The US dollar has continued to trade at weaker levels overnight ahead of tomorrow’s FOMC meeting. It has contributed to USD/JPY falling back below the 147.00-level. One of the main developments overnight was the Senate’s decision to approve President Trump’s economic adviser Stephen Miran to take his position on the board of governors at the Fed. The Republicans fast-tracked the approval ahead of this week’s FOMC meeting. He will now take his temporary place on the Fed board until January of next year after the Senate voted along party lines by 48 to 47 votes. It increases the likelihood that there will be more dissenters in favour of a larger 50bps cut at tomorrow’s FOMC meeting. There were two dissenters in favour of cutting rates by 25bps at the last FOMC meeting in July. The dissenters in July were Fed Governors Christopher Waller and Michelle Bowman who had both been appointed by President Trump during his first term. Ahead of tomorrow’s FOMC meeting, President Trump has called on Fed Chair Powell to deliver a larger rate cut. He posted “”Too late” MUST CUT INTEREST RATES, NOW, AND BIGGER THAN HE HAD IN MIND, HOUSING WILL SOAR!!!”.

Ongoing political pressure on the Fed to lower rates is one reason why market participants have been encouraged to price in more active easing from the Fed. President Trump’s influence over Fed policy is set to increase next year when he will appoint the new Fed Chair and likely new Governor when Jerome Powell’s term comes to an end in May. He is also attempting to fire Fed Governor Lisa Cook but is encountering pushback from the US courts. An appeals court in Washington blocked the White House from removing Lisa Cook from her post for now. The divided court, who voted by 2-1, affirmed that Governor Cook can continue working while her lawsuit challenging President Trump’s move to dismiss her proceeds. The court held that the district judge from Jia Cobb on 9th September was correct to find that President Trump likely violated Governor Cook’s rights by attempting to fire her via a social media post. DC Circuit Judge Bradley Garcia wrote that he believed Governor Cook was at least likely to win on her claim that President Trump and other US officials who played a role in trying to oust her failed to provide her with due process – enough notice and an opportunity to object. President Trump is expected to challenge the decision. The Trump administration’s ongoing interference in Fed policy alongside recent weak US employment data will keep pressure on the Fed to lower rates. It also makes it harder for the Fed to trigger a hawkish repricing in the US rate market and relief rally for the US dollar following this week’s FOMC meeting even if the updated DOT plot does not go as far as fully validating the number of rate cuts currently priced in.

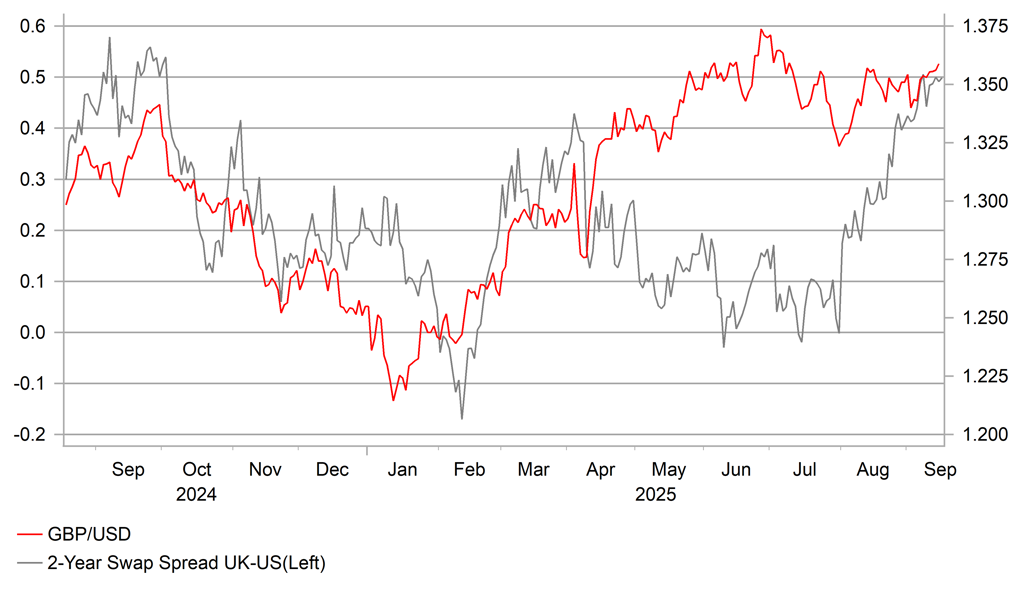

CABLE HAS RECONNECTED WITH YIELD SPREADS

Source: Bloomberg, Macrobond & MUFG GMR