Link to interactive version: https://engaging-data.com/tax-brackets/

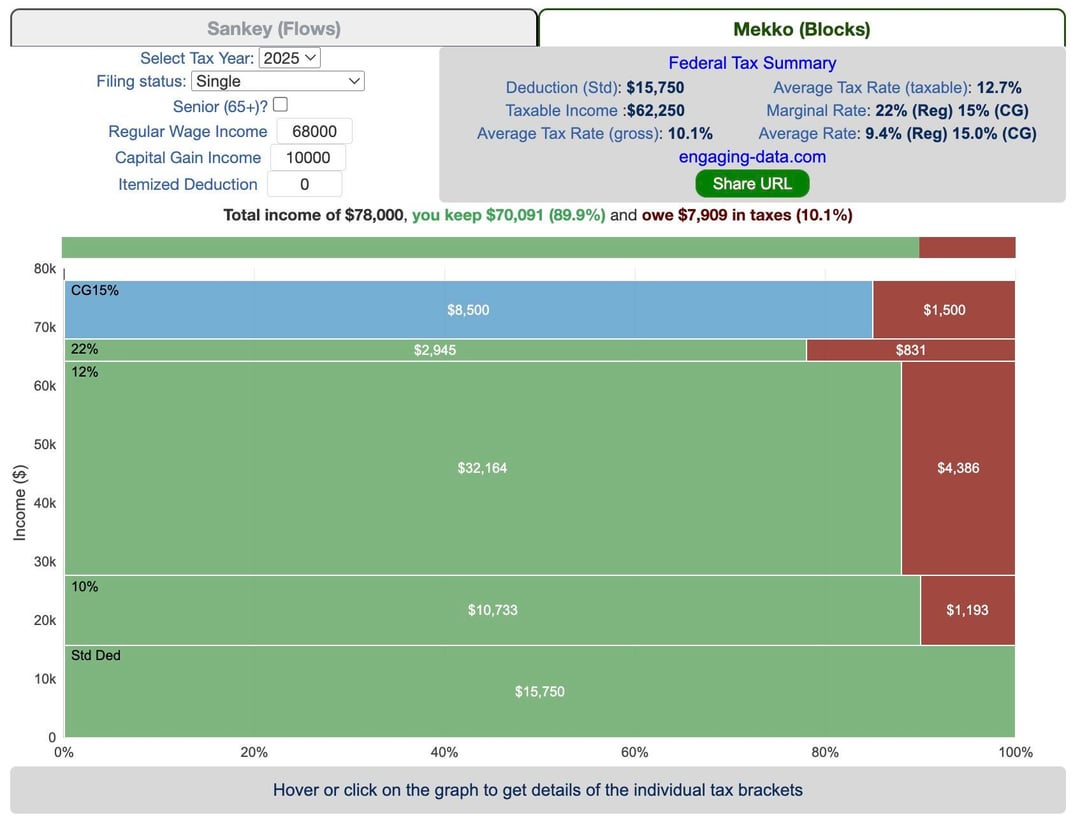

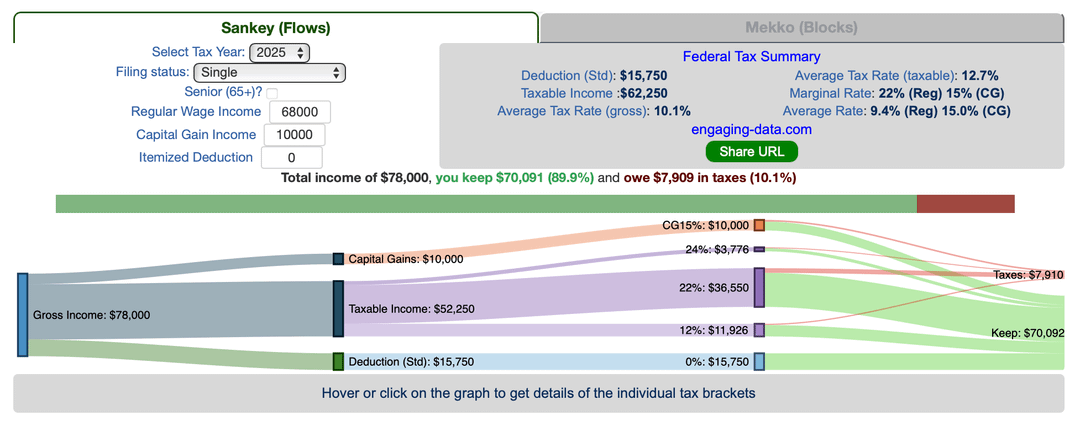

View my tax bracket calculator/visualization. Enter your regular and capital gains income and it calculates your taxes and shows you how the various tax brackets work (how much goes into each bracket and how taxes are applied.

I know many folks have some misunderstandings about how tax brackets work so these graphs can help with showing how the US federal tax brackets work. I added a Mekko graph to the Sankey graph to give a different way to visualize the tax brackets. Also updated the calculations to include the latest tax changes from the 2025 bill, which raises the standard deduction and adds an additional senior deduction.

Data and Tools:

Tax brackets and rates were obtained from the IRS website and calculations were made using javascript, CSS and HTML. The sankey graph was made using code modified from the Sankeymatic plotting website and the mekko graph was made using the Plotly javascript open source library.

Posted by EngagingData

5 comments

You should include employee contribution via FICA. Your computation is probably (haven’t checked in detail) accurate for income tax exclusively, but it doesn’t represent the standard federal tax burden. If you earn wages you pay FICA in addition to income tax and as your demo graphic points out (by showing how relatively low income tax is), FICA is a huge chunk of most folks’ tax bills.

This is awesome. If you wanted to expand it a third tab I would love is an estimate of where your tax dollars are going (military, Medicare, interest on the debt, etc.)

A tax calculator that ignores the difference between (a) earned income, (b) interest, and (c) capital gains is wrong, even misleading.

The middle class mostly has (a), taxed the most. The wealthy class mostly has (c), taxed the least.

A useful addition to this tool would be some information about where to find the input numbers on a 1040 form. There isn’t one line for “regular wage income”, and the lines for capital gains and itemized deductions have labels that are slightly more complex than that. There’s also no clear accommodation for dividends and interest. For purposes of this calculator, they should be part of the “regular wage income” bucket, but they aren’t actually *wages*.

As best I can tell, the correspondence is (for the 2024 edition of the 1040 form):

“regular wage income” = Line 9 – Line 7

“capital gain income” = Line 7

“itemized deduction” = Line 12

10.1% is ridiculously low. And this is without itemized deductions, right?

Comments are closed.