With the global response to climate change, carbon markets have been widely promoted to mitigate carbon emissions, among which the European Union Emissions Trading System (EU ETS) is a typical example. Natural gas, as a widely used clean energy in the power industry, and electricity, as a crucial energy form, have price fluctuations that interact with the carbon market. However, research on the price transmission origin, paths, and multiscale response mechanisms among the three markets, especially the impact of the Russia-Ukraine conflict on their interaction, remains insufficient.

Therefore, Wenjun CHU, Liwei FAN, and Peng ZHOU from the School of Economics and Management & Institute for Energy Economics and Policy, China University of Petroleum, have carried out a research entitled “Examining the interactions of carbon, electricity, and natural gas markets”. This research was supported by the National Natural Science Foundation of China (Grant Nos. 72374213 and 72243012).

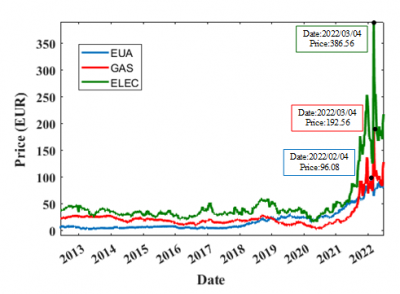

This study analyzes the relationship between the European carbon, electricity, and natural gas markets. To identify the origin and paths of price transmission among these markets, the Diebold Yilmaz spillover approach is employed. To investigate the multiscale response to price signals, the time-varying parameter stochastic volatility vector autoregression system is used, with weekly continuous data from June 1, 2012, to June 24, 2022 (corresponding to Phase III of the EU ETS) analyzed.

The research results show that the natural gas market plays a significant role in setting carbon prices, with short-term negative and medium-term positive effects. However, the Russia-Ukraine conflict can negate these effects, and the resulting natural gas market no longer exerts such shocks on the electricity market. Since the conflict, the electricity market has become a major price transmitter, producing short-term positive but medium-term negative effects on the carbon market. Additionally, each market generates different price signals for different time horizons. The carbon market has positive impacts on the electricity market in the short and medium terms but negative in the long term. The natural gas market responds positively to the carbon market in the short term but increasingly negatively in the medium term, while the carbon market shows short-term positive and medium-term negative responses to the electricity market. These results have important implications for policy-making, enterprise energy demand adjustment, and investor risk management.

The paper “Examining the interactions of carbon, electricity, and natural gas markets” authored by Wenjun CHU, Liwei FAN, Peng ZHOU. Full text of the paper: https://doi.org/10.1007/s42524-025-4077-3.