Oil market dynamics have opened a window for OPEC+ to claw back market share lost to US shale, investors and experts said on the sidelines of a Gulf energy conference, with expectations growing that the group will increase supply despite short-term price pressure.

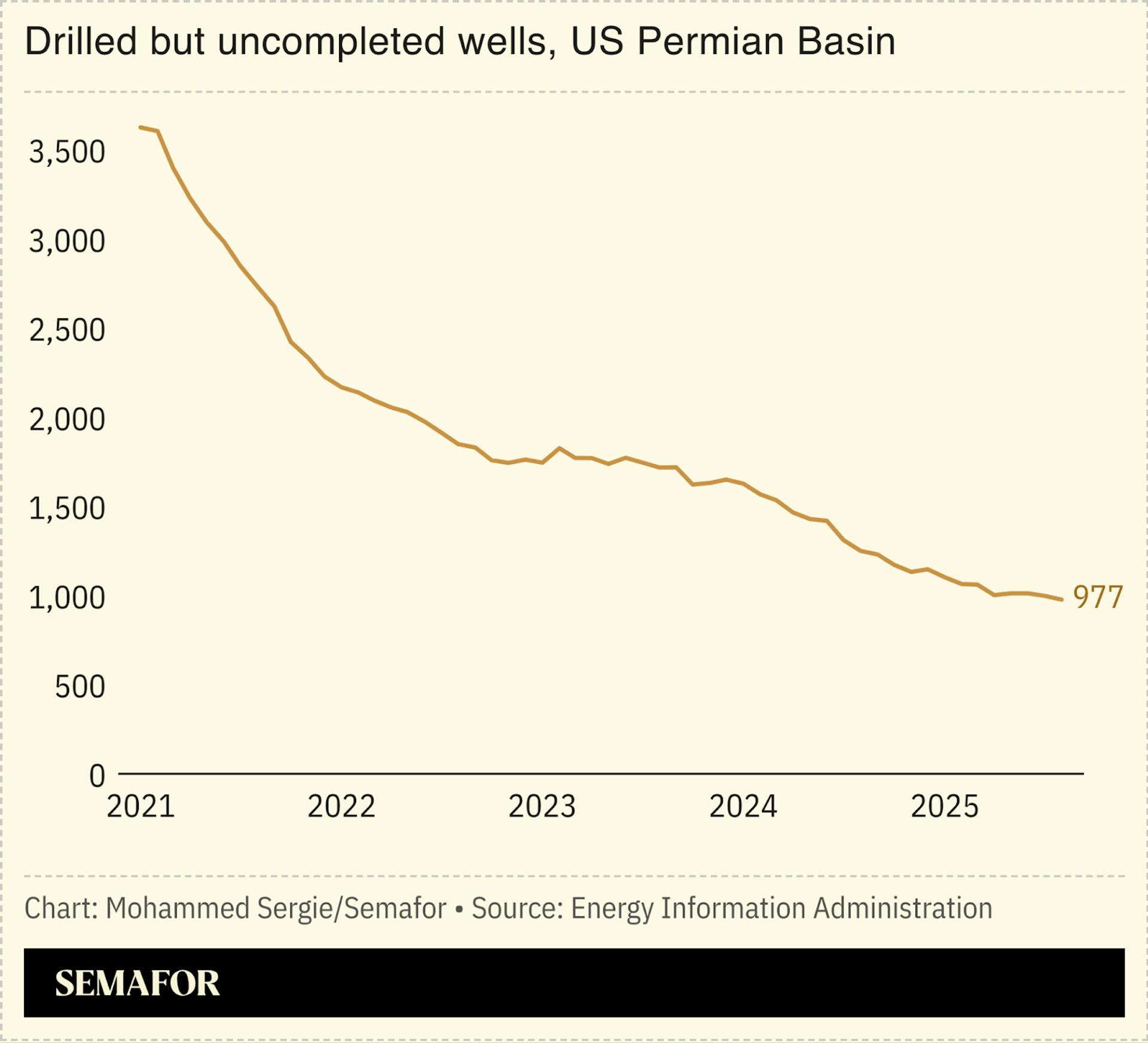

US oil production is forecast to decline slightly next year, according to the Energy Information Administration. President Donald Trump’s “drill, baby, drill” mantra has collided with weaker crude prices and shifting conditions in the Permian basin, the most important shale field. The number of drilled-but-uncompleted wells — used by operators to raise debt or hold for higher prices — has dropped below 1,000, signaling that most prime “Tier 1″ acreage has been tapped, leaving little room for a quick surge, said Brien Pieri, founder of Colorado-based data platform and advisory Energy Rogue.

OPEC’s plan to boost output “is brilliant because right now, many US shale producers are creating their budgets for 2026. This is good timing because other producers will cut investment if there will be more OPEC supply, and lower prices,” Pieri told Semafor.