Over the weekend, the price of the leading cryptocurrency slipped to $115,000. The trader known as Skew urged attention to that mark as markets await the Fed decision on interest rates.

$BTC

Pretty clear price is being walked down here yet again going into a new week

Longs are being used as liquidity thus far

~ likely for fills

However some pretty decent bid depth & liquidity just below $115K

Time to pay attention pic.twitter.com/6x9VHwokAa

— Skew Δ (@52kskew) September 14, 2025

He pointed to “pretty decent bid depth and liquidity just below $115,000”. In his view, that level could prove decisive for bitcoin’s next move.

Ahead of the 17 September Fed meeting, traders remain cautious on the near-term outlook. The analyst known as Rekt Capital stressed that sustained upside requires reclaiming $114,000.

The goal isn’t for Bitcoin to break $117k in the short-term

The goal is for Bitcoin to reclaim $114k into support first

Because that’s what would enable the premium-buying necessary to get price above $117k later on$BTC #Crypto #Bitcoin

— Rekt Capital (@rektcapital) September 14, 2025

“The point is not for bitcoin to break $117,000 in the short term. The main goal is to turn $114,000 into support. That would create the conditions for the active buying needed for a further rally,” he wrote.

He called a weekly close above $114,000 a “bullish” signal.

Bitcoin has likely put in a local bottom

The analyst known as Mr. Wall Street said bitcoin reached a local bottom around $107,000 a few weeks ago.

#Bitcoin — What’s Next ?

In Depth Technical and Psychological Analyses

Everything You Need to Know: A golden cross on the daily timeframe of the MACD was printed at the same time short term MVRV bottomed. This happened few weeks ago near 107k, in the exact same place where we… pic.twitter.com/6nLoKSlLl8

— Mr. Wall Street (@mrofwallstreet) September 14, 2025

He said a “golden cross” appeared on the daily MACD as MVRV fell to its low. In the current cycle, that combination has occurred three times.

“The last time was when bitcoin was at $76,000 during the panic over Trump tariffs. […] The two indicators also fired at $49,000 on the day of the Japanese yen crash and at $16,000–18,000 amid the FTX bankruptcy,” the analyst explained.

Mr. Wall Street added that such a signal often precedes a 30–40% advance. He expects the next target to be $140,000–150,000, while stressing that much will depend on the FOMC decision and remarks by Fed chair Jerome Powell.

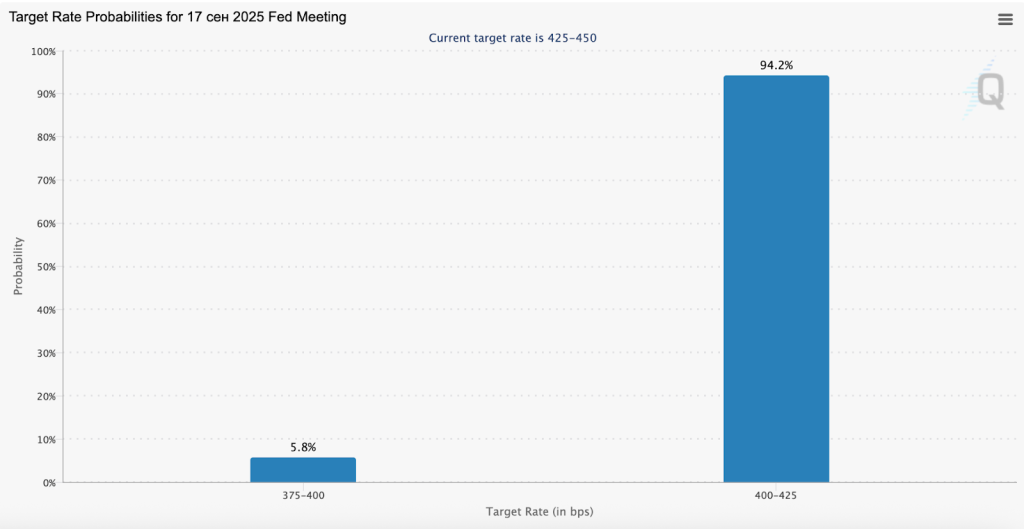

At present, 100% of market participants expect the policy rate to be cut by at least 0.25 percentage points.

Source: CME FedWatch.

Source: CME FedWatch.

At the time of writing, bitcoin trades around $116,400, up 0.5% over the past 24 hours.

Hourly chart of BTC/USDT on Binance. Source: TradingView.

Hourly chart of BTC/USDT on Binance. Source: TradingView.

A whale is selling bitcoin

Analysts at Lookonchain highlighted renewed activity by a large holder who, after a two-week pause, transferred another 1,176 BTC ($136m) to Hyperliquid.

After a two-week break, the #BitcoinOG who exchanged 35,991 $BTC($4.04B) for 886,371 $ETH($4.07B) is back to selling $BTC!

2 wallets linked to this #BitcoinOG have deposited 1,176 $BTC($136.2M) to Hyperliquid in the past 2 hours and started dumping.https://t.co/LTiJHW049j pic.twitter.com/L0m2bEG1J7

— Lookonchain (@lookonchain) September 14, 2025

Earlier, the team noted that in August the whale sold 35,991 BTC ($4bn) and bought 886,371 ETH.

In the same month, another investor who had been inactive since 2018 “woke up”. First, he sold off 670 BTC (~$76m) to acquire 68,130 ETH (~$295m). Later, the large holder bought another 62,914 ETH (~$270m) on the spot market and opened a long position for 135,265 ETH (~$580m) on the futures market.

Earlier, experts outlined market dynamics before and after the Fed meeting.

Нашли ошибку в тексте? Выделите ее и нажмите CTRL+ENTER

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!