In London, the average home was not affordable for any household income decile – The ONS. Pretends to be shocked.

by urbexed

In London, the average home was not affordable for any household income decile – The ONS. Pretends to be shocked.

by urbexed

16 comments

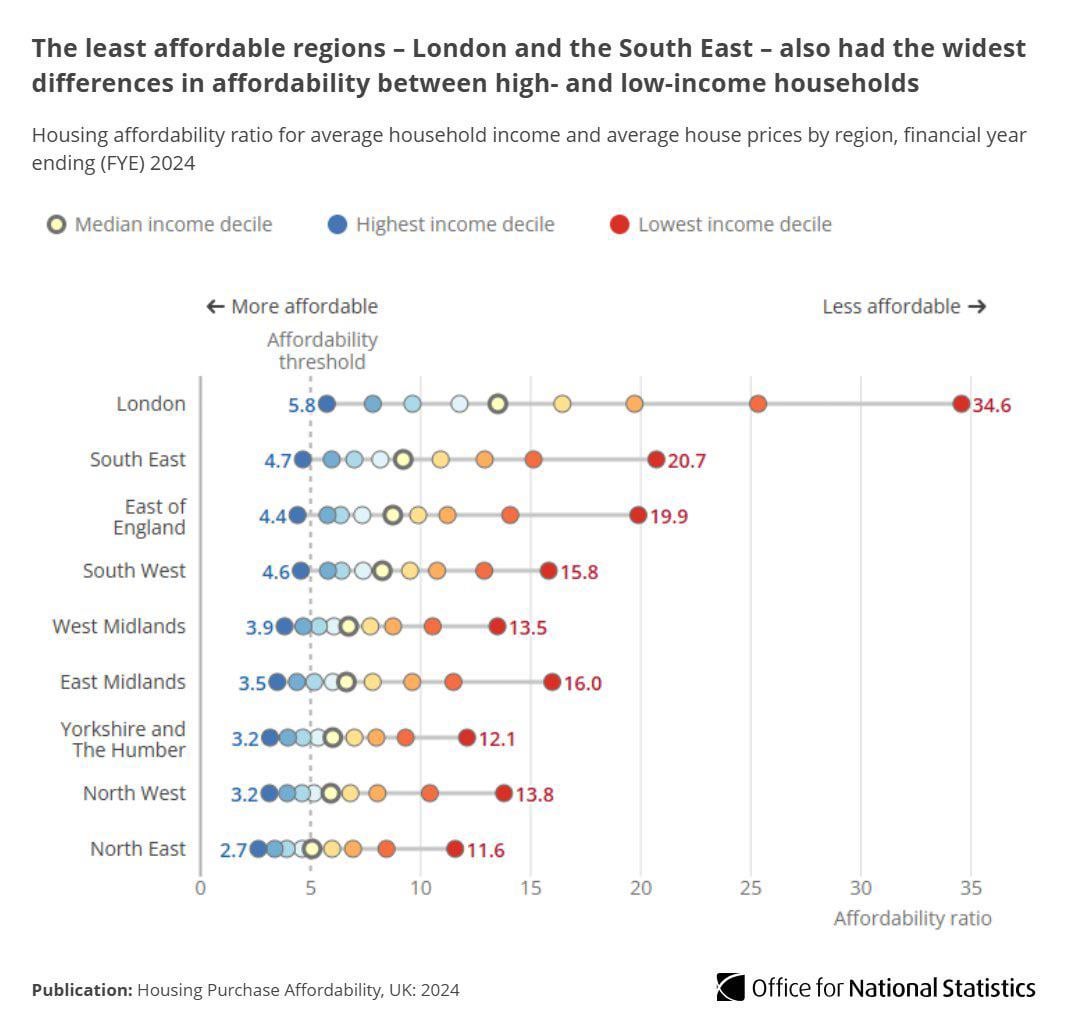

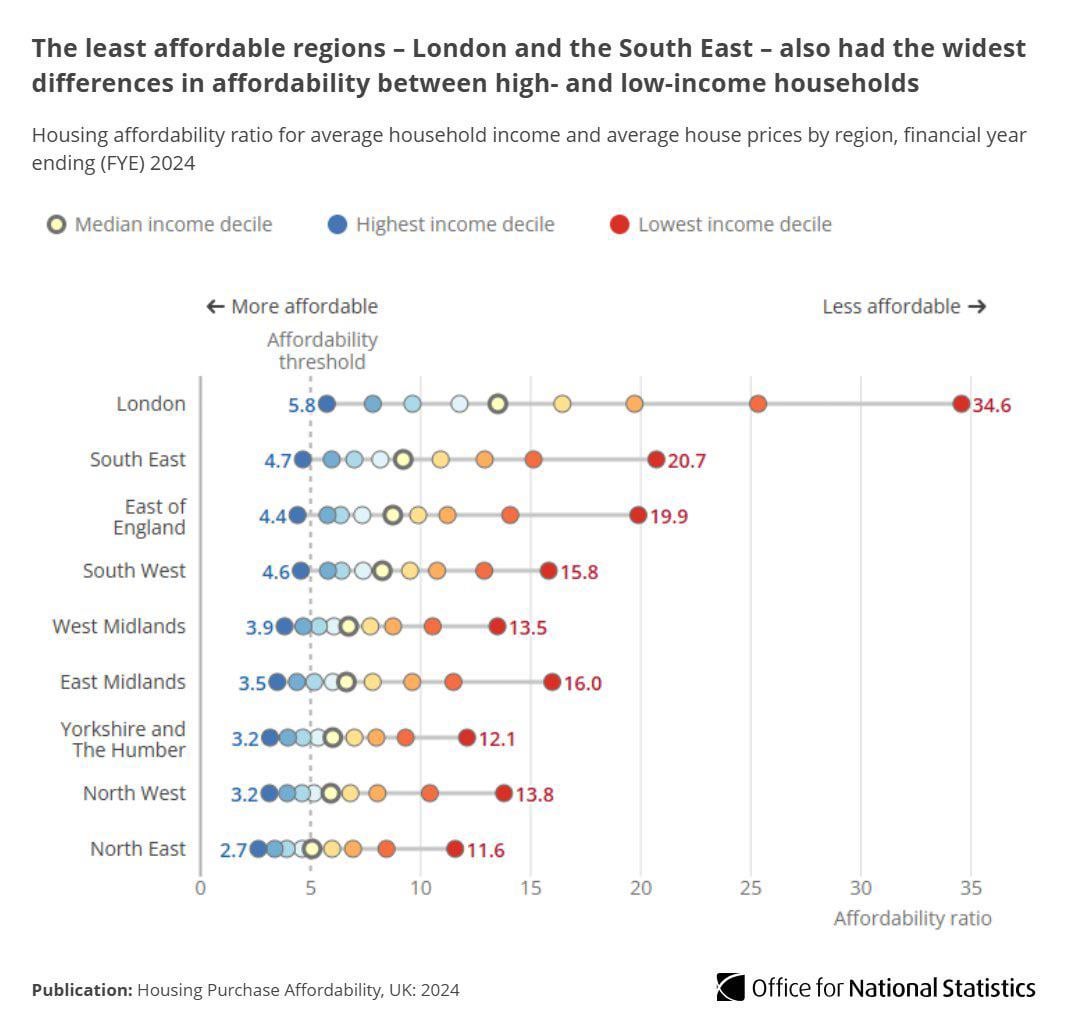

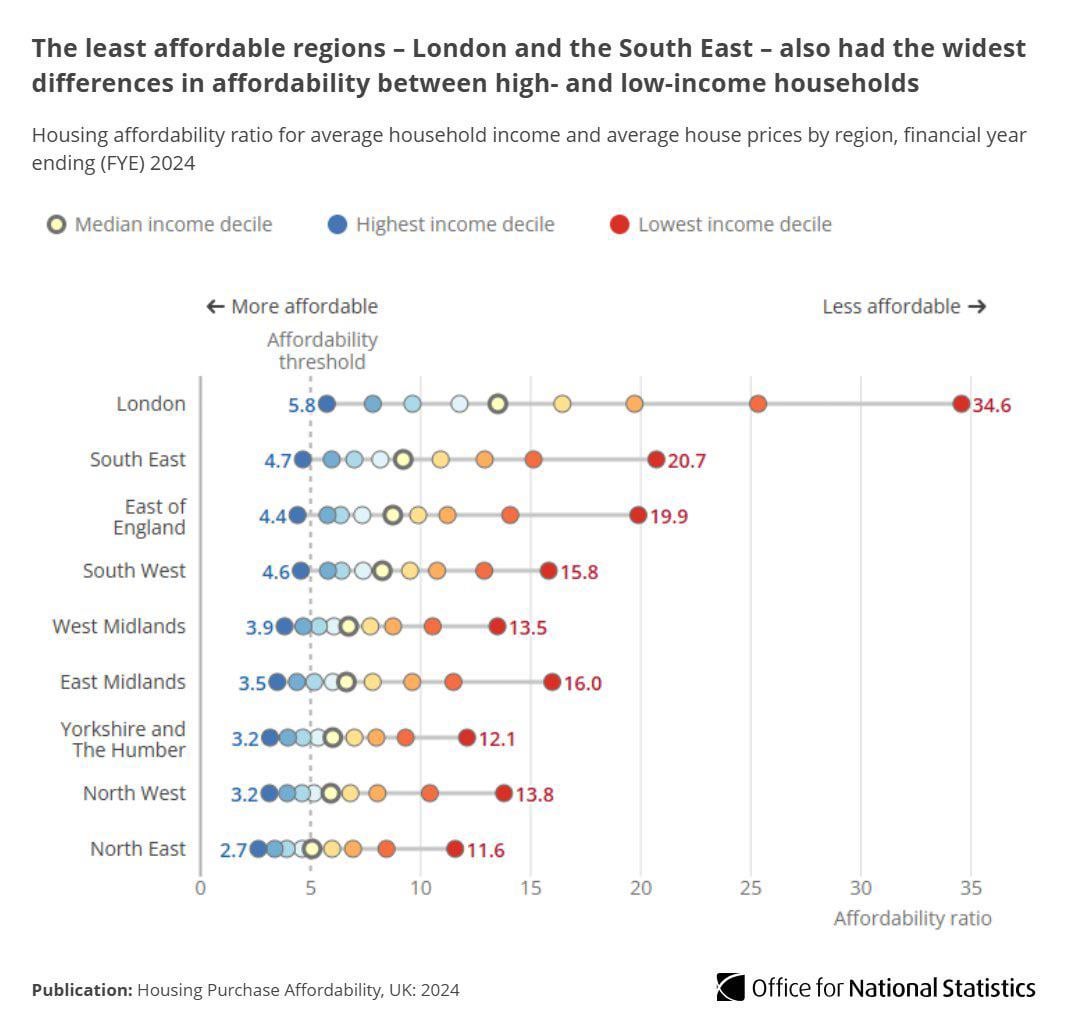

Pretty telling that home ownership is not affordable on a median salary, pretty much anywhere in the country. Something as standard as owning a house is – on paparr at least – beyond the majority of the country right now.

And of course, the London market is several additional levels of insane.

What value do they use for highest income decile, an average across the whole decile? Also just realised a blanket affordability threshold doesn’t really work across income deciles as higher incomes have access to high mortgage multipliers due to high disposable income to total income ratio.

Seems about right, a house is a pipe dream, we own our flat, but the ‘upgrade’ for us is either leaving home for another part of the country or not doing it.

Never going to own a house, rent’s too high now. It’s the end times, why bother?

London property is truly in a bubble. Prices like that make it seem like London is paradise on earth. Most of those places don’t even come close to justifying the price. Most don’t even have more than 1 toilet or AC.

Could someone explain the graph in simple language?

Fixing this requires the kind of dramatic change to our planning system that seems unlikely despite Labour’s commitments. It’s all good pledging to build more, but you cannot do so while leaving the presumed-no, object-to-everything, incredibly slow system we have now intact.

Given that the home ownership rate is above 60%, does this mean that most home owners are old people?

I’m wondering how multi-owner ownership works here. I can’t afford to buy a 2 bedroom home on my own, but once you get to the larger sizes the prices sort of start to plateau (I.E. if I lived with two or three close friends we definitely could afford a 4-5 bedroom house). Is this a feasible “solution” to the cost of living crisis?

The change in affordability over time is ( to me ) stunning. My parents were poorly-educated and low income working class and were able to buy a home in London. Now, 75 years later, here I am very well-educated and quite wealthy ( by some standards ) and I could not afford to buy their old house. But I can buy a house that is 10 times better than theirs, in another country, and pay cash.

>Lives in one of most expensive city in the world

>Can’t afford a house

Suprisedpikachuface.jpeg

I have avocadoes once a month at the very most.

I get the 2 for 1.99 that my local Tesco has.

Being very generous, I spend about 24 quids on avocadoes per year.

I know landlords and Tories aren’t very good at maths but trust me folks: houses are way, way, waaaaaaaay more than 24 quids. I know they weren’t when my landlord got his 8 housing units but times have changed.

If I saved those 24 quids for 100 years, I would have 2400 quids. And that would still be far less than what a house costs.

So the issue isn’t that I eat too many avocadoes.

Is the average household income applied at a national or local level? Not clear if both this and the house prices are by region.

Um, no – they are not pretending to be shocked; they have zero bias towards the gathered data.

How does this map id you change to household income. Dual earning is a factor in pricing.

We should build. Turn everything into housing. Build so much housing that rent is 20% of median wage and then increase the housing stock by another 10% for good measure.

Comments are closed.