(Bloomberg) — Investors are snapping up shares in the Czech Republic’s biggest power utility, betting a potential win for the billionaire challenger in this week’s election will unlock a lucrative government stock buyout.

Andrej Babis, a former prime minister who heads the populist ANO party, has made acquiring the remaining 30% of CEZ AS a centerpiece of his economic program.

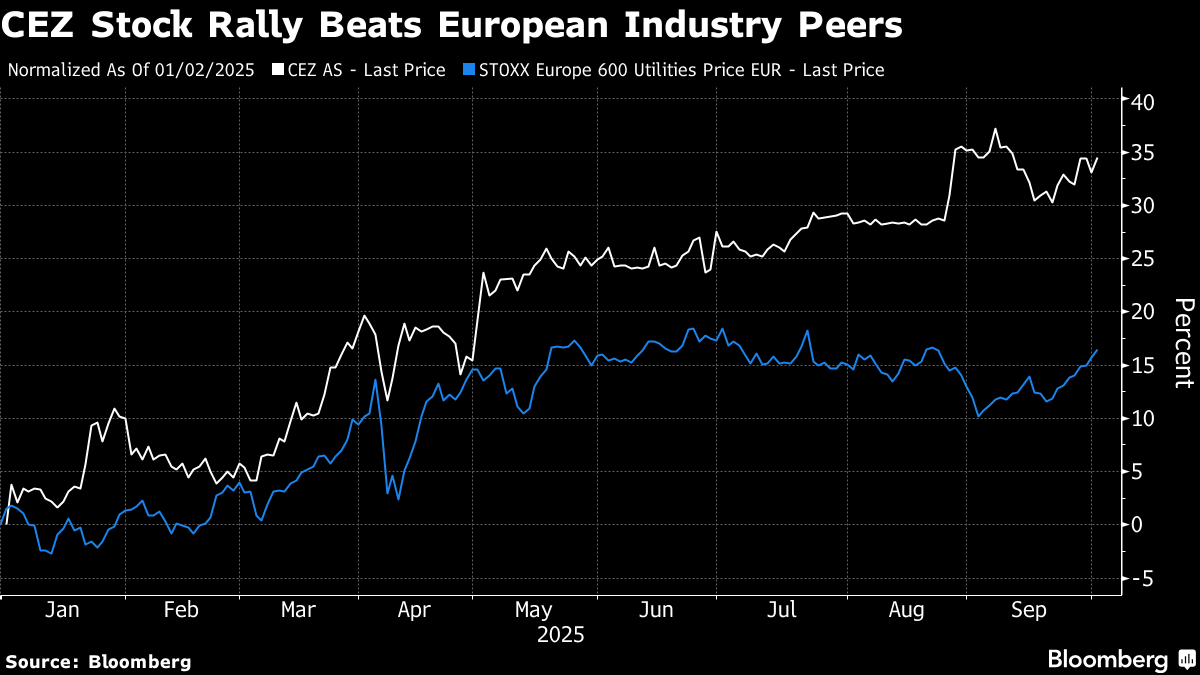

That’s helped unleash more than a 35% rally this year for a company whose share price has traditionally been stifled by heavy-handed state initiatives and constant battles with minority holders.

The gains are “essentially a bet on the elections,” said Michal Snobr, an energy analyst and an activist shareholder since the early 2000s. There’s still a risk the deal won’t happen, but a state buyout on reasonable terms would be better for investors than “more years of state interventions,” he said in an online debate.

The company’s shares are trading close to a 17-year high reached in September. They were down 0.4% at 1,302 koruna on Thursday.

Should Babis fail to return to power after the Oct. 3-4 vote, CEZ’s shares may react “quite negatively,” according to Martin Uher, a trader at KBC Group NV’s Patria Finance brokerage in Prague.

If that happens, “expectations that the state will pay a generous premium could disappear,” he said.

Most Valuable

The rally has lifted CEZ’s market capitalization to the equivalent of $34 billion, making it the most valuable listed company in the European Union’s eastern flank. The purchase of the remaining chunk that the state doesn’t own could cost around 250 billion koruna ($12 billion) and take 12 to 18 months to carry out, a senior ANO party official said in September.

For a successful buyout, the state would have to offer an attractive price that will allow it to clear the 90% ownership threshold needed for a mandatory squeeze-out. That could be a 20% premium over the current price — or more — according to Snobr, citing the ANO party’s estimates.

To be sure, some analysts suggest the buyout talk could be pre-election posturing and may not materialize at all.

If CEZ were required to fund the buyout from its cashflow, the company would need to reduce its dividend payments — an important source of government revenue — and possibly curb investment plans, Komercni Banka analyst Bohumil Trampota said. He’s had a hold recommendation and a target price of 923 koruna for the shares for almost a year.

And CEZ’s departure from the Prague Stock Exchange would be a major blow for a bourse that’s seen a string of high-profile delistings in the past few years, Trampota added.

“We expect the buyout rhetoric to ease after the elections and see a potentially weaker period for the company’s shares,” Petr Bartek and Jan Bystricky, equity analysts at Erste Group Bank AG, wrote in a report.

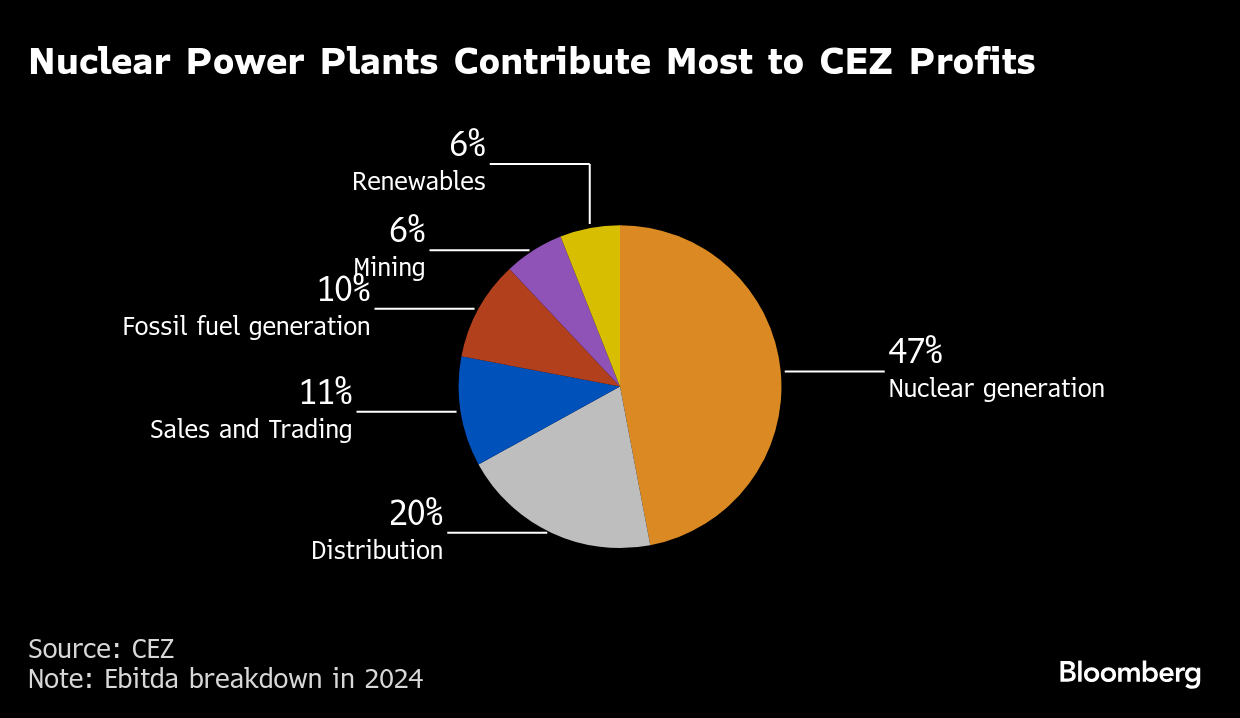

It’s hard to escape the presence of CEZ: the dominant power company operates nuclear reactors, gas and coal power stations as well as distribution networks delivering electricity and natural gas to over 3.5 million clients, including households, small businesses and big enterprises.

Over the years CEZ has faced the risk of being saddled with funding more nuclear reactors, a legislative proposal threatening to weaken ownership rights for smaller shareholders and a windfall tax crimping dividends.

While the outlook for the energy industry is positive, small shareholders and the state will always have a problematic relationship at CEZ should the buyout fail to happen, according to Snobr.

“I’m not naive to think that the windfall tax was the last political interference,” he said. “State efforts to intervene in energy, or control it, will only grow.”

(Updates with fresh market prices in the fifth paragraph.)

©2025 Bloomberg L.P.