Executive Summary:

Infrastructure: US ethane exports likely hit a record high in September thanks to a ramp at Enterprises’ new Neches River terminal.

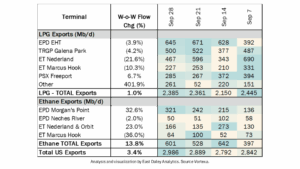

Exports: Total US NGL exports rose 3.4% W-o-W, driven by gains in both ethane and LPG loadings. Ethane exports were up a modest 1%, while LPG exports saw a stronger increase of 13.8%.

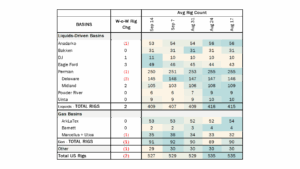

Rigs: The total US rig count decreased during the week of Sept. 14 to 527. Liquids-driven basins increased 2 rigs W-o-W from 407 to 409.

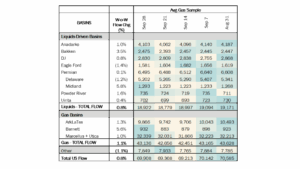

Flows: US natural gas volumes averaged 69.9 Bcf/d in pipeline samples for the week ending Sept. 28, up 0.8% W-o-W.

Infrastructure:

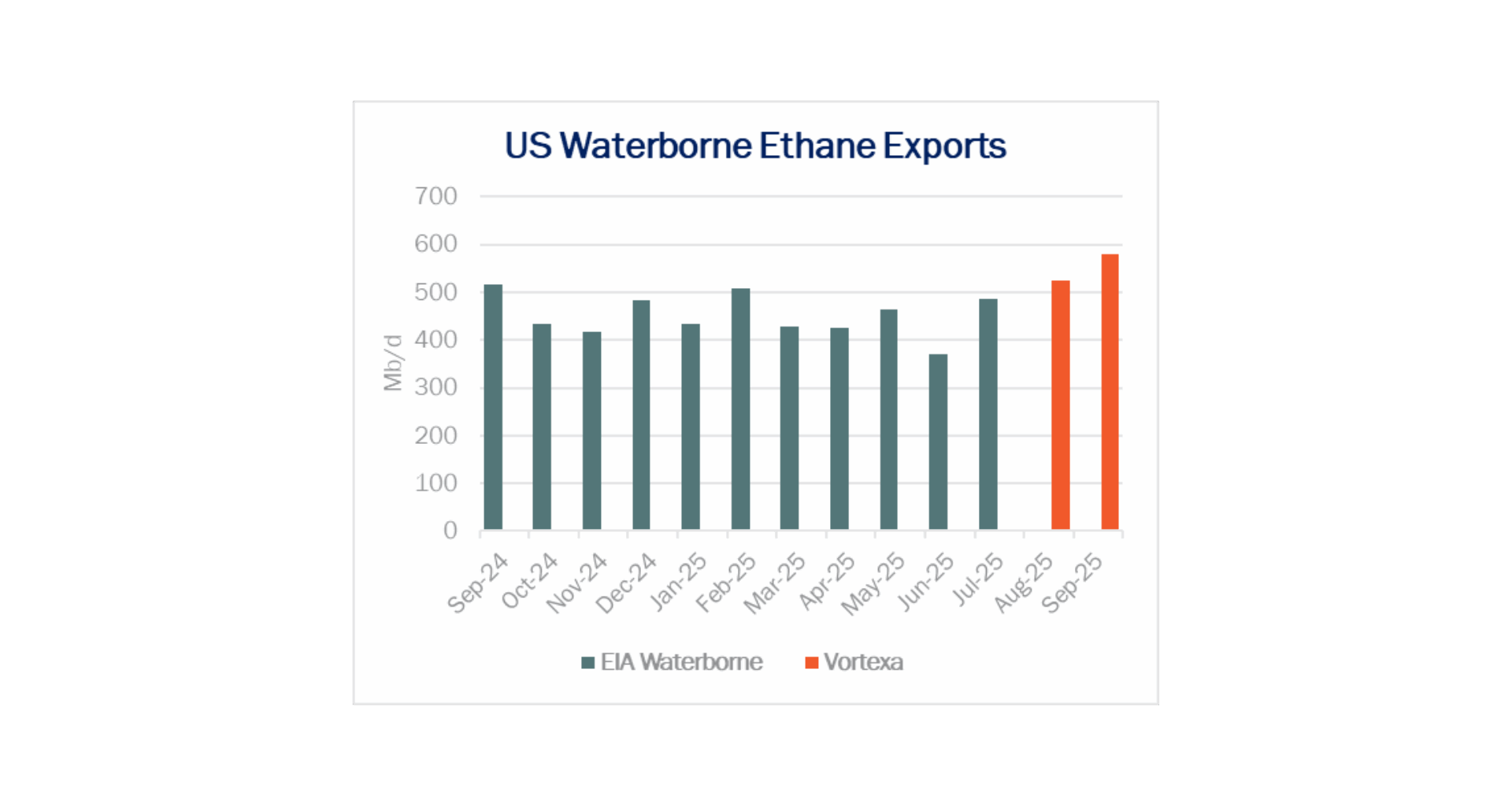

US ethane exports hit a record high in September thanks to a ramp at Enterprise Products’ (EPD) new Neches River terminal and the return of Chinese buyers.

According to shipping-data provider Vortexa, waterborne ethane exports surged to an all-time high in September, averaging 580 Mb/d. That pace would easily eclipse the record of 517 Mb/d reached in Sept ’24 in historical Energy Information Administration (EIA) data. Exports from terminals also neared that market in February, averaging 508 Mb/d ahead of the Trump administration enacting sweeping new tariffs (see figure).

Enterprise’s Neches River project drove most of the gains. Ethane cargoes leaving the new terminal near Beaumont, TX averaged nearly 59 Mb/d in September, according to Vortexa data, more than double exports of 27 Mb/d in August. EPD started exports in July at Neches River and continues commissioning work at the terminal.

Enterprise’s Neches River project drove most of the gains. Ethane cargoes leaving the new terminal near Beaumont, TX averaged nearly 59 Mb/d in September, according to Vortexa data, more than double exports of 27 Mb/d in August. EPD started exports in July at Neches River and continues commissioning work at the terminal.

Exports to China were set to hit a record as well, despite uncertainty over the trajectory of the US-China ethane trade. Cargoes destined for China accounted for 403 Mb/d of September exports, or nearly 70% of the total. The Chinese government in June reportedly doubled its import quota for naphtha, a competing feedstock for making ethylene, signaling a potential replacement for some US ethane after the trade war heated up with Washington. The two countries reached a trade accord in early July. The return of Chinese buyers could signal a thawing in the relationship, a welcome development for terminal operators like EPD and Energy Transfer (ET).

The additional demand is spurring gains in ethane prices. Mont Belvieu ethane traded for $0.28/gal on Thursday (Oct. 2), up from prices in the $0.20-0.22/gal range in August. Meanwhile, exports to India have trended lower in September, down from highs seen when trading restrictions were in place with China. Those restrictions drove prices lower and saw Indian buyers snap up barrels at a discount.

Exports:

Total US NGL exports rose 3.4% W-o-W, driven by gains in both ethane and LPG loadings. Ethane exports were up a modest 1%, while LPG exports saw a stronger increase of 13.8%.

Rigs:

The total US rig count decreased during the week of Sept. 14 to 527. Liquids-driven basins increased 2 rigs W-o-W from 407 to 409.

Permian:

Delaware (-3): Mewbourne Oil, Petro-Hunt, Petroplex Energy

Midland (2): Petroplex Energy, Walter Oil & Gas

Anadarko (-1): OGP Operating

Eagle Ford (+3): Kimmeridge Texas Gas, Tidal Petroleum

DJ (+1): Bison Operating

Flows:

US natural gas volumes averaged 69.9 Bcf/d in pipeline samples for the week ending Sept. 28, up 0.8% W-o-W.

Major gas basin samples increased 1.1% W-o-W to 43.1 Bcf/d. The Haynesville sample increased 1.3% to 9.9 Bcf/d, and the Marcellus+Utica sample rose 1.0% to 32.3 Bcf/d.

Samples in liquids-focused basins gained 0.8% W-o-W to 18.9 Bcf/d. The Eagle Ford sample fell 4.6% to 1.6 Bcf/d, while the Bakken sample decreased 2.6%.

Calendar: