We’ve found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

FLEX LNG Investment Narrative Recap

For shareholders in FLEX LNG, the core story is one of contract-backed revenue visibility amid a young, fuel-efficient fleet and persistent global LNG trade growth expectations. While the recent addition to the S&P Global BMI Index under the NYSE listing may boost institutional awareness and liquidity, it does not materially shift the main catalysts or the current key risk: potential long-term pressure on charter rates if vessel oversupply persists globally.

Among recent announcements, FLEX LNG’s reaffirmed 2025 revenue guidance (US$340 million to US$370 million) stands out in the context of this index inclusion, underscoring management’s confidence in stable earnings despite notable year-over-year earnings volatility and market softness.

However, investors should be aware that, in contrast, over 300 new LNG vessels are projected for delivery in coming years, raising…

Read the full narrative on FLEX LNG (it’s free!)

FLEX LNG’s narrative projects $369.5 million in revenue and $145.9 million in earnings by 2028. This requires a 1.3% yearly revenue growth and a $46.8 million earnings increase from $99.1 million today.

Uncover how FLEX LNG’s forecasts yield a $24.00 fair value, a 4% downside to its current price.

Exploring Other Perspectives FLNG Community Fair Values as at Sep 2025

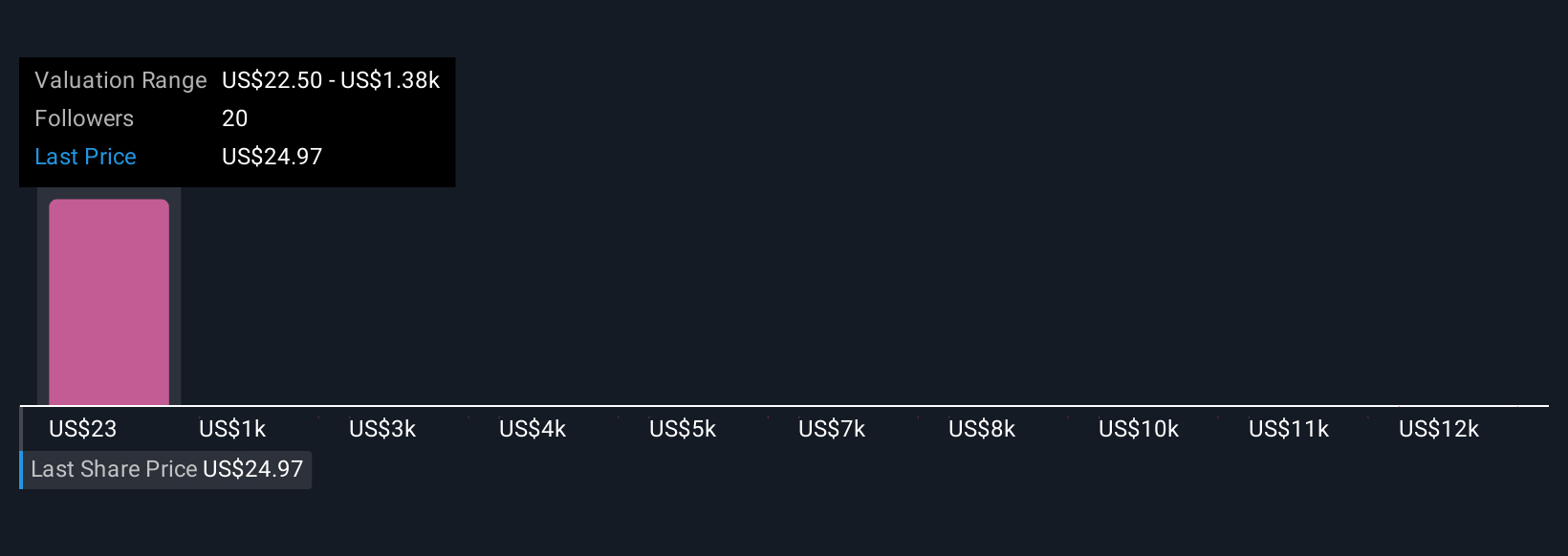

FLNG Community Fair Values as at Sep 2025

Simply Wall St Community members have posted four fair value estimates for FLEX LNG, stretching from US$22.50 to an outlier high of US$13,641.04. While many see multi-year contract coverage as insulation from market headwinds, these diverse views highlight the importance of considering supply risk and wider market forces before forming your own outlook.

Explore 4 other fair value estimates on FLEX LNG – why the stock might be a potential multi-bagger!

Build Your Own FLEX LNG Narrative

Disagree with existing narratives? Create your own in under 3 minutes – extraordinary investment returns rarely come from following the herd.

Want Some Alternatives?

Don’t miss your shot at the next 10-bagger. Our latest stock picks just dropped:

This article by Simply Wall St is general in nature. We provide commentary based on historical data

and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your

financial situation. We aim to bring you long-term focused analysis driven by fundamental data.

Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Simply Wall St has no position in any stocks mentioned.

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com