사진 확대

사진 확대 Although the South Korean stock market has “leveled up” to the next level thanks to the government’s massive stimulus measures, small-sized stocks continue to be marginalized. Unlike the U.S. stock market, where small-cap stocks perform well due to a cut in the benchmark interest rate, small-cap stocks are relatively alienated from stock market stimulus measures in Korea and rarely gain strength.

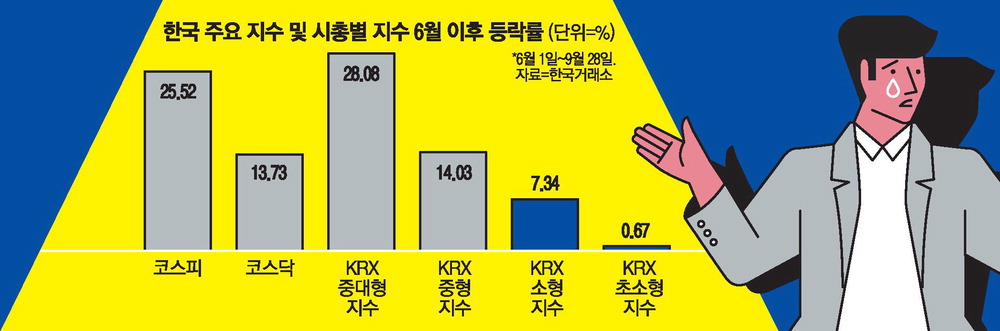

According to the Korea Exchange on the 28th, the KRX’s ultra-small TMI index rose only 0.67% from June when the KOSPI rally began. The rise of ultra-small stocks was not only far below the KOSPI, which rose 25.52 percent during the same period, but also far lower than KOSDAQ (13.73%). TMI is an index calculated for stocks excluding investment ineligible stocks among all stocks in the KOSPI and KOSDAQ markets. Although it has filtered out so-called “miscellaneous stocks,” such as managed stocks, low-flow stocks, and trading suspension stocks, it is alienated from the upward atmosphere of the stock market.

On the contrary, KRX medium- and large-sized TMI rose 28.08% at the time, while medium-sized (14.03%) and small-sized (7.34%) continued to flow well.

Small-cap stocks were also relatively sluggish in the KOSPI market, where the index rose from 2700 to 3,400. Since June, the index of small-cap stocks recorded a low gain of 4.58% while the KOSPI large-cap index rose 28.2% and mid-cap stocks rose 14.53%. Based on the average daily market capitalization, the Korea Exchange divides KOSPI stocks into large stocks (1st to 100th), medium-sized stocks (101st to 300th), and small stocks (301st or less). In fact, while large stocks in the top 100 market capitalization led the KOSPI, small-cap stocks failed to keep up with the index’s flow.

Micro-cap stocks are also neglected in terms of market supply and demand. The KRX medium-sized index, which consists of 426 stocks, traded KRW 200.460.1 trillion for about four months from June, but the KRX ultra-small index has 604 constituent stocks, which is about 40% more, but the transaction amount was around 51.9941 trillion won. The transaction value of large KOSPI stocks (743.1049 trillion won), which has only 100 constituent stocks, also surpassed that of small stocks (76.1186 trillion won) by more than six times.

On the other hand, in the U.S. stock market, the index of small and medium-sized stocks is rather overwhelming large stocks. The Russell 2000 index, which consists of small and medium-sized stocks, rose 17.81% from June to the 28th of this month. During the same period, the S&P 500, which is composed of top-cap stocks, rose 12.38%, compared to the 9.41% increase in the Dow Jones Industrial Average, which is composed of 30 large blue-chip stocks. On the 18th (local time), the day after the U.S. Federal Reserve resumed cutting interest rates, the Russell 2000 index rose 2.51%, the highest in about four years since November 2021.

Low shareholder return capacity and domestic demand-oriented business structure due to deteriorated financial conditions have hampered small-cap companies along with market capitalization.

According to the Financial Supervisory Service, as of the end of July, the delinquency rate for loans to SMEs was 0.82%, up 0.08 percentage points from the end of the previous month (0.74%), and the delinquency rate for small and medium-sized corporations was 0.90%, up 0.11 percentage points from the end of the previous month (0.79%).

Compared to large companies, the financial crisis has worsened and the economic downturn has shaken the fundamentals of small-cap stocks. Small-cap stocks are also out of the way even in the stance of strengthening shareholder returns, which is one of the pillars of stock market stimulus measures. As of the 25th, KRX’s ultra-small TMI had a dividend yield of 0.62%, far below KRX’s medium- and large-sized TMI (1.52%). Jung Yong-taek, a senior researcher at IBK Investment & Securities, said, “Small and medium-sized stocks that are inferior in funds did not have the effect of a ‘value-up theme’ because they could not afford to return shareholders.”

[Reporter Kim Jeongseok]