Bitcoin is ‘following in gold’s footsteps’ and will become a key part of central bank balance sheets within five years, analysts at Deutsche Bank have predicted.

Experts said the cryptocurrency has been treated with scepticism and suspicion – but will eventually win acceptance.

The forecast is likely to horrify many in the financial community and regulators who have long warned that Bitcoin and other such assets have no intrinsic value and anyone who invests in them is liable to lose all their money.

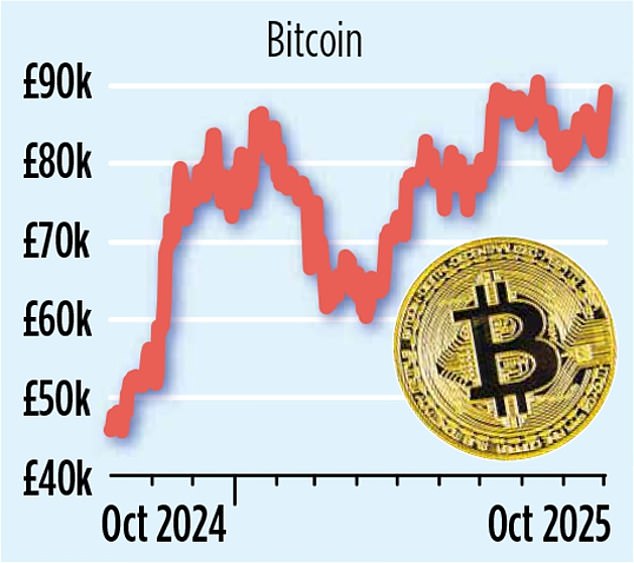

Claim: Bitcoin is ‘following in gold’s footsteps’ and will become a key part of central bank balance sheets within five years

Yet Bitcoin has also been likened to gold as a hedge against assets such as stocks and bonds which can move sharply during periods of political and market instability. Gold is seen as a safe haven in times of volatility even though – like Bitcoin – it earns no regular dividends or yields for investors.

And the cryptocurrency was given a big leg up with Donald Trump’s decision to establish a strategic Bitcoin reserve.

‘History appears to be repeating itself,’ Deutsche’s experts said.

‘Like Bitcoin, gold was once subject to scepticism, suspicion and demand speculation. Like Bitcoin, gold has seen periodic episodes of volatility – its performance has often been marked by the slightest of shifts in public perception.

‘We believe Bitcoin adoption will continue, as regulatory developments, macroeconomic conditions and – above all – time should enable the public to increasingly embrace Bitcoin as a store of value.’

AJ Bell

AJ Bell

Easy investing and ready-made portfolios

Hargreaves Lansdown

Hargreaves Lansdown

Free fund dealing and investment ideas

interactive investor

interactive investor

Flat-fee investing from £4.99 per month

InvestEngine

InvestEngine

Account and trading fee-free ETF investing

Trading 212

Trading 212

Free share dealing and no account fee

Affiliate links: If you take out a product This is Money may earn a commission. These deals are chosen by our editorial team, as we think they are worth highlighting. This does not affect our editorial independence.