Sep 18, 2025

| Updated Sep 18, 2025

KEY TAKEAWAYS:— LLMs are a powerful tool for crypto research, but should not be treated as oracles for predicting prices or getting trading advice.

— While powerful, ChatGPT, Gemini, and other AI models require human oversight to prevent security risks, API errors, or hallucinations – where they invent figures, facts, and even URLs.

— The quality of your crypto research report depends on the quality of your AI prompts.

Imagine trying to listen to a single conversation in a colosseum during the final moments of a World Cup final. The chants of the fans are almost deafening, filled with a chaotic mix of anxiety, exhilaration, and utter hullabaloo. And for the average trader, as well as some professional traders, the cryptocurrency market can feel the same.

To explain, the cryptocurrency market operates 24/7, and its information flow is constant. News breaks, tweets fly, charts juggle between red and green signals, influencers spread FOMO, and bad actors run scams – all at once. Such disarray makes finding a project to invest in a challenge for most traders.

This is where Large Language Models (LLMs), such as Gemini, Grok, and ChatGPT, step in. Think of LLMs as your intelligent yet relentless research assistant that can sift through news, market metrics, social media buzz, and whitepapers to offer clear summaries from trusted sources.

But here’s the catch: don’t treat AI models like oracles for price prediction or generating direct buy/sell signals and trading advice. Instead, their true potential lies in processing large amounts of information to discover patterns, market sentiment shifts, and projects’ fundamentals that would otherwise be tedious and time-consuming to research manually.

Let’s take a closer look at how you can use LLMs for comprehensive crypto research, best practices for LLM-based research, and potential pitfalls to avoid during the research process.

AI Language Models as Crypto Trading Research Assistants

Traditionally, a crypto trader has to dabble between social media, news aggregators, analyst opinions, charts, metrics, whitepapers, and so on, to gauge market sentiments or recognize patterns. And with the constant stream of information in the crypto market, it may be too late to act by the time you analyze this information.

AI models like ChatGPT and Gemini transform how we approach crypto research, moving from reactively consuming information to smarter crypto trading. As such, to fully realize the potential of these powerful tools, it’s essential to understand how to leverage them as crypto trading research assistants.

1. Market Sentiment Analysis

Cryptocurrency price movements often reflect how investors feel or react to news. This phenomenon, referred to as market sentiment, suggests the collective mood of investors and traders. Put another way, investors’ general attitude towards a cryptocurrency is just as important as market fundamentals or technicals.

Therefore, understanding crowd psychology through market sentiment assessment can provide valuable insights into potential movements. AI models allow you to analyze large datasets, from social media posts and expert commentaries to news articles, to understand whether the market is bullish, bearish, or neutral about the news.

To tune into the market’s mood more effectively using AI models, your prompts must be more specific and context-aware. Vague prompts like “What’s Ether’s sentiment” will definitely yield generic and ambiguous responses.

Some of the steps to gauge market sentiment using AI more effectively include:

Specifying sources – AI models like Gemini, ChatGPT, and Grok can pull information from X (formerly Twitter) and news sites. Narrow your scope to social platforms like X and Reddit for crypto community sentiments and news sites for a comprehensive summary.

Cross-referencing – Verify information by comparing data from different sources. For instance, compare X sentiments with news sentiments to recognize discrepancies that might signal potential volatility.

Time-bound analysis – Because crypto markets move quickly, it is essential to limit your analysis to specific timeframes, such as 24 hours, 48 hours, or 7 days, to capture relevant trends accurately.

Headlines and News Sentiment Aggregation

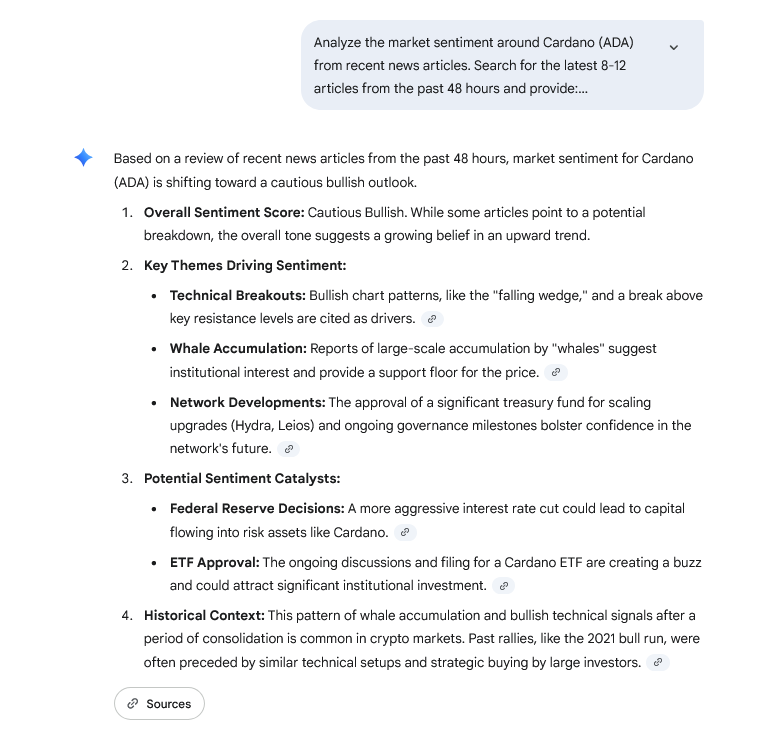

Example prompt:

“Analyze the market sentiment around Cardano (ADA) from recent news articles. Search for the latest 8-12 articles from the past 48 hours and provide:

Overall sentiment score (bearish/neutral/bullish)

Key themes driving sentiment

Potential sentiment catalysts on the horizon

Historical context for similar sentiment patterns.”

This prompt tells Gemini to collect the most recent data, categorize the sentiment, structure the information, and summarize the analysis.

Source: Gemini

Decoding Social Media Buzz

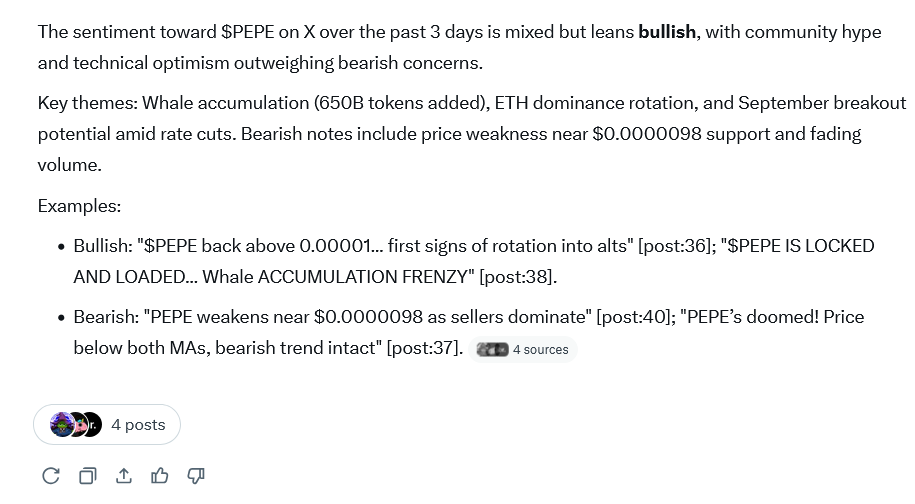

Example prompt:

“Analyze the sentiment toward Pepe based on X posts from the past 3 days. Summarize the prevailing mood (bullish, bearish, or neutral) and highlight key themes or events driving this sentiment. Provide specific examples of posts or phrases that reflect this mood. Exclude any promotional content.”

Grok’s response transforms a disorganized collection of viewpoints into a structured report, thereby helping you understand the collective sentiment beyond a simple “positive/negative” contrast.

Source: Grok

Cross-Platform Sentiment Correlation

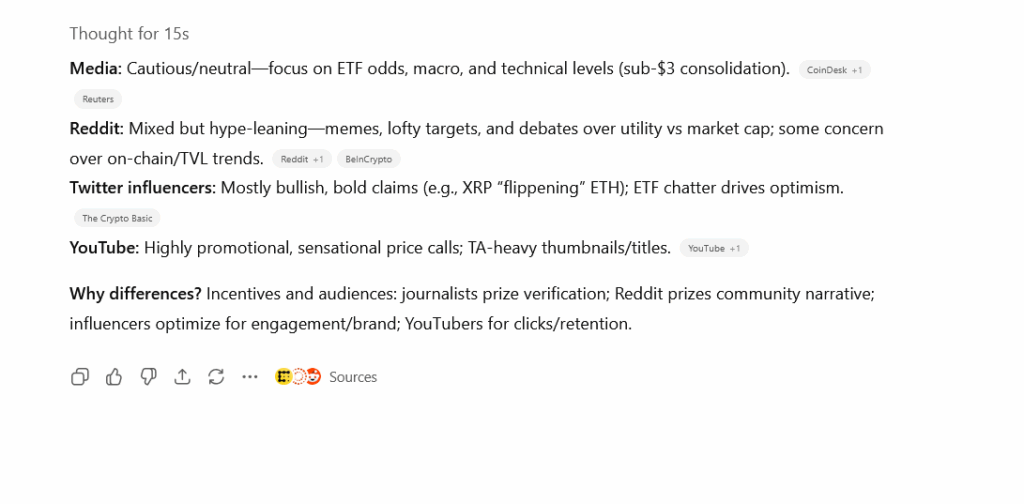

Example prompt:

“Compare sentiment patterns for Ripple (XRP) in the past 30 days across different platforms:

Professional media coverage (tone and focus areas)

Reddit technical discussions (community concerns/excitement)

Twitter crypto influencer opinions

YouTube content creator perspectives

Identify any significant differences in sentiment across platforms and explain potential reasons for these variations.”

Source: ChatGPT

2. Fundamental and Technical Analysis

When considering investing in crypto, it is essential to understand that cryptocurrency prices don’t just fluctuate arbitrarily. Price movements are always driven by underlying factors that can be used for forecasting. A shift in a coin’s circulating supply, for example, primarily influences the coin’s price changes, liquidity, and perceived scarcity.

By examining these factors, as well as historical patterns, fundamental analysis and technical analysis allow you to gain insight into when to invest in a coin. And while AI models are unsuitable for precise technical indicator calculations, a task better suited for specialized trading software, they excel at simplifying concepts, formulating strategies, and interpreting data.

Fundamental Analysis

Fundamental analysis (FA) aims to determine a crypto asset’s intrinsic value by assessing related economic, financial, and other qualitative and quantitative factors. It also evaluates a project’s core values through its underlying technology, development team, and real-world use cases. AI models simplify this process by summarizing complex information.

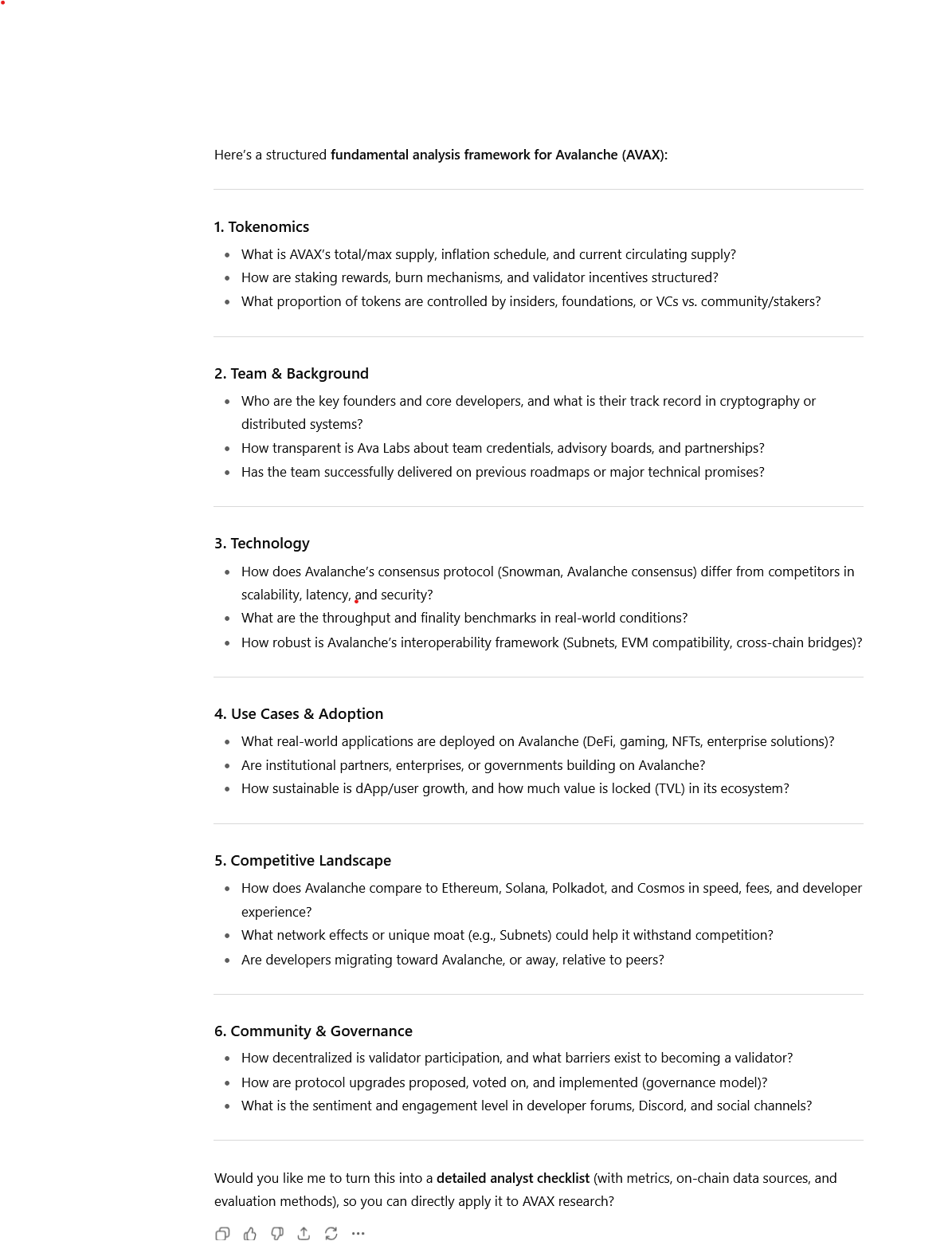

Instead of directly trying to perform fundamental analysis using ChatGPT or Gemini, you can use the models to understand concepts, research historical trends, and even brainstorm potential fundamental factors.

Example prompt: “Act as a crypto research analyst. Provide a comprehensive framework for conducting a fundamental analysis of Avalanche (AVAX). Include sections on tokenomics, team and background, technology, use cases, competitive landscape, and community and governance. For each section, provide at least 3 specific questions I should seek to answer.”

Source: ChatGPT

Technical Analysis

Ideally, the base versions of these powerful tools cannot analyze live crypto charts directly. But you can provide them with historical chart data, patterns, and indicators as input to simply technical patterns, provide historical context, and validate analytical approaches.

By reviewing your past trades (or other historical data), LLMs can analyze the market conditions during your past trades and provide insight into any unusual price movements. As such, they can pinpoint technical signals or indicators that you might have missed to make informed trading decisions.

Moreover, you can use LLMs to understand a complex or technical concept. Rather than simply providing a fact, it can offer context and comparative analysis beyond the textbook definition.

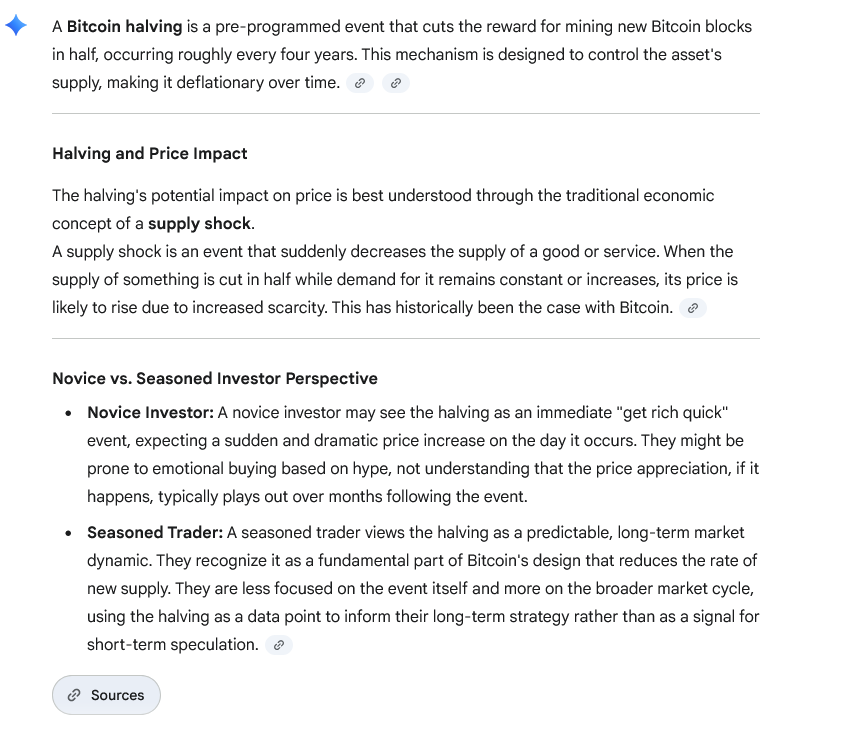

Example prompt: “Explain the concept of Bitcoin halving and its potential impact on price, drawing parallels to traditional economics concepts like supply shock. Then, compare and contrast how a novice investor might view a halving versus a seasoned trader.”

Source: Gemini

3. Market Capitalization

Market capitalization is more than just the product of an asset’s price and supply. Instead, it is a measure of a project’s relative size and its dominance in the market. It gauges the project’s scale and stability, and how different factors can influence it.

To explore what market cap truly signifies, LLMs can help break down circulation dynamics, valuation techniques, and comparative analysis across projects. From a macro research perspective, they can provide a high-level overview of an entire sector, enabling you to quickly understand key market players and the forces influencing them. In short, they can easily compile comparative data and furnish contextual information that raw figures lack.

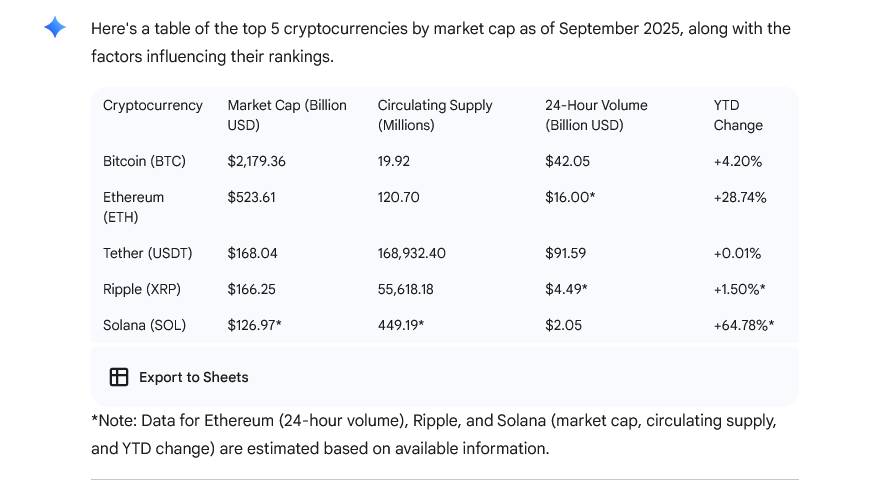

Example Prompt: “Create a table of the top 5 cryptocurrencies by market cap as of September 2025, including circulating supply, 24-hour volume, and year-to-date changes. Explain factors influencing rankings.”

Source: Gemini

Source: Gemini

4. Project-Specific Analysis

Whether it is an established project (including blue-chip blockchains) or an emerging project, DYOR is always an important step before any financial investment.

After identifying a project of interest, the research process begins. However, the information landscape, especially for new projects, is often fragmented and requires diligent verification.

You can use LLMs to dissect a project’s marketing and whitepapers (which are often comprehensive and somewhat technical) and disclose whether the project is what it claims to be. What’s more, you can leverage them to identify risks or spot opportunities in a specific project.

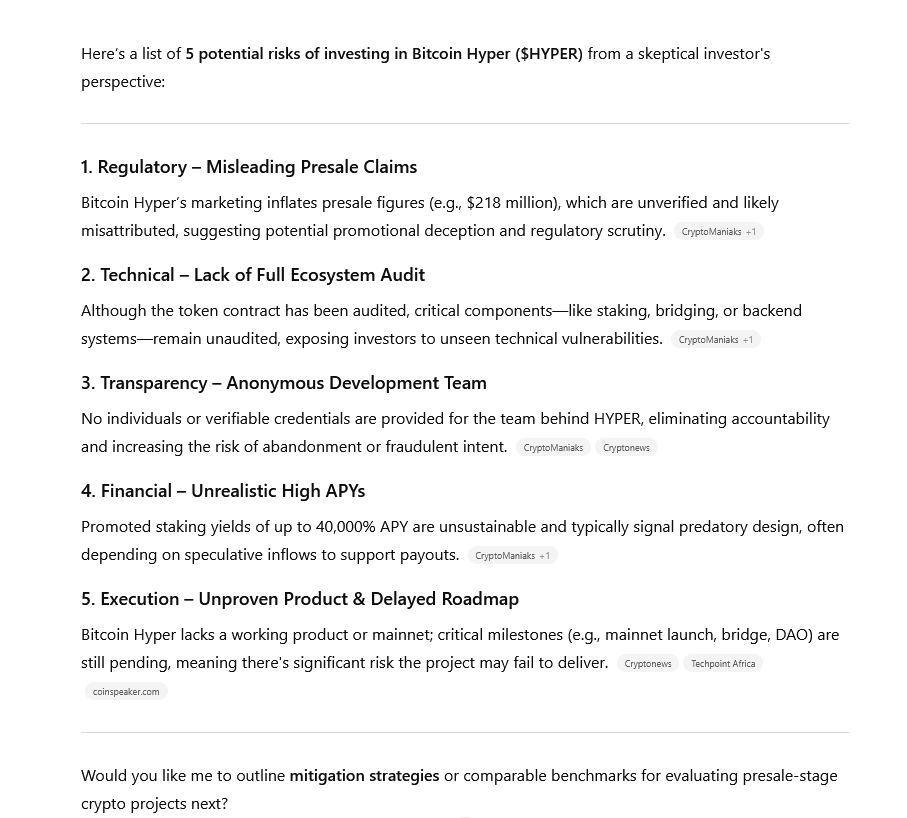

For example, you can explicitly prompt ChatGPT to be the devil’s advocate and identify potential red flags. This allows the model to identify potential issues that might have been overlooked due to the project’s enthusiasm.

Example prompt: “Assume you are a skeptical investor. Based on publicly available information, generate a list of 5 potential risks associated with investing in Bitcoin Hyper ($HYPER). Categorize these risks (e.g., technical, regulatory, competitive, financial). For each risk, provide a one-sentence explanation of why it is a concern.”

Source: ChatGPT

Consequently, whitepapers serve as fundamental documents detailing a project’s technology and roadmap, often characterized by their intricate and technical nature. ChatGPT can summarize or scan these whitepapers (by providing a link or pasting the text), pinpointing the core value proposition of a project or the desired info.

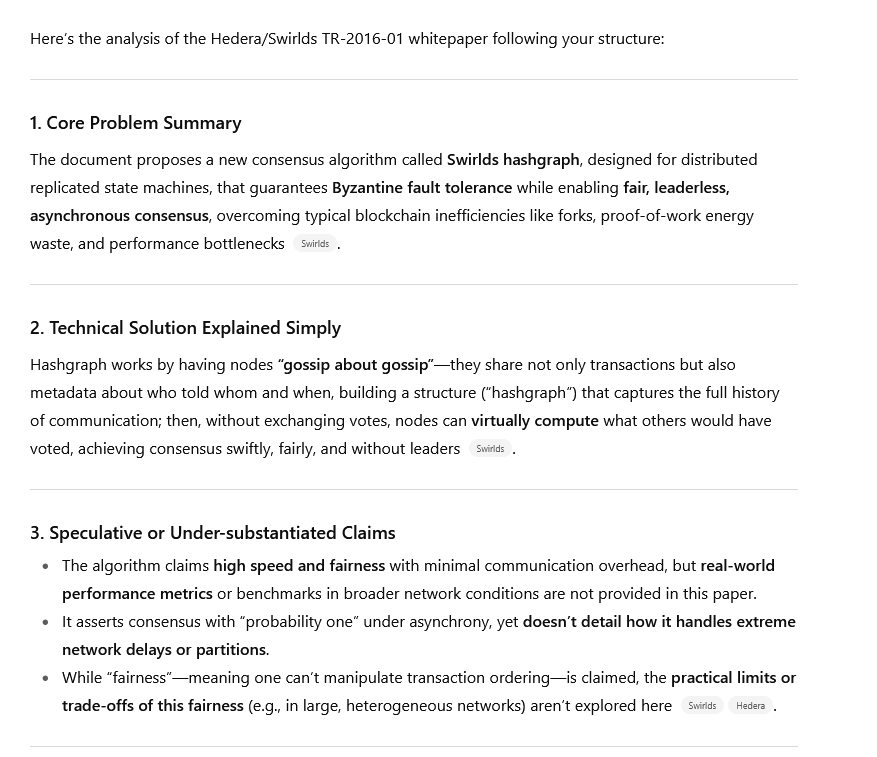

Example prompt: “Kindly analyze the Hedera (Swirlds hashgraph) whitepaper (https://files.hedera.com/SWIRLDS-TR-2016-01.pdf). Your objective is to:

Summarize the core problem the project claims to solve in one paragraph.

Explain its proposed technical solution in simple, non-technical terms.

Identify any claims that seem speculative or that are not backed by technical detail in the provided text.”

Source: ChatGPT

Bonus: Ask What Questions to Ask

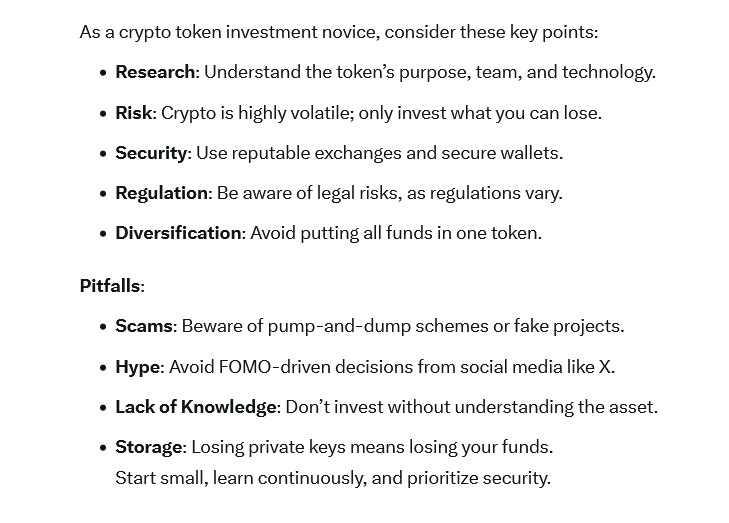

Perhaps you’re unfamiliar with cryptocurrency trading and are unsure which questions to ask. You can consult your preferred AI model to understand what questions to ask.

Example prompt: “As a complete novice interested in crypto token investment, what are the key considerations and potential pitfalls I should be aware of?”

Source: Grok

Best Practices for LLM-based Crypto Research

Some of the best practices when using ChatGPT, Gemini, or Grok for crypto trading research include:

Mastering prompt structure – The quality of your preferred AI response heavily depends on how you structure your prompts. This can include prioritizing specificity over generality, providing context, and requesting multiple perspectives to prevent confirmation bias.

Cross-referencing important info with primary sources – These tools may often misinterpret indicators, resulting in incorrect output. Always verify essential information (such as event dates, token metrics, and technical specifics) from the project’s official sources, its blockchain explorer, or reputable crypto data aggregators.

Validation from different LLMs – For important crypto research decisions, never rely on a single AI model response. Compare responses across different models, verify key claims with primary sources, and validate the information’s currency and relevance. In addition, you can cross-reference AI responses with human expert opinions.

Common Pitfalls to Avoid

While AI models are powerful crypto research assistants, it’s essential to understand that they have their own limitations. Some of the common pitfalls to avoid include:

Overreliance on AI predictions – AI models can analyze patterns and trends, but they cannot predict future prices. They shouldn’t be treated as oracles for price predictions or trading advice, and any interpretation of potential market movement should be considered speculative. Overreliance on AI predictions can result in false confidence.

Information currency or timeliness – Always verify the accuracy and currency of important event dates and developments.

Confirmation bias amplification – Actively use AI to seek unbiased viewpoints or challenge your assumptions rather than validating your existing beliefs.

Conclusion

Generally, ChatGPT, Grok, ChatGPT, and other AI models can pinpoint optimal timing and risk factors by analyzing past trades. However, the ever-changing market conditions mean that human judgment remains an essential part of crypto trading. At the end of the day, you’re the one investing your money, not the AI.

You are the pilot, and AI is your copilot, converting your raw inputs into unbiased and clear insights. Its role is to support your crypto trading decisions, not to substitute it.