AI is about to change healthcare. These 31 stocks are working on everything from early diagnostics to drug discovery. The best part – they are all under $10b in market cap – there’s still time to get in early.

Microchip Technology Investment Narrative Recap

To be a shareholder in Microchip Technology, you need to believe in the company’s ability to capitalize on industrial and automotive digitalization through ongoing innovation in embedded systems and analog products. The recent launch of the MCP9604 integrated thermocouple conditioning IC strengthens Microchip’s industrial lineup, but by itself is not likely to materially impact the most immediate catalyst: the normalization of elevated inventory and improvement in factory utilization that could drive margins and earnings recovery in the short term, a process still expected to take multiple quarters.

Among several product rollouts, the new DualPack 3 (DP3) power modules are particularly relevant, as they address industrial efficiency and cost needs, tying into demand recovery in core end-markets. Both this and the MCP9604 point to a user-focused approach in Microchip’s industrial business, yet near-term investor attention remains squarely on inventory trends and margin improvement milestones.

However, investors should be aware that despite recent launches, stubbornly high inventory and write-offs remain a risk to short-term…

Read the full narrative on Microchip Technology (it’s free!)

Microchip Technology’s outlook forecasts $6.6 billion in revenue and $1.4 billion in earnings by 2028. This calls for 15.9% annual revenue growth and an earnings increase of about $1.58 billion from current earnings of -$178.4 million.

Uncover how Microchip Technology’s forecasts yield a $76.00 fair value, a 18% upside to its current price.

Exploring Other Perspectives MCHP Community Fair Values as at Sep 2025

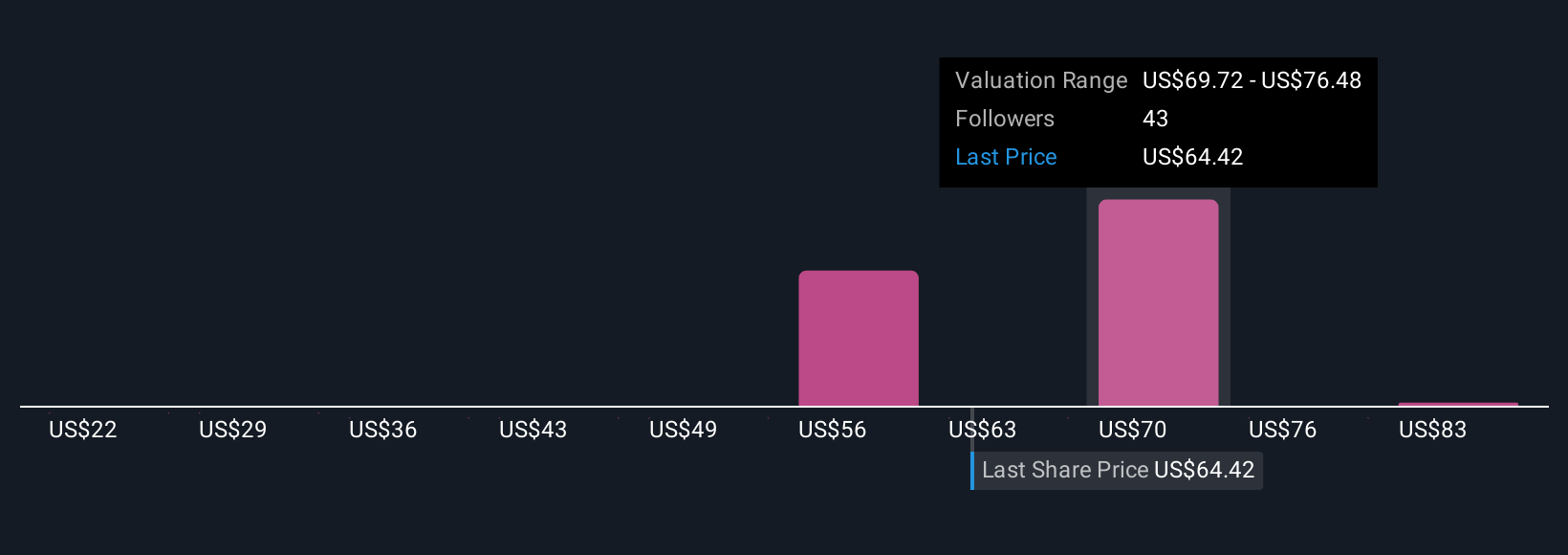

MCHP Community Fair Values as at Sep 2025

Seven members of the Simply Wall St Community submitted fair value estimates for Microchip, ranging from as low as US$22.39 to as high as US$90 per share. While some see strong upside, others are focused on persistent inventory and margin risks that could continue to affect performance, explore these contrasting perspectives to inform your own views.

Explore 7 other fair value estimates on Microchip Technology – why the stock might be worth less than half the current price!

Build Your Own Microchip Technology Narrative

Disagree with existing narratives? Create your own in under 3 minutes – extraordinary investment returns rarely come from following the herd.

Looking For Alternative Opportunities?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

This article by Simply Wall St is general in nature. We provide commentary based on historical data

and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your

financial situation. We aim to bring you long-term focused analysis driven by fundamental data.

Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Simply Wall St has no position in any stocks mentioned.

We’ve created the ultimate portfolio companion for stock investors, and it’s free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com