If you hold or are eyeing W. P. Carey (WPC), the latest moves probably have you leaning in. After a six-day losing streak, shares have started to edge upward just as the company announced another bump in its quarterly dividend. This dividend raise comes against a backdrop of ongoing challenges, with high mortgage rates and rising construction costs pressuring the sector. Still, W. P. Carey is clearly signaling it wants to remain a draw for income-focused investors as markets digest recent moves.

W. P. Carey’s ability to stage a minor rebound reflects steady investor interest, even as the broader real estate space faces tough questions about growth. The company is up 26% year-to-date and has gained 16% over the past year, easily topping the S&P 500’s returns in the same periods. While the stock showed a brief stretch of weakness this month, its overall momentum through the year has been solid, supported by disciplined performance and a resumed pattern of dividend hikes.

After this year’s climb and the latest dividend boost, is W. P. Carey’s share price offering a real opportunity or is the stock already trading at a fair reflection of its future prospects?

Most Popular Narrative: Fairly Valued

The most widely followed valuation perspective sees W. P. Carey as trading close to its fair value, with analysts estimating the stock is neither meaningfully under- nor overvalued at current levels.

Significant lease structures feature inflation-linked escalators (CPI-based) and higher fixed annual bumps (around 2.8% on recent deals), enabling robust same-store rent growth even in a stable inflation environment. This directly enhances rental revenues and overall earnings.

How can a company with robust recurring revenues and resilience in inflation draw analysts to such a neutral verdict? Want to know the formula? It carefully weighs rising profits, expanding margins and strict growth assumptions. You’ll want to see which future forecasts triggered this surprising verdict and how small differences can move billions in value.

Result: Fair Value of $67.27 (ABOUT RIGHT)

Have a read of the narrative in full and understand what’s behind the forecasts.

However, continued heavy reliance on single-tenant properties or a drop in asset sales could quickly shift the outlook and put pressure on future income stability.

Find out about the key risks to this W. P. Carey narrative. Another View: SWS DCF Model Says Undervalued

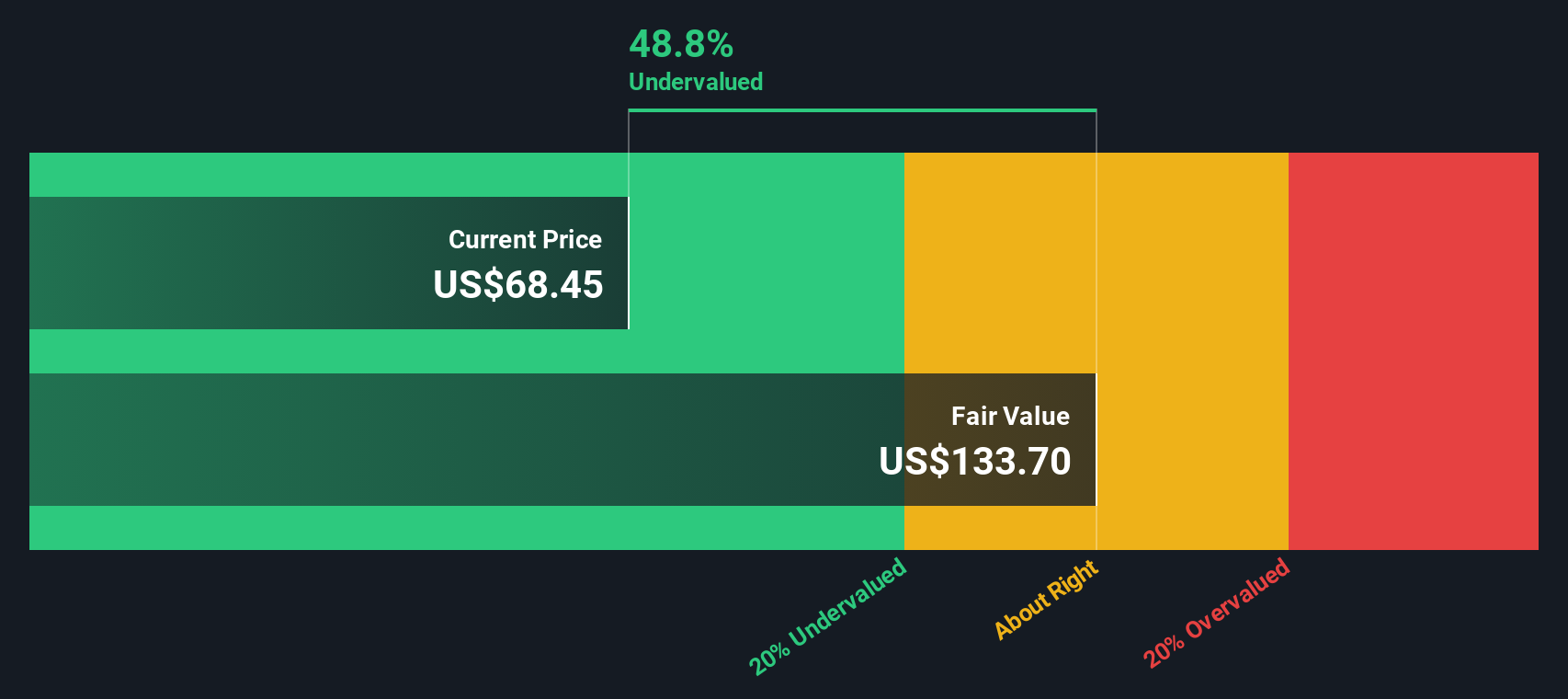

The SWS DCF model comes to a very different conclusion, suggesting that W. P. Carey’s shares are significantly undervalued based on its future expected cash flows. Could fundamentals reveal something that the multiples approach misses?

Look into how the SWS DCF model arrives at its fair value.  WPC Discounted Cash Flow as at Sep 2025 Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out W. P. Carey for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match – so you never miss a potential opportunity.

WPC Discounted Cash Flow as at Sep 2025 Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out W. P. Carey for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match – so you never miss a potential opportunity.

Build Your Own W. P. Carey Narrative

If you see things differently or want to dig deeper into the numbers, shaping your own perspective is quick and easy. Explore the data and Do it your way.

A great starting point for your W. P. Carey research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Don’t let great opportunities pass you by. Use the Simply Wall Street Screener today to spot hidden gems and get ahead of the crowd with fresh investing ideas you won’t want to miss.

This article by Simply Wall St is general in nature. We provide commentary based on historical data

and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your

financial situation. We aim to bring you long-term focused analysis driven by fundamental data.

Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Simply Wall St has no position in any stocks mentioned.

Discover if W. P. Carey might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com