For most of the last decade, OPEC and Russia, collectively referred to as OPEC+, have aligned their interests in maintaining high oil prices and set production quotas that furthered this goal. Saudi Arabia, OPEC’s largest member, has, as part of its Vision 2030 Initiative, a multi-trillion-dollar goal of diversifying its economy away from dependence on hydrocarbons and uses oil revenues to fund this initiative. Russia relies upon oil revenues for about a third of its general revenue, and to fund the war in Ukraine.

Both countries in the past have sought a Brent price in the $80’s to balance their books. And both have had to pinch back spending as the restoration of supply cuts in pursuit of reclaiming market share from U.S shale producers, and pressure from the Trump administration, have led to increasing global inventories. Rapid production increases since April of 2025 have taken the price of Brent from around $80 to the mid-$60’s, with some pundits forecasting a decline into the $50’s as the new year starts.

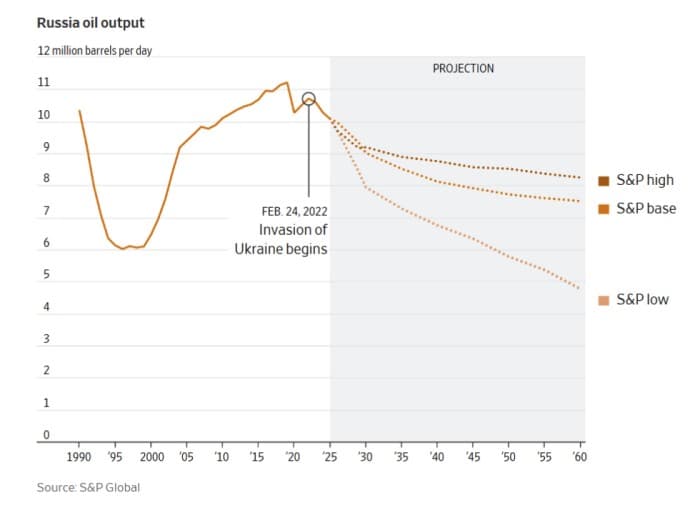

What the market has not priced into its assumptions for crude is the fragility of Russian production thanks to global sanctions since the invasion of Ukraine. A recent article, carried in the Wall Street Journal, discussed the impact of sanctions and the aging out of the country’s legacy production hubs in Western Siberia and the Volga-Urals region.

The article noted that these fields, even before the war in Ukraine, were starting to run low, forcing oil companies to look farther afield to maintain production, potentially tapping their huge shale reserves using Western technology. Post-war sanctions prevented this outcome and have exacerbated the decline. Matthew Sagers, Russia expert at S&P Global Commodity Insight,s noted for the article-

“Getting oil out of the ground is harder and more expensive, but the deteriorating resource base means you have to run faster every year just to stay in place,” he said. “It’s essentially a long, slow goodbye for Russian oil.”

U.S. and EU sanctions have denied the Russians the equipment and technology that would have been needed to carry out this feat. The U.S. shale production growth has supplied most of the world’s incremental oil production growth over the last decade and a half. Since 2010 shale reservoirs have added about 8 million BOPD to global supplies. U.S. Field Production of Crude Oil has ramped from about 5.4 mm BOPD to 13.5 mm today. What isn’t fully appreciated by the average person is that this success was the result of U.S. producers figuring out how to profitably produce these reservoirs at oil prices well below the $90-$100.00 per barrel that prevailed in the early days. I discussed the evolving production dynamics in American shale plays in a previous OilPrice article.

For Russia to replicate the U.S. miracle, it would need access to Western technology that sanctions have denied it. Shale production, as it exists in its highly developed state relies on a number of discrete technologies, trained field crews, and equipment assets that have been developed by U.S. operators.

AI software is now fundamental in reservoir imaging that reliably charts the path of the three and four-mile-long horizontal wells that the industry uses to maximize production per well. It is also used to design the intensive fracture stimulation of these wells that enables the oil to flow toward the wellbore. The WSJ article pointed out the effect sanctions have had on Russia’s ability to develop its shale reservoirs.

“It doesn’t have the latest software to analyze data from rocks and wells to figure out where and how much oil there is and how to get it out of the ground. Even if Russian oil companies possess such computer programs, since 2022, many have been barred from updates, rendering them unusable in many cases, analysts say. “

Trained field crews are also an essential element that is missing in Russia. The war effort in Ukraine has diverted millions of mostly men from availability to work in the oil fields. The Institute for the Study of War noted in an article earlier this year that the country is failing to replace its monthly losses of 45- 50,000 per month, through recruitment. With the war effort draining the young and healthy men who might otherwise seek well-paid oilfield employment, it’s hard to imagine Russia being able to staff an expansion into shale production.

High-pressure pumping equipment is required to fracture the rock thousands of feet below and several miles away from the well head. These pumps, often with horsepower ratings above 2,000 Hydraulic Horse Power (HHP), are deployed into the field in groups of 10-20 per job in what is colloquially known as a “spread.” Estimates for the cost of a spread vary but can run to $60 million dollars in the case of Liberty Energy’s (NYSE:LBRT) digiPrime efrac fleets that are powered with gas turbines, as noted in a Reuters article. Cash strapped Russia simply does not have the money for an expensive capital equipment build-out.

Modern directional drilling tools and Super Spec “Walking” rigs are also missing from the picture in Russia. When you are drilling a shale interval that may be comparatively thin, dozens of meters in thickness in some cases, you need the advanced telemetry and geopositioning that Measurement While Drilling-MWD, and Logging While Drilling-LWD drilling assemblies provide. The WSJ article noted the lack of as many as 200 unique items that include these essential MWD, LWD tools, quoting Aleksandr Dyukov, chief executive of oil producer Gazprom Neft-

“Russian operators are also missing certain sensors built into the drill that transmit real-time information about rock layers, fluids and the drill’s position.”

Super Spec, “Smart Rigs” of the type developed by Nabors Corporation, (NYSE:NBR), and others bring an enhanced capability to the field. Most notable is their ability to “walk” to the next slot on a drill pad. This is a feature that can save a up to a day of down-rigging for a move. These rigs also have enhanced hook-load capacities, surface solids control, and high-pressure mud pumps that enable the long lateral sections now preferred by the industry.

In summary, sanctions on the Russian economy make it unlikely the country will be able to halt the decline in the output from its legacy conventional reservoirs or enable it to exploit its shale reserves. The decline has already set in, as the SP Global graphic from the WSJ article illustrates. Under the worst-case scenario, Russian production could drop over 20% by 2030 to about 8 mm BOPD.

This will be occurring at a time when global demand will be increasing. Estimates vary from one just published by BP, showing 2030 demand at 103.4 mm BOPD, to the one published by OPEC in their World Oil Outlook-WOO, that suggests demand will be much higher. Perhaps as high as 113 mm BOPD. In either scenario the fall-off of Russian supply could put a crimp on global energy needs.

By David Messler for Oilprice.com

More Top Reads From Oilprice.com