Dublin, Oct. 06, 2025 (GLOBE NEWSWIRE) — The “Ireland Embedded Finance Market Size & Forecast by Value and Volume Across 100+ KPIs by Business Models, Distribution Models, End-Use Sectors, and Key Verticals (Payments, Lending, Insurance, Banking, Wealth) – Databook Q4 2025 Update” report has been added to ResearchAndMarkets.com’s offering.

The embedded finance market in Ireland is expected to grow by 7.6% on an annual basis to reach US$1.90 billion by 2025.

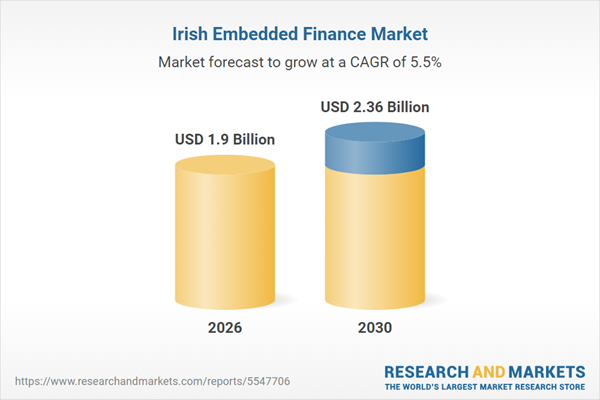

Ireland’s embedded finance market has experienced robust growth during 2021-2025, achieving a CAGR of 10.9%. This upward trajectory is expected to continue, with the market forecast to grow at a CAGR of 5.5% from 2026 to 2030. By the end of 2030, the embedded finance market is projected to expand from its 2024 value of US$1.77 billion to approximately US$2.36 billion.

Key Trends and Drivers Shaping Embedded Finance in Ireland

Ireland’s embedded finance ecosystem is evolving through sector-specific entry points – retail credit, travel, insurance, and payments – driven by consumer demand for convenience and businesses’ need for new monetization channels. Regulatory and infrastructure frameworks are still maturing, particularly in areas such as lending and BaaS, but recent activity signals growing momentum.

Over the next 2-4 years, embedded finance in Ireland is likely to transition from isolated use cases to more structured, compliance-aligned ecosystems anchored in partnerships between platforms, regulated entities, and embedded finance infrastructure providers. The pace and scope of this evolution will be shaped by regulatory clarity, digital adoption patterns, and the role of multinational platforms operating in the Irish market.

Consumer Credit Is Being Embedded into Online Retail and Travel Ecosystems

Ireland is witnessing increasing integration of credit and financing options directly into e-commerce and travel platforms, allowing consumers to access point-of-sale lending during their purchase journey. BNPL offerings are being embedded by both local and international players in retail and ticketing ecosystems. Notably, Humm, a regulated point-of-sale finance provider, has expanded its partnerships with travel platforms such as Sunway Travel and airlines like Ryanair to offer installment-based payment options to Irish consumers.The shift is being driven by strong consumer demand for flexible payment models amid rising cost-of-living pressures. According to the Banking and Payments Federation Ireland (BPFI), Irish households are becoming more price-sensitive and budget-conscious, especially in the 18-35 age group. Merchants are embedding credit at checkout to reduce cart abandonment and improve conversion metrics, while fintechs and banks are leveraging APIs to integrate financing options directly into retail environments.Embedded consumer credit is expected to intensify in sectors beyond retail and travel, including education, elective healthcare, and home improvement. Growth will be shaped by further e-commerce digitization and regulatory oversight of BNPL, especially as the Central Bank of Ireland (CBI) finalizes its stance on proportional regulation. Market expansion will depend on ecosystem partnerships and the ability of providers to manage credit risk in a higher interest rate environment.

Insurance Is Being Embedded into Car Sales, Property Platforms, and Gig Platforms

General insurance products, especially auto, property, and gig-related cover, are increasingly being embedded at the point of sale across digital platforms in Ireland. Similarly, platforms like Daft.ie have begun integrating home insurance referrals during property listing journeys, while gig platforms are offering embedded personal accident and liability covers.Consumer preference for seamless, bundled services and insurers’ interest in reducing acquisition costs are driving this shift. Additionally, regulatory clarity from the Central Bank of Ireland on digital distribution of insurance products has created room for platform-led experimentation. Cross-sector partnerships between InsurTech firms and aggregators like Chill Insurance and Coverinaclick.ie are further facilitating embedded offerings.Embedded insurance is likely to stabilize and expand into niche verticals such as mobility-as-a-service (e.g., shared scooters) and freelancer platforms. Adoption will be conditional on platform scale, consumer trust, and regulatory compliance. Growth will also depend on the ability of insurers to leverage data partnerships for dynamic pricing and claims automation.

Embedded Payments Are Expanding Across Mobility, Retail, and Subscription Commerce

Ireland’s embedded payments ecosystem is deepening, with digital wallets, in-app payments, and contactless integrations embedded across services such as ride-hailing (Bolt), food delivery (Just Eat), and media platforms (Spotify). Embedded payment rails are also being developed in the offline space, with QR-based and mobile-based checkout options integrated into Irish retail outlets through providers like Stripe and Square.Embedded payments will intensify, particularly within subscription commerce and IoT-based experiences (e.g., connected cars and appliances). Real-time payments infrastructure enhancements under the EU’s Instant Payments Regulation may enable new forms of embedded bill payment and merchant settlement models. The landscape will also be shaped by PSD3 compliance and emerging rules on consumer data access and protection.

Banking-as-a-Service (BaaS) Platforms Are Enabling New Entrants to Embed Financial Products

Ireland is seeing the early adoption of Banking-as-a-Service (BaaS) models that allow non-financial companies to offer white-labeled accounts, cards, and payment features. While not as mature as in the UK or Germany, local activity has picked up through platforms like Fire Financial Services, which offers embedded accounts and card services to Irish SMEs and platforms. International BaaS providers such as Railsr and Solaris have also entered the Irish market via cross-border licenses.Ireland’s Fintech ecosystem – centered around Dublin’s International Financial Services Centre (IFSC) – has created a supportive environment for financial API providers. Moreover, Ireland’s role as a European hub for multinational tech companies has encouraged the localization of embedded financial services. Regulatory sandbox support and alignment with European open banking norms under PSD2 have lowered integration barriers for startups and platforms.The BaaS model is expected to expand gradually, especially in the SME sector and niche verticals like B2B SaaS platforms and e-commerce infrastructure providers. Growth may be tempered by licensing complexity, especially if the Central Bank of Ireland tightens oversight of non-bank license holders in line with evolving European Banking Authority (EBA) guidelines.

Regulatory Friction Around Consumer Lending and Data Use Is Influencing Embedded Finance Models

Regulatory scrutiny around BNPL, consumer data use, and digital distribution is influencing how embedded finance products are structured and offered in Ireland. The Central Bank of Ireland’s increased focus on consumer credit regulation and fair lending practices is prompting providers to reassess underwriting models and customer disclosures. The ongoing EU Data Act and Digital Markets Act are also influencing API access norms and third-party data sharing.Rising consumer complaints about lack of transparency in BNPL and data-driven personalization algorithms have prompted intervention. The Central Bank’s consultation paper on consumer-focused financial innovation (2024) highlights risks around over-indebtedness and inadequate disclosure in embedded lending products. EU-wide developments such as PSD3 and the Financial Data Access Regulation are tightening the framework for embedded finance intermediaries.Regulatory developments will act as both a constraint and an enabler. While compliance costs may rise, clarity on permissible embedded finance models could attract institutional players and banks back into the ecosystem. Expect a shift from loosely regulated fintech-led models to bank-partnered or fully licensed frameworks that prioritize transparency and customer protections.

Competitive Activity Remains Focused on Niche Use Cases and Ecosystem Entry Points

Ireland’s embedded finance market is still in a formative stage, characterized by sector-specific implementations rather than large-scale platform integration. Most competitive activity is concentrated in embedded payments, point-of-sale financing, and digital insurance. Local fintechs like Humm are dominant in retail and travel BNPL, while global players such as Stripe facilitate embedded payments for thousands of Irish businesses.Competitive intensity is moderate, with a few high-traction players operating in well-defined verticals. Unlike the UK or Germany, Ireland lacks a high volume of specialized embedded finance platforms, but this is offset by its integration with broader EU financial infrastructure. Competition is largely driven by product embedding into e-commerce, retail, and mobility channels, rather than full-stack BaaS deployments.In the near term, market activity will remain concentrated in specific verticals, particularly BNPL, digital insurance bundling, and payment integrations. However, as regulatory clarity improves and more players enter through cross-border licenses, competition is likely to diversify across new verticals such as B2B SaaS and property services.

Irish and Global Fintechs Are the Primary Players in Embedded Finance Verticals

Domestic players like Humm and Fire Financial Services continue to anchor the embedded finance ecosystem in Ireland. Humm has expanded from retail financing into travel and healthcare, while Fire offers embedded accounts and payments for Irish SMEs. Global infrastructure providers like Stripe (headquartered in Dublin) and Square support embedded payment functionality across Irish platforms.Irish e-commerce firms, travel aggregators, and property portals are increasingly partnering with fintechs to offer embedded finance services. For example, Ryanair has integrated installment payment options in select markets via third-party credit partners, while Daft.ie supports embedded insurance referrals.

Licensing, Data Access, and Regulatory Supervision Are Emerging as Competitive Differentiators

The Central Bank of Ireland (CBI) has started increasing scrutiny of point-of-sale lending models and is expected to bring BNPL under formal credit rules. This could increase compliance costs for fintechs and act as a barrier to entry. Additionally, EU-wide directives such as PSD3 and the Financial Data Access Regulation (FiDA) are influencing how embedded finance firms structure their Irish operations.Ireland remains attractive for firms using pan-European e-money or payment institution licenses, but regulatory tightening is anticipated. For instance, the CBI has shown interest in aligning more closely with European Banking Authority (EBA) expectations on outsourcing and platform risk. Any new guidelines on embedded lending and API-based services may raise the bar for unregulated or cross-border entities seeking Irish market entry.Competitive advantage is also being shaped by readiness to comply with data sharing and API integration standards. Companies able to embed financial services while maintaining data protection (in line with GDPR and upcoming Data Act mandates) are likely to gain traction with enterprise partners.

Competitive Dynamics Will Shift Toward Regulated, Infrastructure-Led Models

Over the next 2-4 years, Ireland’s embedded finance market is expected to evolve from isolated product integrations to infrastructure-led models anchored in compliance, partnerships, and cross-border scalability. Fintechs that operate under formal credit or payments licenses and demonstrate API maturity will likely dominate in new verticals such as healthcare, property services, and SME platforms.The initial growth in BNPL and payments will give way to demand for embedded accounts, invoice finance, and insurance-as-a-service, particularly among B2B platforms. Regulatory alignment across the EU and tighter scrutiny by the CBI may reduce the presence of lightly regulated players, creating room for bank-fintech partnerships or enterprise-grade BaaS providers.The market will likely bifurcate between regulated infrastructure providers (e.g., Fire, Railsr, Stripe) and vertical-specific service enablers (e.g., Humm, Zego). Players that can offer modular, compliant embedded finance stacks will be better positioned to serve Irish platforms looking to internalize financial services in a post-PSD3 environment.

Key Attributes:

Report AttributeDetailsNo. of Pages230Forecast Period2026 – 2030Estimated Market Value (USD) in 2026$1.9 BillionForecasted Market Value (USD) by 2030$2.36 BillionCompound Annual Growth Rate5.5%Regions CoveredIreland

Report Scope

This report provides in-depth, data-centric analysis of the embedded finance market in Ireland, with exclusive coverage of B2C transactions and adoption metrics. Below is a summary of key market segments.

Ireland Embedded Finance Market Size and Growth Dynamics

Total Transaction ValueNumber of TransactionsAverage Value per Transaction

Ireland Embedded Finance Financial Performance Indicators

Total RevenueAverage Revenue per Transaction / Product

Ireland Embedded Finance Key Metrics

Operational Efficiency Metrics: Transaction Success Rate, Automation Rate (Instant Decision %), Average Turnaround / Processing TimeQuality & Risk Metrics: Fraud Rate, Error RateCustomer Behavior Metrics: Repeat Borrowing Rate, Customer Retention Rate, Churn Rate, Conversion Rate, Abandonment Rate, Cross-Sell / Upsell RateUser Experience Metrics: Average Transaction Speed, Average Order / Loan / Policy / Investment Size

Ireland Embedded Payments Market Size and Growth Dynamics

Total Payment Value (TPV) and Growth OutlookNumber of Transactions and Usage TrendsAverage Revenue per Transaction

Ireland Embedded Payments Key Metrics

Transaction Metrics: Transaction Success Rate, Repeat Usage RateOperational Efficiency Metrics: Chargeback Rate, Fraud Rate, Dispute / Resolution RateConversion & Retention Metrics: Conversion Rate, Abandonment Rate, Customer Retention RateUser Experience Metrics: Average Transaction Speed, Error Rate

Ireland Embedded Payments Market Segmentation by Business Models

Platform-Based ModelEnabler-Based ModelRegulatory-Entity Model

Ireland Embedded Payments Market Segmentation by Distribution Models

Own PlatformsThird-Party Platforms

Ireland Embedded Payments Market Segmentation by End-Use Markets

E-commerce & RetailDigital Products & ServicesTravel & HospitalityLeisure & EntertainmentHealth & WellnessUtility Bill PaymentsOther Sectors

Ireland Embedded Lending Market Size and Growth Dynamics

Loan Disbursement ValueNumber of Loans IssuedAverage Loan Size

Ireland Embedded Lending Key Metrics

Credit Quality & Risk Metrics: Delinquency Rate (30/60/90 Days), Approval Rate, Default Rate, Loss Given Default (LGD)Monetization & Unit Economics Metrics: Interest Revenue per LoanAdoption & Usage Metrics: Repeat Borrowing RateOperational & Platform Efficiency Metrics: Loan Origination Time (TAT), Automation Rate (Instant Decision %)

Ireland Embedded Lending Market Segmentation by Business Models

Platform-Based ModelEnabler-Based ModelRegulatory-Entity Model

Ireland Embedded Lending Market Segmentation by Distribution Models

Own PlatformsThird-Party Platforms

Ireland Embedded Lending Market Segmentation by Product Types

Buy Now, Pay Later (BNPL)Point-of-Sale (POS) LendingPersonal LoansGig Worker Income AdvancesOther Loan Types

Ireland Embedded Lending Market Segmentation by End-Use Markets

E-commerce & RetailGig EconomyTravel & HospitalityHealthcareEducation & EdTechAutomotive & MobilityOther Sectors

Ireland Embedded Insurance Market Size and Premium Dynamics

Gross Written Premium (GWP)Number of Policies IssuedAverage Premium per Policy

Ireland Embedded Insurance Key Metrics

Policy & Premium Metrics: Renewal RateClaims & Risk Performance Metrics: Claims Ratio (Loss Ratio), Claim Frequency, Claim Settlement Time, Fraud RatePlatform Monetization Metrics: Embedded Insurance Revenue per User (RIU)Distribution & Conversion Metrics: Attachment Rate, Quote-to-Bind Conversion Rate, Cross-Sell / Upsell Rate

Ireland Embedded Insurance Market Segmentation by Policy Type

Life InsuranceNon-Life Insurance (Motor Vehicle, Home/Property, Accident & Health, Others)Motor VehicleHome/PropertyAccident & Health

Ireland Embedded Insurance Market Segmentation by Business Models

Platform-Based ModelEnabler-Based ModelRegulatory-Entity Model

Ireland Embedded Insurance Market Segmentation by Distribution Models

Own PlatformsThird-Party Platforms

Ireland Embedded Insurance Market Segmentation by End-Use Markets

E-commerce & RetailTravel & HospitalityAutomotive & MobilityHealthcareOther Sectors

Ireland Embedded Banking Market Size and Account Dynamics

Total Deposits / InflowsAccount Fee Revenue

Ireland Embedded Banking Key Metrics

Account Metrics: Account Churn RateRisk & Compliance Metrics: Fraudulent Transaction Rate

Ireland Embedded Banking Distribution by End-Use Markets

Gig & Freelance PlatformsE-commerce & MarketplacesFintech Apps & NeobanksOther Platforms

Ireland Embedded Investments & Wealth Market Size and User Dynamics

Total Assets Under Management (AUM)Number of Investment TransactionsAverage Investment per User

Ireland Embedded Investments & Wealth Key Metrics

Returns & Performance Metrics: Annualized Portfolio ReturnRetention Metrics: Account Churn Rate

Ireland Embedded Investments & Wealth Market Segmentation by Business Models

Platform-Based ModelEnabler-Based ModelRegulatory-Entity Model

Ireland Embedded Investments & Wealth Market Segmentation by Distribution Models

Own PlatformsThird-Party Platforms

Ireland Embedded Investments & Wealth Market Segmentation by End-Use Markets

Fintech & Neobank AppsE-commerce & Super AppsGig & Freelancer PlatformsOther Platforms

For more information about this report visit https://www.researchandmarkets.com/r/d1yx79

About ResearchAndMarkets.com

ResearchAndMarkets.com is the world’s leading source for international market research reports and market data. We provide you with the latest data on international and regional markets, key industries, the top companies, new products and the latest trends.