We’ve found 18 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

EQT Investment Narrative Recap

To be an EQT shareholder today, you need to believe in the ongoing demand for US natural gas and the company’s ability to capitalize on long-term export contracts to drive steady revenues and earnings growth. The newly announced 20-year LNG agreement with Commonwealth LNG aligns with EQT’s global expansion strategy, but does not materially change the key short-term catalyst for the stock, which remains the execution and ramp-up of its existing high-volume supply contracts to domestic power and data center operators. On balance, the biggest risk to the business continues to be external: a faster-than-expected global pivot toward renewables and more aggressive regulation could dampen future demand and raise costs, which is not immediately altered by this news.

One of the most relevant recent announcements is the regulatory approval EQT received in late August for its LNG projects, just prior to the Commonwealth LNG deal. This regulatory milestone supports the catalyst of accelerated export capacity and gives EQT a clearer path to deliver on its announced supply agreements, although project execution and timing still present ongoing uncertainties.

However, investors should also be attentive to the potential for regulatory or policy shifts that could alter the economics of LNG exports…

Read the full narrative on EQT (it’s free!)

EQT’s narrative projects $9.8 billion revenue and $3.8 billion earnings by 2028. This requires 11.3% yearly revenue growth and a $2.7 billion earnings increase from $1.1 billion today.

Uncover how EQT’s forecasts yield a $63.08 fair value, a 24% upside to its current price.

Exploring Other Perspectives EQT Community Fair Values as at Sep 2025

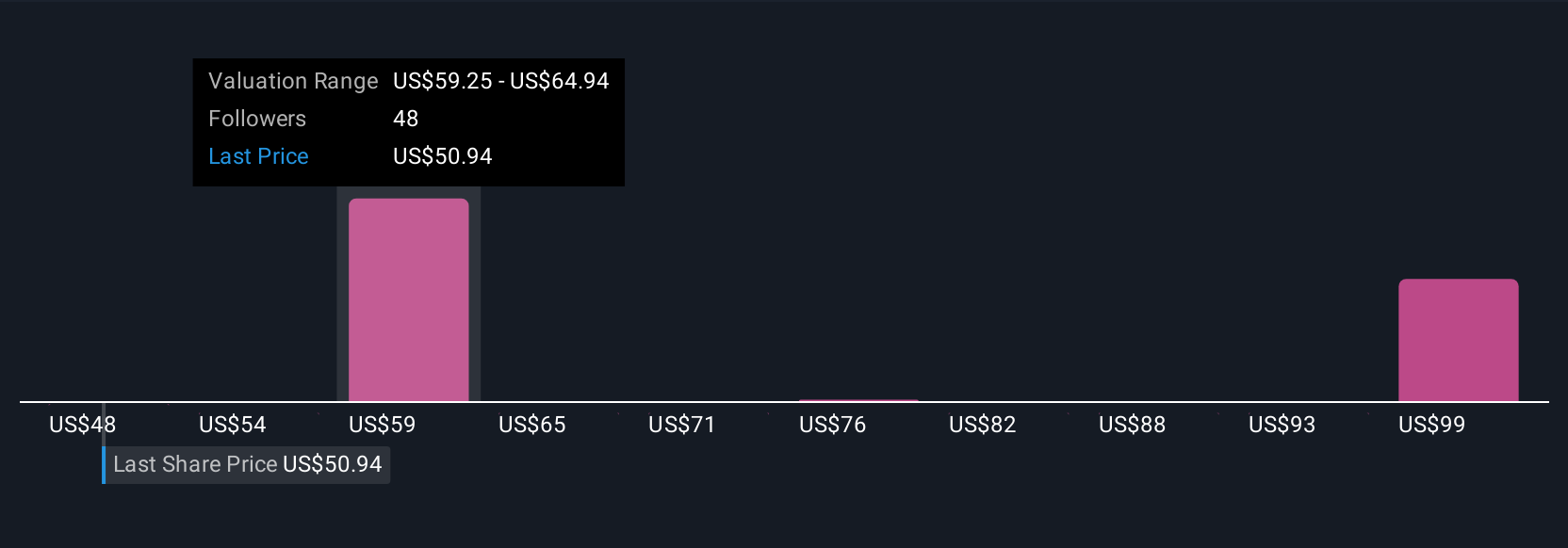

EQT Community Fair Values as at Sep 2025

Five Simply Wall St Community members estimate EQT’s fair value anywhere from US$47.87 to US$104.76 per share. While these opinions vary widely, execution on long-term supply contracts into export and data center markets could play a crucial role in shaping future performance outcomes. Consider how your outlook compares to these varied viewpoints.

Explore 5 other fair value estimates on EQT – why the stock might be worth over 2x more than the current price!

Build Your Own EQT Narrative

Disagree with existing narratives? Create your own in under 3 minutes – extraordinary investment returns rarely come from following the herd.

A great starting point for your EQT research is our analysis highlighting 4 key rewards that could impact your investment decision.Our free EQT research report provides a comprehensive fundamental analysis summarized in a single visual – the Snowflake – making it easy to evaluate EQT’s overall financial health at a glance.Ready To Venture Into Other Investment Styles?

Don’t miss your shot at the next 10-bagger. Our latest stock picks just dropped:

This article by Simply Wall St is general in nature. We provide commentary based on historical data

and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your

financial situation. We aim to bring you long-term focused analysis driven by fundamental data.

Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Simply Wall St has no position in any stocks mentioned.

Discover if EQT might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com