Editorial Note: We earn a commission from partner links on Forbes Advisor. Commissions do not affect our editors’ opinions or evaluations.

West Texas Intermediate (WTI) futures opened at $65.22 per barrel (bbl) on September 26, 2025. Brent crude opened at $69.55 per barrel. Both benchmarks remain closely watched gauges of global energy supply and demand.

West Texas Intermediate (WTI) Crude Oil Price Today

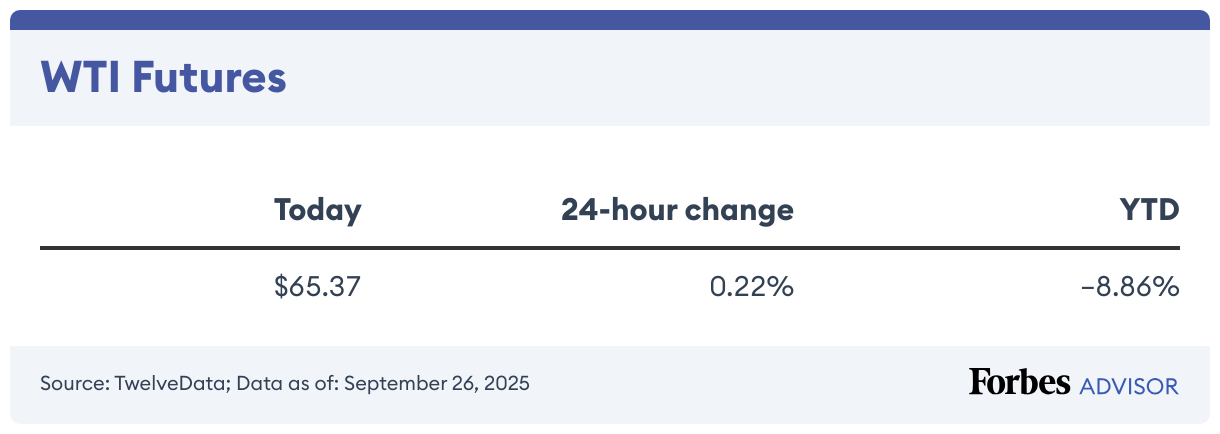

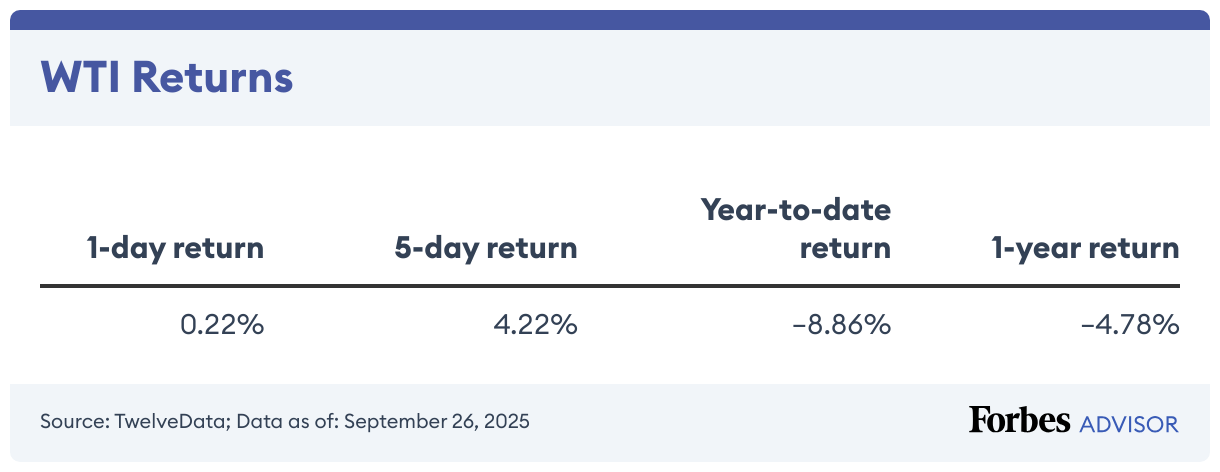

WTI futures are trading at $65.37/bbl, as of 9:19 a.m. ET. That’s up 0.22% since yesterday’s close.

WTI Crude Oil Price Chart

WTI prices have fallen since the start of 2025 and are down by 14.79% compared to 2022.

Over the past year, the 52-week range has stretched from an intraday low of $55.12 per barrel on April 9, 2025, to an intraday high of $80.77 per barrel on January 16, 2025—with that high trading about 23.56% above the current futures price.

Crude Oil Price History

Crude oil’s price history can be fairly described as a highlight reel of economic chaos. In July 2008, Brent crude rocketed to a record of approximately $147 a barrel as demand soared and everyone panicked about running out. Consumers felt it right away—gas in the U.S. blew past $4 a gallon, hitting wallets hard at the exact moment the financial system was cracking.

Just over a decade later, the market flipped in the opposite direction. In April 2020, West Texas Intermediate futures collapsed to -$37.63 per barrel, meaning sellers had to pay buyers to take oil off their hands. While spot crude did not go negative, this negative April 2020 price was a futures settlement price for May 2020 delivery.

The crash was triggered by the COVID-19 pandemic, which wiped out travel and industrial demand while storage tanks filled to the brim. For consumers, that shock briefly translated into the lowest gas prices in years, though it also signaled deep economic distress.

Where Prices Have Traded in Recent Years

Brent usually costs more than WTI because it’s used as the global benchmark. It’s the main reference point for oil prices worldwide—and often travels farther, which adds to the cost. The difference between the two prices is called the Brent‑WTI spread.

Think of it like buying gas locally versus at a faraway rest stop: The fuel is basically the same, but delivery costs make one option pricier. Traders watch this spread closely because when it gets wider or narrower, it signals changes in supply, demand, or shipping routes.

What Could Move Oil Next

Oil prices change fast, and a few key factors usually drive the moves:

OPEC+ can raise or cut production, which changes how much oil is on the market.

Weekly U.S. inventory reports show whether supplies are building up or running low.

Global demand forecasts signal how much fuel the world’s factories, cars and planes will need.

Decisions from the Federal Reserve affect the strength of the dollar, which changes how expensive oil looks to other countries.

Geopolitical conflicts or shipping disruptions can tighten supply overnight.

Even the seasons matter. Summer driving and winter heating often push demand higher.

For consumers, all of these forces show up eventually in the cost of gas, flights and everyday goods.

WTI’s all-time high was on July 3, 2008, trading at $145.29 per barrel.

Brent Crude Oil Price

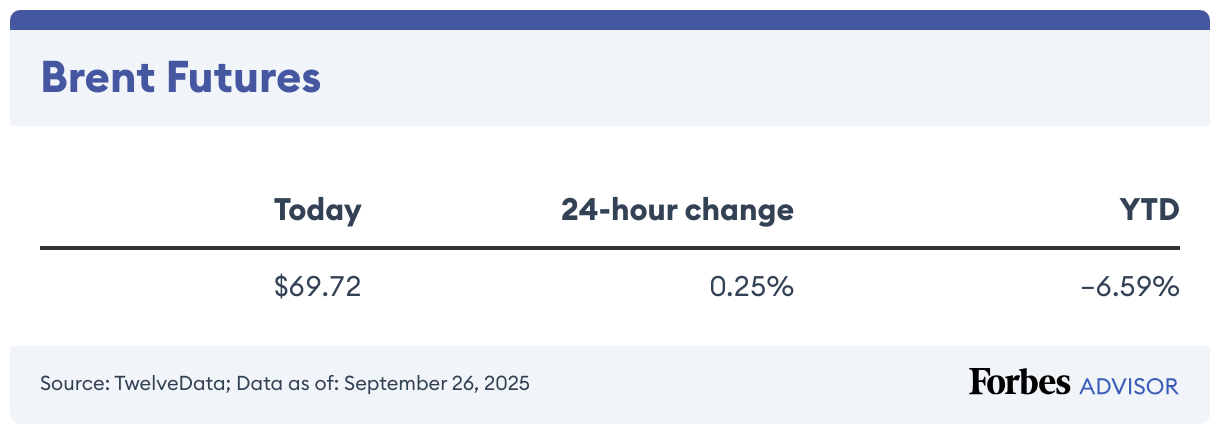

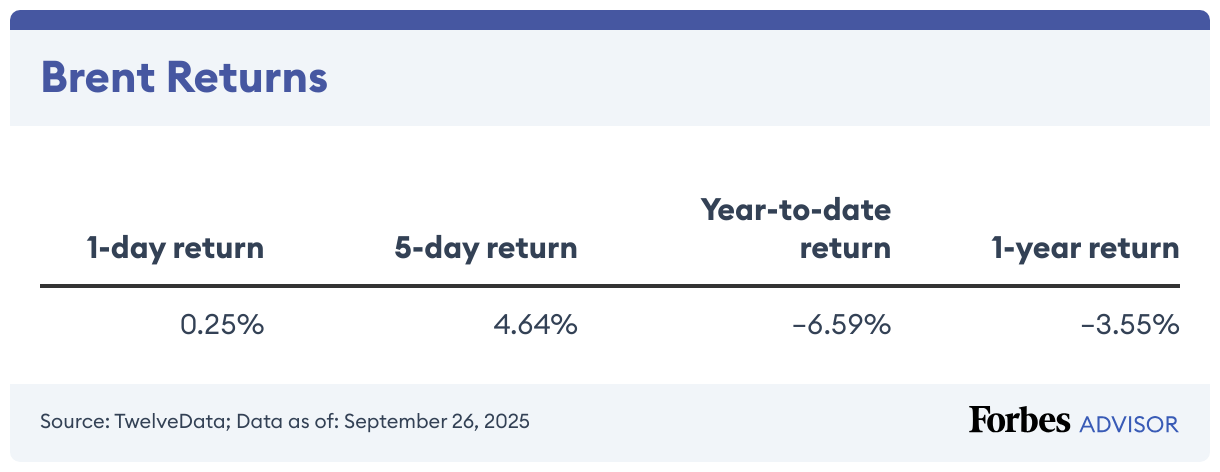

Brent futures rose in the past 24 hours by 0.25% to $69.72/bbl, as of September 26, 2025.

Brent Crude Chart

Brent crude oil is generally subject to the same supply and demand factors that influence WTI crude prices, so the long-term price chart may look similar to the WTI chart.

Brent Crude Price History

Brent crude reached its 52-week intraday high of $82.65 on January 16, 2025. The lowest intraday price in the past year was $50.31 per barrel on April 30, 2025.

Brent crude oil prices hit their all-time high of $146.08/bbl on July 3, 2008.

What Is Crude Oil? What Is Crude Used for?

Crude oil is pumped from underground rock, often with natural gas sitting above it and salty water below. After extraction, refineries heat and separate the mix—distillation—into gasoline, diesel, jet fuel, asphalt and chemical feedstocks used to make plastics and other materials. Biofuels—fuel grown, not drilled—are blended into stretch supply and cut emissions, such as ethanol in gasoline and biodiesel or renewable diesel in diesel.

Oil prices matter because they ripple through daily life: Higher crude often means pricier fill-ups, shipping and manufacturing. Prices move with supply and demand—and with what markets expect next. Wars, hurricanes, OPEC+ policy shifts and economic slowdowns can all move the needle.

Quick glossary:

Crude oil vs. petroleum: Crude is the raw liquid from the ground; petroleum is the family of products made from crude or natural gas.

Distillation: This is the refinery step that separates crude into useful parts by boiling point.

Distillate fuel oil: This includes diesel and heating oil, used in trucks, trains, construction equipment and boilers.

Hydrocarbon gas liquids: This includes propane, ethane and butane from gas plants and refineries; used for heating, plastics and industry.

New to Oil? Start Here

Think of oil investing like using a power tool. It can do the job, but it demands care. Oil traders place particular weight on settlement prices, which are the official closing levels set at the end of each trading day. Think of it as the “final score” for oil markets: The number that determines how contracts are valued and how much traders make or lose. For traders, the daily settlement is key, as it sets contract values and trading tallies.

Futures also use leverage, so small price moves can create big gains or losses. Keep extra cash for margin. Add up every cost you will pay, including commissions, fund expense ratios, exchange fees and margin interest. Spread your risk instead of betting on a single company or contract. Set a time horizon you can live with because energy markets cycle through booms and busts.

If you plan to use a day trading platform, start in a simulator. Learn the tools, set hard loss limits and consider micro futures. Futures trading does not use the stock market’s pattern day trader rule. It still has strict margin rules and poses a real risk of losing more than you deposit.

Frequently Asked Questions (FAQs)

What are the types of oil investments?

Oil is a commodity, meaning a basic raw material that trades in standard units on global exchanges.

You can typically reach the oil market in three ways: owning energy stocks, buying diversified funds such as exchange-traded funds (ETFs) or mutual funds or using futures and options.

Of course, each method comes with its own mix of risk, cost and complexity. Before investing, it’s wise to consult with a qualified and experienced financial advisor.

Oil company stocks are the most familiar route. You’re buying shares of businesses that find, move or refine oil.

– Upstream companies are the explorers and drillers that search for oil and pull it out of the ground, such as ConocoPhillips (COP) and BP (BP).

– Midstream companies handle pipelines and storage, such as Kinder Morgan (KMI) and Enbridge (ENB).

– Downstream companies turn crude into gasoline and diesel, such as Marathon Petroleum (MPC) and Phillips 66 (PSX).

These stocks often pay dividends and are easy to buy through an online brokerage, but they can rise and fall with oil prices and news. Upstream stocks usually move the most.

Oil ETFs and mutual funds bundle dozens of energy companies into one purchase, which spreads your risk. Popular choices include Energy Select Sector SPDR Fund (XLE), Vanguard Energy Index Fund ETF Shares (VDE) and Fidelity Select Energy Portfolio (FSENX).

ETFs trade like a stock and keep things simple. You’ll still feel big moves in oil, and funds charge fees, so check costs before you click buy.

Futures and options are the direct, high-octane path. A futures contract sets a price today for oil delivered later.

If you buy at $75 a barrel and the price climbs to $90, you profit. If it drops to $65, you take the hit. Options are paid-upfront bets on direction with defined risk. This lane can move fast and requires a margin-approved account and strict risk rules. Smaller “micro” futures exist if you want tiny position sizes.

If you’re new, keep it simple. Start with a broad energy ETF or a large, steady oil company, set a budget, and learn the rhythms of the market. If you ever try futures, practice on a simulator first and start small.

What do we use petroleum for?

We use petroleum for gasoline, diesel and jet fuel for transportation. It heats homes and factories. Some power plants use it to make electricity. Industry uses it as a feedstock for plastics, solvents and many everyday goods. Biofuels are often mixed into gasoline and diesel.

How do I invest in oil futures like WTI and Brent?

Open a futures-approved brokerage, then search for WTI and Brent. WTI trades on NYMEX as CL. Brent trades on ICE as B.

Futures use borrowed power, so small price moves can hit big. Keep extra cash for margin. Expect swings driven by supply, demand and geopolitics.

Pick your size. The standard WTI contract is 1,000 barrels. Micro WTI is 100 barrels. A move of 0.01 changes the standard contract by $10. A full dollar move is about $1,000 on the standard and about $100 on the micro.

Know the schedule. Trading runs nearly around the clock from Sunday evening to Friday afternoon Eastern, with a short daily break. WTI settles with physical delivery at expiration, so most traders close or roll before that date.

Starter game plan: Practice on a simulator, begin with “micro” contracts. Set a hard daily loss limit, use stop orders and size small. If you want oil exposure without the futures learning curve, consider an oil ETF and keep researching as you go.

What petroleum products do Americans use most?

According to the U.S. Energy Information Administration, gasoline made up about 43% of U.S. petroleum use in 2022 at about 8.78 million barrels per day.

Distillate fuel oil was about 20% at about 3.96 million barrels per day. Distillate includes diesel and heating oil. Hydrocarbon gas liquids were about 18% at about 3.59 million barrels per day. Jet fuel was about 8% at about 1.56 million barrels per day.