With the government at a standstill and the threat of mass furloughs looming, the Fed’s path appears increasingly tilted toward additional cuts. Policymakers had already acknowledged a softer labor market in September when they delivered their first reduction of the year, lowering the federal funds rate to 4%–4.25%. Now, the shutdown makes it harder for officials to gain clarity on whether conditions are stabilizing, which could push them to err on the side of easing again.

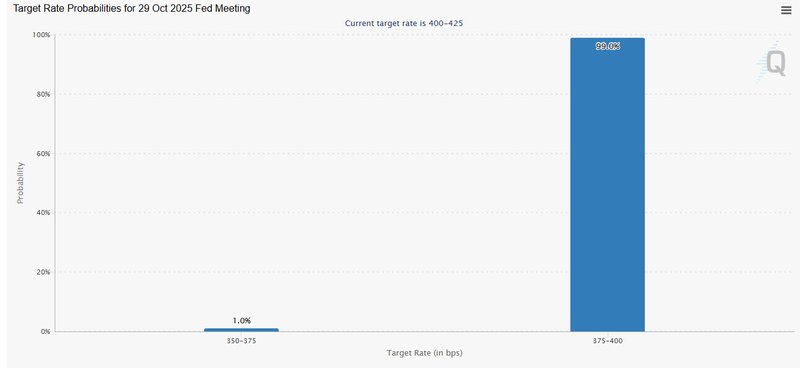

Markets fully price in October move

Futures trading shows investors no longer see a cut as optional but inevitable. According to CME FedWatch data, markets are assigning a 99% probability of a reduction at the October meeting, alongside an 88% chance of another move in December. Both probabilities have risen since the shutdown began, reflecting a consensus that the political impasse will only tighten the pressure on policymakers.

Source: CMEgroup

Data blackout complicates fed decisions

The longer the budget dispute drags on, the greater the risk of a “data blackout.” A shutdown would halt the Bureau of Labor Statistics from releasing its September jobs report and delay critical inflation readings. Without these benchmarks, officials lose visibility into the labor market and price dynamics at precisely the moment they need to calibrate policy. In such an environment, risk-management arguments for cutting rates become harder to resist.

Labour market fragility at the center

Private payroll data already signaled weakness in September, with ADP reporting a loss of 32,000 jobs. If government employees are laid off without assurances of rehiring, as the White House has hinted, the labor market will deteriorate further. That risk, combined with delayed data, strengthens the case for pre-emptive easing. Even if inflation remains above target, many believe the Fed will prioritize cushioning the job market against additional shocks.