By Ed Dolan – Sep 19, 2025, 10:21 AM CDT

1. Speculators Flee Crude as Oversupply Drains Future Bets

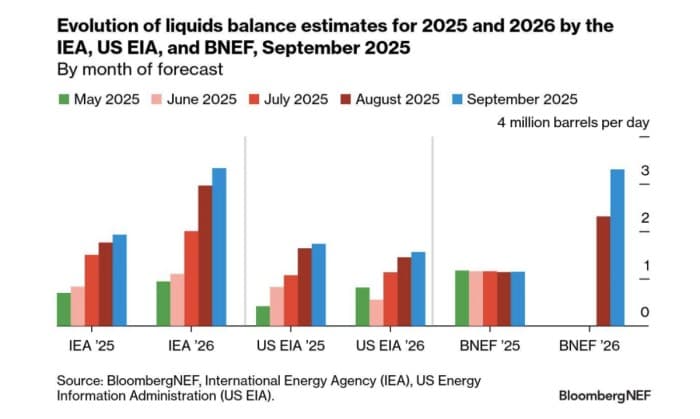

Oversupply is steadily becoming the buzzword for oil markets in 2026, with the IEA’s updated outlook for next year predicting a 3.3 million b/d market surplus if current policies remain in place. The International Energy Agency predicts that global oil supply will grow by 2.7 and 2.1 million b/d in 2025 and 2026, respectively, compared to a mere 700,000 b/d in global demand growth. OPEC does not forecast oil production of its own members, only publishing retrospective monthly output numbers based on direct communication and secondary sources. Fears of oversupply have triggered an exodus of speculative investment away from crude markets, with net positioning held by hedge funds in WTI futures now the lowest in post-COVID years, at less than 20,000 contracts.US shale might become the primary target of oversupply-driven pricing downside, with Saudi Arabia pushing ahead with OPEC+ unwinding despite industry analysts’ gloomy outlooks.

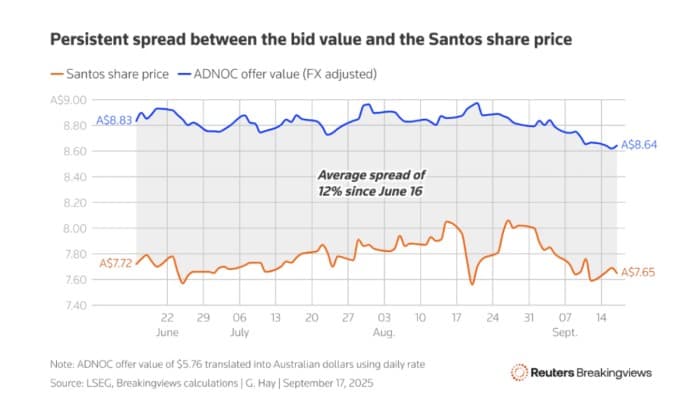

2. Santos Blames ADNOC’s XRG as Landmark Takeover Unravels

One of the most closely followed potential M&A deals of 2025 has fallen apart after Abu Dhabi’s national oil company ADNOC dropped its $18.7 billion bid for Australian gas-focused producer Santos. According to media reports, the decision was due to disputes over the company’s valuation as well as questions regarding Santos’ gas fields in Papua New Guinea and capital gains tax liabilities arising therefrom. Santos…