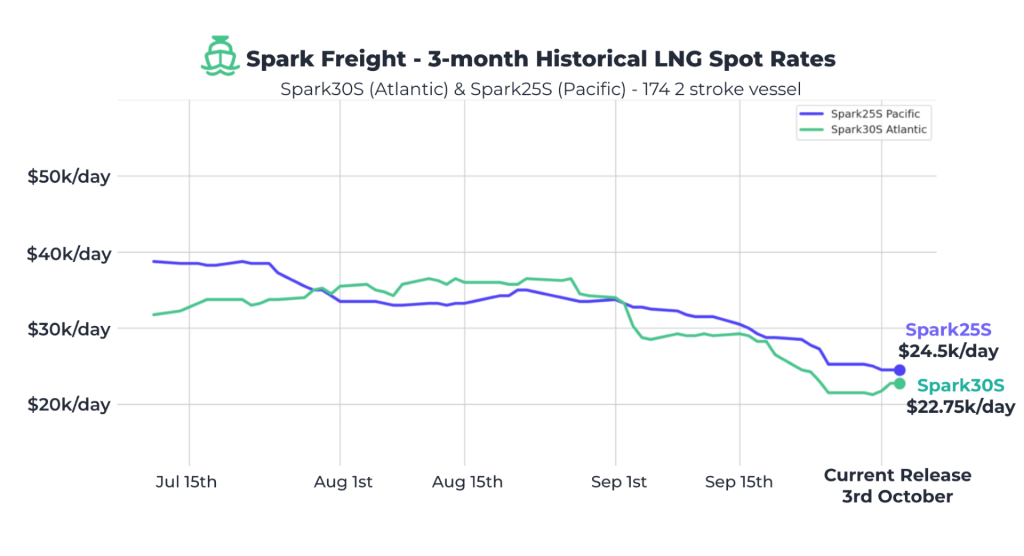

Spark’s product and pricing analyst, Janusz Rydzewski, told LNG Prime on Spark30S (Atlantic) LNG freight increased $1,250 week-on-week to $22,750 per day.

“Spark25S (Pacific) rates softened, declining $750 per day week-on-week to $24,500 per day and marking a sixth consecutive weekly rate decline, and the lowest rate since mid-June,” Rydzewski said.

European prices down

In Europe, the SparkNWE DES LNG dropped compared to last week.

“The SparkNWE DES LNG front month price for November decreased for a second consecutive week, declining by $0.334/MMBtu to $10.183/MMBtu,” Rydzewski said.

Moreover, the basis of DES LNG to TTF “held relatively steady over the week around -$0.615/MMBtu,” he said.

“The US front-month arb to NE-Asia (via the Cape of Good Hope) is priced at -$0.065/MMBtu, still narrowly incentivising US cargoes to deliver to Europe,” Rydzewski said.

“The US front-month arb to NE-Asia (via Panama) is priced at -$0.096/MMBtu,” he said.

Data by Gas Infrastructure Europe (GIE) shows that volumes in gas storages in the EU rose from last week and were 82.57 percent full on October 1.

Gas storages were 79.86 percent full on September 24, 2025, and 94.31 percent full on October 1, 2024.

JKM

In Asia, JKM, the price for LNG cargoes delivered to Northeast Asia in November 2025 settled at $11.025/MMBtu on Thursday.

Last week, JKM for November settled at 11.295/MMBtu on Friday, September 26.

Front-month JKM dropped to 11.200/MMBtu on Monday, 11.050/MMBtu on Tuesday, and 11.045/MMBtu on Wednesday.

State-run Japan Organization for Metals and Energy Security (Jogmec) said in a report earlier this week that JKM for last week “fell to low-$11s/MMBtu on September 26 from mid-$11s/MMBtu the previous weekend.”

“Spot LNG demand in Northeast Asia remained weak, due to ample LNG inventories and sufficient supply in the region. With little change in fundamentals, the price showed only minor fluctuations throughout the week,” Jogmec said.