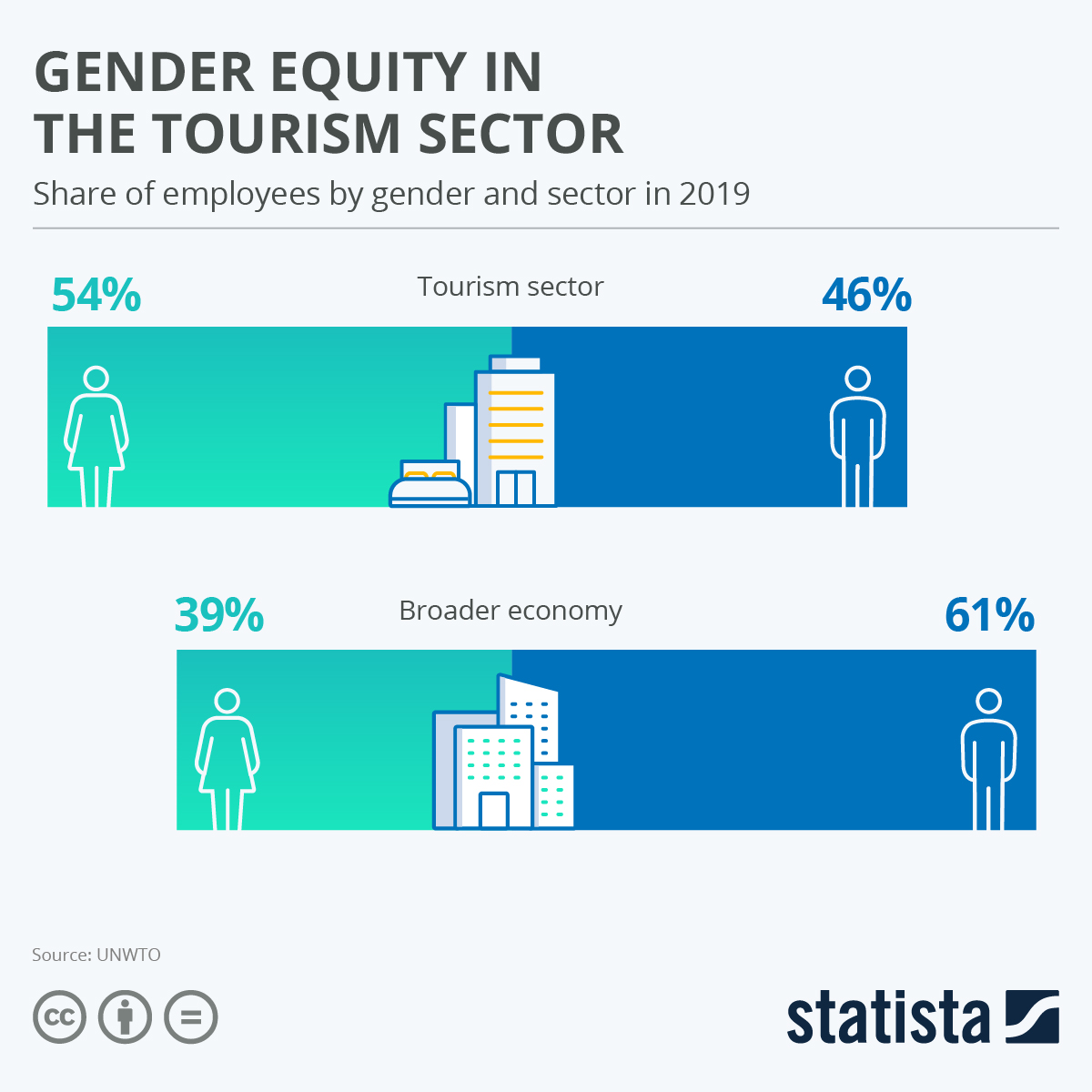

© UN TourismEurope’s travel and tourism sector is labour-intensive, geographically distributed, and uniquely resilient. From alpine guesthouses to coastal inns, the accommodation industry sustains local economies that would otherwise struggle with youth unemployment, if not depopulation. It anchors supply chains that include food growers, caterers, artisans, local services, and even European tech vendors like Booking.com or Amadeus. Travel and tourism is also an inclusive employer: more than half of workers in the sector are women, and small, family-run businesses make up the majority of market players.

© UN Tourism

© UN TourismSmall and medium-sized enterprises (SMEs) are the backbone of the European travel industry. In its Annual Report on European SMEs, the European Commission estimated that they generate 81% of the value added and account for nearly 85% of employment in hospitality. But it’s not just about numbers; SMEs are central to the sector’s identity and provide the diversity and authenticity that draws global travellers to Europe in the first place.

Despite their outsized role, these SMEs face mounting challenges.

The Accommodation Barometer reveals a consistent performance gap between chain-affiliated and independent properties. Chain hotels show higher sentiment, stronger outlooks, and better tech adoption rates. AI tools, automation, and data analytics are beginning to transform the sector – but smaller businesses are at risk of falling behind. The biggest barriers? Cost, staffing, and lack of digital skills.

© Booking.com

© Booking.comUpskilling and tech adoption remain elusive goals for many. Without targeted support, this innovation gap will only widen, entrenching a two-speed industry.

By using open platforms like ours, SMEs can focus on delivering high-value services, such as personalised guest experiences, while benefiting from advanced technology and global reach. Partnership with digital platforms helps small businesses solve one of their biggest headaches – customer acquisition – in a risk-free way without the need for upfront investment. This synergy between small businesses and large tech platforms is exactly what Prof. Mario Draghi championed in his landmark report – and what independent research from McKinsey also underscores.

© Booking.com

© Booking.comEU-wide funding streams such as the Recovery and Resilience Facility and Cohesion Funds have opened up possibilities for digital and green investment, and we know that tourism can be part of the solution to our continent’s economic woes. Cities like Paris, Vienna, and Copenhagen are experimenting and pioneering smart, sustainable tourism. The next step is to treat the travel sector not as an afterthought but as a strategic industry.

Europe’s policy focus must sharpen around three imperatives: upskilling the tourism workforce, accelerating the diffusion of digital technologies, and supporting the SMEs that shape the tapestry of the European travel ecosystem. This doesn’t mean picking winners or sidelining open digital platforms – it means making sure the tools of modern competitiveness are accessible to all, not just the largest hospitality brands with global name recognition.

In rural and coastal regions, tourism is often the mainstay of the local economy. But it also plays a strategic role in Europe’s soft power – shaping perceptions, building intercultural ties, and projecting values. No industrial policy or forward-looking vision is complete without factoring in what travel can do not just for GDP, but for identity and resilience.

The European Accommodation Barometer 2025 makes one thing clear: Europe’s travel sector is not coasting. It’s evolving, professionalising, and investing for the long term. Now the question is whether public policy will keep up.