Forex markets started the week on a subdued note, with Asian trading showing little momentum. With no top-tier data scheduled, activity is likely to stay muted until later in the week, leaving traders watching central bank commentary for direction.

Several Fed officials are set to deliver remarks today, their first since last week’s rate cut. Their speeches may shed light on how individual members view inflation risks and labor market resilience after the latest policy move. But collectively, there should be broad alignment around the outlook for two more cuts this year.

The BoE, on the other hand, is a bigger source of uncertainty. Chief Economist Huw Pill will speak today, and his comments could sway expectations ahead of the November meeting, where markets still see the chances of a cut as a coin toss.

Elsewhere, Asian equities diverged. Japan’s Nikkei advanced strongly, building on Wall Street’s rally from Friday, while Hong Kong’s Hang Seng came under pressure. Sentiment in Hong Kong was dampened by Beijing’s reluctance to roll out fresh stimulus despite mounting evidence of domestic fatigue.

In commodities, gold remained range-bound while silver outperformed, breaking higher as traders looked for alternative momentum plays. Cryptocurrencies, by contrast, were under renewed selling pressure, with Bitcoin and Ethereum slipping further in their ongoing consolidations.

On the geopolitical front, U.S. President Donald Trump said progress had been made in negotiations over TikTok’s U.S. operations. The expected deal would see the app’s American assets transferred to domestic ownership under a board with national security credentials. Trump named business leaders Lachlan Murdoch, Larry Ellison, and Michael Dell as potential backers, a move that could give his allies greater influence over a platform central to U.S. political and cultural discourse.

In Asia, at the time of writing, Nikkei is up 1.09%. Hong Kong HSI is down -1.02%. China Shanghai SSE is down -0.09%. Singapore Strait Times is down -0.11%. Japan 10-year JGB yield is up 0.02 at 1.661.

RBA’s Bullock: Economy may prove weaker or stronger than forecasts

RBA Governor Michele Bullock told a parliamentary committee today that the central bank expects underlying inflation to moderate toward the midpoint of its 2–3% target range, with forecasts conditioned on the market’s assumption of modest further easing. Recent rate cuts are seen supporting household and business spending, while real income growth should help sustain consumption in the year ahead.

She noted that domestic data since the August meeting have been “broadly in line with expectations, or slightly stronger,” giving the Board some confidence heading into next week’s policy meeting. But Bullock stressed that forecasts remain only estimates, and the outlook is highly uncertain, particularly given the unpredictable global environment.

She highlighted risks on both sides: growth momentum may fade, or it could prove “materially stronger” than anticipated. Bullock warned that “excess demand” in the economy and labour market could persist, particularly that “productivity growth has not picked up and growth in unit labour costs remains high”.

PBoC holds fire, China stays patient on stimulus as economy shows strain

The People’s Bank of China left its one-year loan prime rate at 3.0% and the five-year at 3.5% today, extending a steady policy stance for the fourth month running. The unchanged setting came in line with forecasts and follows the central bank’s last 10bps trim in May, part of earlier efforts to shore up growth.

Policymakers opted for patience as the recent strong rally in domestic equities reduced pressure for immediate support, even as official data continue to point to uneven demand and fading momentum in industry and property.

Still, most expect modest easing steps before year-end as Beijing works to lock in its 5% growth target, also as policy focus shifted from deflation management to reflation

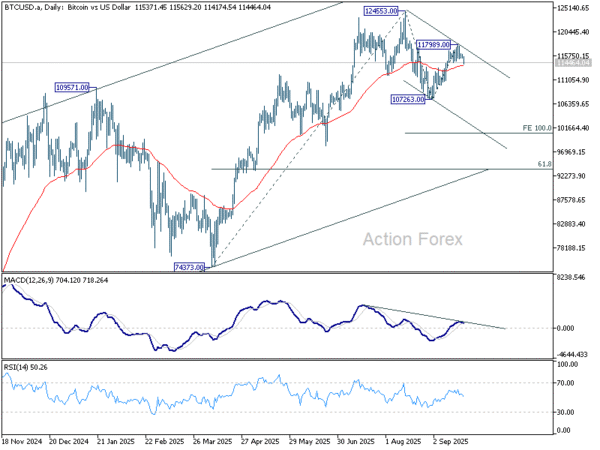

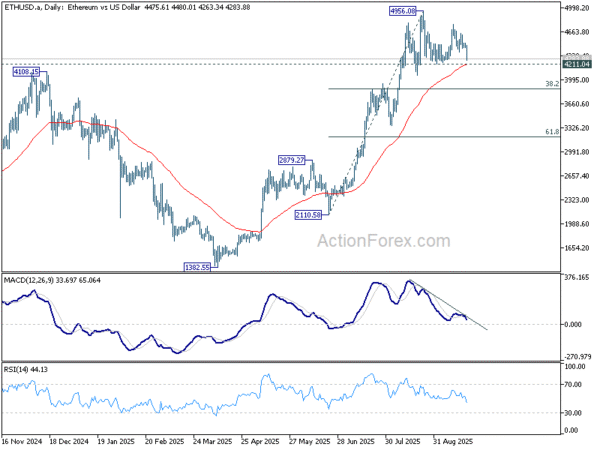

Bitcoin risks drop toward 100k correlation with tech stocks breaks

Bitcoin and Ethereum lost ground over the past week as stronger Dollar weighed, breaking their recent correlation with the NASDAQ. While tech stocks surged to fresh records, the two largest cryptocurrencies failed to follow. The price action suggests that the consolidation phase in both Bitcoin and Ethereum, in place since August, is set to extend with another downward leg.

For Bitcoin, sustained break of 55 D EMA (now at 113,835) would confirm that the correction from 124,553 has entered its third leg. That would open the way for a retest of the 107,263 support. Firm break there would target a deeper fall toward 100% projection of 124,553 to 107,263 from 117,989 at 100,699, which is close to 100k psychological level.

Ethereum’s structure looks slightly less fragile, but risks are also tilting lower. The current move from 4,956.08 is seen as correcting only the rise from 2,110.58, not the larger trend from 1,382.55. Still, decisive break of 4,211.04, which aligns closely with 55 D EMA (now at 4,207.58) would signal scope for a deeper correction. The next technical target for Ethereum would be 38.2% retracement of 2,110.58 to 4,956.08 at 3,869.09.

SNB set to hold, Fed officials to shape post-cut outlook

The SNB takes center stage this week, with its policy decision as the only major central bank highlights. Consensus strongly points to no change, with the policy rate remaining at 0.00%. A Bloomberg survey showed only two out of 21 economists anticipate a return to negative rates, reflecting the broad belief that the hurdle for such a move is exceptionally high.

SNB Chair Martin Schlegel has reiterated several times that reintroducing negative rates would require extraordinary circumstances. Even with Switzerland now facing sweeping 39% U.S. tariffs on exports, inflation has remained stable above 0%, providing the Bank room to stay patient. The message is clear: no urgency to deploy policy “mega-bullets” at this stage.

Attention in the U.S. will turn to August PCE inflation due Friday. Both headline and core are projected to hold steady at 2.7% and 2.9%, respectively. Markets are unlikely to be shaken even by a mild upside surprise, as last week’s FOMC meeting signaled two more cuts this year as part of a gradual risk-management strategy.

Fed officials have struck a more confident tone on inflation since tariffs were adjusted away from worst-case scenarios. Minneapolis Fed President Neel Kashkari said last week that while inflation may stay near 3%, it is unlikely to accelerate to 4–5%. That aligns with the Fed’s view that the balance of risks still tilts toward guarding against labor market deterioration.

The focus this week will be less on data surprises and more on Fed officials’ remarks following the latest rate cut. With two more reductions penciled in for 2025, investors will parse comments for insight into how comfortable policymakers are with maintaining a steady easing path. Diverging views within the Committee could start to shape expectations for timing and magnitude.

Europe will also provide important signals through Germany’s Ifo business climate index. Markets are worried that the early recovery momentum in Europe’s largest economy is losing steam, and the survey results will either validate or challenge those concerns. A downside print could weigh on Euro sentiment, especially after last week’s failure of the currency to hold gains versus Dollar.

In Canada, July GDP will be closely watched. Optimism for a rebound in Q3 is high after upbeat retail sales, but the print will be a critical test of whether growth momentum is truly returning. The Loonie’s outperformance last week, despite the BoC’s rate cut, highlights how data surprises can swing sentiment in either direction.

Beyond these highlights, Australia’s monthly CPI, Japan’s Tokyo CPI, and global flash PMI readings round out the calendar.

Here are some highlights for the week:

Monday: Canada IPPI, RMPI; Eurozone consumer confidence.

Tuesday: Australia PMIs; Eurozone PMIs; UK PMIs; US PMIs.

Wednesday: Japan PMIs; Australia monthly CPI; Germany Ifo business climate; US new homes sales.

Thursday: BoJ minutes, corporate service prices; Germany Gfk consumer climate; SNB rate decision; Eurozone M3 money supply; US Q2 GDP final, jobless claims, durable goods orders, goods trade balance, existing home sales.

Friday: Japan Tokyo CPI; Canada GDP; US personal income and spending, PCE inflation.

EUR/GBP Daily Outlook

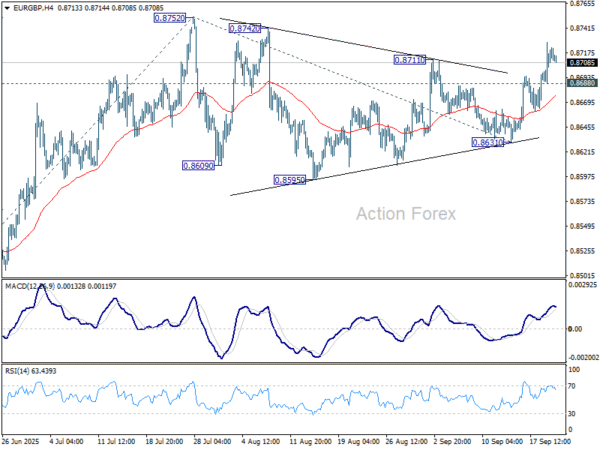

Daily Pivots: (S1) 0.8698; (P) 0.8714; (R1) 0.8737; More…

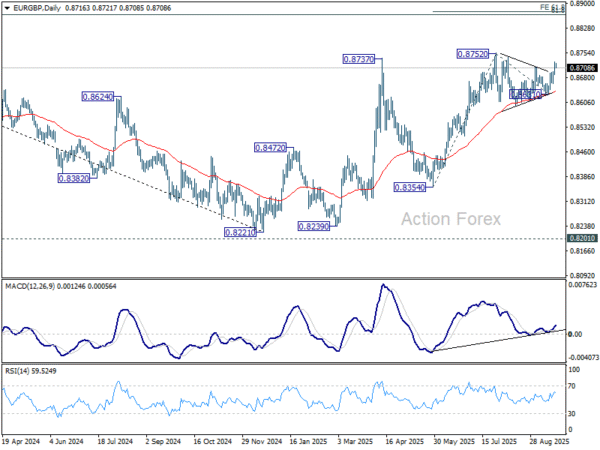

Intraday bias in EUR/GBP remains on the upside for retesting 0.8752 resistance. Firm break there will resume larger rally to 61.8% projection of 0.8354 to 0.8752 from 0.8631 at 0.8877, which is close to 0.8867 fibonacci level. On the downside, though, below 0.8688 minor support will dampen this view and turn bias neutral first.

In the bigger picture, the structure from 0.8221 medium term bottom are not impulsive enough to suggest that it’s reversing the down trend from 0.9267 (2022 high). But even if it’s a correction, further rise could still be seen to 61.8% retracement of 0.9267 to 0.8221 at 0.8867. Nevertheless, sustained trading below 55 W EMA (now at 0.8518) will argue that the pattern has completed and bring retest of 0.8221 low.