When snow begins to dust the Rockies and frost settles into New England, North America’s ski community usually shifts into high gear with optimism. But as the 2025–26 ski season approaches—one poised to crescendo with the Winter Olympics in Milan-Cortina—a double economic hit is reshaping the industry: U.S. tariffs on European sporting goods and a weakened U.S. dollar against the euro. Together, they are raising prices, complicating supply chains, and threatening accessibility in a sport already navigating slim margins.

A Perfect Storm: Tariffs Meet a Weak Dollar

In August 2025, U.S. officials announced a sweeping 15% tariff on European sporting goods, encompassing a wide range of products, from bicycles to skis. For cross-country skiing, nearly every major brand is affected: Fischer and Atomic (Austria), Salomon and Rossignol (France), Madshus and Swix (Norway).

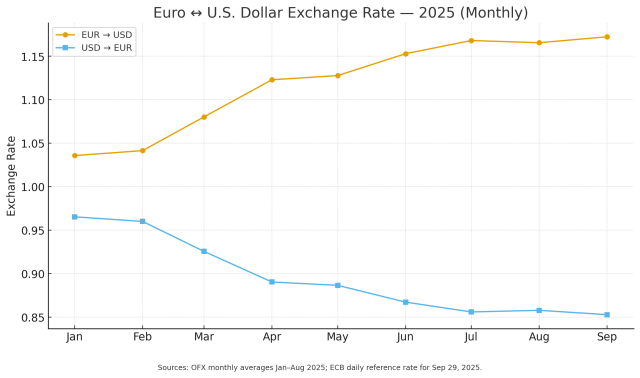

At the same time, the value of the U.S. dollar has weakened relative to the euro. In practice, this means that European brands invoicing in euros are already charging more before tariffs are added. Importers now face what retailers call a “double tax”: currency pressure first, followed by tariffs.

“It’s not just the 15% tariff,” says Nathan Schultz, owner of Boulder Nordic Sport (BNS), which operates stores in Colorado and Maine. “When you add in the weaker dollar, it’s closer to a 25% increase on the goods we bring in from Europe. That’s a big deal for shops, teams, and families trying to keep skiing affordable.”

In addition to a 15% tariff, importers are also faced with navigating a roughly 10% reduction in the value of the US dollar compared to the Euro since the beginning of the year.

In addition to a 15% tariff, importers are also faced with navigating a roughly 10% reduction in the value of the US dollar compared to the Euro since the beginning of the year.

Retail Price Shock

The most visible effect of these economic headwinds will be at the cash register. Industry analysts estimate that retail prices for skis, boots, and poles could climb 10–20% this season.

A racing ski that cost $750 last winter could now exceed $850, while entry-level packages—once reliably in the $400–$500 range for high school athletes—may cross into territory that forces parents to think twice.

Junior clubs and college programs, often purchasing equipment in bulk, face an even heavier burden. A 15% hike on 40 pairs of skis adds thousands in unbudgeted expenses, straining already tight development budgets.

Importing in a Shifting Marketplace

As both a retailer and importer of Holmenkol and Rode wax, Schultz has felt these challenges firsthand. Initially, tariffs were expected to be 10%, so BNS priced accordingly. When the finalized 15% tariffs hit, Schultz decided not to reprice mid-stream, absorbing about 5% of the increase himself.

“We ate that extra hit for now,” he explains. “But it’s not sustainable forever. There will have to be more price increases unless something changes.”

Brand-Level Challenges

For ski brands, the new trade environment is a strategic headache. North America has long been considered a key growth market, buoyed by Olympic visibility and U.S. athletes such as Jessie Diggins, Rosie Brennan, Julia Kern, Sophia Laukli, Gus Schumacher, and Ben Ogden.

“North America is a showcase market,” said one brand manager. “Having athletes win on the World Cup while using our skis matters—but so does making sure local clubs and young skiers can actually afford them. Tariffs and exchange rates put us in a bind.”

Some companies may absorb part of the increase, but margins are already thin. Others could delay or scale back product launches. A new boot line slated initially for 2025 may be postponed until 2026, when pricing pressure is (hopefully) less severe.

(Photo: NordicFocus)

(Photo: NordicFocus)

Tariff Burden by Brand

While most European brands face similar baseline tariffs, differences in origin create slight variations in exposure.

Fischer and Atomic (Austria): ~15% baseline tariff.

Salomon and Rossignol (France): ~15%.

Madshus and Swix (Norway): ~17% estimated, reflecting Norway’s non-EU status and potential reciprocal adjustments.

Retail Complexity: More Labor, More Headaches

Beyond costs, the logistics of managing inventories are increasingly complicated.

“We have 25,000 SKUs between bike and ski,” Schultz notes. “Every brand is handling this differently. Some have had two price increases already, while others have had none. It’s a lot of extra labor just tracking what’s going on.”

Even smaller suppliers face hurdles. Boutique companies like Guru Wax or Air Trim Masks often ship just a few boxes via UPS. But new customs procedures mean all goods are routed through central hubs, adding delays and expense. “Instead of a straightforward shipment to Denver, everything gets bottlenecked,” Schultz says.

Barriers to Entry: The Impact on Families and Clubs

Relative to sports like alpine skiing or hockey, cross-country skiing remains relatively inexpensive. But those margins matter. “When kids need both a skate and classic setup, it’s already a big ask,” Schultz points out. “Add 10 to 25% more on top, and suddenly the sport is out of reach for more families.”

High school and junior programs, many of which rely on bulk gear purchases, are especially vulnerable. “If equipment becomes too expensive, it risks shrinking the base at a time when we should be growing participation,” warns Mount Greylock High School coach Hilary Greene.

The busy scenes of a Minnesota Youth Ski League practice. (Photo: Minnesota Youth Ski League).

The busy scenes of a Minnesota Youth Ski League practice. (Photo: Minnesota Youth Ski League).

Historical Parallels

This isn’t the first time global economics have intersected with Nordic skiing. In the early 2000s, rising costs prompted several companies to relocate their production from Western Europe to Eastern Europe and Asia. More recently, the ban on fluorocarbon wax has required significant R&D investment, squeezing brands that were already operating on thin margins.

For Schultz, the tariffs feel uniquely discouraging: “At the start of COVID, we thought we were doomed. But it turned into a boom because people rediscovered the outdoors. This is the opposite—it just depresses the market.”

Looking Ahead: The Olympic Test

The timing could hardly be worse. With the 2026 Winter Olympics in Italy just months away, the industry had been bracing for a surge in interest and participation.

“There’s always an Olympic bump,” Schultz says. “But if starter packages cost hundreds more, will families still make the leap? Rising prices could blunt that momentum.”

Some retailers are adapting by delaying orders, expanding consignment programs, or promoting non-European goods. Industry groups, such as Snowsports Industries America (SIA), are lobbying U.S. trade officials for relief. Brands, meanwhile, are weighing long-term strategies like currency hedging, North American assembly, or collaborative lobbying.

Ski brands have a long history of using the Olympic platform to showcase innovations and new products. (Photo: NordicFocus)

Ski brands have a long history of using the Olympic platform to showcase innovations and new products. (Photo: NordicFocus)

The Outlook: Uncertainty Meets Opportunity

The following 18 months will test the resilience of the U.S. cross-country ski industry. Tariffs and currency fluctuations threaten to disrupt what should otherwise be a banner Olympic cycle. Yet history shows that Nordic skiing is an adaptable sport, built on perseverance through tough conditions.

“Skiing is resilient,” Schultz reflects. “People love it, and once they’re hooked, they’ll find a way. Our job is to keep it as accessible as possible, even in tough times. If we do that, the sport will weather this too.”