Dublin, Oct. 06, 2025 (GLOBE NEWSWIRE) — The “Austria Embedded Finance Market Size & Forecast by Value and Volume Across 100+ KPIs by Business Models, Distribution Models, End-Use Sectors, and Key Verticals (Payments, Lending, Insurance, Banking, Wealth) – Databook Q4 2025 Update” report has been added to ResearchAndMarkets.com’s offering.

The embedded finance market in Austria is expected to grow by 10.4% on an annual basis to reach US$4.63 billion by 2025.

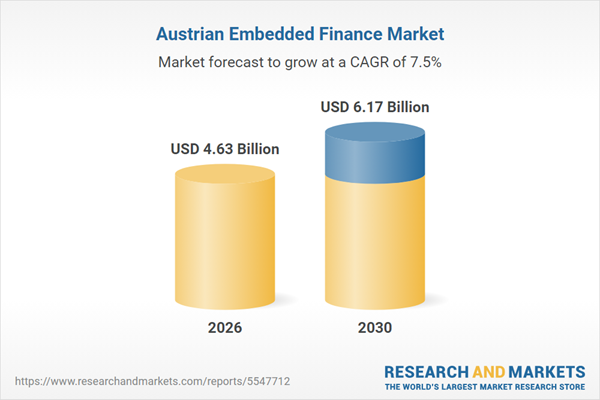

Austria’s embedded finance market has experienced robust growth during 2021-2025, achieving a CAGR of 14.9%. This upward trajectory is expected to continue, with the market forecast to grow at a CAGR of 7.5% from 2026 to 2030. By the end of 2030, the embedded finance market is projected to expand from its 2024 value of US$4.19 billion to approximately US$6.17 billion.

This report provides a detailed data-centric analysis of the embedded finance industry in Austria, covering five major verticals: payments, lending, insurance, banking, and investments & wealth management. It covers more than 100 KPIs, including transaction value, transaction volume, average transaction size, revenue indicators, and financial performance measures.

The report offers segmentation by business models (platform-based, enabler, and regulatory entity), distribution models (own and third-party platforms), and end-use markets, including e-commerce, retail, healthcare, travel & hospitality, utilities, automotive, education, and the gig economy. Together, these datasets provide a comprehensive, quantifiable view of market size, operational efficiency, risk, customer behavior, and user experience in the embedded finance market.

Reasons to buy

Comprehensive KPI Coverage: Access over 100 key performance indicators (KPIs), including transaction value, transaction volume, revenue, and average transaction size.Complete Vertical Coverage: Structured datasets across all five embedded finance verticals – payments, lending, insurance, banking, and investments & wealth.Granular Market Segmentation: Detailed data by business models (platform-based, enabler, regulatory-entity), distribution models (own vs. third-party platforms), and product types.Sector-Level Data Tracking: Coverage across B2C end-use markets such as e-commerce, retail, healthcare, travel & hospitality, utilities, automotive, education, gig economy, and others.Operational & Performance Metrics: Provides data on efficiency, quality & risk, monetization, customer behavior, and user experience indicators for a rounded view of market performance.

Key Attributes:

Report AttributeDetailsNo. of Pages230Forecast Period2026 – 2030Estimated Market Value (USD) in 2026$4.63 BillionForecasted Market Value (USD) by 2030$6.17 BillionCompound Annual Growth Rate7.5%Regions CoveredAustria

Report Scope

This report provides in-depth, data-centric analysis of the embedded finance market in Austria, with exclusive coverage of B2C transactions and adoption metrics.

Below is a summary of key market segments:

Austria Embedded Finance Market Size and Growth Dynamics

Total Transaction ValueNumber of TransactionsAverage Value per Transaction

Austria Embedded Finance Financial Performance Indicators

Total RevenueAverage Revenue per Transaction / Product

Austria Embedded Finance Key Metrics

Operational Efficiency Metrics: Transaction Success Rate, Automation Rate (Instant Decision %), Average Turnaround / Processing TimeQuality & Risk Metrics: Fraud Rate, Error RateCustomer Behavior Metrics: Repeat Borrowing Rate, Customer Retention Rate, Churn Rate, Conversion Rate, Abandonment Rate, Cross-Sell / Upsell RateUser Experience Metrics: Average Transaction Speed, Average Order / Loan / Policy / Investment Size

Austria Embedded Payments Market Size and Growth Dynamics

Total Payment Value (TPV) and Growth OutlookNumber of Transactions and Usage TrendsAverage Revenue per Transaction

Austria Embedded Payments Key Metrics

Transaction Metrics: Transaction Success Rate, Repeat Usage RateOperational Efficiency Metrics: Chargeback Rate, Fraud Rate, Dispute / Resolution RateConversion & Retention Metrics: Conversion Rate, Abandonment Rate, Customer Retention RateUser Experience Metrics: Average Transaction Speed, Error Rate

Austria Embedded Payments Market Segmentation by Business Models

Platform-Based ModelEnabler-Based ModelRegulatory-Entity Model

Austria Embedded Payments Market Segmentation by Distribution Models

Own PlatformsThird-Party Platforms

Austria Embedded Payments Market Segmentation by End-Use Markets

E-commerce & RetailDigital Products & ServicesTravel & HospitalityLeisure & EntertainmentHealth & WellnessUtility Bill PaymentsOther Sectors

Austria Embedded Lending Market Size and Growth Dynamics

Loan Disbursement ValueNumber of Loans IssuedAverage Loan Size

Austria Embedded Lending Key Metrics

Credit Quality & Risk Metrics: Delinquency Rate (30/60/90 Days), Approval Rate, Default Rate, Loss Given Default (LGD)Monetization & Unit Economics Metrics: Interest Revenue per LoanAdoption & Usage Metrics: Repeat Borrowing RateOperational & Platform Efficiency Metrics: Loan Origination Time (TAT), Automation Rate (Instant Decision %)

Austria Embedded Lending Market Segmentation by Business Models

Platform-Based ModelEnabler-Based ModelRegulatory-Entity Model

Austria Embedded Lending Market Segmentation by Distribution Models

Own PlatformsThird-Party Platforms

Austria Embedded Lending Market Segmentation by Product Types

Buy Now, Pay Later (BNPL)Point-of-Sale (POS) LendingPersonal LoansGig Worker Income AdvancesOther Loan Types

Austria Embedded Lending Market Segmentation by End-Use Markets

E-commerce & RetailGig EconomyTravel & HospitalityHealthcareEducation & EdTechAutomotive & MobilityOther Sectors

Austria Embedded Insurance Market Size and Premium Dynamics

Gross Written Premium (GWP)Number of Policies IssuedAverage Premium per Policy

Austria Embedded Insurance Key Metrics

Policy & Premium Metrics: Renewal RateClaims & Risk Performance Metrics: Claims Ratio (Loss Ratio), Claim Frequency, Claim Settlement Time, Fraud RatePlatform Monetization Metrics: Embedded Insurance Revenue per User (RIU)Distribution & Conversion Metrics: Attachment Rate, Quote-to-Bind Conversion Rate, Cross-Sell / Upsell Rate

Austria Embedded Insurance Market Segmentation by Policy Type

Life InsuranceNon-Life Insurance (Motor Vehicle, Home/Property, Accident & Health, Others)Motor VehicleHome/PropertyAccident & Health

Austria Embedded Insurance Market Segmentation by Business Models

Platform-Based ModelEnabler-Based ModelRegulatory-Entity Model

Austria Embedded Insurance Market Segmentation by Distribution Models

Own PlatformsThird-Party Platforms

Austria Embedded Insurance Market Segmentation by End-Use Markets

E-commerce & RetailTravel & HospitalityAutomotive & MobilityHealthcareOther Sectors

Austria Embedded Banking Market Size and Account Dynamics

Total Deposits / InflowsAccount Fee Revenue

Austria Embedded Banking Key Metrics

Account Metrics: Account Churn RateRisk & Compliance Metrics: Fraudulent Transaction Rate

Austria Embedded Banking Distribution by End-Use Markets

Gig & Freelance PlatformsE-commerce & MarketplacesFintech Apps & NeobanksOther Platforms

Austria Embedded Investments & Wealth Market Size and User Dynamics

Total Assets Under Management (AUM)Number of Investment TransactionsAverage Investment per User

Austria Embedded Investments & Wealth Key Metrics

Returns & Performance Metrics: Annualized Portfolio ReturnRetention Metrics: Account Churn Rate

Austria Embedded Investments & Wealth Market Segmentation by Business Models

Platform-Based ModelEnabler-Based ModelRegulatory-Entity Model

Austria Embedded Investments & Wealth Market Segmentation by Distribution Models

Own PlatformsThird-Party Platforms

Austria Embedded Investments & Wealth Market Segmentation by End-Use Markets

Fintech & Neobank AppsE-commerce & Super AppsGig & Freelancer PlatformsOther Platforms

For more information about this report visit https://www.researchandmarkets.com/r/w63jxl

About ResearchAndMarkets.com

ResearchAndMarkets.com is the world’s leading source for international market research reports and market data. We provide you with the latest data on international and regional markets, key industries, the top companies, new products and the latest trends.

Austrian Embedded Finance Market