Grid investments and the electricity bill

One of the most crucial preconditions for a successful business location is the availability of a stable and reliable energy supply provided by a resilient energy infrastructure. In the past decades electricity grids have been close partners of European businesses and industries. Furthermore, Distribution System Operators (DSOs) are core enablers of the clean energy transition with most renewables connected to the distribution grid and key actors in providing households and industries reliably with energy. Since the transition of the energy system primarily takes place in the distribution grid, unprecedented investments in grid expansion, renewal and smartening are required, estimated at €55-67 bn per year on average until 2050. Although the network component of the electricity bill has gone down or remained stable during past decades in most Member States, the significant investments that are now needed have raised concerns over potential increases in the network component of the bill in the future.

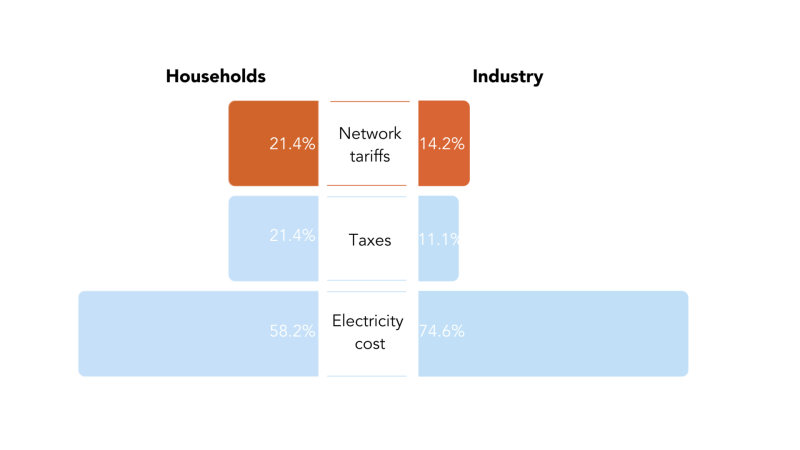

Despite differences in Member States, the average electricity bill in the EU consists of three core components:

Commodity cost for the produced electricity, usually measured in kWh.

Network cost for the delivery of electricity (transmission and distribution) including capital costs as well as the costs for maintaining and operating the system.

Taxes and levies which can differ per country but usually include the value-added tax (VAT), electricity taxes, renewable energy levies and/or other environmental taxes or government charges.

While network costs differ slightly in EU countries a recent publication of the European Commission on network charges showed that in recent years network charges have represented between 24-29% of the electricity bill for households. During the recent energy crisis their share was even less due to higher commodity prices as visible in the depiction below.

Illustration: DSO Entity, based on European Commission’s Action Plan for Fffordable Energy (COM/2025/79), p.3.

Investing in grid infrastructure: a no-regret option

Even if the network component was to increase, studies from the European Commission expect the electricity prices to remain rather stable. This shows the positive effect of sufficient investments in grids to connect renewables to bring the energy component of the electricity bill down.

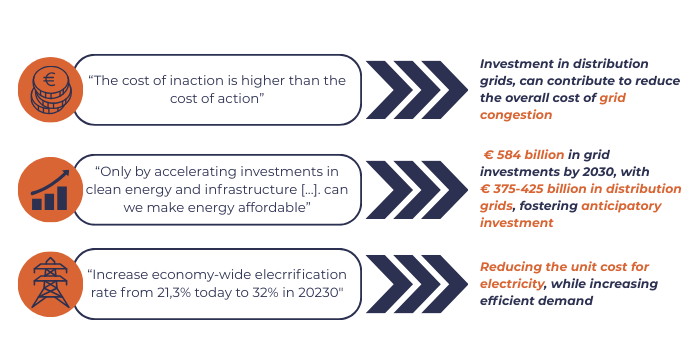

Similarly, the Action Plan for affordable energy highlighted the need for sufficient grid investments to ensure the fast deployment and connection of renewables to accelerate decarbonisation and thus, imports of costly fossil fuels. (see quotes below).

Illustration: DSO Entity

Already now billions of Euros are expended on congestion-related costs with the UK spending over €1 billion a year and Germany nearly twice as much. Also, redispatch volumes are expected to surge with estimates for the EU to rise from 50 TWh in 2023 to 374 TWh by 2030, potentially costing an additional €100 billion. A recently conducted case study in Austria of Frontier Economics let them to arrive at the conclusion that “overinvestment is suboptimal, [but] underinvestment is catastrophic”. Therefore, they argue for a twofold shift: in mindset to recognise the asymmetric risk that the cost of delay far outweighs the cost of some surplus capacity and in the set of regulatory instruments highlighting the need for an embrace of anticipatory investments, improved system planning and others.

Additional measures to mitigate effects on consumers

Even if the electricity bill might increase temporarily due to higher investment needs, several options exist on how effects on consumers could be mitigated.

Public Funds: European or national public funds could be used to protect consumers from (short-term) price increases. Member States could make use of their public budget to lower network charges to cover the additional costs resulting from measures to accelerate decarbonisation and market integration. More indirectly, public funds could also be used to increase the demand for electricity, for example by directly funding the electrification of customers or industries. Lastly, public funds could be used to more directly facilitate the access to efficient sources of finances for DSOs thereby also alleviating the burden from consumers / tariffs.

Accelerated electrification: Since the level of distribution fees is connected to consumption levels an increase in demand for electricity connections will positively affect consumer fees as the costs are distributed among more users. So, an increase of electricity demand could also allow to keep network unit costs around current levels.

Anticipatory investments: The implementation of a forward-looking, long-term regulatory approach will lead to dynamic efficiency and ultimately to lower network tariffs. A conclusion mirrored also in the guidance of the EC on anticipatory investments which states: “In many locations, underinvesting in grid infrastructure may become costlier to society in the medium term than making anticipatory investment under controlled scrutiny and risk management processes.”

Right regulatory environment as key for grid operators to serve European consumers

DSOs as regulated entities depend on the right regulatory framework to timely and reliably connect and supply consumers. Vital conditions are a forward-looking regulatory framework that allows for anticipatory investments, sufficient EU (funding) support for DSOs and EU leadership on strategic topics such as supply chains or public procurement. Given the national and diverse character of DSOs, the report underlines the need for well-orchestrated actions and good cooperation between the EU and national level to arrive at the right balance between direct EU activities and a plurality of national solutions.

Full Competitiveness Report here.