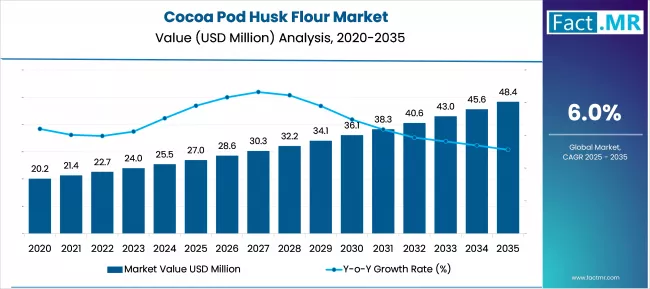

The global cocoa pod husk flour market is projected to grow from USD 27.0 million in 2025 to approximately USD 48.0 million by 2035, recording an absolute increase of USD 21.0 million over the forecast period. This translates into a total growth of 77.8%, with the market forecast to expand at a compound annual growth rate (CAGR) of 6.0% between 2025 and 2035. The overall market size is expected to grow by nearly 1.78X during the same period, supported by increasing focus on sustainable food ingredients, rising demand for fiber-rich functional foods, and growing awareness of circular economy principles in cocoa processing.

Quick Stats for Cocoa Pod Husk Flour Market

Cocoa Pod Husk Flour Market Value (2025): USD 27.0 million

Cocoa Pod Husk Flour Market Forecast Value (2035): USD 48.0 million

Cocoa Pod Husk Flour Market Forecast CAGR: 6.0%

Leading Application in Cocoa Pod Husk Flour Market: Bakery Products (45%)

Key Growth Regions in Cocoa Pod Husk Flour Market: West Africa, North America, and Europe

Top Key Players in Cocoa Pod Husk Flour Market: Cocoa Innovations Ltd., Green Food Ingredients, Sustainable Flours Corp., BioCocoa Extracts

Between 2025 and 2030, the cocoa pod husk flour market is projected to expand from USD 27.0 million to USD 36.8 million, resulting in a value increase of USD 9.8 million, which represents 46.7% of the total forecast growth for the decade. This phase of growth will be shaped by rising consumer awareness about sustainable food production, increasing demand for functional ingredients in food processing, and growing penetration of waste-to-value conversion technologies in cocoa-producing regions. Food manufacturers are expanding their sustainable ingredient portfolios to address the growing demand for environmentally responsible food solutions.

Cocoa Pod Husk Flour Market Key Takeaways

Metric

Value

Estimated Value in (2025E)

USD 27.0 million

Forecast Value in (2035F)

USD 48.0 million

Forecast CAGR (2025 to 2035)

6.0%

From 2030 to 2035, the market is forecast to grow from USD 36.8 million to USD 48.0 million, adding another USD 11.2 million, which constitutes 53.3% of the overall ten-year expansion. This period is expected to be characterized by expansion of sustainable supply chains, integration of advanced processing technologies, and development of specialized applications for cocoa pod husk flour. The growing adoption of circular economy principles and zero-waste initiatives will drive demand for innovative cocoa by-product utilization solutions with enhanced nutritional profiles and functional properties.

Between 2020 and 2025, the cocoa pod husk flour market experienced steady expansion, driven by increasing focus on sustainable agriculture practices and growing awareness of food waste reduction. The market developed as food manufacturers recognized the potential of cocoa processing by-products as valuable functional ingredients. Environmental sustainability concerns and regulatory support for waste-to-value initiatives began emphasizing the importance of utilizing cocoa pod husks in food and feed applications for resource optimization.

Why the Cocoa Pod Husk Flour Market is Growing?

Market expansion is being supported by the increasing focus on circular economy principles in the cocoa industry and the corresponding demand for sustainable ingredient solutions. Modern food manufacturers are increasingly prioritizing waste reduction strategies that can transform agricultural by-products into valuable functional ingredients. Cocoa pod husk flour’s proven benefits in providing dietary fiber, antioxidant properties, and sustainable sourcing credentials make it a preferred ingredient in environmentally conscious food formulations.

The growing emphasis on functional foods and clean label ingredients is driving demand for cocoa pod husk flour derived from organic cocoa processing operations. Consumer preference for products that combine nutritional benefits with environmental sustainability is creating opportunities for innovative applications. The rising influence of sustainability certifications and zero-waste manufacturing practices is also contributing to increased product adoption across food processing, animal nutrition, and nutraceutical sectors.

Segmental Analysis

The market is segmented by application, form, processing method, source, end-use, and region. By application, the market is divided into bakery products, animal feed, nutraceuticals, and others. Based on form, the market is categorized into powdered form and pellet form. In terms of processing method, the market is segmented into conventional processing, organic processing, and specialty processing. By source, the market is classified into conventional cocoa pods, organic cocoa pods, and certified sustainable cocoa pods. By end-use, the market is divided into food manufacturers, feed producers, nutraceutical companies, and specialty ingredient suppliers. Regionally, the market is divided into North America, Europe, East Asia, South Asia & Pacific, Latin America, and Middle East & Africa.

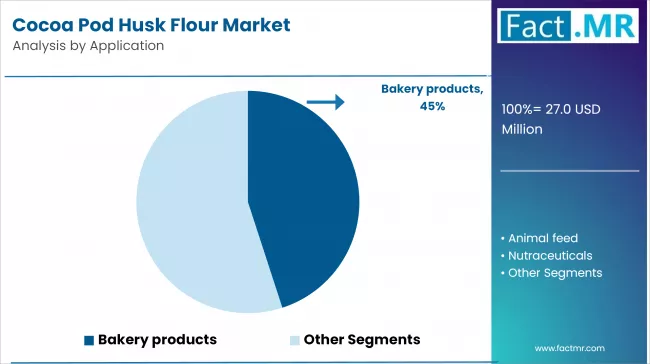

By Application, Bakery Products Segment Accounts for 45% Market Share

The bakery products application is projected to account for 45% of the cocoa pod husk flour market in 2025, reaffirming its position as the category’s primary application. Food manufacturers increasingly recognize the value of cocoa pod husk flour as a functional ingredient that provides dietary fiber, natural cocoa flavor enhancement, and sustainable sourcing credentials. This ingredient addresses consumer demands for healthier baked goods while supporting waste reduction initiatives in cocoa processing.

This application forms the foundation of most product development strategies, as it represents the most established and commercially viable use of cocoa pod husk flour in food manufacturing. Nutritionist endorsements and ongoing research validation continue to strengthen confidence in cocoa pod husk flour formulations. With consumer preferences shifting toward sustainable and functional food ingredients, bakery product applications align with both health-conscious and environmentally responsible consumption goals. Its versatility in various baked goods ensures sustained market leadership, making it the central growth driver of cocoa pod husk flour demand.

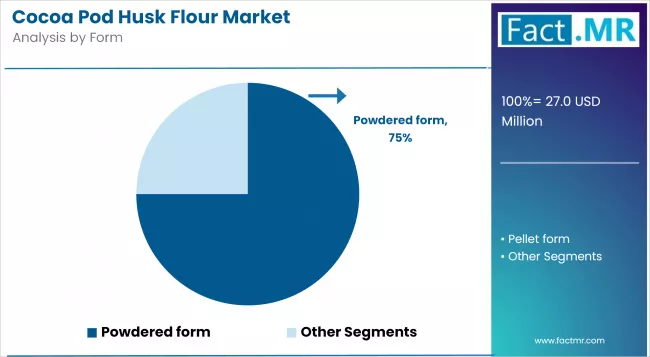

By Form, Powdered Form Segment Accounts for 75% Market Share

Powdered form is projected to represent 75% of cocoa pod husk flour demand in 2025, underscoring its role as the preferred processing format for diverse food applications. Food manufacturers gravitate toward powdered cocoa pod husk flour for its ease of incorporation, consistent particle size distribution, and ability to blend uniformly with other ingredients, maximizing functional benefits in final products. Positioned as a versatile functional ingredient, powdered form offers both nutritional enhancement and processing convenience in bakery, confectionery, and specialty food applications.

The segment is supported by the established infrastructure for powder processing and the compatibility with existing food manufacturing equipment. Additionally, brands are increasingly combining powdered cocoa pod husk flour with other functional ingredients like proteins, vitamins, or minerals, enhancing nutritional profiles and justifying premium positioning. As ingredient-conscious manufacturers prioritize processing efficiency and product consistency, powdered cocoa pod husk flour will continue to dominate demand, reinforcing its practical advantages within the sustainable ingredient market.

By Source, Organic Cocoa Pods Segment Accounts for 38% Market Share

The organic cocoa pods source is forecasted to contribute 38% of the cocoa pod husk flour market in 2025, reflecting the growing intersection of sustainability and organic certification in food ingredient sourcing. Food manufacturers are increasingly attentive to ingredient origins, preferring cocoa pod husk flour derived from certified organic cocoa processing operations that maintain strict environmental and quality standards. This aligns with the clean label movement, which emphasizes transparency, chemical-free production, and environmentally responsible sourcing methods.

Organic certifications and traceability systems provide credibility, reassuring buyers about ingredient integrity and environmental compliance. The segment also benefits from manufacturer willingness to pay premium prices for organic formulations that combine functional benefits with ethical and sustainable values. With heightened consumer awareness of agricultural practices and rising demand for organic food products, organic sourcing serves as a powerful differentiator, making it a critical driver of trust and brand loyalty in the cocoa pod husk flour category.

What are the Drivers, Restraints, and Key Trends of the Cocoa Pod Husk Flour Market?

The cocoa pod husk flour market is advancing steadily due to increasing focus on sustainable agriculture and growing demand for functional food ingredients. However, the market faces challenges including processing technology limitations, supply chain standardization issues, and competition from other fiber-rich ingredients. Innovation in processing methods and sustainable sourcing practices continue to influence product development and market expansion patterns.

Expansion of Circular Economy Initiatives in Cocoa Processing

The growing adoption of circular economy principles is enabling cocoa processors to transform waste streams into valuable ingredients while reducing environmental impact. These initiatives offer economic benefits, resource optimization, and sustainability credentials that influence purchasing decisions. Government incentives and corporate sustainability commitments are driving investment in waste-to-value technologies, particularly among cocoa processing companies seeking to maximize resource utilization.

Integration of Advanced Processing Technologies and Quality Enhancement

Modern cocoa pod husk flour manufacturers are incorporating advanced processing technologies such as controlled fermentation, enzymatic treatment, and precision drying to enhance nutritional profiles and functional properties. These technologies improve ingredient stability while reducing anti-nutritional factors and providing better sensory characteristics. Advanced processing techniques also enable specialized product grades that deliver targeted functionality for specific food applications.

Cocoa Pod Husk Flour Market by Key Country

Europe Market Split by Country

The European cocoa pod husk flour market demonstrates sophisticated development through circular economy leadership and sustainable food processing excellence. Germany leads through advanced environmental regulations, corporate sustainability commitments, and innovative waste-to-value technologies that transform agricultural by-products into valuable functional ingredients. France emphasizes sustainable agriculture, premium food innovation, and consumer awareness of environmental sustainability issues driving manufacturer interest in sustainable ingredient alternatives.

The United Kingdom focuses on sustainable food initiatives, ingredient transparency, and comprehensive food waste reduction awareness among consumers and manufacturers. European food companies prioritize environmental responsibility, resource efficiency, and advanced processing solutions, positioning cocoa pod husk flour as essential component of sustainable ingredient portfolios. Strong regulatory frameworks and clean label movement drive widespread adoption across bakery applications and specialty food sectors throughout the region.

Japan Market Split by Country

The Japanese cocoa pod husk flour market demonstrates exceptional potential within sophisticated food manufacturing industry emphasizing functional benefits, dietary fiber enhancement, antioxidant properties, and sustainable sourcing credentials. Japanese manufacturers prioritize superior ingredient quality, precision processing excellence, and comprehensive environmental sustainability practices, making powdered form cocoa pod husk flour highly attractive for premium bakery product applications. The market benefits from cutting-edge processing technologies, controlled fermentation methods, and advanced quality enhancement systems reflecting Japanese manufacturing precision standards.

Growing consumer preference for functional foods and clean label ingredients drives sustained demand for organic cocoa pod-derived flour across diverse applications. Integration with advanced manufacturing principles and sustainable supply chain development supports comprehensive market expansion throughout food manufacturing and nutraceutical sectors. Japanese companies emphasize ingredient reliability, consistent quality outcomes, and environmental responsibility creating opportunities for premium processing solutions delivering exceptional performance and long-term value.

South Korea Market Split by Country

The South Korean cocoa pod husk flour market shows emerging growth potential driven by expanding food manufacturing industry and increasing focus on sustainable ingredient solutions meeting international quality standards. Korean food manufacturers demonstrate growing interest in functional ingredients providing dietary fiber, comprehensive nutritional enhancement, and strong environmental responsibility credentials supporting brand differentiation. The market benefits from South Korea’s advanced technological capabilities and emphasis on food export competitiveness, creating sustained demand for certified sustainable cocoa pod husk flour meeting stringent international regulatory requirements.

Rising consumer awareness of functional foods and clean label movement supports widespread adoption in bakery products and specialized applications. Integration of circular economy principles and waste-to-value conversion technologies creates valuable opportunities for advanced processing methods and quality enhancement. Korean manufacturers increasingly prioritize sustainable sourcing practices, organic processing methods, and comprehensive quality assurance systems across diverse food processing applications requiring superior performance standards.

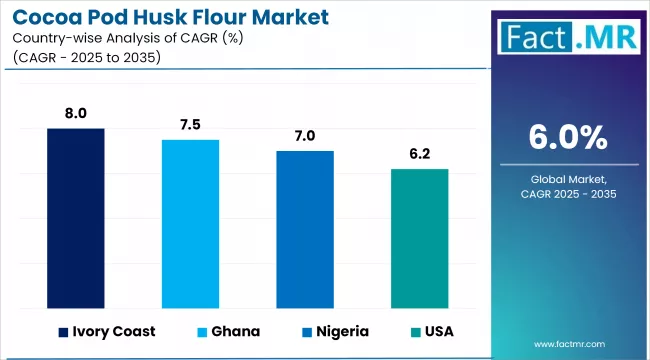

Analysis of Cocoa Pod Husk Flour Market

Country

CAGR (2025-2035)

Ivory Coast

8.0%

Ghana

7.5%

Nigeria

7.0%

USA

6.2%

Germany

5.9%

France

5.7%

UK

5.5%

The cocoa pod husk flour market is experiencing robust growth globally, with Ivory Coast leading at an 8.0% CAGR through 2035, driven by government initiatives promoting value-added cocoa processing, increasing investment in waste-to-value technologies, and growing collaboration with international food ingredient companies. Ghana follows closely at 7.5%, supported by established cocoa processing infrastructure, cooperative farming initiatives, and increasing awareness of sustainable by-product utilization. Nigeria shows solid growth at 7.0%, emphasizing food security initiatives and sustainable agriculture practices. The USA records 6.2%, focusing on sustainable ingredient sourcing and functional food development. Germany shows 5.9% growth, prioritizing circular economy principles and sustainable food processing technologies.

The report covers an in-depth analysis of 40+ countries; seven top-performing countries are highlighted below.

Ivory Coast Leads African Market Growth with Value-Added Processing Innovation

Revenue from cocoa pod husk flour in Ivory Coast is projected to exhibit strong growth with a CAGR of 8.0% through 2035, driven by government support for agricultural diversification and increasing investment in cocoa by-product processing technologies. The country’s position as the world’s largest cocoa producer creates significant availability of raw materials for cocoa pod husk flour production. Major international food ingredient companies and local processors are establishing processing facilities to serve both domestic and export markets.

Government initiatives promoting value-added agriculture and waste reduction are driving investment in cocoa pod husk processing infrastructure throughout major cocoa-producing regions.

International development programs and sustainable agriculture partnerships are supporting technology transfer and capacity building for cocoa by-product utilization among farming cooperatives nationwide.

Ghana Demonstrates Strong Market Potential with Cooperative Processing Systems

Revenue from cocoa pod husk flour in Ghana is expanding at a CAGR of 7.5%, supported by established cocoa processing infrastructure, cooperative farming systems, and increasing awareness of circular economy opportunities. The country’s organized cocoa sector and quality certification systems are creating opportunities for premium cocoa pod husk flour production. International sustainability initiatives and local processing companies are establishing collection and processing networks to serve growing market demand.

Rising focus on farmer income diversification and agricultural waste reduction is creating opportunities for community-based cocoa pod husk processing initiatives across major cocoa-growing regions.

Growing partnerships between international buyers and local cooperatives are driving investment in quality improvement and processing standardization for export market access.

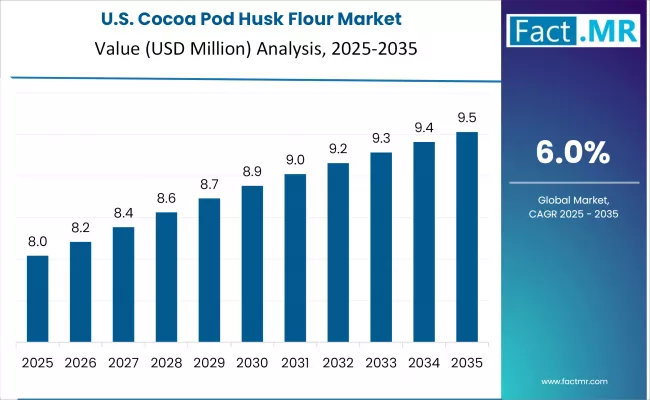

United States Focuses on Sustainable Ingredient Innovation and Functional Foods

Demand for cocoa pod husk flour in the U.S. is projected to grow at a CAGR of 6.2%, supported by increasing focus on sustainable ingredient sourcing and growing demand for functional food ingredients. American food manufacturers are increasingly prioritizing circular economy principles, ingredient transparency, and environmental sustainability in product development. The market is characterized by strong demand for certified sustainable ingredients that combine nutritional benefits with environmental responsibility.

Clean label movement and sustainable sourcing initiatives are driving demand for cocoa pod husk flour from verified sustainable and organic cocoa processing operations throughout supply chains.

Food manufacturer interest in functional ingredients and dietary fiber enhancement is supporting product development and application research for cocoa pod husk flour in various food categories.

Nigeria Maintains Growth with Food Security and Sustainable Agriculture Focus

Revenue from cocoa pod husk flour in Nigeria is projected to grow at a CAGR of 7.0% through 2035, driven by the country’s focus on food security, agricultural diversification, and sustainable farming practices. Nigerian food processors and agricultural development organizations are increasingly exploring cocoa by-product utilization as both an environmental solution and economic opportunity.

Government support for agricultural value addition and food security initiatives is promoting investment in cocoa pod husk processing technologies and local food ingredient production capacity.

Growing awareness of nutritional benefits and sustainable agriculture practices is encouraging adoption of cocoa pod husk flour in local food processing and animal feed applications.

Germany Strengthens Market with Circular Economy Leadership

Revenue from cocoa pod husk flour in Germany is projected to grow at a CAGR of 5.9% through 2035, supported by the country’s leadership in circular economy implementation and sustainable food processing technologies. German food manufacturers and ingredient companies value environmental sustainability, resource efficiency, and innovative processing solutions, positioning cocoa pod husk flour as a valuable component of sustainable ingredient portfolios.

Strong environmental regulations and corporate sustainability commitments are encouraging adoption of waste-to-value technologies and sustainable ingredient sourcing practices across food manufacturing sectors.

Investment in research and development for functional ingredient applications is supporting product innovation and market development for cocoa pod husk flour in specialized food applications.

France Anchors Growth with Sustainable Food Innovation

Revenue from cocoa pod husk flour in France is projected to grow at a CAGR of 5.7% through 2035, supported by the country’s emphasis on sustainable agriculture, food innovation, and premium ingredient applications. French food manufacturers and specialty ingredient companies prioritize environmental sustainability and product quality, making cocoa pod husk flour an attractive choice for sustainable food product development.

Strong consumer awareness of environmental issues and sustainable consumption practices are driving manufacturer interest in sustainable ingredient alternatives and circular economy solutions.

Investment in sustainable supply chain development and ingredient innovation is supporting market growth for cocoa pod husk flour in premium food and specialty ingredient applications.

United Kingdom Demonstrates Steady Growth with Sustainable Food Initiatives

Revenue from cocoa pod husk flour in the UK is projected to grow at a CAGR of 5.5% through 2035, supported by increasing consumer interest in sustainable food products and growing awareness of food waste reduction. British food manufacturers value environmental responsibility, ingredient transparency, and sustainable sourcing practices, positioning cocoa pod husk flour as a valuable sustainable ingredient option.

Growing emphasis on circular economy principles and waste reduction initiatives is encouraging food manufacturers to explore sustainable ingredient alternatives and by-product utilization opportunities.

Rising demand for functional food ingredients and dietary fiber enhancement is supporting product development and market expansion for cocoa pod husk flour in various food applications.

Competitive Landscape of Cocoa Pod Husk Flour Market

The cocoa pod husk flour market is characterized by competition among established cocoa processors, specialty ingredient companies, and emerging sustainable food players. Companies are investing in advanced processing technologies, sustainable sourcing practices, quality certification systems, and market development strategies to deliver effective, high-quality, and accessible cocoa pod husk flour solutions. Technology innovation, supply chain optimization, and application development are central to strengthening product portfolios and market presence.

Cocoa Innovations Ltd. leads the market with specialized focus on cocoa by-product processing and value-added ingredient development, offering consistent quality cocoa pod husk flour with emphasis on sustainability and nutritional functionality. Green Food Ingredients provides comprehensive sustainable ingredient solutions with transparent sourcing and processing methods. Sustainable Flours Corp. delivers innovative processing technologies with emphasis on product quality and environmental sustainability. BioCocoa Extracts focuses on organic and natural cocoa by-product processing with specialized applications for food and nutraceutical markets.

Regional cocoa processors and agricultural cooperatives provide localized processing capabilities and direct farmer relationships, while international ingredient companies offer comprehensive distribution networks and technical support services. Specialty processing companies focus on customized solutions and premium product grades for specific applications and quality requirements.

Key Players in the Cocoa Pod Husk Flour Market

Cocoa Innovations Ltd.

Green Food Ingredients

Sustainable Flours Corp.

BioCocoa Extracts

Cargill (Cocoa Processing Division)

Barry Callebaut (Sustainability Solutions)

Olam Cocoa (Value-Added Products)

JB Cocoa (By-Products Division)

Blommer Chocolate Company

Indcresa (Sustainable Ingredients)

Scope of the Report

Items

Values

Quantitative Units (2025)

USD 27.0 Million

Application

Bakery products, Animal feed, Nutraceuticals, Others

Form

Powdered form, Pellet form

Processing Method

Conventional processing, Organic processing, Specialty processing

Source

Conventional cocoa pods, Organic cocoa pods, Certified sustainable cocoa pods

End-Use

Food manufacturers, Feed producers, Nutraceutical companies, Specialty ingredient suppliers

Regions Covered

North America, Europe, East Asia, South Asia & Pacific, Latin America, Middle East & Africa

Countries Covered

United States, Canada, United Kingdom, Germany, France, Ivory Coast, Ghana, Nigeria, Brazil, Australia and 40+ countries

Key Companies Profiled

Cocoa Innovations Ltd., Green Food Ingredients, Sustainable Flours Corp., BioCocoa Extracts, Cargill, Barry Callebaut, Olam Cocoa, JB Cocoa, Blommer Chocolate Company, and Indcresa

Additional Attributes

Dollar sales by processing method and source type, regional supply chain analysis, competitive landscape, buyer preferences for organic versus conventional sources, integration with sustainability certifications, innovations in processing technologies, controlled quality systems, and sustainable sourcing practices

Cocoa Pod Husk Flour Market by Segments

Application :

Bakery products

Animal feed

Nutraceuticals

Others

Form :

Powdered form

Pellet form

Processing Method :

Conventional processing

Organic processing

Specialty processing

Source :

Conventional cocoa pods

Organic cocoa pods

Certified sustainable cocoa pods

End-Use :

Food manufacturers

Feed producers

Nutraceutical companies

Specialty ingredient suppliers

Region :

North America

United States

Canada

Mexico

Europe

Germany

United Kingdom

France

Italy

Spain

Nordic

BENELUX

Rest of Europe

East Asia

South Asia & Pacific

India

ASEAN

Australia & New Zealand

Rest of South Asia & Pacific

Latin America

Brazil

Chile

Rest of Latin America

Middle East & Africa

Kingdom of Saudi Arabia

Other GCC Countries

Türkiye

South Africa

Other African Union

Rest of Middle East & Africa