Finder Energy, a Perth-based oil and gas exploration player, is taking steps to secure remaining funds for a final investment decision (FID), which will enable it to develop two oilfields off the coast of Timor-Leste. To this end, the firm has agreed to enable its partner to boost its interest in the project.

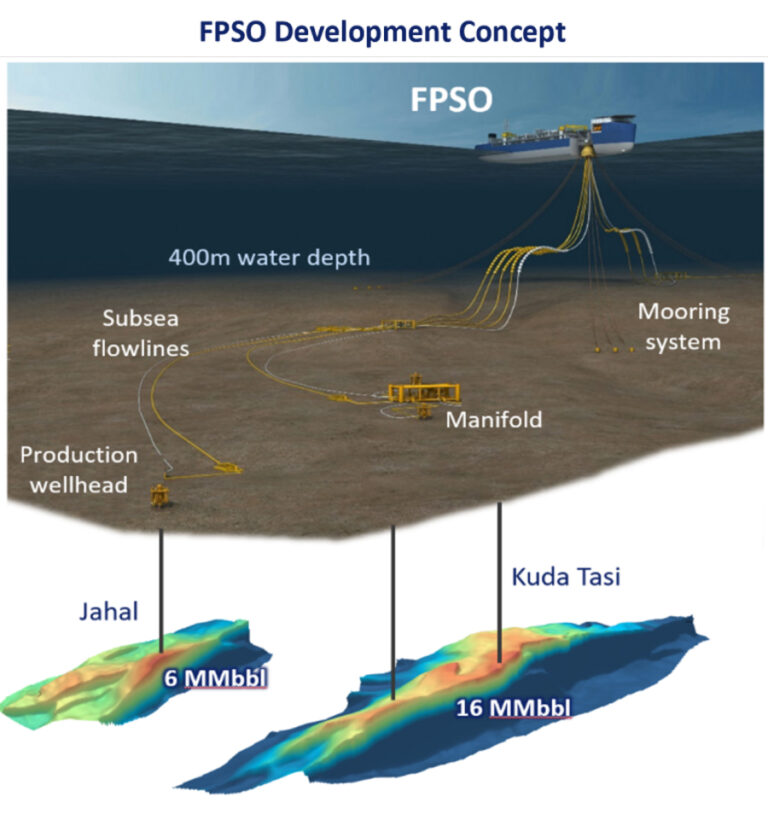

FPSO development concept; Source: Finder Energy

FPSO development concept; Source: Finder Energy

Finder PSC 19-11, a subsidiary of the company, has entered into a farm-in agreement with its joint venture partner, Timor Gap PSC 11-106 Unipessoal, a subsidiary of Timor Gap, which is the national oil company (NOC) of Timor-Leste. Thanks to the agreement, the latter will acquire a further 10% participating interest in PSC 19-11, increasing their interest in the joint venture to 34%.

This asset entails the Kuda Tasi and Jahal (KTJ) oilfield project, which consists of two fields. While the completion of the transaction is subject to receiving regulatory and third-party approvals, Finder anticipates this will occur in or about late October 2025.

Damon Neaves, Finder’s CEO, underlined: “We are delighted to strengthen our partnership with Timor Gap through this agreement, which not only increases their participation in the KTJ project but also demonstrates confidence in the acceleration strategy targeting FID by mid-2026.

“This agreement significantly de-risks the development, underpins the project’s strategic importance for Timor-Leste and marks a major milestone for the KTJ project.”

Finder, which maintains majority ownership (66%) and operatorship of the PSC, describes the KTJ project as the first 100% sovereign Timor-Leste development and claims to be strongly aligned with its partner in the desire to achieve FID sooner.

While Timor Gap was previously carried for its 24% interest until FID, the terms of the farm-in agreement will see it contribute to 24% of the costs of activities to accelerate the FID up to a gross cap of $15 million and 12% of the costs of other joint venture expenditure retrospectively from January 1, 2025, until the FID date.

If the FID gets taken before September 30, 2026, Timor Gap will contribute 50% of development capex up to a gross cap of $338 million, which means the parties will contribute to development capex pro rata in accordance with their participating interests.

The operator explained: “The funding provided by Timor Gap under the farm-in agreement significantly de-risks the KTJ project and strengthens Finder’s position to secure debt funding as well as other critical project elements such as the FPSO and a drilling unit for the development wells.

“Timor Gap is working closely with Finder at this critical phase of the KTJ project and will be seconding personnel to Finder’s Perth office as part of the FID acceleration strategy, including the current accelerated FEED project and subsequent phases of the project.”

Timor-Leste’s NOC or its affiliates will provide services to the KTJ project, such as helicopter transport, supply boats, and other services. As the integrated project team sets out to progress all work streams to advance the KTJ project through assurance checks and project decision gates, the current focus is on transforming design concepts into a fully defined FDP to support a development decision at FID.

Finder highlighted: “During this stage, we are undertaking detailed subsurface evaluation and reservoir modelling, refining SPS components, FPSO selection and interface engineering as part of FEED to refine technical specifications, cost estimates, and schedules. Key commercial and regulatory work is also being undertaken, including partner alignments, regulatory approvals and engagement with contractors and suppliers.

“Risk assessments, environmental and social impact studies and project execution strategies are also being completed. The outcome of FEED is to define a robust, de-risked FDP with a clear technical and economic case to achieve FID.”

The company is adamant that it is fast approaching several major catalysts and project milestones, including securing an FPSO, independent resource certification for the Kuda Tasi and Jahal oil fields, and updated dynamic modelling simulation and production forecasts.

In addition, the firm is nearing a time of booking a drilling unit for the development drilling campaign, the completion of FEED, approval of FDP, debt funding, making the final investment decision, and unlocking the cash flow potential of the KTJ project, which is its highest priority.

𝐓𝐚𝐤𝐞 𝐭𝐡𝐞 𝐬𝐩𝐨𝐭𝐥𝐢𝐠𝐡𝐭 𝐚𝐧𝐝 𝐚𝐧𝐜𝐡𝐨𝐫 𝐲𝐨𝐮𝐫 𝐛𝐫𝐚𝐧𝐝 𝐢𝐧 𝐭𝐡𝐞 𝐡𝐞𝐚𝐫𝐭 𝐨𝐟 𝐭𝐡𝐞 𝐨𝐟𝐟𝐬𝐡𝐨𝐫𝐞 𝐰𝐨𝐫𝐥𝐝!

𝐉𝐨𝐢𝐧 𝐮𝐬 𝐟𝐨𝐫 𝐛𝐢𝐠𝐠𝐞𝐫 𝐢𝐦𝐩𝐚𝐜𝐭 𝐚𝐧𝐝 𝐚𝐦𝐩𝐥𝐢𝐟𝐲 𝐲𝐨𝐮𝐫 𝐩𝐫𝐞𝐬𝐞𝐧𝐜𝐞 𝐢𝐧 𝐭𝐡𝐞 𝐡𝐞𝐚𝐫𝐭 𝐨𝐟 𝐭𝐡𝐞 𝐨𝐟𝐟𝐬𝐡𝐨𝐫𝐞 𝐞𝐧𝐞𝐫𝐠𝐲 𝐜𝐨𝐦𝐦𝐮𝐧𝐢𝐭𝐲!