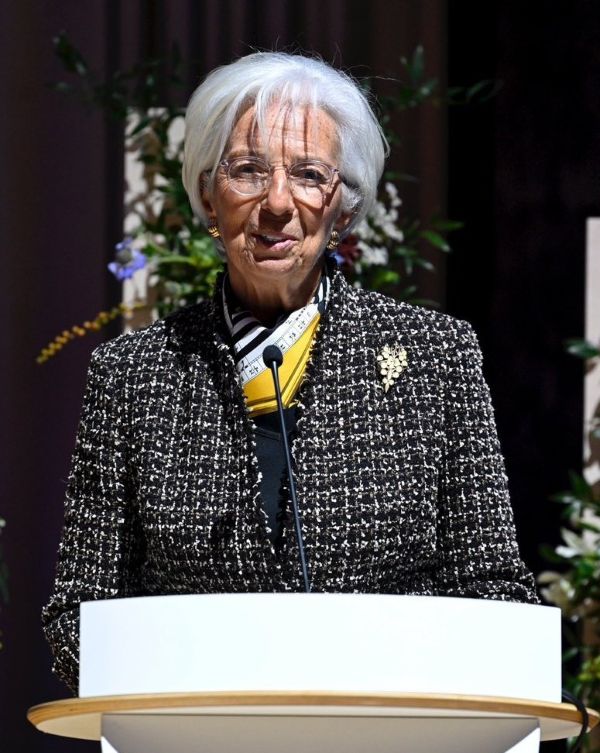

Europe’s economy has performed better than expected in the face of U.S. President Donald Trump‘s new tariffs, thanks in part, European Central Bank (ECB) head Christine Lagarde believes, to the European Union’s decision not to respond to Washington’s move with punitive retaliatory tariffs of its own that would have ended up being self-defeating.

In a speech to a top-level banking conference in Helsinki, Christine Lagarde said the impact of Trump’s trade war on eurozone economies had also been eased because of a stronger euro and the trade deal the EU negotiated with Trump that capped tariffs at 15%. This, she maintained, had helped remove uncertainties threatening business investment.

A year ago, most would have assumed that U.S. tariffs “would trigger a major adverse shock to the euro area economy,” Lagarde declared, yet she noted that “some of these assumptions have not been borne out.” There had been little impact on inflation while the impact on growth had been “relatively moderate”, positives she attributed to European governments opting for pro-growth measures in response to Washington’s moves.

Because of this, the ECB’s interest rate policy was “in a good place”, unchanged at 2% since 11 September, with the bank’s next policy meeting scheduled for 30 October.

The EU’s executive arm suspended a list of goods it had drawn up to hit with retaliatory tariffs, or import taxes, in the tariff deal Trump and Commission President Ursula von der Leyen arrived at in July.

This enabled Europe to continue importing raw materials and goods needed while keeping its economy free from the high tariff costs and/or bottlenecks that might otherwise have raised prices. “As a result, we have not yet seen significant supply chain disruption,” Lagarde said. “Global supply chain pressures remain contained, and in the euro area, bottleneck indicators are close to historical averages.”

Trump’s policies have been accompanied by a fall in the dollar and a strengthening of the euro, which makes Europe’s imports cheaper and helps the ECB in its efforts to contain the annual rate of inflation, which in August was a moderate 2%.

Growth, however, remains mediocre, coming in at only 1.1% in the second quarter, which is above the rate of the previous quarter. Tariffs and associated uncertainty are expected to reduce performance by approximately 0.7% through 2025 and 2027.

(This article used information from the Associated Press)