🤔💰 Ever wondered why Latin Americans complain about taxes when we actually pay less than most developed countries? Let's explore ↓

We've all heard someone complain about taxes. In Latin America, we have a skeptical attitude towards our hard-earned money being spent responsibly by our public servants.

Most of us don't think about it until we're adults and in the economic systems that bring avocados, cars, and microchips to life. Then we realize that there are multiple scenarios under which the tax man comes, often double-dipping: in everyday purchases, when we score some income, or just for owning property for another year (more or less in that order).

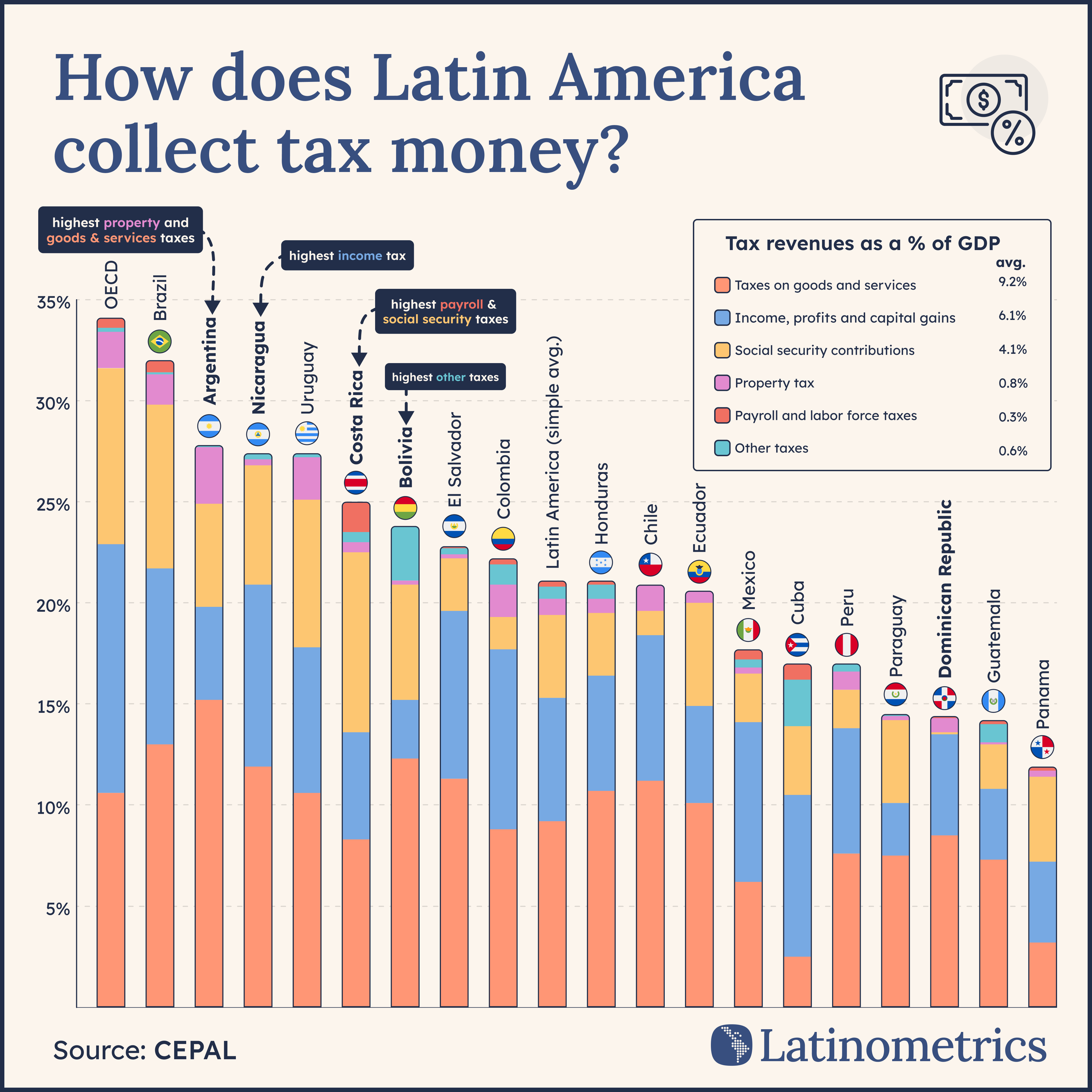

What you might not know (until today, thanks to your friends at Latinometrics) is that every single Latin American country collects less tax than the average OECD country, in terms of tax revenue as a % of their GDPs.

Does that sound great? It depends on who you ask.

Although we pay less tax proportionately than the OECD, this doesn't necessarily mean we give away a lower share of our own money; it simply means the economy as a whole contributes a lower proportion to the government.

story continues… 💌

Tools: Figma, Rawgraphs

Posted by latinometrics

![[OC] Tax revenues as a % of GDP, Latin American countries](https://www.europesays.com/wp-content/uploads/2025/09/ny5376bh4rof1-1920x1024.png)

9 comments

Brazil is much more well rounded than I thought it would be. Despite being the most suffocating of all of the others. Giving me the impression that it needs some sort of calibration on the amount. It needs to be studied, the continental size of the country and the model of government is for sure a factor.

Edit: I’m really shocked with Mexico. How come?

The tax burden in my country—I am an Argentine citizen—is unbearable. Our income from January to August goes solely to paying taxes. The sum of different municipal, provincial, and consumption taxes makes the economy almost unviable.

This is compounded by the fact that almost none of the taxes collected are returned to the people in the form of services, and corruption is rampant throughout the state.

Two years ago, President Milei tried to change this, but Peronism/populism put a spoke in his wheel. We’ll see…

Why is brazil growth so bellow the average? Well here is the answer. We strip resources from productive industries to pump into low productivity areas

Is Panama lowest because it collects revenue from “fees” to use the canal? Wouldn’t that be included somehow?

Feedback on the chart: When listing items in the legend, it would be helpful on the eyes to stack the categories in the same order they are stacked in the graph. You have it flipped. Readers can figure it out, but the reversal is an unnecessary bump on the road to comprehension. $0.02

Stacked bars are a pain to compare once you get above the first category.

And they want more. Instead of making the state more efficient they want more, less freedom for us, more control, more corruption. None of this states deserve a dime, because they have done nothing to deserve it.

Does this chart includes tariffs? Having worked with companies in both Brazil and Argentina, I was shocked at how much levies are placed on import / exports. It’s not a small amount

Thank you for the information, it is very well presented and interesting.

I’ve got some follow up questions:

How are income, profits and capital gains divided between personal taxes and company taxes?

This could reveal important aspects of each country’s policies. For example, in Colombia we have relatively low personal taxes but huge taxes for companies which creates disincentives to create new ones.

Also, in order to talk about how we “feel” about taxes, we need to know the % applied, because that’s what each citizen see, not a % of the GDP. For example, in Colombia we have 19% percent of IVA (VAT): how does it compare against other LATAM countries.

Finally, it looks like we are not collecting that much money from taxes (as % of the GDP). What does that mean? That we have other sources to get money to fund the economy, or that the government lacks the economic strenght to push the economy forward with adequate incentives (like R&D) and thus our economies will continue to struggle?

Comments are closed.