What’s behind all this? Trump and his MAGA advisers are determined to take control of the Federal Reserve

FED

Federal Reserve

Officially, Federal Reserve System, is the United States’ central bank created in 1913 by the ’Federal Reserve Act’, also called the ’Owen-Glass Act’, after a series of banking crises, particularly the ’Bank Panic’ of 1907.

FED – decentralized central bank : http://www.federalreserve.gov/

and end its relative ‘independence’ from politicians. Trump wants the Fed to cut its ‘policy interest

Interest

An amount paid in remuneration of an investment or received by a lender. Interest is calculated on the amount of the capital invested or borrowed, the duration of the operation and the rate that has been set.

rate’ to at least 1% from its current level of 4%-plus and he wants the Fed to be at his beck and call over monetary policy and financial deregulation. Trump has called Fed chair Powell a “numbskull” and “stubborn mule” for refusing (so far) to accede to his demands to slash rates. Trump’s treasury secretary Scott Bessent likened Fed staffers to beneficiaries of “universal basic income for academic economists”. All these PhDs over there, I don’t know what they do.” Trump has already got one of his MAGA supporters on the Fed board (former White House chief adviser, Stephen Miran) and replacing Cook would get him closer to controlling the Fed – especially as Powell ends his term next year. Bessent is favourite to replace him.

Financial investors and mainstream economists like Krugman are shocked at Trump threatening ‘central bank

Central Bank

The establishment which in a given State is in charge of issuing bank notes and controlling the volume of currency and credit. In France, it is the Banque de France which assumes this role under the auspices of the European Central Bank (see ECB) while in the UK it is the Bank of England.

ECB : http://www.bankofengland.co.uk/Pages/home.aspx

independence’. This has been the mainstream mantra of the last 40 years. David Wessel, director of the Hutchins Center for Fiscal and Monetary Policy at the Brookings Institution, warned: “President Trump seems determined to control the Fed — and will use any lever he has to get a majority on the Federal Reserve Board of Governors,” he said. “This is one more way in which the president is undermining the foundations of our democracy.”

But are the Federal Reserve and all the other ‘independent’ central banks globally part of “the foundations of our democracy”? Actually, the Fed is a very undemocratic institution. American households have no say in who is appointed and what the board members decide. So why the strong support for central bank independence (CBI) among mainstream economists, financial investors, banks and politicians? Apparently, CBI provides an objective ‘neutral’ base for monetary policy uninfluenced by dangerous political forces (like democratically elected officials?) with appointees who have unparelled ‘expertise’ in monetary economics and policy. As neoliberal economist John Cochrane put it: “The veneration of independence also has intellectual roots in an era when people distrusted “politicians” despite their democratic accountability, and instead trusted disinterested technocrats.”

The usual contemporary example of what happens when a central bank comes under the control of an elected president is Turkey, where President Erdogan continually sacked central bank governors until they did his bidding to cut interest rates

Interest rates

When A lends money to B, B repays the amount lent by A (the capital) as well as a supplementary sum known as interest, so that A has an interest in agreeing to this financial operation. The interest is determined by the interest rate, which may be high or low. To take a very simple example: if A borrows 100 million dollars for 10 years at a fixed interest rate of 5%, the first year he will repay a tenth of the capital initially borrowed (10 million dollars) plus 5% of the capital owed, i.e. 5 million dollars, that is a total of 15 million dollars. In the second year, he will again repay 10% of the capital borrowed, but the 5% now only applies to the remaining 90 million dollars still due, i.e. 4.5 million dollars, or a total of 14.5 million dollars. And so on, until the tenth year when he will repay the last 10 million dollars, plus 5% of that remaining 10 million dollars, i.e. 0.5 million dollars, giving a total of 10.5 million dollars. Over 10 years, the total amount repaid will come to 127.5 million dollars. The repayment of the capital is not usually made in equal instalments. In the initial years, the repayment concerns mainly the interest, and the proportion of capital repaid increases over the years. In this case, if repayments are stopped, the capital still due is higher…

The nominal interest rate is the rate at which the loan is contracted. The real interest rate is the nominal rate reduced by the rate of inflation.

. The result, according to the mainstream economists was rampant inflation

Inflation

The cumulated rise of prices as a whole (e.g. a rise in the price of petroleum, eventually leading to a rise in salaries, then to the rise of other prices, etc.). Inflation implies a fall in the value of money since, as time goes by, larger sums are required to purchase particular items. This is the reason why corporate-driven policies seek to keep inflation down.

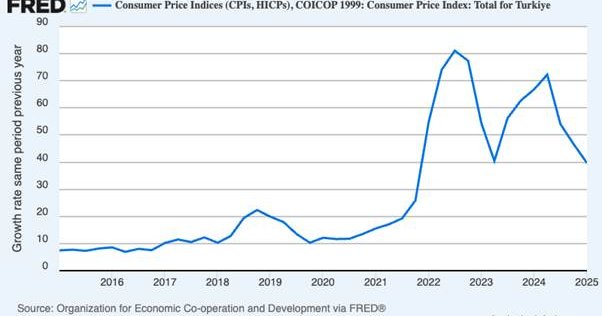

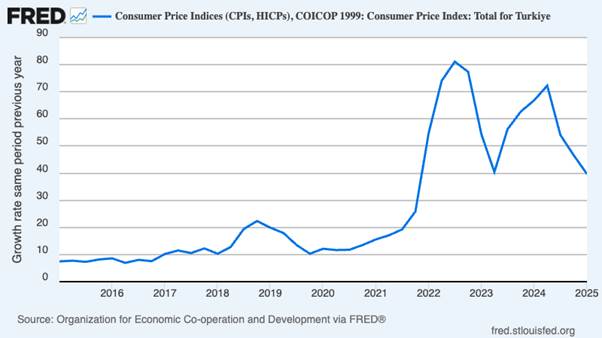

. Krugman gives us Turkey’s inflation rate under Erdogan.

But was Turkey’s 40-50% a year inflation due to low interest rates or due to its chronically huge current account deficits that drove down the Turkish lira against the euro and the dollar -and also Erdogan’s political moves to suppress opposition forces in the country, Trump style? Turkey’s current account and trade deficit relative to GDP

GDP

Gross Domestic Product

Gross Domestic Product is an aggregate measure of total production within a given territory equal to the sum of the gross values added. The measure is notoriously incomplete; for example it does not take into account any activity that does not enter into a commercial exchange. The GDP takes into account both the production of goods and the production of services. Economic growth is defined as the variation of the GDP from one period to another.

more than doubled during the Erdogan years.

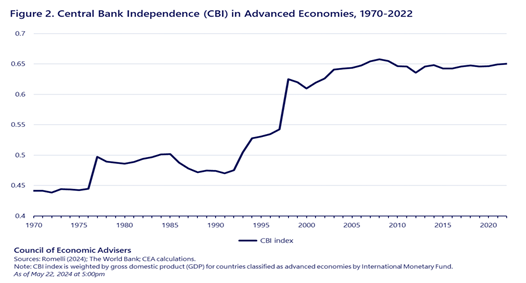

Central bank independence (CBI) mushroomed in the neo-liberal period after the stagflationary 1970s. CBI was a part of neo-liberal economic policy, which aimed to get government out of the ‘managing the economy’ Keynesian style and instead allow free markets and deregulation of finance, in particular. Since the 1990s, in particular, CBI has become “accepted wisdom of modern economics” (Cochrane).

All the great and good of financial institutions now praise the need for CBI. Take the IMF

IMF

International Monetary Fund

Along with the World Bank, the IMF was founded on the day the Bretton Woods Agreements were signed. Its first mission was to support the new system of standard exchange rates.

When the Bretton Wood fixed rates system came to an end in 1971, the main function of the IMF became that of being both policeman and fireman for global capital: it acts as policeman when it enforces its Structural Adjustment Policies and as fireman when it steps in to help out governments in risk of defaulting on debt repayments.

As for the World Bank, a weighted voting system operates: depending on the amount paid as contribution by each member state. 85% of the votes is required to modify the IMF Charter (which means that the USA with 17,68% % of the votes has a de facto veto on any change).

The institution is dominated by five countries: the United States (16,74%), Japan (6,23%), Germany (5,81%), France (4,29%) and the UK (4,29%).

The other 183 member countries are divided into groups led by one country. The most important one (6,57% of the votes) is led by Belgium. The least important group of countries (1,55% of the votes) is led by Gabon and brings together African countries.

http://imf.org

. The IMF’s Managing Director Kristalina Georgieva said it clearly earlier this year, when she noted that “independence is critical to winning the fights against inflation and achieving stable long-term economic growth.” She claimed: “Just consider what independent central banks have achieved in recent years. Central bankers steered effectively through the pandemic, unleashing aggressive monetary easing that helped prevent a global financial meltdown and speed recovery.” And “central bank actions have brought inflation down to much more manageable levels and reduced the risks of a hard landing.”

Georgieva cited one IMF study, looking at dozens of central banks from 2007 to 2021, which showed that those with strong independence scores were more successful in keeping people’s inflation expectations in check, which helps keep inflation low. Another IMF study tracking 17 Latin American central banks over the past 100 years examined factors including: decision-making independence, clarity of mandate, and whether they could be forced to lend to the government. It also found that greater independence was associated with much better inflation outcomes. “The bottom line is clear: central bank independence matters for price stability—and price stability matters for consistent long-term growth.”

But are these claims valid? Correlation is not causation, as we know. The period from the 1990s through the 2010s was one of falling global inflation anyway as economies grew more slowly. Global consumer price inflation fell from a peak of 16.9 percent in 1974 to 2.5 percent in 2020. As the World Bank explains: “Global inflation fell sharply (on average by 0.9 percentage points) in the year to the trough of global recessions and continued to decline even as recoveries got underway. Conversely, persistently below-target inflation has accompanied weak growth in advanced economies since the 2007–09 global financial crisis.”

The fall in inflation may coincide with the rise of independent central banks but the cause is really down to slowing economic growth. Indeed, during the 2010s Long Depression, global inflation slowed despite central banks reducing interest rates close to zero in an attempt to ‘create’ some inflation. The classic example of this is the Bank of Japan where policy rates were kept to zero and yet there was price deflation.

And when it comes to the post-pandemic inflationary spike, central banks (independent or not) just ‘chased’ inflation without much success. The reason for the failure of central banks to control post-pandemic inflation was that it was not caused by ‘excessive demand’ or ‘excessive money supply’ as mainstream monetarist or Keynesian theory argued, but by supply-side factors. As a FT article concluded at the time: “Either way, monetary policy is a catchall tool. It cannot control demand in a quick, linear or targeted manner. Other measures need to pick up the slack. Estimates suggest supply factors — which rates have little influence over — are now contributing more to US core inflation than demand.”

As Cochrane puts it: “This presumption that central banks control inflation is so strong that many articles on time consistency, independence, and related simply assume that central banks directly control inflation! But it’s no longer so obvious that central banks do tightly control inflation….the evidence that they can boost inflation with low interest rates in a functioning economy is much weaker. This is the “pushing on a string” or “money is oil” view of the macroeconomy — too little oil seizes the engine, but 8 quarts instead of 4 won’t make you spurt down the freeway.”

The other claim for CBI is that ‘expert technicians’ can better control monetary policy and financial regulation than stupid or corrupt politicians. And yet all that expertise (and all those PhD Fed employees) were unable to see the financial crash coming in 2008. As Fed chair Alan Greenspan spoke to Congress after the event: “I am in a state of shocked disbelief.” He was questioned further:“In other words, you found that your view of the world, your ideology was not right, it was not working”(House Oversight Committee Chair, Henry Waxman). “Absolutely, precisely, you know that’s precisely the reason I was shocked, because I have been going for 40 years or more with very considerable evidence that it was working exceptionally well”. And there is another Fed chair, Ben Bernanke: In his statement to Congress in May 2007, when the sub-prime mortgage collapse was just getting under way, Bernanke said “at this juncture . . . the impact on the broader economy and financial markets of the problems in the subprime markets seems likely to be contained. Importantly, we see no serious broader spillover to banks or thrift institutions from the problems in the subprime market”. He went on to estimate that the likely losses to the financial sector of the mortgage

Mortgage

A loan made against property collateral. There are two sorts of mortgages:

1) the most common form where the property that the loan is used to purchase is used as the collateral;

2) a broader use of property to guarantee any loan: it is sufficient that the borrower possesses and engages the property as collateral.

crisis in the US would be “between $50 billion and $100 billion”. It turned out to be $1.5trn in the US and another $1.5trn globally. So much for the expertise of independent technocrats in central banks.

Central bank independence mushroomed not because it was more efficient in ‘controlling’ inflation or avoiding financial collapses, but because it fitted the neoliberal theory that freedom of markets and finance from government control was best for capitalism. CBI allows the financial sector to look after its fictitious capital (bonds and stocks) and the profits gained at the expense of wages and real value without potential interference by any democratically elected (left?) government. Bailing out the banks in the global financial crash to preserve an independent financial sector was the Fed’s policy. As Cochrane again puts it: . “The Fed went all-in with Treasury on the bailouts of 2020, buying up nearly all the new treasury issues, directly buying state and local government debt

Government debt

The total outstanding debt of the State, local authorities, publicly owned companies and organs of social security.

, financing astounding firehoses of money. The Fed could have invoked independence to object to any of this. It did not, and indeed egged the treasury on. (Bassetto and Sargen quote an un named Federal Reserve official as saying “The best way to defend the independence of a central bank is never to exercise it.”) Central bank independence means independence from the demands of the many to protect the interests of the financial sector.

That CBI is intended to help the financial sector, not the economy, is revealed in the reaction of financial markets to Trump’s recent attacks on the Fed. The US equity

Equity

The capital put into an enterprise by the shareholders. Not to be confused with ’hard capital’ or ’unsecured debt’.

market has kept on rising as stock market investors hope for quicker and deeper reductions in interest rates, thus making it cheaper to borrow to speculate. The bond market

Bond market

A market where medium-term and long-term capital is lent/borrowed in the form of bonds. Bonds are creditor stakes issued by companies or States.

is less sanguine and the so-called bond

Bond

A bond is a stake in a debt issued by a company or governmental body. The holder of the bond, the creditor, is entitled to interest and reimbursement of the principal. If the company is listed, the holder can also sell the bond on a stock-exchange.

yield

Yield

The income return on an investment. This refers to the interest or dividends received from a security and is usually expressed annually as a percentage based on the investment’s cost, its current market value or its face value.

curve (the difference between the interest return on ten-year government bonds and the short-term rate set by the Fed) has continued to widen. But this suggests that bond investors are worried by rising inflation reducing their real return – not particularly because Trump might soon control the Fed.

Of course, none of this scepticism about the merits of CBI and the consequent lack of democratic control over the banking system in the major economies means supporting Trump’s autocratic attempt to control the Fed as the ‘lender of last resort’. Replacing undemocratic central bank independence with Trumpist autocracy will do nothing for America’s working people; their mortgages, their loans, their savings, or their cost of living.