These 11 companies survived and thrived after COVID and have the right ingredients to survive Trump’s tariffs. Discover why before your portfolio feels the trade war pinch.

Archrock Investment Narrative Recap

To own Archrock, investors need to believe in the long-term durability of U.S. natural gas demand and the necessity of compression infrastructure, which anchors its revenue base. The recent surge in analyst optimism and strong short-term earnings estimates have not materially shifted the biggest catalyst, robust natural gas market fundamentals and long-term contracts, or reduced the key risk of sector concentration and exposure to regulatory changes.

Among recent announcements, Archrock’s August buyback update stands out, with over 1.2 million shares repurchased last quarter. This move underscores management’s confidence and may reinforce support for the share price amid upcoming catalysts like contract renewals and growth investments.

However, in contrast to upbeat short-term expectations, investors should be aware of the risk posed by Archrock’s heavy reliance on the U.S. energy policy environment and what may happen if …

Read the full narrative on Archrock (it’s free!)

Archrock’s outlook anticipates $1.8 billion in revenue and $393.7 million in earnings by 2028. This relies on a 9.4% annual revenue growth rate and a $165.1 million increase in earnings from the current level of $228.6 million.

Uncover how Archrock’s forecasts yield a $30.89 fair value, a 28% upside to its current price.

Exploring Other Perspectives AROC Community Fair Values as at Sep 2025

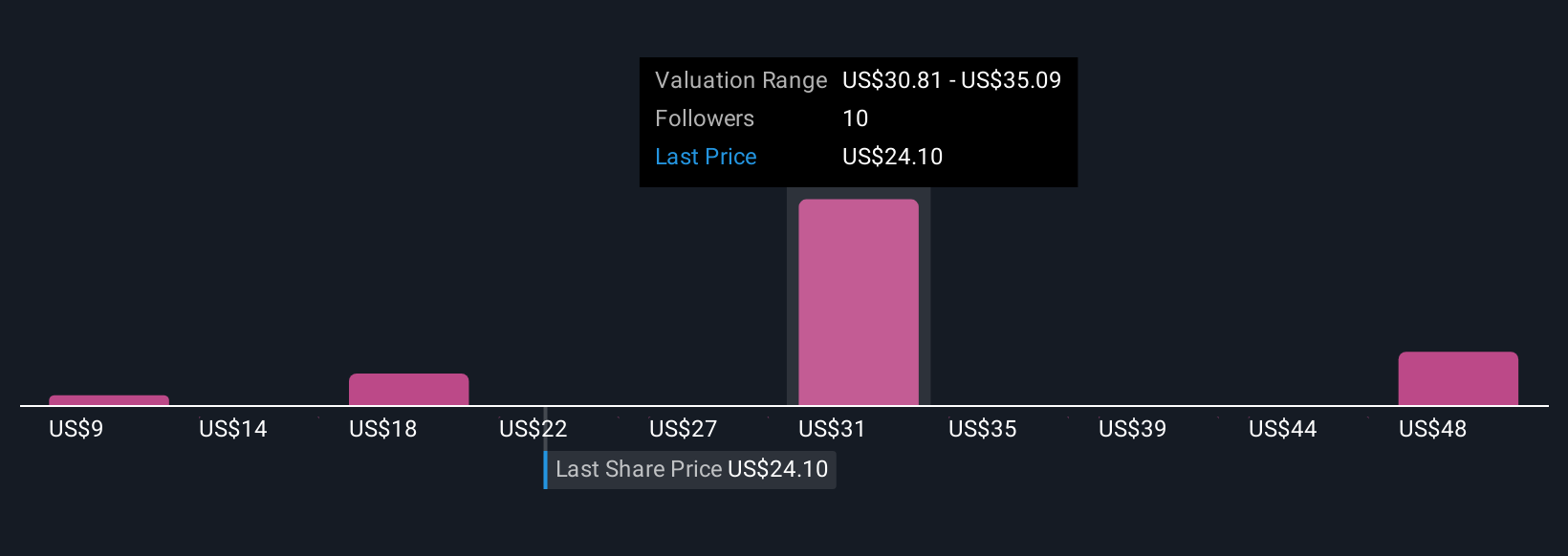

AROC Community Fair Values as at Sep 2025

Five private investors from the Simply Wall St Community see fair value for Archrock spanning US$9.41 to US$52.21 per share. While opinions differ widely, surging U.S. natural gas demand remains central to the bullish case for the company’s future growth.

Explore 5 other fair value estimates on Archrock – why the stock might be worth over 2x more than the current price!

Build Your Own Archrock Narrative

Disagree with existing narratives? Create your own in under 3 minutes – extraordinary investment returns rarely come from following the herd.

Looking For Alternative Opportunities?

Early movers are already taking notice. See the stocks they’re targeting before they’ve flown the coop:

This article by Simply Wall St is general in nature. We provide commentary based on historical data

and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your

financial situation. We aim to bring you long-term focused analysis driven by fundamental data.

Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Simply Wall St has no position in any stocks mentioned.

We’ve created the ultimate portfolio companion for stock investors, and it’s free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com