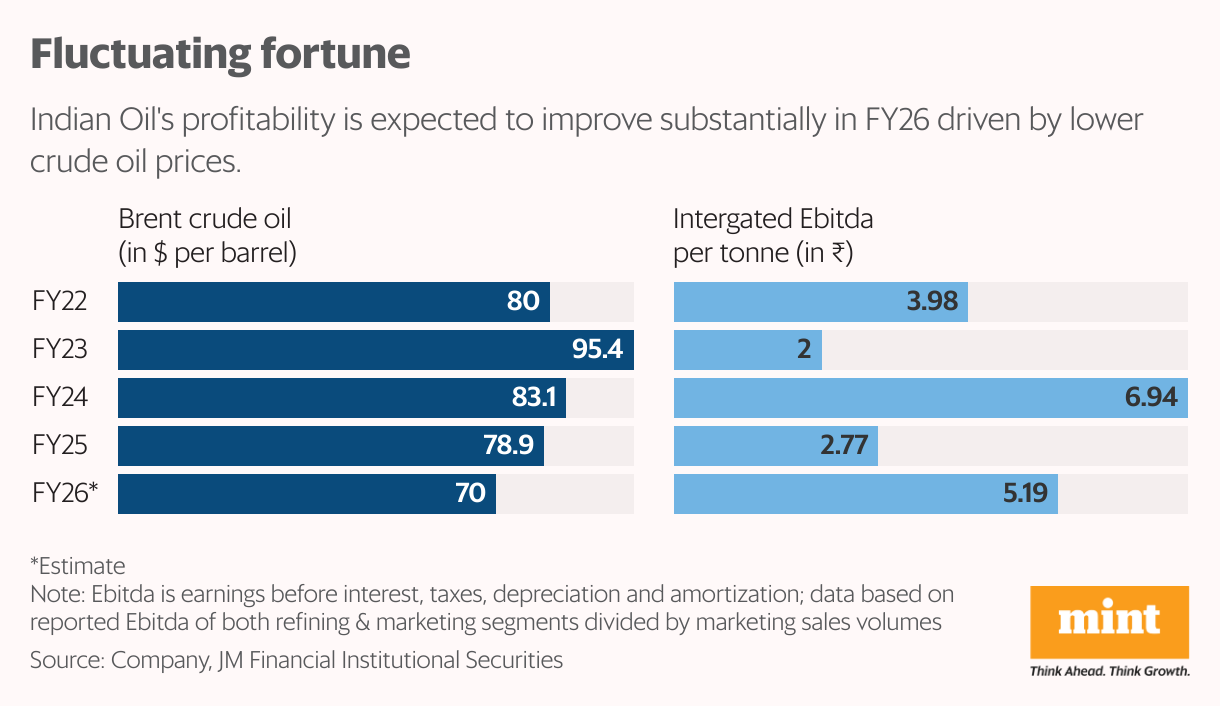

Indian Oil Corp. Ltd (IOC) is navigating choppy waters as near-term business conditions remain uncertain amid oil price volatility, tariffs, exchange rate weakness, and geopolitical disturbances. Over the past five quarters through Q1FY26, IOC’s gross refining margin ranged from $7.9 per barrel to $2.2 per barrel, while the average crude oil price fell from over $80 a barrel to around $68.

To tackle these challenges, IOC launched its strategic plan SPRINT in April, aimed at strengthening core businesses, optimizing costs, and enhancing customer focus and technological capabilities. Under SPRINT, two of its refineries recorded an energy intensity index of 93 in the first five months of FY26, improving from 97 in FY25. (A lower index indicates higher energy efficiency.) The company also plans to cut FY26 operating expenses, excluding employee costs, by 20% year-on-year.

IOC has charted ambitious expansions. As a 28 September ICICI Securities report points out, “Aggressive capex plans are intended to gradually increase the share of petrochemical and specialty chemicals, shifting away IOC’s dependence from simple refining while investments in renewables, biomass and gas are intended to diversify the business mix materially over FY26-30.”

In a meeting with analysts last week, IOC’s management reiterated that the company’s refining capacity will expand over 20% over the next twelve months to 98 million tonnes per annum, from 81 million tonnes per annum (mtpa). This entails a capital expenditure (capex) of ₹90,000 crore.

The first of the three petrochemicals (petchem) projects at Paradip is expected to be commissioned in FY26. IOC targets to achieve petchem intensity of 15% from 6% currently, with total capacity rising to 13 mtpa from 4.3 mtpa by FY30. Higher petchem exposure would help offset the slowdown in petroleum product growth due to electric vehicles (EV) adoption.

IOC’s green hydrogen plant of 10,000 tonnes per annum at Panipat is expected to be commissioned in FY27. Blending of jet fuel with sustainable aviation fuel should start in FY27.

Petchem and margins

Yet, the stress in petchem is a concern for investors. FY25 reported Ebit (earnings before interest and tax) showed a loss of ₹440 crore, with eight losses in the past 12 quarters. Petrochemical spreads are likely to remain muted given the significant upcoming capacity additions in China, notes Motilal Oswal Financial Services.

Still, IOC’s overall FY26 earnings growth could be robust. The government’s approval of a ₹30,000 crore reimbursement to oil marketing companies towards LPG under recoveries should aid earnings. With a 45% market share, IOC is seen as a big beneficiary.

IOC’s Q1FY26 Ebitda grew 46% year-on-year to ₹12,600 crore, driven by strong performance in the marketing segment thanks to lower oil prices, even as refining margins suffered.

The stock trades at 1.02x its FY26 estimated book value, lower than 10-year average of 1.1x, weighed down by continued market uncertainty. Motilal Oswal maintains a bearish view on refining, expecting spreads to stay range-bound amid substantial global net capacity additions and weak demand growth for refined products over calendar years 2024-30.

“With a modest RoE of ~7%-8.5% over FY26/27, returns remain unattractive compared to peers,” said the broking firm in a 29 September report.

Improving geopolitical conditions are key to the stock’s prospects. Any cut in retail fuel prices would dampen earnings, while export curbs on Russian crude pose a risk, even as IOC expects the share of Russian crude in its sourcing mix to remain steady.