If you have Coinbase Global stock in your portfolio or you are just considering what move to make next, you are not alone. The stock has been on a wild ride lately, and investors are watching closely to see if the recent momentum can keep up. Over just the past year, Coinbase has delivered a striking 95.0% return. If you zoom out even further to the last three years, the gain tops a huge 433.0%. That kind of growth can catch your eye and make you wonder: is the rocket still fueled or are we approaching the stratosphere of risk?

Some of this movement has been tied to evolving regulatory news and shifting attitudes toward cryptocurrency, especially in institutional spaces. News of potential White House action allowing crypto and alternative assets in 401(k) plans introduced both excitement and fresh speculation, adding a new wrinkle to the risk outlook. Meanwhile, talk of Coinbase expanding globally, with acquisition rumors swirling in India, hints at the company’s ambitions. At the same time, U.S. banks recently dialed back price targets after an earnings miss. Despite these ups and downs, Coinbase still posted a 29.1% gain so far this year and a 3.8% bump in just the last month.

So where does this leave us from a valuation perspective? On most traditional metrics, Coinbase currently looks undervalued in just 1 out of 6 different valuation checks, earning it a value score of 1. That is far from a screaming “bargain,” but as with most things in crypto, there is always more to the story. Next, let’s walk through the main valuation methods analysts use and why conventional scores might not capture the whole picture. Stay tuned for a deeper, arguably better, lens on how to really value this company at the article’s end.

Coinbase Global scores just 1/6 on our valuation checks. See what other red flags we found in the full valuation breakdown. Approach 1: Coinbase Global Excess Returns Analysis

The Excess Returns valuation model focuses on how well a company uses its investors’ money to generate profits beyond the cost of that capital. In this approach, we look at Coinbase’s ability to produce returns on its book value—essentially, its net asset base—over and above what shareholders require as compensation for risk.

For Coinbase Global, the model highlights the following:

Book Value: $47.17 per share Stable EPS: $8.77 per share (Source: Weighted future Return on Equity estimates from 7 analysts.) Cost of Equity: $4.61 per share Excess Return: $4.16 per share Average Return on Equity: 15.65% Stable Book Value: $56.02 per share (Source: Weighted future Book Value estimates from 2 analysts.)

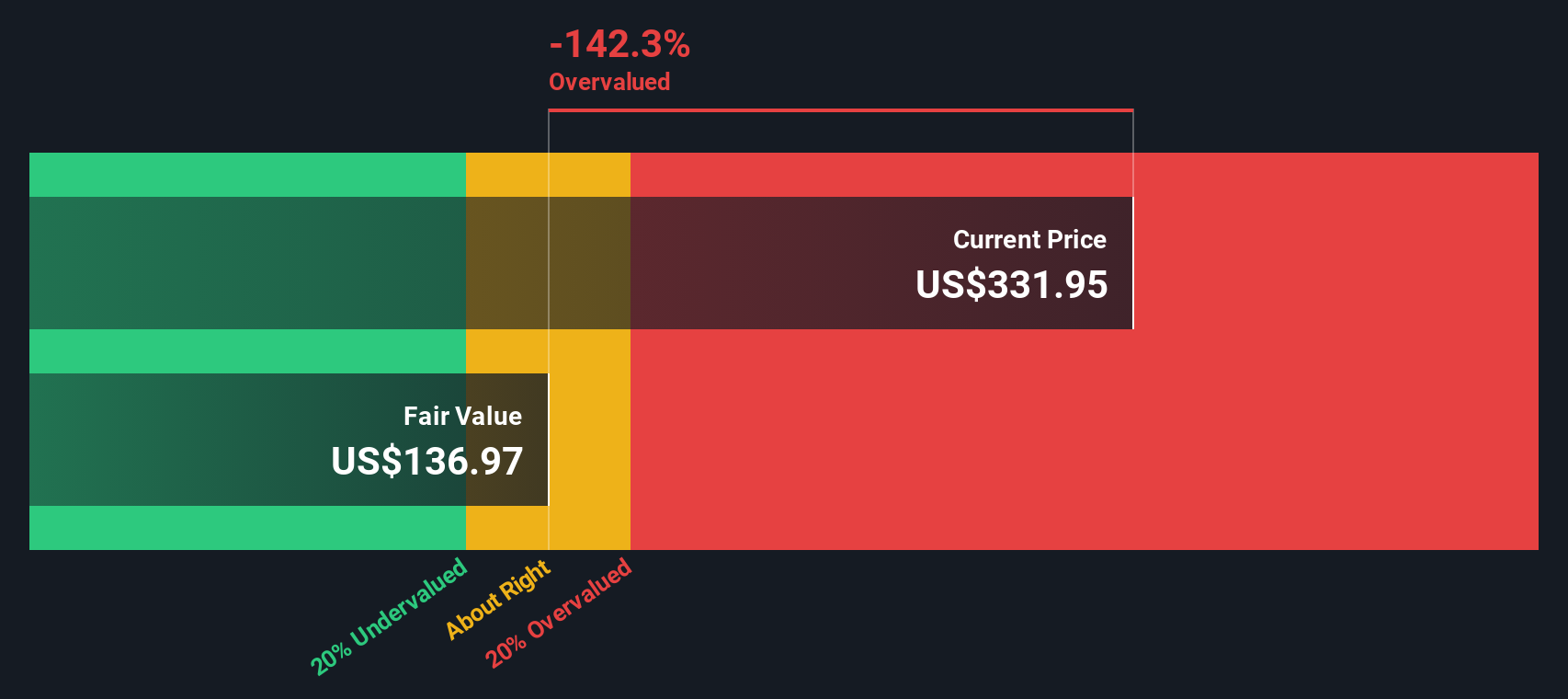

According to this Excess Returns analysis, the fair value per share for Coinbase is estimated at just $136.97. When compared to the current share price, this implies the stock is 142.3% overvalued. This suggests investors are pricing in returns or growth far above what the company’s fundamentals currently support.

Result: OVERVALUED

Head to the Valuation section of our Company Report for more details on how we arrive at this Fair Value for Coinbase Global.  COIN Discounted Cash Flow as at Sep 2025 Our Excess Returns analysis suggests Coinbase Global may be overvalued by 142.3%. Find undervalued stocks or create your own screener to find better value opportunities.

COIN Discounted Cash Flow as at Sep 2025 Our Excess Returns analysis suggests Coinbase Global may be overvalued by 142.3%. Find undervalued stocks or create your own screener to find better value opportunities.

Approach 2: Coinbase Global Price vs Earnings

For profitable companies like Coinbase, the price-to-earnings (PE) ratio is often considered the most meaningful valuation yardstick. This multiple lets investors quickly compare how much they are paying for each dollar of earnings, making it especially useful when a company is generating consistent profits. Nonetheless, what counts as a “normal” or “fair” PE ratio can swing widely depending on growth rates and the risks that come with the business. Faster growing, higher quality, and less risky companies typically justify higher multiples.

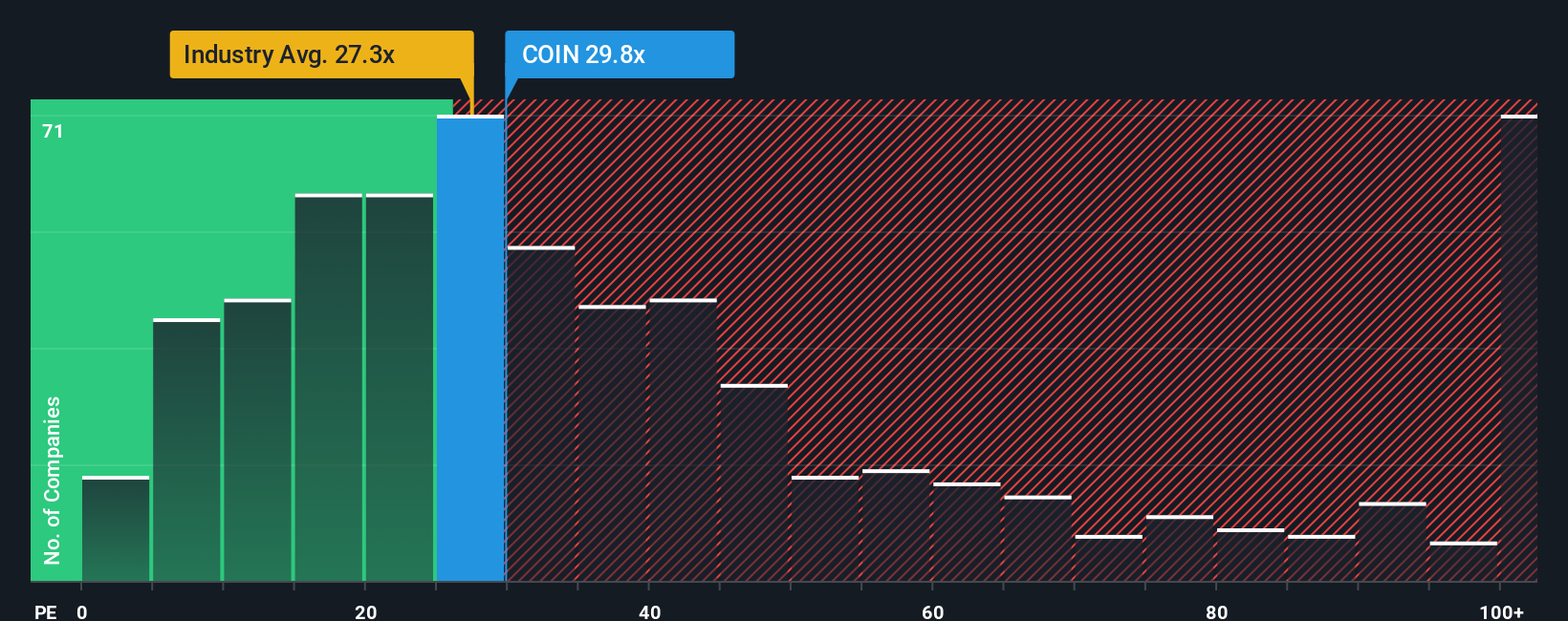

Currently, Coinbase trades at a PE ratio of about 29.8x. For context, the industry average for Capital Markets companies is 27.3x, while peers average a slightly higher 34.3x. At first glance, Coinbase looks priced close to the sector norm and actually a bit below its peers, suggesting the market’s sentiment is not overly exuberant relative to other similar companies.

To add more context, let’s bring in the “Fair Ratio,” a proprietary metric from Simply Wall St that blends in company-specific factors such as expected earnings growth, profit margins, scale, industry positioning, and risk profile. Unlike simple peer or sector averages, this fair multiple goes deeper, offering a more tailored perspective of what the stock “should” trade at. For Coinbase, the Fair Ratio sits at about 25.2x. Since the current PE multiple is a few points above this level, it suggests the market is demanding a premium that may not be fully warranted by fundamentals and risks right now.

Result: OVERVALUED

NasdaqGS:COIN PE Ratio as at Sep 2025 PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth. Upgrade Your Decision Making: Choose your Coinbase Global Narrative

NasdaqGS:COIN PE Ratio as at Sep 2025 PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth. Upgrade Your Decision Making: Choose your Coinbase Global Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let’s introduce you to Narratives. A Narrative is simply your story or your perspective about a company, woven together from what you believe about its future, such as how much revenue and profit it might earn, or what risks and catalysts matter most. Instead of only looking at numbers, Narratives let you connect the “why” behind a business’s journey to a set of detailed forecasts and, ultimately, a fair value estimate for the stock.

This approach is intuitive and powerful, and now accessible to everyone on Simply Wall St’s Community page, where millions of investors share and discover Narratives for companies like Coinbase. With Narratives, you can easily compare what you think a stock is worth to its market price, helping you decide when it makes sense to buy or sell. As new information emerges, such as earnings, major news, or regulatory changes, Narratives update dynamically and transparently, keeping your analysis relevant in real-time.

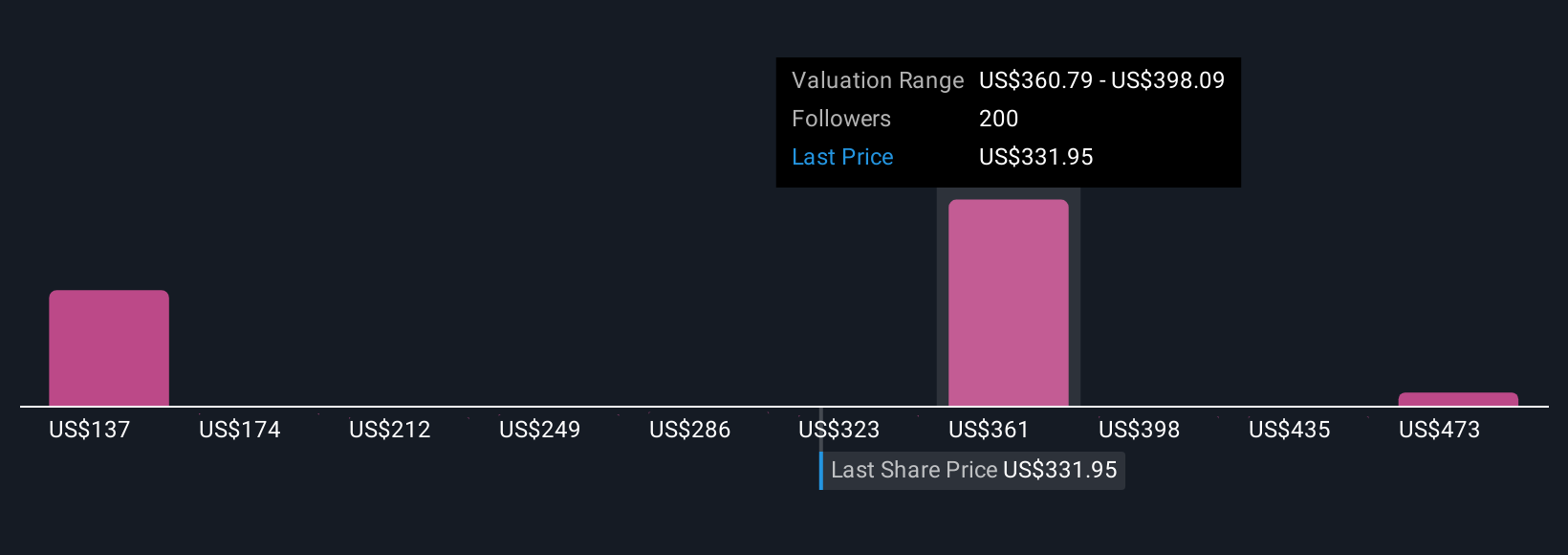

For example, with Coinbase Global, recent analyst Narratives have diverged dramatically: the most bullish expect a price target as high as $510, while the most bearish see fair value closer to $185, reflecting vastly different beliefs about future growth, risks, and the role of blockchain in finance. Narratives help you cut through the noise and shape your decision around your own evidence-based convictions.

Do you think there’s more to the story for Coinbase Global? Create your own Narrative to let the Community know!  NasdaqGS:COIN Community Fair Values as at Sep 2025

NasdaqGS:COIN Community Fair Values as at Sep 2025

This article by Simply Wall St is general in nature. We provide commentary based on historical data

and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your

financial situation. We aim to bring you long-term focused analysis driven by fundamental data.

Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Simply Wall St has no position in any stocks mentioned.

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com