Nuclear startup Deep Fission has chosen an alternative route to raise capital. On Monday, the company announced it had completed an alternative public offering (APO), which brought in $30 million.

The offering was priced at $3 per share, below the $10-per-share level usually associated with traditional public offerings.

The deal gives Deep Fission more financial room to pursue its projects while coming with added regulatory reporting requirements. The company, which will retain its name, plans to quote its shares on the OTCQB market.

“This is a unique moment for the nuclear industry,” said Liz Muller, Co-Founder and Chief Executive Officer of Deep Fission.

“Deep Fission has the right technology, at the right time, and in the right place. With this funding, we can begin building our pilot reactor, with the goal of completion in 2026. We believe we can scale our technology rapidly and profitably to address the massive energy demand from AI data centers and other customers worldwide.”

How the reactors will work

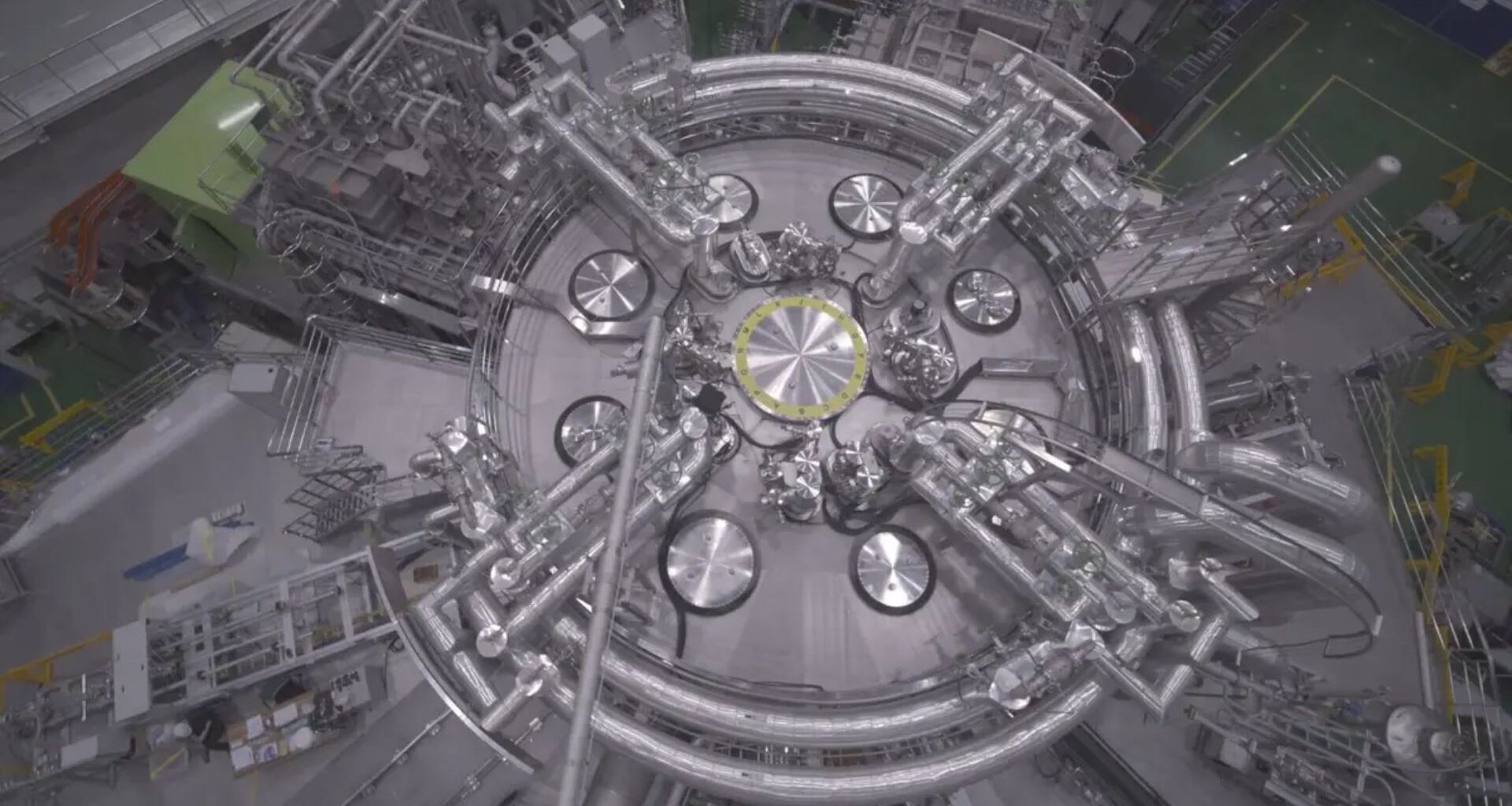

Deep Fission’s technology centers on small cylindrical reactors that can be lowered into 30-inch diameter boreholes drilled a mile into the Earth. Each reactor is designed to generate 15 megawatts of power and uses pressurized water cooling, a system proven in nuclear submarines and traditional power plants.

By placing the reactors deep underground, the company hopes to solve some of the long-standing challenges of nuclear power.

Burying the systems in bedrock creates natural shielding, offers protection against external threats, and reduces the surface footprint. Billions of tons of rock provide passive safety and containment.

The company says its proprietary design combines techniques from the nuclear, oil and gas, and geothermal industries. It will rely on off-the-shelf parts and low-enriched uranium to simplify supply chains. Deep Fission estimates that its first commercial systems could deliver electricity for 5 to 7 cents per kilowatt-hour.

Deals and government backing

Earlier this year, Deep Fission signed an agreement with data center developer Endeavor to build two gigawatts of underground nuclear reactors. The deal highlights the growing demand for reliable, carbon-free power to support artificial intelligence infrastructure and cloud computing.

In August, the startup was chosen as one of ten companies to join the Department of Energy’s Reactor Pilot Program. This program is designed to streamline permitting and accelerate deployment. The DOE has set a target for Deep Fission’s pilot reactor to reach criticality by July 4, 2026, with commercialization to follow.

The government’s support could prove crucial in helping the company bring its designs from concept to reality. Nuclear projects face high upfront costs and long development timelines, and backing from federal initiatives offers a path to reduce risks.

Financial pressures and plans

Despite the progress, the circumstances around the SPAC deal point to financial headwinds. Deep Fission raised only $4 million last year and had been seeking a $15 million seed round as recently as April.

While successful in securing $30 million, the reverse merger also brings added regulatory costs. Those costs could weigh heavily on a young company in an expensive sector.

Still, the startup sees this as a pivotal moment. With the new funding, it is preparing to build its first underground reactor by mid-2026.