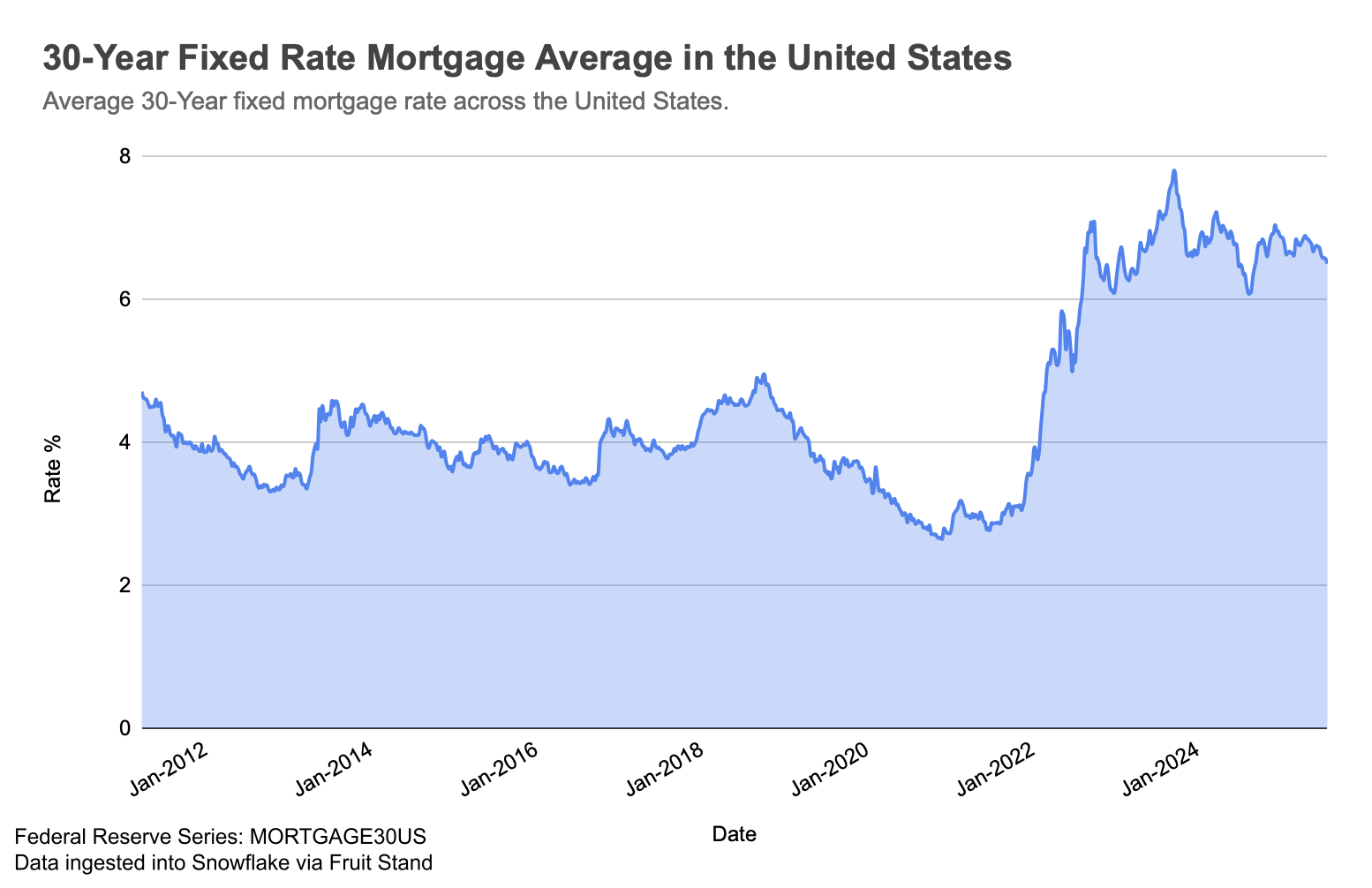

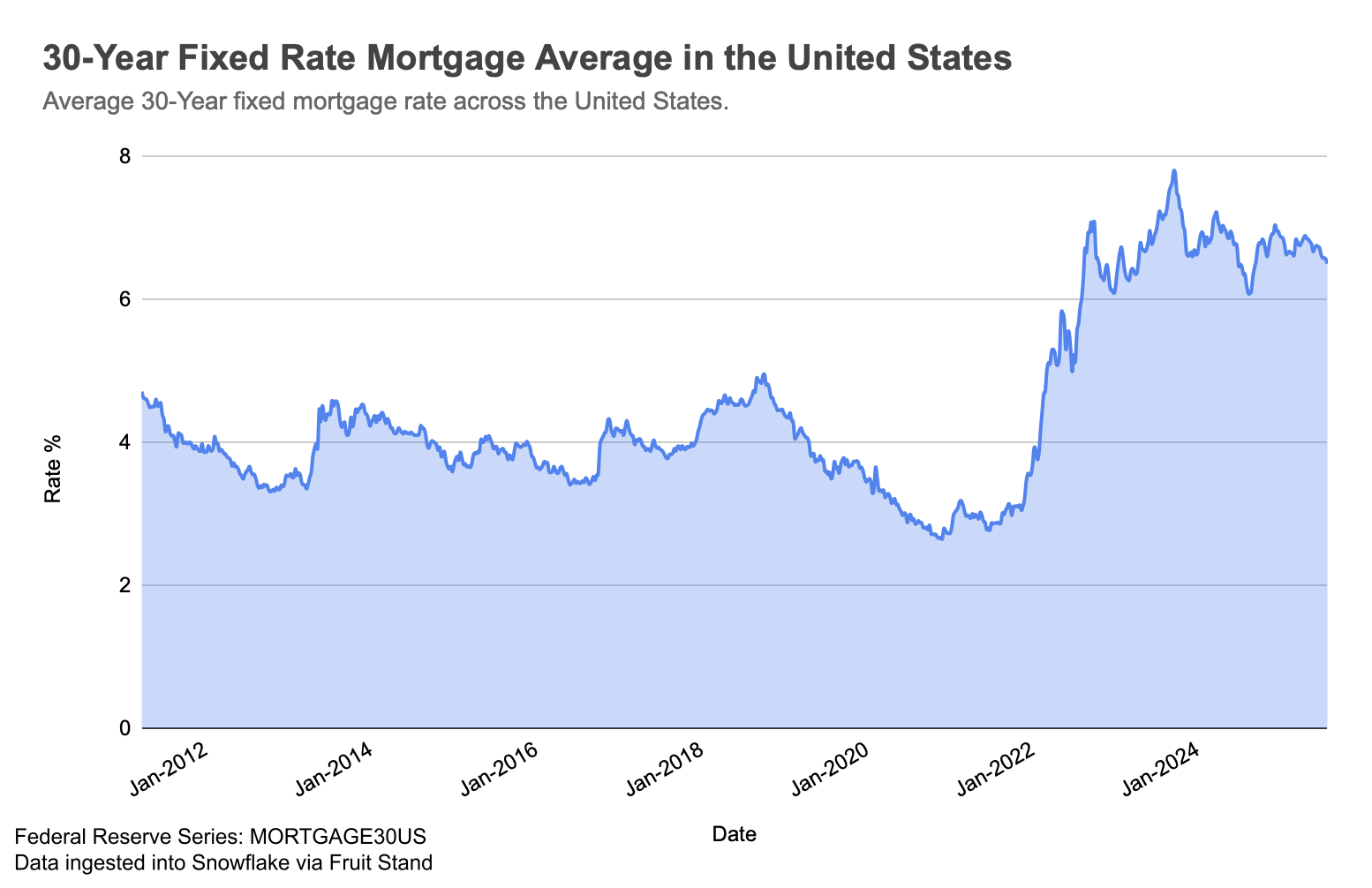

Data is sourced from the Federal Reserve (MORTGAGE30US). Based on applications submitted to Freddie Mac from lenders across the country.

Posted by fruitstanddev

![[OC] Latest Average 30-Year Fixed Mortgage Rate in the Unites States? 6.5%](https://www.europesays.com/wp-content/uploads/2025/09/5mqcxrnmjtof1.png)

Data is sourced from the Federal Reserve (MORTGAGE30US). Based on applications submitted to Freddie Mac from lenders across the country.

Posted by fruitstanddev

16 comments

[Here’s what it looks like when you zoom out](https://fred.stlouisfed.org/series/MORTGAGE30US)

https://preview.redd.it/mfwew83oktof1.jpeg?width=1206&format=pjpg&auto=webp&s=b1fa0766e5f8625f78d13fd0dd621dc64386ed24

Data is sourced from the Federal Reserve (MORTGAGE30US). Based on applications submitted to Freddie Mac from lenders across the country. Visualized via Google Sheets.

For those thinking about buying a home, I did some napkin math, buying a home today with a 400k mortgage at 6.5% compared to pre-covid at 4%, will cost you an extra $600 a month in interest payments. Each extra 1% interest is about $250 of interest a month.

So back to normal finally.

We bought our first home in 1993 at 9.5%. When we refinanced at 6.5% three or four years later, we thought we had robbed the bank.

Our smallish mortgage on our condo is at 3%. Not letting that go anytime soon.

Interest rates are not usually in the 2-4% range. The idea that people will be able to refinance “when rates drop” does not comport with the fact that current interest rates are actually quite reasonable.

We should be pulling different levers in order to lower housing prices. One alternative is adjusting zoning regulations in order to permit more density. It’s currently illegal to build anything except large single-family homes in much of the US. Smaller houses and more multi-family options would increase supply and provide more choice, which would drive down prices.

I bought a condo in Nov 2020 with a 30 year fixed rate 2.75%

I’m very lucky

Only time I’ve been happy I’m on the bottom of a curve.

I missed the boat on the sub-3% rates of a few years ago and got in at 5.99%. I wonder when it’ll even get to 4% again, much less 3.

I mean, at least show a spread to treasuries? One line is not beautiful.

Fed increases the funds rate? Mortgage rates go up.

Fed decrease the funds rate? Mortgage rates go up.

My first house was 3.25% in 2013. 8 years later I moved and it is 2.625%. I got very lucky.

I remember that recent dip, home prices got crazy. Houses would sell without going on the market, people would start putting in offers while the coming soon sign was still on the house. Multiple houses in my neighborhood sold instantly.

Run a 50 year on that and show the rates in the 80’s. Shit was 16% at the beginning and 10% at the end of the 80’s

I bought mid 2021 and have a fixed 30 year at 2.875%… I am never planning to sell this house if I can help it. Mortgage company tried to talk me into an ARM at the time too 😂😂

Every dip in my life I’ve bought at the top, except this one.

You’ll find my corpse in the attic. 🤘

Absolutely wild that it was about 4% or lower for over a decade straight. Never before and probably never again.

Comments are closed.