OLIVIA KABELL, Associate Editor

The short-to-near term outlook for global upstream activity looks to be restrained, considering that as of this writing (late September) oil prices have slipped to the low $60s/bbl, following steady declines over 2025. Global activity is contracted, due in no small part to OPEC’s decision to increase production amid declining oil prices. Global drilling growth will be greatly contracted for 2025, with minimal gains led largely by the Western Europe, Far East/South Asia and Middle East regions. Meanwhile, remaining regions show a decline in activity for 2025, led by the South Pacific, followed by North America, South America and Africa.

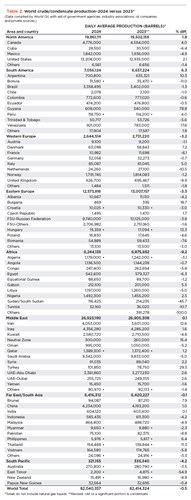

Discovered and recoverable oil resources increased by 5 Bbbl over the course of 2025. Global production over the last year was similarly constrained, with gains led by South America, followed by North America and the Middle East. Meanwhile, the remaining regions showed declines in daily production averages, with Africa showing the greatest declines, followed by the South Pacific, Eastern Europe, Western Europe and Far East/South Asia regions.

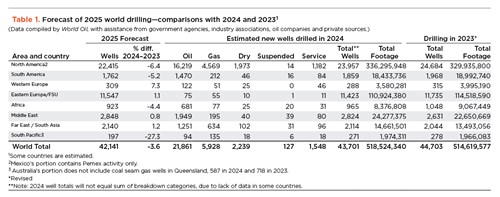

Global Highlights. This year, World Oil forecasts the number the number of wells drilled outside the U.S. to decrease 0.6%, to 25,574, Table 1. This isn’t surprising, considering that four of the seven regions show declines. This is offset slightly by gains in the Far East / South Asia, Middle East and Western Europe regions.

As for global production, crude and condensate output decreased slightly for 2024, Table 2. Production fell 0.5%, averaging 82.04 MMbopd. Of the eight regions World Oil tracks, only three were up for 2024.

NORTH AMERICA

In activity outside the U.S., Canada saw a slight shift towards drilling for gas, prompted by low oil prices and wildfires disrupting output. In Mexico, the Kan discovery appraisal added 500 MMbbl of oil in place to reserves, while state-owned Pemex sought additional debt mitigation strategies. Including U.S. activity, World Oil expects a 6.4% decline in drilling for the region, with 22,415 new wells in 2025.

Fig. 1. Harbour Energy continues to work with Pemex to develop Zama field offshore Mexico. Image: Harbour Energy.

Canada saw a substantial uptick (26%) in gas licenses issued early this year, compared to oil, with low crude prices likely playing a part. Interest seems to be shifting from oil to gas, with ongoing tariffs and OPEC production hikes likely as major drivers. The country’s first major LNG terminal shipped its first 14 MMt cargo in July, further emphasizing the growing gas interest. Wildfires in Alberta shuttered over 1 MMbpd of oil sands production, prompting evacuations in late May. Canada’s new PM, Mark Carney, has indicated greater support for Canada’s domestic oil and gas industry, and a development decision for Equinor’s Bay du Nord project is due this December. All told, World Oil expects drilling to dip 2.6% for 2025.

Mexico. The Kan discovery in the Salina del Istmo basin holds an estimated 500 MMbbl in place, following an appraisal in June, making it the biggest discovery offshore Mexico since the Zama field. Two contracts were awarded for drilling and deepwater services for the Trion deepwater oil and gas development, with eight wells planned so far. And Harbour Energy is the largest partner of Pemex in the Zama project offshore Mexico, Fig. 1. At Zama, FEED on the approved development concept was completed early 2025. The Zama partners are now in discussions with Pemex to optimize the development concepts and accelerate first oil.

Meanwhile, state-owned Pemex posted its first profit in over a year after a debt offering in July, with a $10 billion bond buyback also on the table, backed by government funds. All told, World Oil expects drilling to increase 10.3% in 2025.

Fig. 2. ExxonMobil’s development work remains the core of Guyana’s activity, as symbolized by this FPSO at Liza field. Image: SBM.

SOUTH AMERICA

Guyana continues to be the standout in the region as it approaches the 1 MMbpd production mark, as new projects come online. Much of the region’s activity remains focused on the offshore, with the exception of Argentina’s Vaca Muerta shale. While Argentina and Brazil forge ahead with increasing production, Colombia and Venezuela continue to contend with governmental policy. World Oil expects drilling activity to fall 5.2% in the region for 2025.

Guyana and Suriname. Guyana remains a hotspot for oil production and development, with the Stabroek Block as a center for activity in first-half 2025, Fig. 2. The Chevron-Hess merger—with Hess’ 30% stake in the block—was completed in June. The Yellowtail project began production in Q3, bringing total Exxon FPSO production capacity to 900,000 bopd, with aims for 1.7 MMbopd by 2030. Meanwhile, the country’s presidential elections in early September saw some Venezuelan interference but remain in progress. President Irfaan Ali seems unlikely to adjust current production terms, but other candidates have proposed agreement terms more favorable to Guyana.

Despite Hess’s exit earlier in 2025, Suriname continues to see some development by other majors in blocks 66 and 58, with production startup for Block 58 expected in 2028. World Oil expects no meaningful change in drilling in 2025.

Brazil. The offshore continues to be a focus for Brazil, with activity centered on new prospects and exploration. A total of 173 blocks in five basins, including the Potiguar, Pelotas and Foz do Amazonas basins, went on auction in June. Exploration in Foz do Amazonas basin stalled in 2023, while Pelotas basin has a promisingly similar geologic profile to Namibia.

FID was reached for both the Golfinho Boost project—aiming to increase recoverable resources by 12 MMbbl for the mature Golfinho field—and the Gato do Mato project, which anticipates first oil in 2029. Both projects are in the Santos basin, where another major deepwater discovery was made in the third quarter of this year. World Oil anticipates drilling to increase 29.8% in 2025.

Argentina. Despite record production in the Vaca Muerta shale during fourth-quarter 2024, state-run YPF expects drilling to slow amid rising operational costs. Over $2 billion in stakes changed hands in first-half 2025, with several more sales under consideration. Meanwhile, a major-backed pipeline proposes 300,000 bopd of additional capacity, which could aid government ambitions for 1 MMbpd of crude production within the next few years. World Oil expects drilling activity to decline 10.3% for 2025.

Venezuela. The country’s ongoing struggle to produce amid U.S. sanctions continues, with U.S. major Chevron cleared to continue production in a limited capacity in July, after earlier U.S. licenses expired. Meanwhile, Chinese private and state investment is increasing, with two 20-year development agreements underway, involving over $1 billion in investment, 500 wells to be developed and a production goal of 60,000 bpd of crude by end-2026. All in all, World Oil expects drilling activity to rise 56.3% for 2025, but we are still only talking numbers in the double digits.

Colombia. Gas demand continues to outpace production, with gas supplies expected to fall by 10% to 20% in 2026. Multiple developments are underway, but first gas isn’t expected until 2029 at the earliest. Meanwhile, government opposition to new exploration, guerilla sabotage on energy infrastructure and a major exit from three offshore blocks has put increasing pressure on state-owned Ecopetrol SA to meet gas demand with maturing assets. World Oil anticipates a 25.6% decline in drilling for 2025.

WESTERN EUROPE

Norway continues to set a rapid pace for development and exploration, with up to 167 MMboe added to potential reserves in discoveries this year. Meanwhile, activity continues to expand in the Johan Castberg, Yggdrasil, Fram Sør, and Johan Sverdrup areas. The country also saw record output in July this year, reaching nearly 2 MMbpd.

Meanwhile, the U.K. industry continues to see legislative and financial friction for new projects, like the Buchan Horst development. Activity appears to be largely focused on expanding CCS projects and maintaining existing brownfields. World Oil anticipates activity to increase 7.3% for the region, with 309 new wells in 2025.

Norway continued to add more discoveries in 2025, boosting reserves by up to 167 MMboe. Meanwhile, oil production for the country saw record numbers in July, reaching 1.96 MMbpd in output—a ten-year high for the country. Meanwhile, the Johan Castberg offshore development started oil production early this year, reaching 220,000-bpd peak production in mid-2025. The Fram Sør field, discovered in 2019, holds an estimated 116 MMboe in recoverable volumes and is slated to start production in 2029, with $2 billion in investment announced in June this year. Another $1.3 billion was greenlit for the Johan Sverdrup Phase 3 project, which will increase recoverable resources by 40-50 MMboe in late-2027. World Oil anticipates drilling to rise 15.3% for 2025.

United Kingdom. Activity remains centered on maintenance and CCS initiatives. Multiple contracts were awarded in first-half 2025, related largely to CO2 injection, well maintenance, and CCS services. A merger between Repsol Resources UK and Neo Energy completed in July 2025, creating the largest single operator on the continental shelf. Last year’s contested windfall tax is slated to not expire until 2030, cooling major interest in new developments in the North Sea. The Buchan Horst development project was put on hold in March this year, following additional emissions guidelines established in late 2024. Prior to this, the project was expected to start production in 2026. All told, World Oil expects drilling to rise 6.8% in 2025.

EASTERN EUROPE/FSU

With OPEC hikes to supply and declining oil prices, Russia saw little change in activity. Fellow OPEC member Kazakhstan continues to expand production at its Tengz field despite quotas, while Azerbaijan’s focus remains on gas production and development. World Oil anticipates a 1.1% uptick in drilling for the region, with 11,547 new wells for 2025.

Russia. In contrast to earlier this year, when OPEC was enforcing strict cuts, now Russia has to contend with the coalition’s major supply hikes amid declining oil prices. Prospective peace talks between Russian and Ukraine in August kept prices low on the thought of Russian oil possibly returning to broader markets. India remains the largest buyer of Russian crude with the current discount, and it looks to remain so, despite increased U.S. sanctions. World Oil anticipates drilling to grow 1% in 2025.

Kazakhstan & Azerbaijan. Gas development continues for Azerbaijan, with one gas exploration deal signed with Israel early this year, after delays since 2023. An MOU was also signed for a Shamakhi-Gobustan joint venture exploration project in the second quarter. A new $2.9 billion Shah Deniz Compression project phase will add gross 50 Bcmg and 25 MMbbl of condensate, with first gas expected in 2029.

In Kazakhstan, Tengiz field saw completion for the Future Growth Project, reaching first oil. Total field capacity is expected to be 40 MMtpa, once all facilities are online. Activity also continues at the North Caspian project offshore, which includes five fields: Kashagan, Kalamkas-Sea, Kairan, Aktoty, and Kashagan South-West, Fig. 4. Meanwhile, the country must contend with lowering oil prices, as OPEC+ seeks to correct production consistently over quotas. World Oil anticipates drilling to creep 0.4% higher for 2025 in the FSU outside of Russia.

AFRICA

Despite earlier doubts, the Orange basin’s potential remains a driving force for increased activity around the region, with many majors shifting their focus to offshore development. Angola and Libya have launched new bidding rounds, with the latter being the first in over a decade. Nigeria, one of the region’s highest oil producers, looks to expand gas development. World Oil expects drilling across the region to fall 4.4% in 2025.

Angola continues to see a resurgence in activity following its departure from OPEC+ and successes in offshore Namibia. Operations are ramping up, with two major JVs underway and one major discovery so far, adding an estimated 1 Tcfg and 100 MMbbl of condensate to reserves. More favorable operating terms have also drawn departed majors back to the country. Production dipped below 1 MMbpd in July—the first time since March 2023. Consequently, a new bidding round for five blocks is planned for end-2025. All told, World Oil anticipates drilling to decrease 39.7% in 2025.

Egypt continues to ramp up gas activity, and the country has signed over $121 million in exploration deals, with 25 new wells to be drilled. FID for a new project in the Mina West offshore gas field was also reached in Q3, and several contracts for subsea tiebacks were announced this year, expanding on existing gas production. Domestic gas production rose 200 MMcfgd in Q3 and brought needed relief, but a continued shortage prompted the country to sign a $35 billion deal doubling Israeli gas imports, starting in 2026. Oil production was down about 6%, at 542,600 bpd, Fig. 5. World Oil expects drilling activity to dip 2.7% in 2025.

Libya reached the milestone of 1 MMbpd production midway through 2024 and is now aiming to raise that to 2 MMbpd before 2030. Earlier this year, the country launched its first exploration bidding round since 2007, offering 22 onshore and offshore blocks and attracting over 30 oil majors. Redevelopment of the Sirte basin’s production and developing the NC-7 Block are also on the table, with a potential 53 Tcf of gas resources yet to be explored. World Oil anticipates drilling to decline 2.7% for 2025.

Namibia. Despite earlier doubts on Namibia’s Orange Basin, development is forging ahead, with multiple majors undertaking drilling campaigns. Activity looks to be centered in blocks 2914 and 11B/12B, where several discoveries have added over 600 MMboe in estimated reserves. Majors are seeking FID by end-2026 for the Venus and Capricornus discoveries, which could mean first production by 2029, at the earliest. Meanwhile, the country is considering further licensing rounds, and appraisal work for the Kudu license is slated for late-2025.

Nigeria continues to pursue its “Decade of Gas” initiative, which has drawn some majors back. The country has an estimated 15 Tcf in untapped gas, and gas development from the Ubeta and Greater Tortue Ahmevim projects is underway. Oil activity is also continuing. Two offshore exploration permits were issued in Q3, with Nigeria exploring other non-domestic assets. All told, World Oil anticipates drilling to decrease 6.4% in 2025.

South Africa. Similar to Namibia, the focus remains largely offshore, in the country’s portion of the Orange basin. South Africa also launched its NOC in May this year, aiming to increase activity. However, after several majors’ exit last year, remaining majors have faced some environmentalist friction, delaying development. Up to 12 wells are planned across the Orange basin and the South African coast.

MIDDLE EAST

Bouts of conflict in the region saw suspended operations in Iran, Israel, and neighboring countries like Egypt. Of note are the increased OPEC+ quotas prompted by Saudi Arabia, despite downward-trending oil prices, following the nation’s over-quota production. Activity was a mix of onshore and offshore, with increased focus on natural gas throughout the region, as demand for the fuel continues to rise. World Oil expects drilling to rise 0.8% for the region, with 2,848 new wells for 2025.

Fig. 6. Although Saudi Arabia has slowed development, drilling is still underway at a steady pace. Image: Saudi Aramco.

Saudi Arabia. The leader of OPEC+ has pushed for greater production quotas in 2025, and in a rare move, it overproduced by 400,000 bpd in June this year. This looks to continue, as OPEC+ agreed to increased production caps in August this year. The country also signed $90 billion in MoUs with major U.S. companies earlier this year, in addition to an agreement with Woodside on the Louisiana LNG project. State-owned Aramco has also awarded a $750 million-plus pipeline contract, to begin in 2027. Drilling has slowed but is still at a significant pace, Fig. 6. World Oil anticipates drilling to fall 8.2% for 2025.

Iraq continues to pursue revival of existing mature assets, like Kirkuk field, which saw a finalized first phase contract earlier this year to target up to 20 Bboe. Ratawi field is also seeing redevelopment, with production slated to reach 120,000 bpd by early 2026 and 210,000 bpd by 2028, with 160 MMcfd of associated gas. The field is part of Iraq’s multi-billion-dollar Gas Growth Integrated Project. Meanwhile, over 200,000 bpd in production was suspended in Kurdistan following attacks in July. World Oil expects drilling to grow 0.4% in 2025.

Iran. The country continues to ramp up production, with the Azadegan field expected to reach 550,000 bpd within the next eight years. However, an Israeli strike to the South Pars field suspended 12 MMcmd in gas production. The U.S. has also blocked both a gas deal and electricity waiver with Iraq, prompting Iran to seek out possible FSRU solutions for fuel shortages.

UAE. The UAE continues to invest in greater oil and gas production, with $20 billion of CAPEX committed to various projects so far, including $5 billion for the Rich Gas Development project. The Ruwais LNG project is an area of focus, bringing total LNG production to 15 MMtpa beginning in 2028 and reinforcing UAE plans for gas self-sufficiency. The project saw another LNG supply deal with India this year, with 8 MMtpa of 9.6 MMtpa total supply contracted so far. Meanwhile, ADNOC Drilling awarded an $800 million contract, adding to over $2.3 billion in contracts already underway in that sector. ADNOC also sought out a Santos buyout earlier this year, with aims to expand LNG assets, but the prospective deal fell through in September. World Oil anticipates a 10.8% increase in drilling for 2025.

Oman put three oil and gas blocks back on offer for exploration early this year. The Marsa LNG project broke ground in 1H 2025, with start-up slated for Q1 2028. Meanwhile, the country looks to raise more funds for new projects with a potential natural gas assets stake sale worth $8 billion. The country looks to leverage earlier discoveries to raise production by 50–100,000 bpd over the next two or three years, and an exploration contract with Turkish company TPAO could yield further discoveries. World Oil anticipates a 0.9% rise in drilling in 2025.

Israel. Several assets and projects resumed this year, following bouts of conflict. The MJ-01 well, suspended since the start of the Hamas-Israel war in 2023, resumed completion and testing activity this year. Leviathan field was also shut and reopened in June, during an exchange with Iran. Activity remains focused on gas, with expansion projects for Leviathan slated for 2026 and onwards. Existing natural gas deals with Egypt were expanded, with delivery of 130 Bcmg planned from 2026–2040. A gas exploration deal with Azjerbaijan, originally reached in 2023, has signed new agreements for one offshore block.

FAR EAST/SOUTH ASIA

Activity in the region outside of China remains largely in the offshore, with some limited onshore shale activity. China leads oil activity in the region, while India aims to follow suit through exploration investments. Meanwhile, Indonesia and Malaysia continue to focus on growing gas production, and the two countries hope to explore contested areas through mutual agreements. World Oil forecasts drilling activity to grow 1.2% for the region, with 2,140 new wells outside of China for 2025. Chinese figures are unavailable at the moment.

China. Historically responsible for most of the region’s drilling activity, the country reported several new discoveries both onshore and offshore, with 220 MMt of proven shale oil reserves and a prospective 100 MMt of oil in place in a deepwater play, similar to previous discoveries. Despite PetroChina reporting record profits in 2024, fellow major CNOOC saw profits dip, with downward-trending oil prices in Q2 2025. Ongoing U.S. tariffs have prompted reduced U.S. LNG imports, and the U.S. floated oil sanctions in July. Meanwhile, the country is pursuing several African interests in Angola, Tanzania and Mozambique.

Fig. 7. Chinese oil production squeezed out a 1.0% gain during 2024, to 4.234 MMbpd. Image: PetroChina.

India. Currently the largest importer of Russian oil, India looks to continue, despite heavy U.S. tariffs, with 1.7 MMbpd as of mid-2025. The country is also solidifying its LNG supply, with a total 2.7 MMtpa planned across three ADNOC gas deals, with the first to start in 2026. Meanwhile, the country has launched several partnerships and projects to increase exploration and production activity, targeting a potential 20 MMboe so far. World Oil expects drilling to dip 0.3% in 2025.

Malaysia continues to pursue gas, with a $1 billion loan for an LNG facility on the table. State-run Petronas is considering selling $8 billion in Canadian and Brazilian assets, with a 10% cut to its workforce announced in response to declining oil prices. A gas deal between Petronas and nearby Borneo is still in discussion after earlier disputes. Malaysia also looks for a long-term agreement with Indonesia over the Sulawesi Sea area, contested since 2005. All told, World Oil anticipates a 31.4% decrease in drilling.

Indonesia’s focus remains firmly in gas, with first production achieved from Merakes East field, Kutei basin, in Q2 this year. Up to 2 Bcfgd and 90,000 bpd of condensate production are expected, once the North Hub and Gendalo-Gandang fields start production. An exploration PSC for the Gaea and Gaea II blocks was signed in August, adding a potential 100 Tcfg in estimated reserves, while a 7-year maintenance contract was awarded for the Tangguh LNG facility. World Oil anticipates a 1.2% uptick in drilling.

SOUTH PACIFIC

Activity in the region remains largely dominated by Australia, with an ongoing drilling campaign in the Beetaloo basin and first gas reached within Barossa field. Papua New Guinea, meanwhile, is steadily moving toward FID for its long-awaited PNG LNG project, with gas development to follow shortly after. For the region, World Oil anticipates a 27.3% decline in drilling for 2025.

Australia remains the most active country in the region, with a drilling campaign in the Beetaloo basin kicking off this year. Three wells are planned, with a five-well Shenandoah South pilot program also underway. The North West Shelf Project Extension saw final environmental approval, bolstering the major LNG operation. Meanwhile, the Santos LNG project achieved first gas via its FPSO unit, the BW Opal, stationed at Barossa field. World Oil expects drilling to decrease 27.3% in 2025.

Papua New Guinea. Activity in Papua New Guinea remains slow but steady, with progress on the PNG LNG project facing environmental objections. These, added to too-high initial quotes, stifled its ability to obtain financial backing from lenders earlier this year. However, FID for the project is expected for early 2026, with gas development to follow soon after, if approved. A partnership between Petronas and TotalEnergies also plans to drill a frontier exploration well in late-2025, targeting the Mailu prospect. World Oil anticipates a 57.1% drop in drilling activity for 2025.

Related Articles

FROM THE ARCHIVE