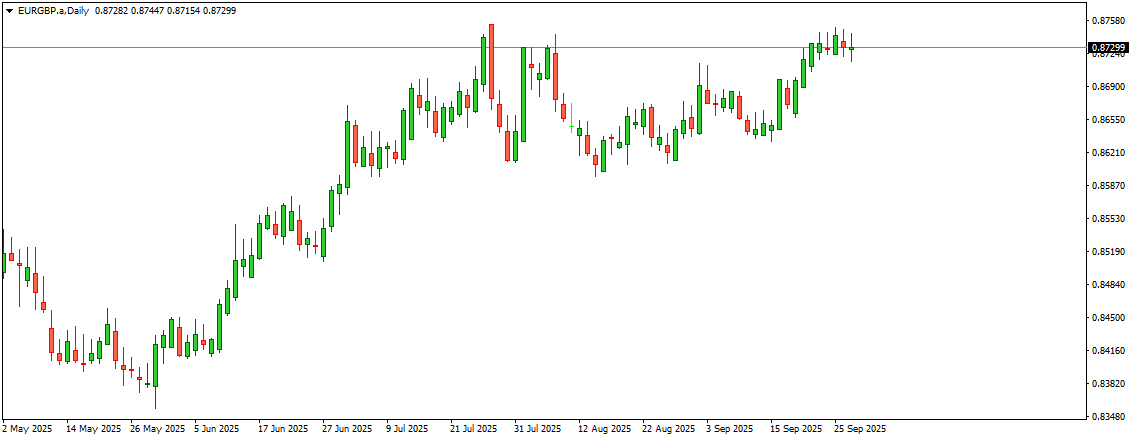

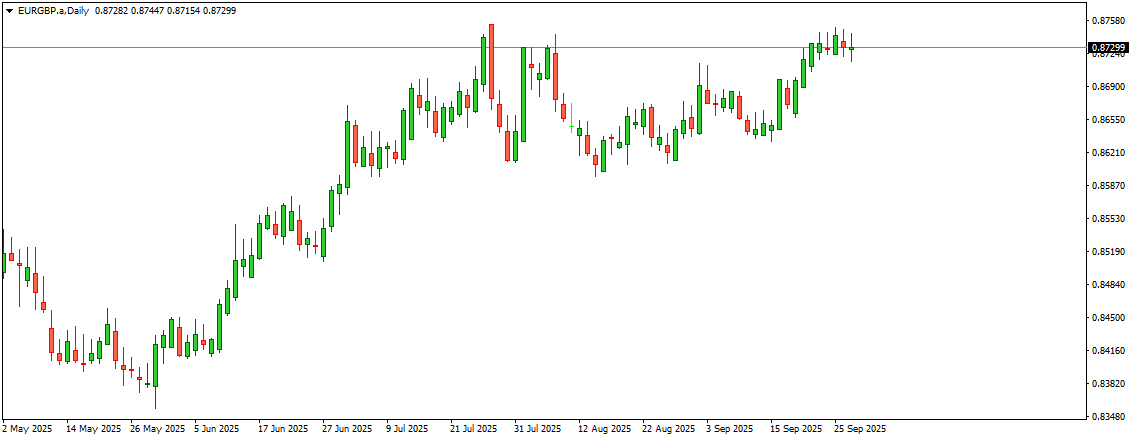

The EUR/GBP cross edged lower toward 0.8720 during the early European session on Monday, with the Pound Sterling (GBP) gaining modest support from expectations that the Bank of England (BoE) will maintain its current policy stance. Investors largely believe that the UK central bank will hold rates at 4.0% for the remainder of the year, adopting a “gradual and careful” approach toward monetary easing as inflationary pressures prove more persistent than anticipated.

Adding to the cautious outlook, BoE Monetary Policy Committee (MPC) member Megan Greene recently highlighted the risks of upside inflation, signaling that premature rate cuts could destabilize the path back to the 2% inflation target. This hawkish undertone has helped the Pound resist broader volatility, even as markets await fresh economic data for further direction.

On Tuesday, investors will closely monitor Germany’s Retail Sales figures for August and the UK’s second-quarter Gross Domestic Product (GDP) release. UK GDP is forecast to grow 0.3% quarter-on-quarter, unchanged from the prior reading, while annual growth is expected at 1.2%. Any downside surprise in the data could weigh on the Pound, offering some relief to the Euro. Conversely, resilient figures would reinforce the BoE’s cautious stance and provide Sterling with additional tailwinds.

Meanwhile, geopolitical risks continue to weigh heavily on the Euro. Over the weekend, CNN reported that Russia launched more than 600 drones and missiles against targets across Ukraine, marking one of the most intense strikes since the conflict began. Ukrainian President Volodymyr Zelensky confirmed casualties in Kyiv, including a 12-year-old girl. The escalation highlights growing instability in the region and underscores the risk of higher energy prices across Europe. Such uncertainty tends to pressure the Euro, especially as the Eurozone economy remains fragile.

Trade Idea: Consider short positions in EUR/GBP near 0.8720, targeting 0.8680, with stops above 0.8755, as BoE hawkishness and Eurozone geopolitical risks favor GBP strength.