The European Union is under mounting pressure to reconcile its global ambitions with its expanding regulatory model.

In contrast to Washington, Brussels has been extremely slow to adjust to new economic realities. © Getty Images

In contrast to Washington, Brussels has been extremely slow to adjust to new economic realities. © Getty Images

Europe’s economic identity is caught between openness and control

Regulation expands faster than trade deals are concluded

The continent risks stagnation as partners move ahead with other deals

For comprehensive insights, tune into our AI-powered podcast here

As the global economic landscape fractures into competing blocs and spheres of influence, Europe finds itself at a critical juncture. On one hand, it aspires to remain a global champion of multilateral trade. On the other, it increasingly relies on regulation, both as an expression of internal values and as a tool of geopolitical influence.

This tension between openness and control characterizes Europe’s current economic identity. Openness demands flexibility, speed and the willingness to compete and to compromise to secure trade agreements in a rapidly changing world. Control and regulation, by contrast, stem from successful lobbying efforts by key industries. These policies are often framed in terms of a deep commitment to standards – on data, labor, the environment and now even artificial intelligence – enshrined in complex and expanding bureaucratic structures that tend to stifle economic dynamism.

This dual impulse is not inherently contradictory. In theory, mild and transparent regulation can enhance Europe’s soft power and make it an attractive and dynamic trading partner. In practice, however, the regulatory burden is mounting. Businesses and trade partners alike increasingly fear that the European model is drifting toward stagnation in the name of caution and control.

Europe must now confront an uncomfortable question: Can it remain a credible, competitive actor on the global stage while holding fast to a regulatory model that risks slowing down innovation and growth?

An inward-looking and risk-averse EU

In recent years, the European Union has become increasingly focused on internal consolidation: refining its regulatory frameworks, managing member-state tensions, and advancing strategic goals such as climate neutrality and digital sovereignty. While these ambitions reflect the bloc’s long-term political vision, they have come at a cost, particularly in the realm of trade diplomacy and external economic engagement.

The EU once positioned itself, at least on paper, as a global champion of open markets. It was a key driver of the multilateral trade order through the World Trade Organization and concluded a series of free trade agreements (FTAs) with countries across Latin America, Asia and Africa. Yet today, many of those deals are stalled, diluted or politically contested. The EU-Mercosur agreement – two decades in the making – was recently approved but remains unratified. The proposed trade agreement with India is progressing only slowly. An update to the EU’s trade strategy in 2021 emphasized “open strategic autonomy,” a term that signals caution as much as ambition.

This wary approach is particularly striking when compared with other global powers. The United States has moved away from traditional FTAs but has advanced a series of bilateral and multilateral frameworks (such as the Indo-Pacific Economic Framework) focused on strategic goals. China continues to strike new trade and investment deals, most notably the Regional Comprehensive Economic Partnership (RCEP), even as it expands its Belt and Road Initiative. In contrast, the EU’s deliberative, consensus-based structure often slows down its ability to respond to emerging opportunities.

Part of the problem is internal fragmentation. Trade policy, though nominally an EU-level competence, remains politically sensitive in member states. France, for instance, often resists agricultural concessions in trade deals, while others push for greater access to industrial markets. This creates bottlenecks in negotiation and ratification. Meanwhile, powerful regulatory initiatives, such as the Carbon Border Adjustment Mechanism (CBAM) and the Corporate Sustainability Due Diligence Directive (CSDDD), are viewed by some partners as protectionist tools dressed in moral language.

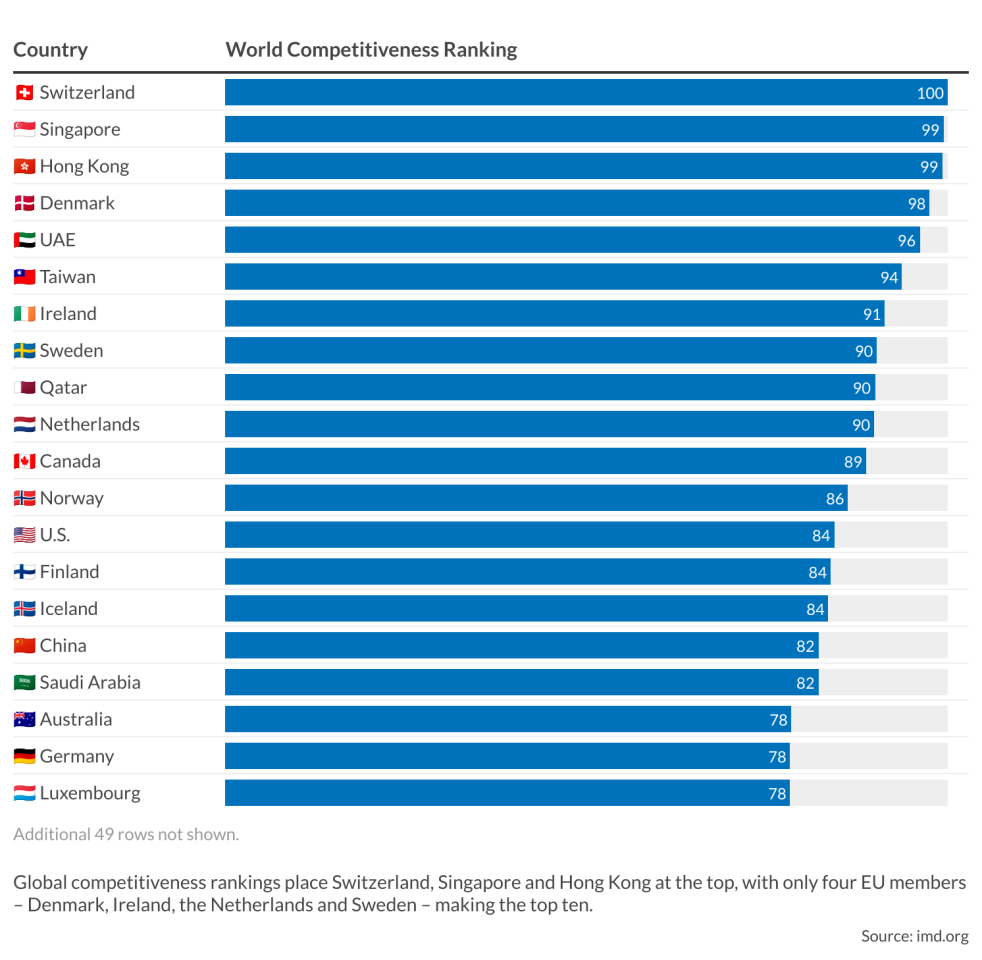

Investors are taking note. Europe’s regulatory complexity and legal uncertainty have become deterrents, especially for high-growth and tech-oriented firms. While the EU excels at creating rules, it has been less successful at creating scalable innovation ecosystems or forming rapid commercial partnerships. Countries such as South Korea, Vietnam and even the post-Brexit United Kingdom are moving more quickly to negotiate and finalize trade frameworks with key partners.

The result is a perception that the EU is becoming more inward-looking and risk-averse, prioritizing internal political consensus and regulatory harmonization over speed, agility and economic competitiveness. As global trade becomes increasingly geopolitical and transactional, this stance could erode Europe’s relevance unless recalibrated.

Regulation fatigue and strategic vulnerabilities

Recent years have seen a surge in legislative initiatives aimed at transforming Europe’s economy and setting global benchmarks. The Green Deal and the Fit-for-55 package impose strict environmental targets. The CBAM seeks to extend climate responsibilities to trade partners. Meanwhile, sweeping digital regulation, through the Digital Services Act, the Digital Markets Act and the AI Act, imposes rules on tech firms operating within the single market. The Corporate Sustainability Reporting Directive (CSRD) and due diligence laws further increase reporting obligations, requiring companies to track and disclose a wide range of environmental, social and governance (ESG) metrics across their supply chains.

Europe risks becoming a standard-setter without scale, admired for its ethics but sidelined in economic terms.

While the goals behind these measures are clear – sustainability, fairness, accountability – the cumulative burden is becoming a liability. Businesses, especially small and medium-sized enterprises, are struggling to meet expanding compliance demands. Startups warn of innovation being stifled before it can scale. Even multinational corporations with strong legal and compliance teams increasingly voice concerns over legal uncertainty, administrative delays and unpredictability.

The signs of regulatory fatigue are no longer subtle. Industry groups across Europe are calling for simplification and restraint. The European Commission has acknowledged the issue, with President Ursula von der Leyen pledging to cut reporting obligations by 25 percent. But these promises – not yet actions − come amid growing unease that Europe is falling behind in key strategic sectors, not because of a lack of vision or resources, but because it moves too slowly to compete with more assertive and flexible global powers.

The contrast with other major economies is striking. The U.S., while sidestepping traditional trade deals, has adopted a proactive industrial strategy centered on investment, speed and reshoring. China continues to deploy state-led initiatives that prioritize execution over consensus. Both powers adapt regulation to strategic needs; Europe, by contrast, continues to apply a uniform rules-based approach, even when geopolitical or industrial priorities would call for greater pragmatism.

More by economic policy expert Karl-Friedrich Israel

This mismatch carries a growing strategic cost. Europe risks becoming a standard-setter without scale, admired for its ethics but sidelined in economic terms. Trade partners may accept EU norms where convenient, but increasingly seek commercial agreements elsewhere, where timelines are shorter and obligations lighter. Investors, particularly in high-growth and technology sectors, may look beyond the EU in search of more favorable environments. And European firms themselves may even relocate production, research or capital formation outside the bloc.

Scenarios

Most likely: Status quo plus – regulation with cautious outreach

Under this most probable scenario, the EU continues along its current trajectory, refining but not fundamentally altering its regulatory approach. Regulatory expansion slows modestly in response to internal pushback, with limited adjustments for high-priority sectors such as AI, energy and defense. Efforts are made to simplify reporting and clarify legal obligations, but the overall framework remains complex.

On the trade front, the EU makes incremental progress. Some pending FTAs are revived, especially where there is limited domestic opposition (for example, with smaller or like-minded economies). But the EU’s focus remains inward-looking: enforcing compliance with existing rules, safeguarding consumer and environmental protections, and maintaining political cohesion across member states. The term “open strategic autonomy” continues to shape the narrative, signaling a preference for selective engagement over ambitious liberalization.

This scenario risks further erosion of Europe’s economic dynamism. Regulatory fatigue will persist. Trade partners will remain cautious. And Europe will struggle to respond quickly in moments of geopolitical disruption. The likelihood of this scenario is 50 percent.

Somewhat likely: European protectionism 2.0 – regulatory overreach and strategic decline

In this scenario, Europe doubles down on its regulatory model, expanding instruments like CBAM and enforcing strict conditions on trade, data flows and supply chains. What begins as normative leadership hardens into inflexible protectionism. Trade deals stall, innovation slows and relations with key partners deteriorate.

Rather than adapting to global realities, the EU insists on exporting its rules, even when doing so undermines strategic interests. Startups and investors redirect their focus to more agile markets. Compliance costs rise and competitiveness erodes. The EU preserves its standards – but at the cost of influence, growth and global relevance. The likelihood of this scenario is 30 percent.

Less likely: Regulatory retreat and strategic trade offensive

In this scenario, mounting pressure from industry, shifting political sentiment and intensified global competition push the EU toward a course correction. A new wave of reform-minded leaders in Brussels and key member states opts to streamline the regulatory state and actively pursue strategic trade deals. Redundant or burdensome rules are frozen, simplified or delayed.

The European Commission revives stalled negotiations with Mercosur and India, fast-tracks deals with Southeast Asian and African nations, and explores fresh trade channels with the U.S. Trade policy becomes an instrument of industrial strategy, geared toward securing energy inputs, rare earths and digital infrastructure access. Regulation is no longer treated as a fixed condition but as a negotiation tool – flexible and selectively applied.

This scenario would mark a major shift in Europe’s economic identity and could reinvigorate its global relevance. However, it remains unlikely in the near term. Political and institutional inertia, strong vested interests in the regulatory complex and public attachment to high standards continue to constrain a sharp pivot toward deregulation and dealmaking.

Contact us today for tailored geopolitical insights and industry-specific advisory services.