Previously, we reported that U.S. oil production has maintained its upward trajectory in the current year even as oil prices have sunk to multi-year lows. According to data from the Energy Information Administration (EIA), U.S. crude oil production hit an all-time high of 13.58 million barrels per day (mb/d) in June 2025, exceeding the previous record set in October 2024 by 50 thousand barrels per day (kb/d), and the pre-COVID November 2019 high by 582kb/d. Commodity experts at Standard Chartered have predicted that U.S. production will continue to grow before peaking at 14.34 mb/d in March 2026.

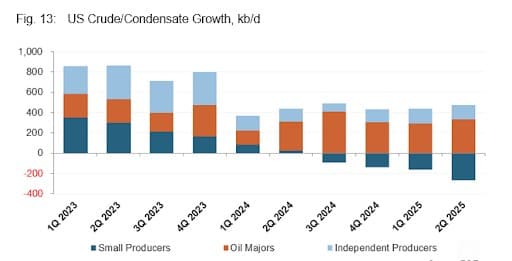

However, the U.S. oil sector is already showing a clear trend of slowing growth, with the year-over-year increase clocking in at just 328kb/d in June. Further, production in Texas, the country’s leading oil production hub, fell 33 kb/d y/y and is now 109 kb/d lower than its October 2024 peak of 5.832 mb/d. That said, this slowdown is not uniform, with small U.S. producers in decline but oil majors and independent producers continuing to grow. According to global energy consultant FGE, overall U.S. oil production increased throughout 1H 2025 despite declines from smaller producers. This trend is pretty much in line with FGE’s earlier prediction that lower crude prices will have the biggest impact on smaller, higher cost producers in the United States.

Related: US Drillers See Slight Uptick in Oil Activity

According to the energy consultant, growth from smaller U.S. producers plateaued around mid-2024 and began to decline in 2H 2024 as lower oil prices started to kick in. With oil prices currently trading ~15/barrel lower than the 2025 peak, the decline has since continued, with FGE estimating that output from small producers will decline by 200-250 kb/d y-o-y in the second half of the current year. However, growth by U.S. oil majors will be enough to more than offset this decrease. FGE has also revised its 2025 global oil output up by 130 kb/d to 109.1 mmb/d and its 2026 forecast up by 230 kb/d to 110.4 mmb/d.

In its latest Short Term Energy Outlook (STEO), the EIA has maintained its earlier forecast for U.S. crude and condensate to fall from 13.57 mb/d in December 2025 to 13.16 mb/d in December 2026. EIA has maintained its prediction despite June output coming in 100 kb/d above its estimates. The U.S. energy watchdog says prevailing low oil prices will be largely responsible for the falling output, prompting producers to slow down drilling and well completion activities.

Source: FGE

Compensation Cuts To Offset OPEC+ Unwinding

On Sunday, the eight members of OPEC+ agreed to increase oil output from October by 137,000 barrels per day, a much lower clip compared to the 555,000 bpd increase announced for August and September and 411,000 bpd in June and July.

Story Continues