India and China’s interest in Russia’s crude oil will remain ‘strong’ irrespective of existing and upcoming sanction rounds, believes Vortexa, the cargo tracking & energy market intelligence firm. In its latest report on Russia’s oil exports, Vortexa says that Russian crude oil is likely to maintain its share at ‘biggest scale possible’ at the time of export. India is facing increasing pressure from the Donald Trump administration to stop buying crude oil from Russia. Trump officials have alleged that India’s crude oil trade with Russia indirectly helps finance the latter’s war with Ukraine. Russia’s share in India’s crude oil imports has gone up considerably from almost negligible before the Russia-Ukraine war to over 30%. Trump administration officials also claim that Indian refineries are ‘profiteering’ by selling refined Russian crude to global markets.

Russian crude ‘too significant’ for India, China

Russian supply remains essential and price-competitive for Indian and Chinese markets, despite fleet limitations and Western restrictions.“Despite tightening fleet dynamics and Western pressure, Russian supply is too significant and competitively priced for India and China,” Vorexta says.“But low oil prices and oversupply concerns for the next six months may embolden sanction efforts with some additional repercussions,” it adds.

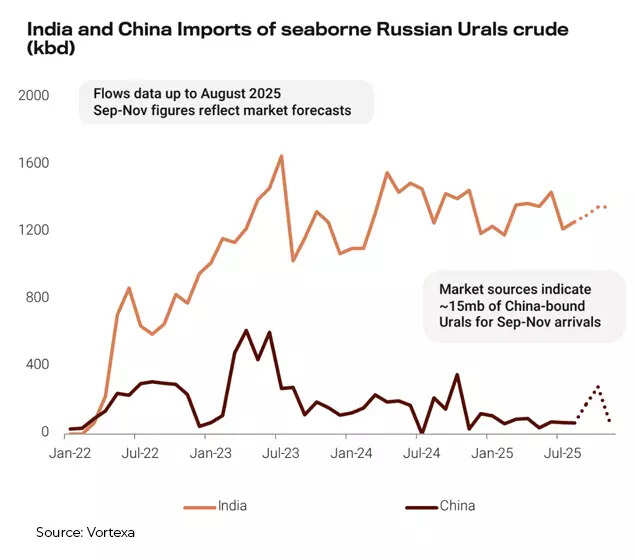

India and China imports of seaborne Russian urals

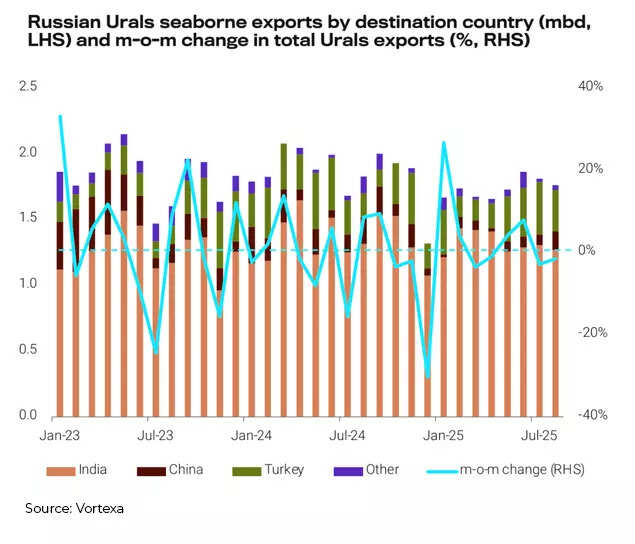

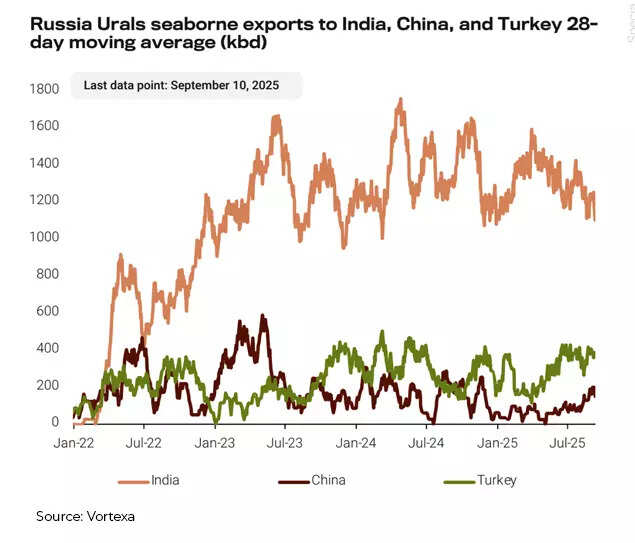

Russian Urals seaborne exports maintain steady volumes currently, with India representing a crucial market share. “Total seaborne Russian Urals exports see marginal change in volumes for now, share to India is too large to lose,” says Vortexa.Fourth quarter projections of Vortexa indicate growth in India’s crude imports, particularly through Sikka and Vadinar ports for Russian crude shipments.

Russian urals seaborne exports by destination country

China is prepared to receive approximately 15mb of Russian Urals previously destined for India, with the Northern Sea route facilitating quicker transport, says Vortexa.

Russia urals seaborne exports to India, China and Turkey

Fleet availability risks for Russian crude

According to Vortexa, Russian crude will aim to maintain export share but tightened fleet availability raises questions. Russian seaborne crude shipments showed year-on-year decline throughout most of 2025, primarily due to two factors:

Nevertheless, despite international pressure, Russian crude exports are expected to maintain substantial market presence. Whilst periodic export fluctuations may occur, substantial declines appear unlikely, Vortexa says.Also Read | India pushes back against Trump pressure: Russia crude imports rise to $3.4 bn, close to China’s $3.64 bn; EU buys fossil fuels too