Credit: Adani Samat, White House/ZUMA Press/Newscom

The U.S. economy is already feeling the effects of Trump’s tariffs, and the Organization for Economic Cooperation and Development (OECD) projects that things could get worse.

The OECD’s biannual interim economic outlook, published on Tuesday, forecasts U.S. growth will fall by a full percentage point from its 2024 rate. While this might not sound like much, this will translate to Americans missing out on trillions of dollars of goods and services by 2035 if this decrease in growth persists.

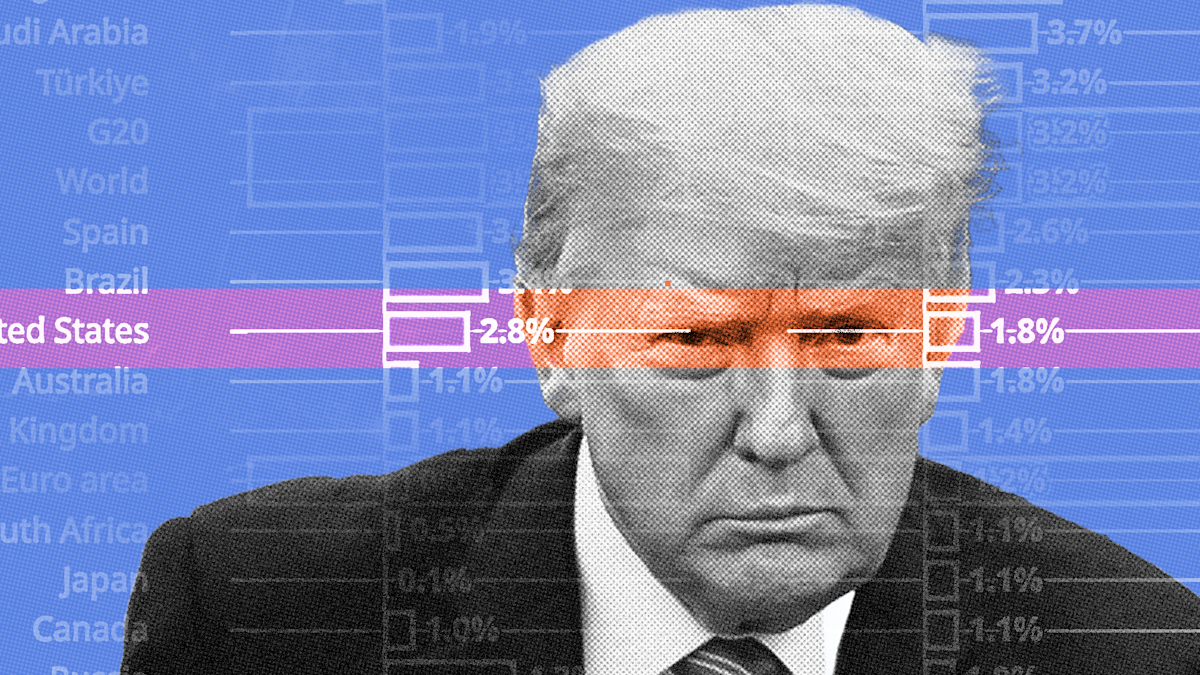

From 2010 to 2019, American gross domestic product (GDP) grew by an average of 2.4 percent per year. In 2024, it grew by 2.8 percent. Now, the OECD projects that the economy will grow by only 1.8 percent in 2025 and 1.5 percent in 2026, “owing to higher tariff rates [and] moderating net immigration,” among other factors. Assuming that yearly GDP growth neither rebounds nor falls further but persists at 1.8 percent, the U.S. economy will be $2.2 trillion smaller in 2035 than it would be had President Donald Trump not adopted his protectionist policies and growth remained at 2.4 percent.

Even though the OECD’s growth projections show the long-run macroeconomic damage of Trump’s tariffs, the American economy has remained relatively strong since he took office. The stock market is at an all-time high while inflation has been about the same as that experienced during the last year of the Biden administration: The average monthly inflation from January 2024 to August 2024, as measured by the consumer price index (CPI), was 0.2 percent. From January 2025 to August 2025, monthly CPI growth was not much higher: 0.225 percent. Meanwhile, the average monthly increase in the producer price index (PPI), which measures changes in expenses borne by American businesses, was 36 percent lower compared to the same time last year.

The Bureau of Labor Statistics (BLS) explains that “imports are excluded from PPI.” The experimental BLS index, which incorporates imports, tells a story similar to regular PPI: this index experienced 38 percent lower inflation from January 2025 to July 2025 than it did during the same period a year ago.

Relatively stable consumer price inflation and lower producer price inflation—excluding and including imports—under Trump are surprising. After all, the president has more than tripled the average effective tariff rate to 11.6 percent on approximately $2.2 trillion worth of imports, according to the Tax Foundation. Therefore, all things being equal, CPI and PPI should be elevated. So, why aren’t they? The answer lies in the delayed implementation of Trump’s tariffs: Although “Liberation Day” was April 2, the “reciprocal tariffs” announced then were postponed for months, finally taking effect on August 7, meaning “the full effects of tariff increases have yet to be felt,” as the OECD explains.