Every Wednesday we break down the latest data, research and financial results into digestible chunks.

Read on for the numbers you need to know about without the fluff.

This column is sponsored by Xsolla, which can help you to quickly launch your branded web shop to boost revenue and expedite your marketing ROI. Get started here.

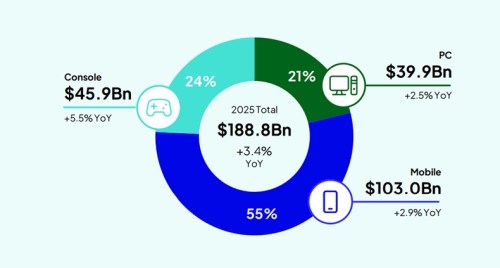

Mobile market to rise 2.9% to $103bn in 2025

Mobile games revenues are forecast to reach $103bn in 2025 (+2.9% YoY), according to research firm Newzoo.

In its latest global games market report, it estimates mobile will account for 55% of total game software and subscription services revenues this year.

Worldwide games revenue is forecast to hit $188.8bn in 2025 (+3.4% YoY), with consoles generating $45.9bn (+5.5% YoY), accounting for 24% of the total. Spending on PC game software and subscription services is expected to reach $39.9bn (+2.5% YoY), representing 21% of total revenues.

Mobile’s share of the overall market is forecast to decline slightly over the coming years. In 2026, it’s expected to account for 54% ($105.9bn) of a $196.1bn market.

In 2027, mobile will account for 53% ($106.8bn) of a $201.6bn market, and in 2028, it will account for 53% ($109.4bn) of a $206.5bn market.

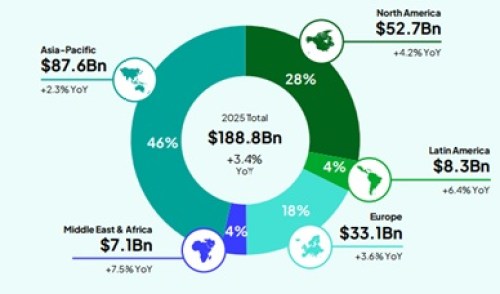

Across all platforms, the Asia-Pacific market is forecast to reach $87.6bn (+2.3% YoY) in 2025, representing 46% of the worldwide total.

That figure will almost be matched by the combined revenue generated in North America ($52.7bn) and Europe ($33.1bn), representing YoY growth in these markets of 4.2% and 3.6% respectively.

The largest growth is expected to come from the Middle East & Africa, which is forecast to generate $7.1bn (+7.5% YoY), and Latin America, with $8.3bn (+6.4% YoY).

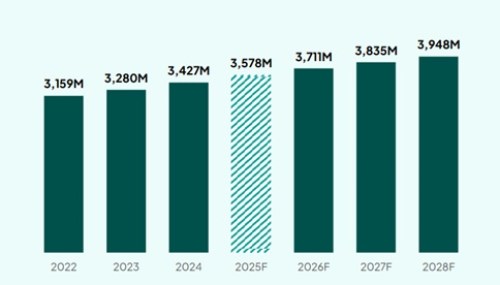

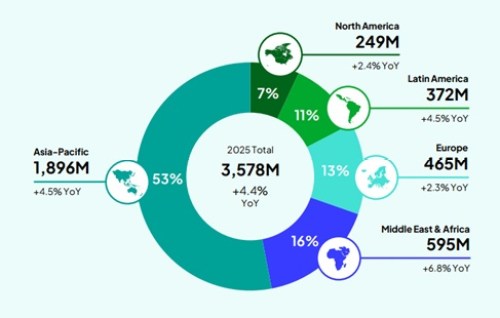

Newzoo forecasts there will be almost 3.6bn (4.4% YoY) game players worldwide this year.

2.985bn (+4.5% YoY) people, or 83% of all players, will be mobile gamers. 936m (+3.1% YoY), or 26% of the total, will play on PC. And 645m (+2.5% YoY), or 18% of all players, will play on console.

Asia-Pacific will be the largest market with 1.896bn players (+4.5% YoY), representing 53% of total players.

North America will be home to 249m players (+2.4% YoY), Europe to 465m (+2.3% YoY), Latin America to 372m (+4.5% YoY), and Middle East & Africa to 595m (+6.8% YoY).

Of the 3.6bn players, 1.6bn (4.9% YoY), or 44% of the total, are expected to be ‘payers’ who have spent money on games in the previous six months. The average spend per paying gamer is forecast to be $119.7.

Aonic acquires Prime Insights for $250m+

Gaming and tech group Aonic has acquired research technology firm Prime Insights in a deal worth “in excess” of $250m.

Prime Insights, Aonic’s largest acquisition to date, was founded in 2022. Aonic said Prime Insights will join its existing firms, including flagship user acquisition platform Exmox, “to form a unified, global rewards and data platform spanning 50 million+ consumers, 12 owned and operated consumer brands, and approximately $300m+ in yearly revenues”.

In January, Aonic invested $10m in loyalty and rewards platform Mega Fortuna, best known for its ‘play and earn’ app Richie Games. The deal included an option to acquire the entire share capital of Mega Fortuna for up to $70m.

2024 mobile game spending hit $13.8bn in key EU markets

Mobile games generated approximately €11.8bn ($13.8bn) across five key European markets in 2024.

That’s according to Ipsos data covering France, Germany, Italy, Spain and the UK, which was commissioned by Video Games Europe for its annual ‘All About Video Games’ report.

In total, consumers in these markets spent €26.8bn ($31.5bn) on games last year, which was up 4% compared to 2023.

Mobile accounted for 44% of the total (versus 41% in 2023), with console games contributing 38% (vs. 41%), PC titles 15% (vs. 14%), and on-demand/streaming games 4% (vs. 3%).

Digital game sales accounted for 90% of total revenue in these markets last year, compared to 85% in 2023.

In-app purchases and paid apps made up 43% of digital revenue, compared to 41% in 2023.

The total number of players across platforms reached 128.3m, which was up from 124.4m a year earlier.

54% of Europeans aged 6-64 played games, including 35.9m in Germany, 30.8m in France, 25.5m in the UK, 22.1m in Spain, and 14m in Italy. 45% of all players were women.

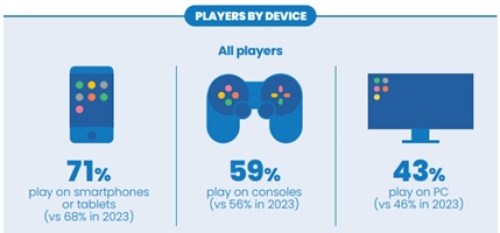

In 2024, 71% of players played on smartphones or tablets (vs. 68% in 2023), 59% played on consoles (vs. 56%), and 43% played on PC (vs. 46%).

Looking at women only last year, 76% played on mobile devices, 55% played on consoles, and 35% played on PC.

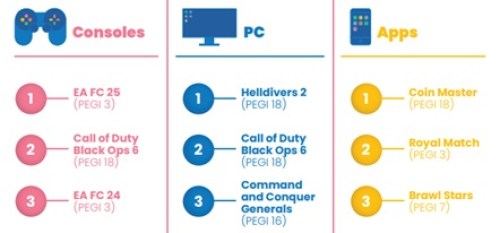

Coin Master was the top-earning mobile game across the five European markets, followed by Royal Match, Brawl Stars, Candy Crush and Roblox.

Monopoly Go, Gardenscapes, Last War: Survival, Whiteout Survival and Clash of Clans rounded off the top 10.

Kaiju No. 8 reaches 2m downloads in four days

Kaiju No. 8: The Game hit 1m downloads on its release day and 2m within four days, according to publisher Akatsuki Games.

Players battle colossal monsters in the turn-based RPG, which is based on the Japanese manga and anime franchise Kaiju No. 8. The title was released for mobile on August 31, and is coming to Steam soon.

Shadowverse: Worlds Beyond earns $30m in first month

The mobile version of strategy card game Shadowverse: Worlds Beyond earned $30m globally in its first month, including over $28m in Japan, Sensor Tower reports.

According to its data, Cygames’ title racked up over 1.1m downloads worldwide between its release on June 17 and July 16. The game has also been released on Steam.

Appmagic ranked Shadowverse: Worlds Beyond as June’s 33rd highest grossing title with $22m in IAP revenue.

SuperGaming’s flagship first-person shooter MaskGun has reached 100m players worldwide across iOS and Android. Since its launch in January 2019, players have spent over 40m hours in the game and formed millions of clans, according to its developer.