With the increasing frequency of extreme weather events, climate risks have gradually become a key factor affecting the stability of the global oil market. However, existing research on crude oil price forecasting has not fully considered the impact of extremely high-temperature weather, and there is a lack of accurate microscale meteorological data support and interpretable analysis of prediction models.

Therefore, Donglan ZHA, Shuo ZHANG, and Yang CAO from the College of Economics and Management and the Research Centre for Soft Energy Science of Nanjing University of Aeronautics and Astronautics jointly carried out a research entitled “Can extremely high-temperature weather forecast oil prices?”. This research was supported by the National Natural Science Foundation of China (Grant No.72074111).

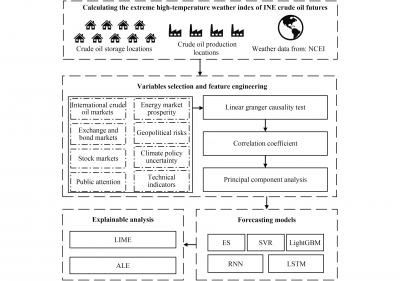

This study focuses on China International Energy Exchange (INE) crude oil futures, constructs an extreme high-temperature weather index (HTI) based on meteorological data from INE crude oil production and storage sites, and uses local interpretable model-agnostic explanations (LIME) and accumulated local effects (ALE) methods to compare the predictive contribution of HTI with 15 common predictors. The research results show that HTI significantly improves the out-of-sample prediction accuracy of five classical prediction models for INE oil prices. Among them, the recurrent neural network (RNN) model with an input sequence length of 1 has the best out-of-sample prediction performance, with a mean absolute error (MAE) of 14.379, a root mean square error (RMSE) of 19.624, and a directional symmetry (DS) of 66.67%. In most test cases, the predictive importance of HTI in the optimal RNN model ranks third, surpassing traditional oil price predictors such as stock market indicators. ALE analysis reveals a positive correlation between extremely high-temperature weather and INE oil prices. These findings can help investors and oil market regulators improve the accuracy of oil price forecasting and provide new evidence for the relationship between climate risk and oil prices.

The paper “Can extremely high-temperature weather forecast oil prices?” authored by Donglan ZHA, Shuo ZHANG, Yang CAO. The paper is published in Front. Eng. Manag. 2025, 12(3): 529–542, and the DOI is https://doi.org/10.1007/s42524-025-4075-5.