(Bloomberg) — Inside the investment banking division of JPMorgan Chase & Co., there’s concern that enthusiasm for nuclear energy might have gone too far.

“We’ve spent so much time on nuclear that I’ve become worried that maybe we’re over indexing on this problem,” Rama Variankaval, the bank’s global head of corporate advisory, said in an interview.

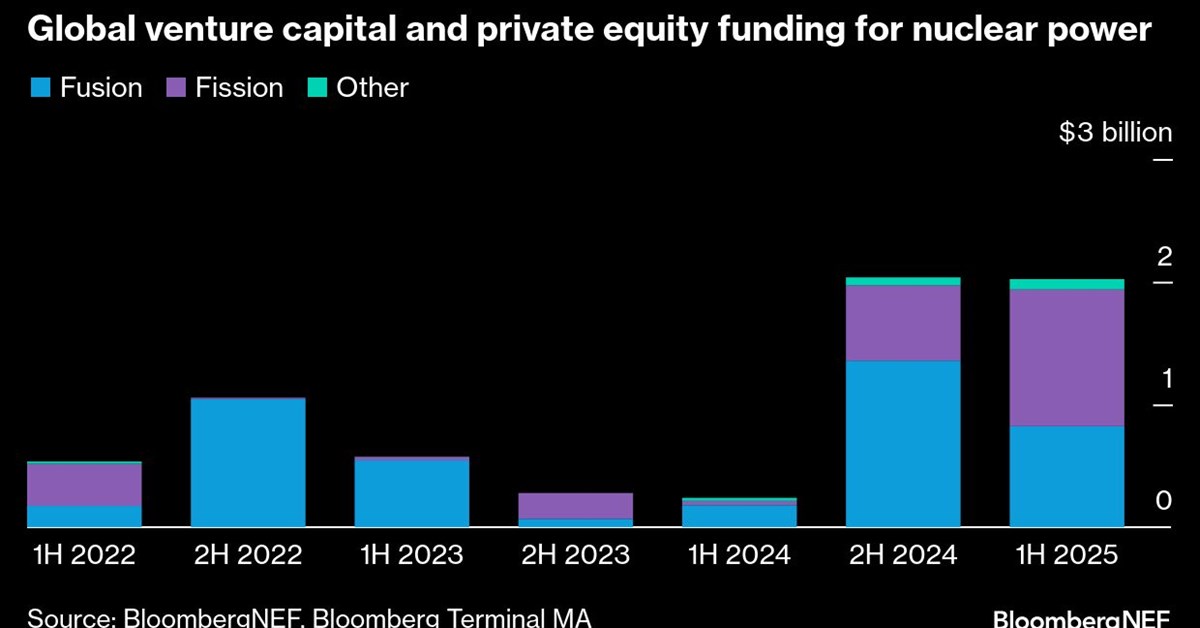

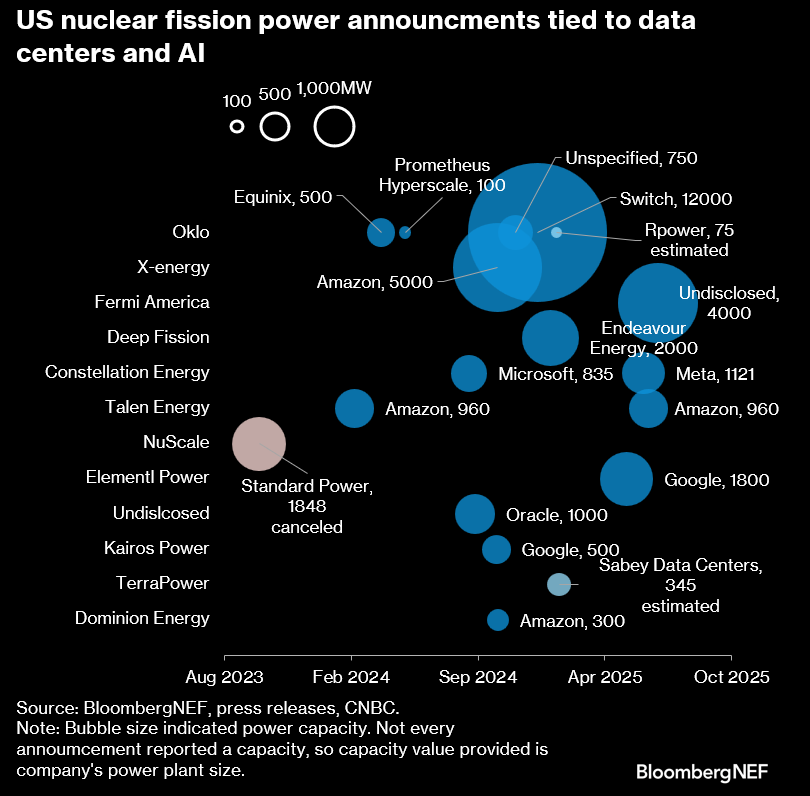

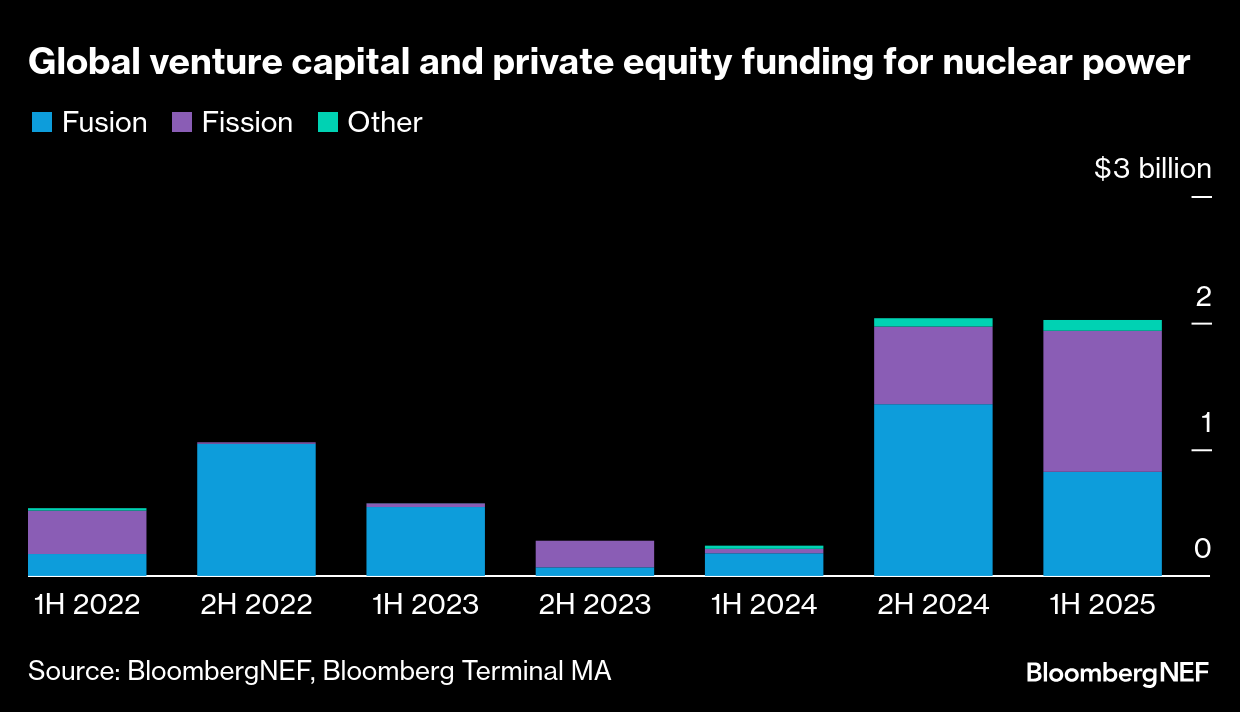

Nuclear power is having a moment in the US. After being largely stagnant for decades, the industry has been reignited by an insatiable demand for energy to power the data centers needed to support artificial intelligence. Bloomberg Intelligence estimates that demand for electricity will drive a $350 billion nuclear spending boom in the US, boosting output from reactors by 63% by mid-century.

Expectations of a nuclear renaissance have sent stocks soaring. Shares of nuclear energy startup Oklo Inc. have surged more than 500% this year, helped by a Sept. 22 announcement that the company broke ground on its first commercial reactor in Idaho. The MVIS Global Uranium & Nuclear Energy index is up over 70% in the period, compared with a 14% increase in the S&P 500 Index.

That exuberance looks overdone when considering likely delays in supply, according to Variankaval. “The demand of new power is materializing in real time, but the supply of new nuclear may take time,” he said.

Nuclear energy is experiencing a renaissance. Listen to a BNEF panel presented at the BNEF Summit Houston on Sept. 18, 2025Source: Bloomberg

Nuclear energy is experiencing a renaissance. Listen to a BNEF panel presented at the BNEF Summit Houston on Sept. 18, 2025Source: Bloomberg

Nuclear is one of the few low-carbon energy sources that is backed by the administration of US President Donald Trump. He’s signed executive orders to boost nuclear power and challenge rivals including Russia and China, a policy that includes a goal of quadrupling US nuclear capacity.

“Nuclear is almost certainly going to see a renaissance and be a bigger part of the electricity supply in the future,” Variankaval said. But “the reality of nuclear is it’s not ready for prime time,” he said.

Variankaval said his concerns have in part been shaped by the tone of several closed-door meetings he attended during New York climate week, in which what he characterized as unrealistic optimism around nuclear power dominated the conversation.

Source: Bloomberg

Source: Bloomberg

Nuclear power plants come with very high upfront costs, often take at least a decade to build and regularly encounter delays that mean budget predictions rarely hold. And despite soaring demand for carbon-free fission power in the US, the pace of construction has been glacial. Newer technologies intended to address some of those issues remain unproven.

Variankaval urged caution when it comes to expectations around small modular reactors, which can be built in factories and are faster and cheaper to produce than their larger counterparts. Despite the support for SMRs, the technology is “probably still a handful of years away from being a cost-competitive source of energy,” he said. “Fusion is likely two handfuls of years away.”

Bloomberg Intelligence forecasts that only 9 gigawatts of new nuclear capacity of any type will be added in the next decade, with widespread deployment of SMRs not expected to start until after 2035.

Nuclear developments also have been hampered by a lack of skilled labor, domestic fuel supply and regulatory infrastructure, among other things. Just three traditional reactors have been completed in the US this century.

Given the challenges facing nuclear, meeting short-term power requirements may still need to be “anchored around gas” with additional carbon capture, as well as solar and batteries, wind and hydropower, Variankaval said. “Power prices are already going up in many parts of the country” and “a continuation of this will test the policy support and the question of who pays for the incremental cost of new energy will need to be carefully addressed.”

Meanwhile, it’s not clear that nuclear power will be able to add enough to the energy mix to meet the demand generated by AI, according to Karen Fang, global head of sustainable and infrastructure finance at Bank of America Corp.

There’s been some “really promising progress,” she said on a panel at Bloomberg’s Women, Money & Power event in London on Oct. 1. But it still “doesn’t solve the AI power need for the next three to five years.”

Bloomberg Intelligence says the race to power AI’s $2 trillion capex wave “will be won by fast-build assets,” with about 72% of respondents to a recent BI survey seeing gas as critical to powering AI data centers.

(Adds BI analysis)

©2025 Bloomberg L.P.