Wondering what’s next for Rezolve AI stock? It is a question more and more investors are asking after a wild few weeks in the markets. Over just the past month, shares rocketed higher by 91.3%, which is a massive run for any company. That surge comes on the heels of a 10.7% pullback in the last seven days and a longer-term slide that saw the stock drop 40.0% over the past three years. After these recent swings, the stock is still up 45.5% year-to-date, but the journey has not been smooth.

Many are linking the recent explosive move to renewed interest in artificial intelligence across the market, with investor optimism driving tech stocks higher. Yet, for Rezolve AI, these price shifts also may reflect a changing perception of risk and future opportunity, particularly as AI companies jockey for position in a fast-evolving sector. Looking further back, the negative one-year return of -19.4% suggests the stock is still clawing its way back from earlier lows and any optimism remains cautious.

So where does this leave Rezolve AI’s valuation? On a traditional scorecard, Rezolve AI comes in at a value score of 0 out of 6, meaning it is not considered undervalued by any of the six major checks currently used by analysts. But those numbers alone do not tell the full story. To really understand where Rezolve AI stands today, we have to unpack the different valuation methods investors use and consider why there might be an even smarter approach to thinking about value in the end.

Rezolve AI scores just 0/6 on our valuation checks. See what other red flags we found in the full valuation breakdown. Approach 1: Rezolve AI Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates a company’s intrinsic value by projecting future cash flows and then discounting those figures back to today’s dollars. This approach aims to determine what Rezolve AI is actually worth, based on its ability to generate cash going forward.

Currently, Rezolve AI has a last twelve months (LTM) Free Cash Flow (FCF) of negative $21.67 million. Analyst forecasts predict that by 2026, annual FCF will reach $5.23 million and continue rising over the next decade. While analysts typically provide estimates for up to five years, projections beyond that rely on extrapolations by financial modeling platforms. The ten-year forecast shows FCF gradually increasing each year, but all figures remain in the low millions of dollars, a modest scale for a company competing in the fast-paced Software sector.

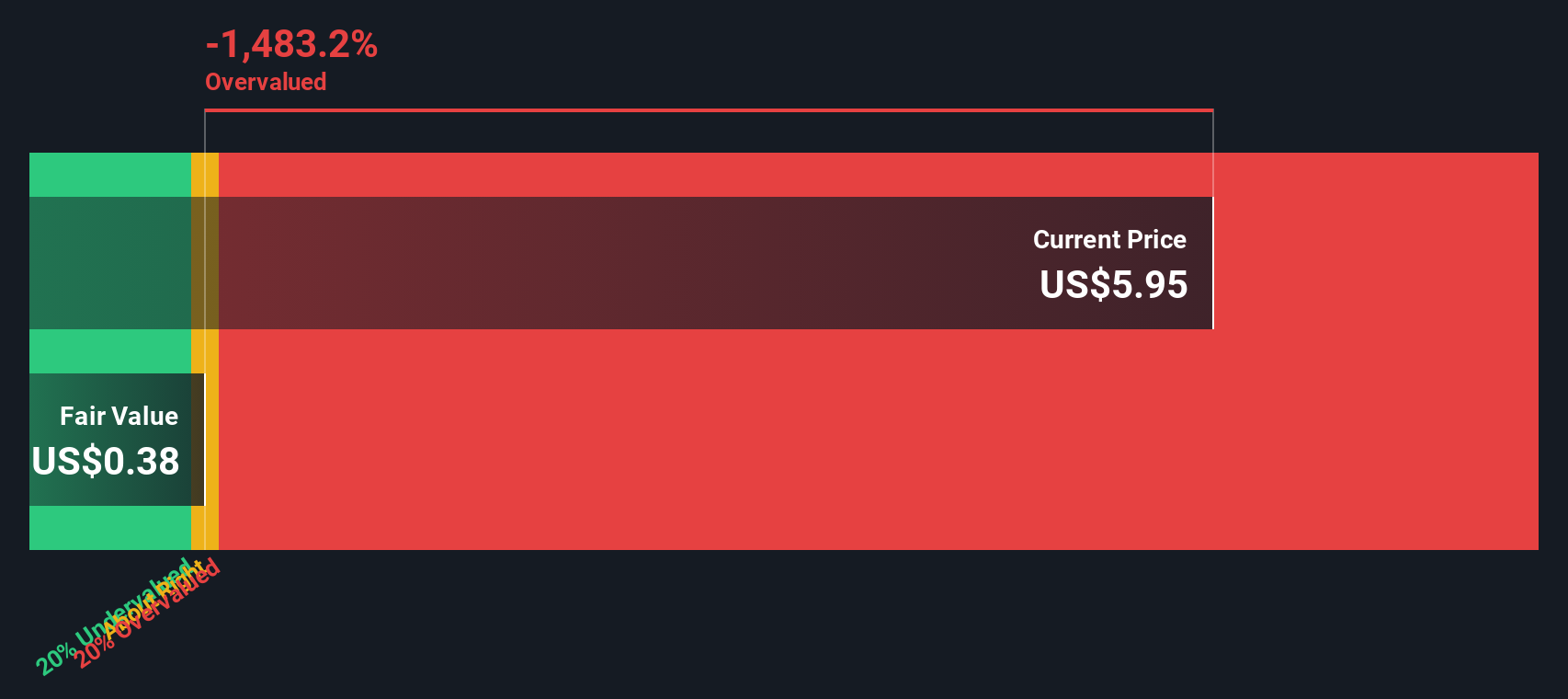

Based on these cash flow projections and the DCF model, Rezolve AI’s estimated fair value per share is $0.38. However, compared to the company’s current share price, this valuation implies that the stock is a massive 1483.2% overvalued.

Result: OVERVALUED

Head to the Valuation section of our Company Report for more details on how we arrive at this Fair Value for Rezolve AI.  RZLV Discounted Cash Flow as at Sep 2025 Our Discounted Cash Flow (DCF) analysis suggests Rezolve AI may be overvalued by 1483.2%. Find undervalued stocks or create your own screener to find better value opportunities.

RZLV Discounted Cash Flow as at Sep 2025 Our Discounted Cash Flow (DCF) analysis suggests Rezolve AI may be overvalued by 1483.2%. Find undervalued stocks or create your own screener to find better value opportunities.

Approach 2: Rezolve AI Price vs Book Value

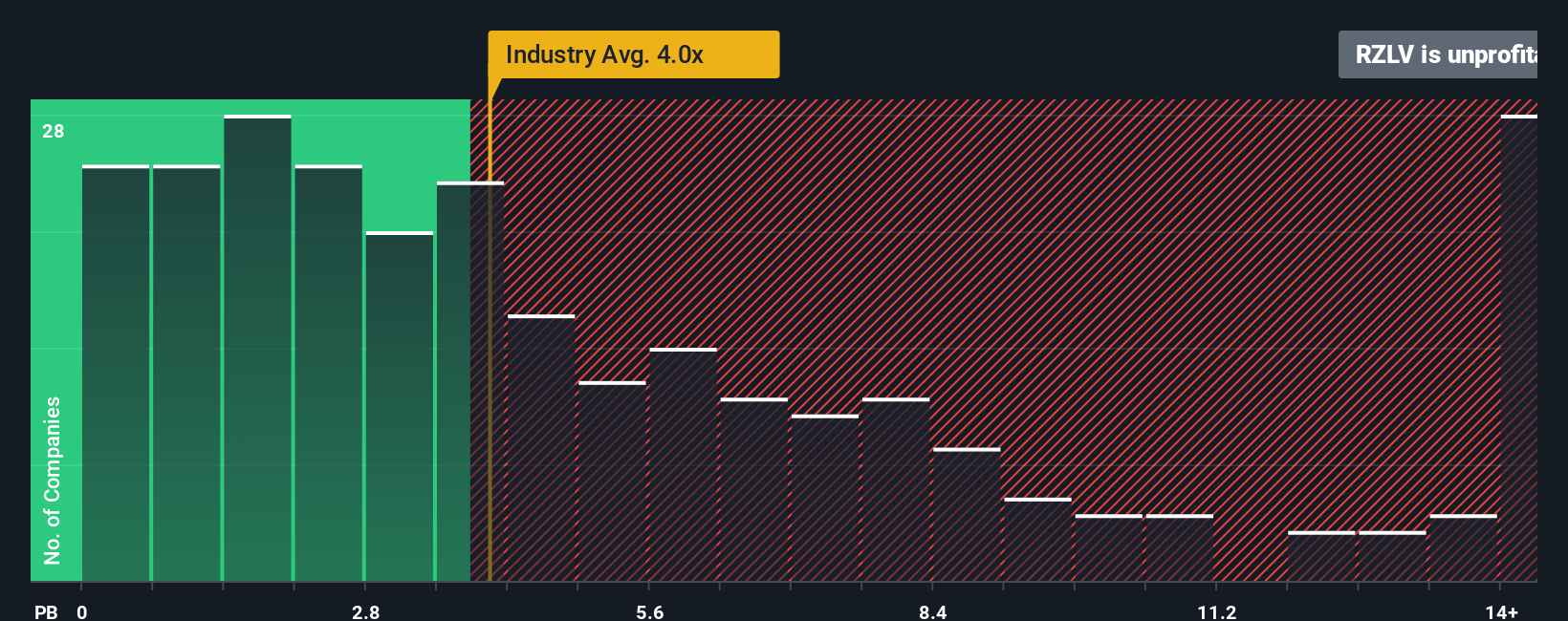

For many companies, particularly those still working toward profitability, the price-to-book (PB) ratio can be a revealing way to gauge value. The PB ratio shows how much investors are willing to pay for each dollar of a company’s net assets. This makes it especially useful for evaluating businesses operating at a loss or with unpredictable earnings, like many AI firms.

While a higher PB multiple might be justified for high-growth or low-risk companies, what is considered “normal” or “fair” often depends on the firm’s growth prospects and perceived risks. Investors commonly compare a company’s PB ratio with the industry average or with peers to see if it is trading at a premium or discount, but that only tells part of the story.

Currently, Rezolve AI trades at a PB ratio of -38.93x, which is dramatically below the Software industry average of 4.01x and also well below the peer group average of 158.44x. Such a negative PB ratio usually signals significant balance sheet concerns, potentially due to negative equity or accumulating losses, and makes these comparisons less meaningful in isolation.

This is where Simply Wall St’s “Fair Ratio” comes in. The Fair Ratio calculates what PB multiple would be expected for Rezolve AI, after factoring in key details like its growth outlook, industry context, profit margins, market capitalization, and business risks. Instead of simply looking at where the stock stands compared to broad averages, this custom benchmark drills deeper and adjusts for what truly matters for this particular company.

Since the company’s actual PB ratio is negative and there is no positive Fair Ratio available for comparison, it highlights ongoing financial distress and means traditional benchmark-based valuation is not reliable here. The valuation based on book value alone suggests the stock remains overvalued, and prospective investors should be especially cautious with companies showing negative equity.

Result: OVERVALUED

NasdaqGM:RZLV PB Ratio as at Sep 2025 PB ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth. Upgrade Your Decision Making: Choose your Rezolve AI Narrative

NasdaqGM:RZLV PB Ratio as at Sep 2025 PB ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth. Upgrade Your Decision Making: Choose your Rezolve AI Narrative

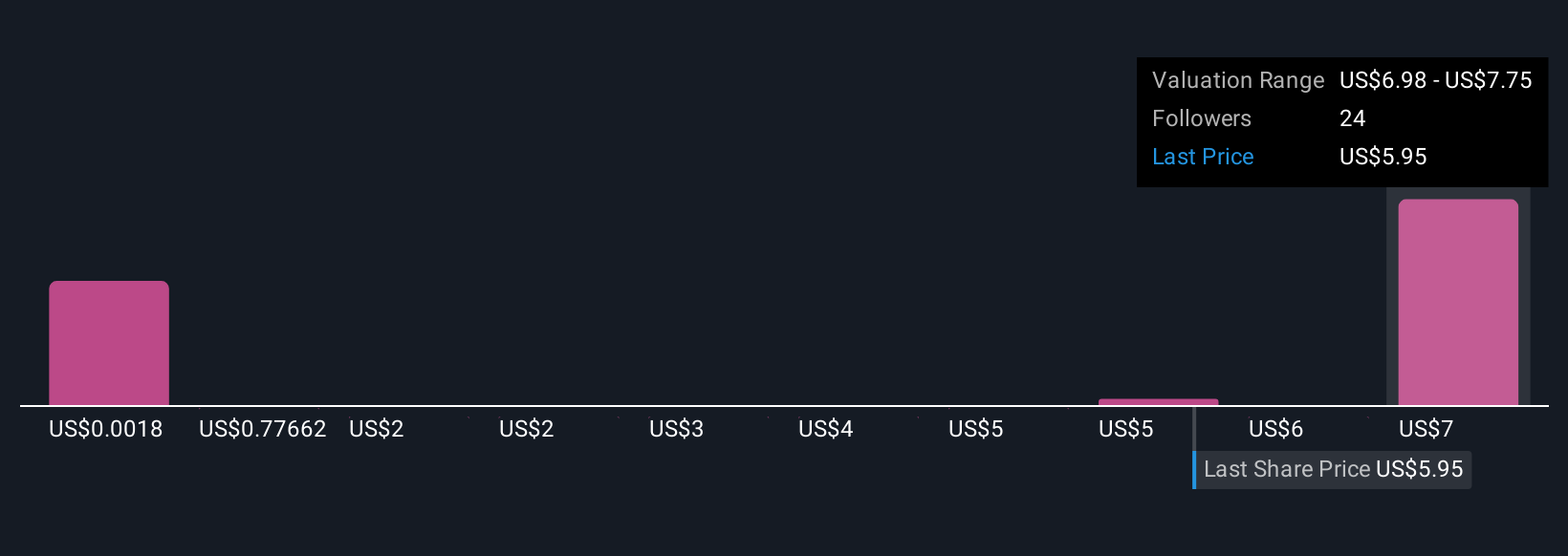

Earlier we mentioned there is an even smarter way to assess value, so let us introduce Narratives, a simple yet powerful approach that connects a company’s story to the numbers behind its future. A Narrative goes beyond formulas, allowing investors to explain their perspective on Rezolve AI and back it up with their own estimates for future revenue, earnings, and margins. This story-driven forecast then leads to a “fair value,” showing how your outlook stacks up against the current share price.

Narratives are available right on the Simply Wall St Community page, making them accessible to millions of investors who want to see how others are viewing the company. What makes Narratives even more dynamic is that they update automatically when new news or earnings emerge, keeping your view relevant in real-time. By comparing your calculated Fair Value with today’s price, you can decide whether you think the stock is a buy, hold, or sell based on the story you believe in most.

For example, one investor might be optimistic about Rezolve AI’s growth and see a fair value well above today’s price, while another, more cautious user could assign a much lower value using the same tools.

Do you think there’s more to the story for Rezolve AI? Create your own Narrative to let the Community know!  NasdaqGM:RZLV Community Fair Values as at Sep 2025

NasdaqGM:RZLV Community Fair Values as at Sep 2025

This article by Simply Wall St is general in nature. We provide commentary based on historical data

and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your

financial situation. We aim to bring you long-term focused analysis driven by fundamental data.

Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Simply Wall St has no position in any stocks mentioned.

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com